Summary:

- Analysts were overly pessimistic about Micron’s earnings, but the company exceeded expectations with strong guidance, particularly in HBM and DRAM demand.

- I recap Micron’s supply and demand situation, focusing on the weaker end markets of PC and mobile.

- Reconciling the bullish memory market with a corrective chart has some options, but it’s not the new all-time high expectations bulls have.

William_Potter

In my last article in August, I outlined how the fundamentals for Micron Technology, Inc. (NASDAQ:MU) were still holding up in this memory cycle. But I wanted to hear bits shipped won’t continue to be flat. After all, bits shipped are the tell-tale sign of how the company’s current business dealings are faring. Meanwhile, the chart indicated a corrective move lower and could potentially bring the stock back into the $70s in fairly quick order. But I’ve looked at an alternative path where the memory cycle could continue strongly and the stock finds less material weakness and continues a bit higher than expected (though still less likely to make new all-time highs). Together, I’m holding all the data Micron is providing – from fundamentals to chart – to keep an eye on how long this cycle can go and when it might peak.

The Lead Into Earnings Was Suspect

As earnings approached last month, analysts began to pile on in the weeks and days ahead of the earnings call. This crowd of Wall Street analysts came out within days and weeks of each other saying there was weakness in Micron’s end markets, a weakness with a bearing on overall business performance. But it becomes suspect when some go so far as to throw out very questionable premises like “HBM will become oversupplied in 2025” when HBM has already been stated to be sold out (more on this later).

Meanwhile, I had no indication Micron’s business was turning south. HBM has become too much of a kingpin of its margins as they’re higher than DRAM’s already leading margins. With HBM being the fastest-growing product, even when other end markets like PC and mobile show potential signs of weakness or delayed purchases, the margin-leading new kid on the block is lifting the tide for all boats. Add to it the sold-out product for the next 14 months, and it’s hard to point to this new market as a reason to go bearish.

It became clear none of the analyst expectations came to fruition after Micron revealed a very different story three weeks ago.

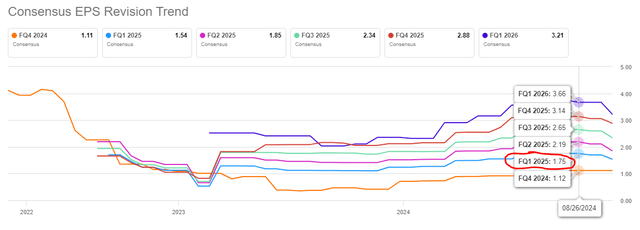

You know my focus throughout this cycle has been on bits shipped and where the company sees that headed next quarter and throughout FY25. This, combined with pricing, is setting up Micron for a – still on track – record-breaking revenue year for FY25. These two factors are why guidance for FQ1 was considerably above analyst expectations, expectations that started at $1.75 in EPS a month ago and worked down to $1.54 this week.

When it was all said and done, though, management guided for $1.74 in EPS – within a penny of where all these same analysts were before they got the wrong information and used it to overweight their models. Winter Is Coming: Part 2? Dead wrong.

To expand further, the guidance also showed positives on every other line, including revenue at $8.7B vs. analyst estimates of $8.21B and gross margins from FQ4’s 36.5% to FQ1 guidance of 39.5%. With this kind of momentum going into FY25, it seems to be starting off on the right foot.

But this is very high-level stuff any internet blogger can put together – and generally does. As I’ve been saying these past two years, especially, the real meat and potatoes lie in the DRAM and NAND metrics and expectations.

Diving Deeper Into The Fundamentals

Demand Picture

Demand has been the center of attention for analysts who have stumbled over each other to bring down estimates based on “deteriorating demand.” However, management not only doesn’t see demand deteriorating, it sees 2024 ending above expectations, expectations set out for the year at around this time last year.

Calendar 2024 DRAM industry demand outlook has improved, driven by strength in data center servers and growth in the other market segments has performed consistent with our prior market commentary.

Hence, we have upgraded our expectation for calendar 2024 industry DRAM bit demand growth to now be in the high-teens percentage range…In calendar 2025, we expect both DRAM and NAND industry bit demand growth to be around the mid-teens percentage range.

– Sanjay Mehrotra, CEO, Micron’s FQ4 ’24 Earnings Call

An improving 2024, one set to beat expectations, is heading into 2025 with expectations for a similar demand profile – perhaps just slightly under 2024’s growth in terms of demand. Thus, neither 2024 nor 2025 shows signs the memory market is getting ready to collapse. But we all know things can turn south quickly, so take it with a grain of salt.

Let’s drill down further into this demand picture as data centers seem to be the prominent end market holding down the fort. Therefore, how stable are the “weaker” end markets like PC and mobile?

As discussed in our last earnings call, PC customers have built inventories due to the rising memory price trajectory, anticipated growth in AI PCs as well as an expectation of tight supply caused by an increasing portion of production output being dedicated to meeting the growing data center demand.

As sell-through of PCs continues at a steady pace with a seasonal increase in the second half of calendar 2024, we expect healthier inventories at PC OEMs by spring 2025. PC unit volumes remain on track to grow in the low single-digit range for calendar 2024. We expect unit growth to continue in 2025 and accelerate into the second half of calendar 2025…

– Sanjay Mehrotra, CEO, Micron’s FQ4 ’24 Earnings Call

Now, we all know AI PCs are pretty much non-existent right now, even though there are offerings on the market. Their use cases don’t provide any utility when cloud computing via the Internet, as opposed to on-device AI processing, is perfectly suitable for the level of capability consumers are being offered today. This may change in the future, but there’s a lot more hype around AI PCs than anything right now; essentially a solution looking for a problem.

Here’s Tom’s Hardware describing the situation very similar to my conclusion:

Copilot+ PCs, the first of which will launch on June 18, 2024, will have a series of four unique Windows AI features that other PCs cannot access. These include Cocreator (image generation in Paint), Windows Studio Effects (webcam blurring and special effects), real-time translation and captions for audio and Recall. Recall, the controversial feature which keeps a record of almost everything you do on your PC so you can remember it, was just pulled from the Copilot+ launch date build of Windows.

…

Given the weak set of Copilot+ features, anyone who is actually paying attention probably isn’t that sad about having to miss them or wait for them. There are many other ways to get an offline (or online) AI image generator, to do real-time translation and to blur your webcam background. Recall is somewhat unique, but many people won’t want it, because of the privacy risks associated with taking constant screenshots of your work.

So, I don’t expect AI PCs to move the needle anytime soon. Having said that, the healthier inventory levels by spring 2025 probably mean during spring 2025 as these estimates tend to get pushed out. Anything on time can be considered outperformance in this regard. Moreover, healthier inventory levels lead to purchases regardless of whether they’re AI PCs or traditional PCs. These purchases will then come with higher memory pricing as OEMs will purchase in Q1 and Q2 at elevated levels from the previous year, where their initial purchases were made in this cycle.

Mobile handsets, on the other hand, have a better situation for AI-driven use cases as we use these devices where hands-free or multiple-step processes could be alleviated by having the device do the work. Moreover, doing Photoshop work for the photo you just took without having a separate app or the skills to manipulate pictures and videos is entirely a valid use case for AI. We see this with Samsung and Google phones as well as iPhones.

Mobile seems to be in a better situation even though the inventory situation looks similar to PCs.

Smartphone customer inventory dynamics are evolving in a manner somewhat similar to that of PC customers. Smartphone unit volumes in calendar 2024 are on track to grow in the low-to-mid single-digit percentage range and we expect unit growth to continue in 2025.

Smartphone OEMs are seeking to differentiate their devices by incorporating more AI features such as personalized recommendations, improved camera functionalities and smarter voice assistants.

– Sanjay Mehrotra, CEO, Micron’s FQ4 ’24 Earnings Call

But here’s the key part Mehrotra goes into next:

…leading Android smartphone OEMs have announced AI-enabled smartphones with 12GB to 16GB of DRAM, versus an average of 8GB in flagship phones last year.

So not only are units (volumes of handsets) expected to grow, but content is expected to grow 75% on average in those handsets coming this fall and next year. Again, it’s another waiting game for inventory to clear, so at best, it’s neutral to slightly positive, and at worst, there’s a slight drag on bits going out the door for these two areas. But the combined DRAM and NAND mobile business was up 18% sequentially and up over 58% year-over-year – so mobile, at least, isn’t much of a drag.

Say What Now About Supply?

Remember that comment I made earlier about analysts even going so far as to say HBM will become oversupplied in 2025 – the same HBM sold out for 2025? Well, supply has a lot to do with that. Samsung Electronics Co., Ltd. (OTCPK:SSNLF) has been the laggard out of the Big Three DRAM manufacturers in terms of HBM3 and HBM3e. It’s still qualifying 8-high products, while Micron and SK Hynix now qualify and mass-produce 12-high HBM. Yet, somehow, not only will Samsung get its act together in the next three months, but it will ramp up that same HBM faster than its competitors and “flood the market” with – checks notes – cheap HBM?

If you’re bored enough, you can read that really funny report here.

This is where we’re at with analysts.

But the question was asked nonetheless on the call.

Sanjay, on that same topic of HBM, there is some concern about the potential for HBM oversupply in ’25, let’s say, there are three suppliers instead of the two that are right now. Is that something you see that there is any potential for oversupply?

I don’t need to tell you what Mehrotra said because it’s obvious – HBM is sold out for the entirety of calendar 2025, and it is never considered the “third supplier” to be out of the game. The supply of HBM is extremely tight because capacity is lower than peak levels in 2022, plus HBM requires three times as many bits to get the equivalent output. Oh, and the push to HBM is taking bit supply away from non-HBM bits, so it’s shrinking bits across the board.

Do I need to explain further?

Combining The Two

Let’s get to the important part.

Heading into this earnings report, I was focused on bits shipped. After the conference in early August, which indicated downside guidance in this area, it became my focus as bits shipped is the culmination of supply and demand. You can only ship what you have and sell what customers are buying. Then, it was adjusted slightly higher weeks later. The CFO seemed to do a decent job answering when asked about it – which was the first question, by the way, so that should tell you something.

We had said before they were going to be flat and then we revised that to flat to slightly up and in this latest guide, we now view DRAM to be up somewhat higher from that.

– Mark Murphy, CFO, Micron’s FQ4 ’24 Earnings Call Q&A

The only piece he’s missing is the FQ1 guide during the FQ3 earnings call when he said, “We forecast shipment growth to strengthen modestly in the November quarter.” That’s the quarter we’re now in. So, to recap, it went from “strengthen modestly” to flat to flat-to-slightly up to now “up somewhat higher than what we had said before.” This lands me somewhere in the slightly up to moderately up category. So the trend has now shifted back more bullishly but still below modestly – net-net a tad lower than initially anticipated.

This is better than flat, but the more important part I heard was later in the Q&A when discussing inventory.

…our volumes happen to be a bit more second half weighted of the fiscal year.

– Mark Murphy, CFO, Micron’s FQ4 ’24 Earnings Call Q&A

This is a key indicator of bits shipped because they are related to volume – almost as if it’s the same thing. That second-half ramp of bits shipped means the cycle is still well underway and will likely continue into the latter half of 2025. When bits shipped flatten for more than two quarters or begin showing signs of turning negative without an outlook of improvement, things become cautionary and potentially the top (for the business).

So, The Chart…

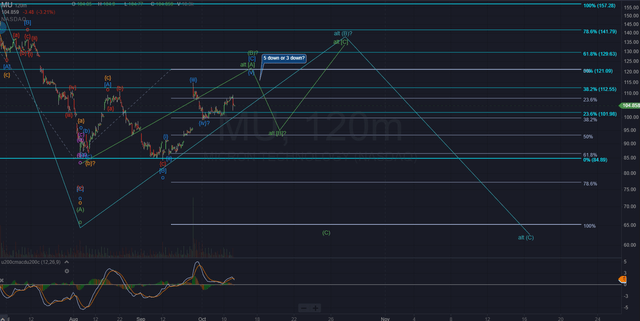

So, now that we know the memory cycle is roaring along, and the fundamentals are improving, how does this jive with the chart for expectations of a move back to the $70s and even the potential for the $60s I outlined in August? It’s a great question.

One answer shows a path to reconcile these strong, ongoing fundamentals with the potential not to see the $70s over the coming six to nine months. This case isn’t much different than what I’ve been tracking, except it’s ongoing and more “delayed.” In other words, it pushes out the inevitable C wave drop for several months. The other is the current case I’ve been following, which would mean either the fundamentals don’t shape up as expected, or they diverge from the fundamentals, and the stock is taken out due to broader market circumstances (though it would be premo for the newly reinstated share buyback program as fundamentals continue on while the stock is hammered).

So how do we know which scenario plays out? It will show us by either a five-wave down move off of [C] of [B] (primary), showing us the alternate scenario is not in play, or giving us a three-wave down move, showing the alternate is still in play.

Here’s what I’m talking about:

So when this [C] wave completes, how it reverses will make all the difference. If you’re rooting for continued, somewhat higher targets over the next two quarters, you want three waves down.

Keep The Bigger Picture In Mind

Analysts were very wrong leading up to Micron’s earnings report last month. This is why it’s important to know the fundamentals at a deeper level than the headlines. Bits shipped, supply and demand, and the machinations therein tell the story. And right now, that story shows quite a bit of momentum left for this cycle. However, this cycle may not have the sentiment left in the stock to power it to new all-time highs. While I expect it to retrace a majority of the selloff from all-time highs, the corrective nature of the chart says it’s not likely to break out. Of course, there’s the outside chance this B wave becomes an expanded B wave pattern and pokes through to new highs, but the C wave is still lurking behind it to usher in new lows.

For now, I remain cautious on the stock and bullish on the business. While there’s potential for more share price appreciation, it’s not with the momentum we saw over the summer and not with the risk-adjusted potential it was months ago.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join The Top AI And Tech Investing Group

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Second, if you want more of this two-fold fundamental and chart analysis, step up to being a paid subscriber to my Investor Group Tech Cache with a two-week free trial and read more of this type of analysis on other tech stocks and assets.