Summary:

- Micron’s stock has performed well in the past three months, but my analysis reveals that massive optimism is already priced in, as the stock is more than 15% overvalued.

- The company’s revenue is expected to rebound in the new fiscal year, but I expect profitability to lag behind the top-line growth by multiple quarters.

- While the long-term prospects for Micron are promising, the next few quarters are expected to be challenging, leading to volatility in the stock.

vzphotos

Investment thesis

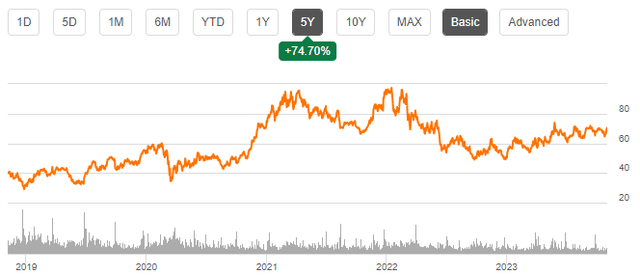

My initial bearish thesis about Micron’s (NASDAQ:MU) stock did not age well since the stock rallied by more than 6% over the past three months, outperforming the broader U.S. market. It seems that I was wrong and underestimated the fundamental strength of the company. Today, I want to upgrade my rating for MU, but it is still not a “Buy” because my valuation analysis suggests that a lot of optimism is already priced in. The stock looks overvalued from both ratios and discounted cash flow perspectives. I also want to emphasize that I do not expect the company’s path to financial performance recovery after last year’s massive headwinds to be rapid and easy. All in all, I assign MU a “Hold” rating.

Recent developments

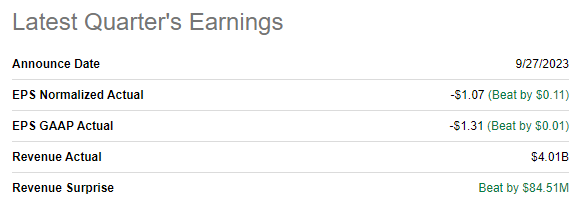

The latest quarterly earnings were released on September 27, when the company topped consensus estimates. Revenue decreased almost 40% year-to-year as the company continued navigating through the weak environment due to vast macroeconomic uncertainty multiplied by the chip ban from China. As a result of the massive revenue drop, the profitability shrank as well, with the adjusted EPS diving below -$1.

Seeking Alpha

I will not dig into much detail regarding the massive profitability shrinkage because negative disruptions of FY 2023 are obvious for MU, and it is no surprise that profitability suffered a lot after revenue almost halved. In such an unfavorable environment, it is more important to understand whether disruptions are temporary or secular and the strength of the company’s financial position.

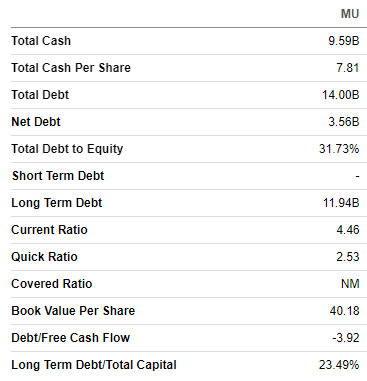

Let me continue with the latter because the financial position looks much less controversial. Despite being in a substantial net debt position, the leverage ratio is still very prudent, and the major part of the debt is long-term. It is also important to emphasize that short-term liquidity metrics are in excellent shape. That said, the company’s balance sheet is a fortress and is strong enough to help the company weather the current environment of the massive revenue drop.

Seeking Alpha

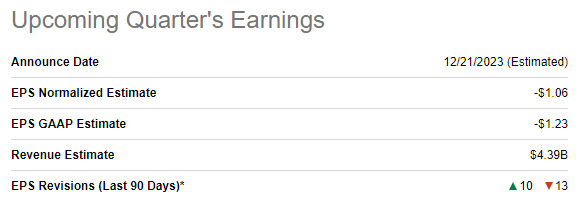

Now let me proceed with the analysis of the company’s near-term prospects. The upcoming quarter’s earnings are scheduled for release on December 21. Quarterly revenue is expected by consensus at $4.39 billion, which indicates a solid 7% YoY growth. Despite an expected solid revenue rebound, no improvement is expected for the bottom line, even from the YoY perspective.

Seeking Alpha

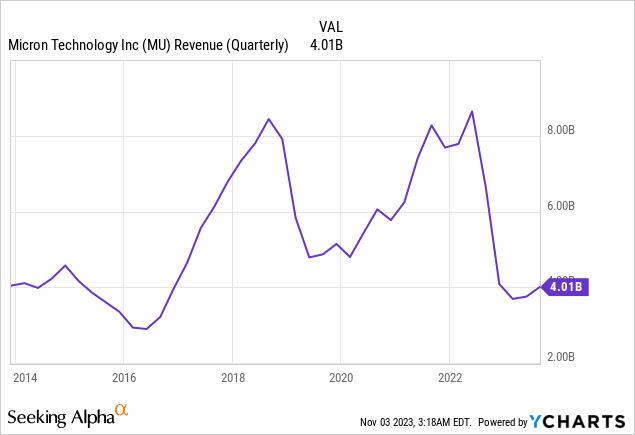

A pivot in the revenue dynamics is a good sign, which is likely to indicate that the worst is in the rearview mirror for MU. For the whole fiscal year 2024, consensus estimates forecast a 34% revenue growth, which is a solid and relatively fast rebound. However, I do not expect profitability to rebound as fast because the company experienced massive adverse disruptions last fiscal year, and it would take a longer time for the bottom line to recover, especially in the current environment of high inflation and high interest rates.

The latest and the upcoming quarter’s revenues are closer to $4 billion, meaning there is still a long and bumpy road to the company’s all-time highs in quarterly revenue, which were above $8 billion. That said, the company’s sales must double before MU returns to its peak financial performance. At the same time, the stock price is about 30% lower than its recent year’s peak, and such an imbalance between the stock price and revenue dynamic is a red flag to me.

Seeking Alpha

Let us also not forget that the current macro environment is highly uncertain, with high-interest rates, deteriorating consumer confidence, and an escalating global geopolitical situation. That said, from the perspective of the next couple of years, I think that Micron’s path toward its financial performance recovery will not be easy, softly speaking.

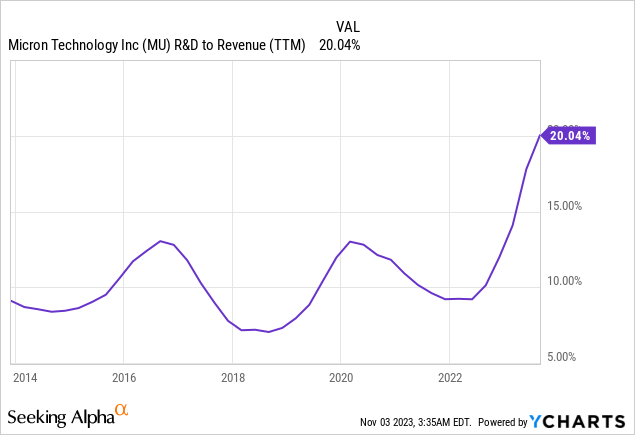

However, the long-term prospects of the company look much brighter. Being one of the world’s largest semiconductor companies and the most significant memory chip provider gives the company a wide moat that will likely protect its market share over the long term. The secular global trend toward more digitalization of both businesses and households, together with the need for more sophisticated memory hardware to support new cutting-edge software technologies, means that the demand for MU’s offerings is poised to demonstrate solid growth over the long term. The key to being able to capture secular tailwinds is to innovate and invest in business expansion. The fact that the company invests heavily in innovation, which I see from the rapidly increasing TTM R&D to revenue ratio, indicates the management’s confidence in the company’s long-term prospects.

Overall, the company’s long-term prospects look promising due to its dominant position in its niche of the large semiconductor industry. On the other hand, the adverse effect of the last fiscal year’s massive headwinds was too bad to expect rapid recovery. That said, I expect the next multiple quarters to be bumpy for the company despite a positive long-term outlook.

Valuation update

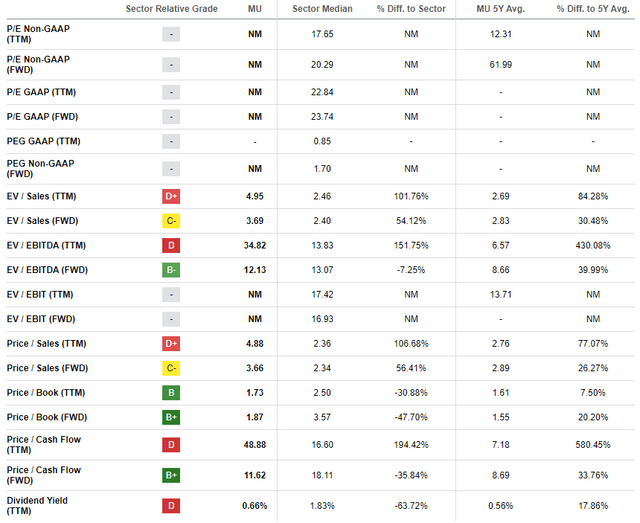

The stock rallied by almost 40% year-to-date, significantly outperforming the broader U.S. market. Seeking Alpha Quant assigns the stock a very low “D-” valuation grade because multiples are mostly substantially higher than the sector median and the last five years’ averages. That said, from the valuation ratios perspective the stock looks overvalued.

Seeking Alpha

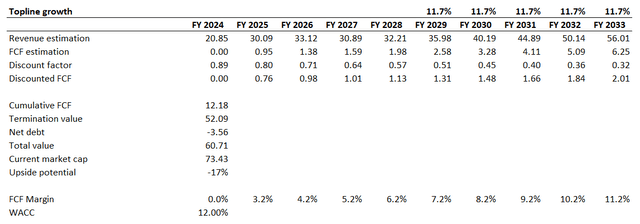

I want to simulate one more approach to get more conviction. The discounted cash flow [DCF] looks like an excellent choice to proceed with, given MU is still a growth stock. I use an elevated 12% WACC due to the recent Fed’s hawkish rhetoric indicating higher interest rates for longer. TTM FCF margin is slightly below zero, but to be less pessimistic I implement a zero FCF margin for the base year. For the next fiscal year, I expect an FCF margin at the level of FY 2022 3.2%. And for the years beyond, I project a one percentage point yearly expansion. I have revenue consensus estimates available up to FY 2028 and project an 11.7% long-term CAGR for the years beyond.

Author’s calculations

According to my DCF valuation, the business’s fair value is about $61 billion. That said, the stock is about 17% overvalued, and my target price is approximately $58.

Risks to my cautious thesis

We live in a rapidly changing environment and that is the main factor why positive catalysts might pop up for the company. For example, any indications of the improvement in the U.S.-China relationships might add a lot of optimism to investors and MU’s stock might soar amid possible de-escalation in the cold war between the world’s two largest economies.

The Fed’s tight monetary policy also can pivot relatively rapidly, or at least the rhetoric might become less hawkish if the U.S. economy cools down faster than expected. A lot depends on inflation here, and commodity prices are also playing a significant role in inflationary pressures. That said, the U.S. inflationary factor significantly depends on events that have low predictability because depend on the decisions of OPEC leaders. This fact also brings a significant level of uncertainty for my cautious thesis.

Bottom line

To conclude, MU is a “Hold”. While I acknowledge the company’s bright long-term prospects due to strong secular tailwinds, I also think that the bumpy road is ahead for multiple quarters. Revenue almost halving in the last fiscal year is a big adverse disruption, and it will take substantial time before the company fully recovers its revenue trajectory and profitability metrics. Given the company’s strong balance sheet and massive scale, I have no doubts that Micron will recover, but I expect substantial volatility for the stock in the foreseeable future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.