Summary:

- Mr. Market continues to award MU with premium FWD valuations due to the refreshed PC replacement cycle and potential tailwinds from generative AI.

- The memory industry has also bottomed, as reported by multiple South Korean producers, with stable inventory levels and improved top/bottom lines.

- However, the MU stock is likely to trade sideways as it grows into its pulled-forward upside potential, with the stock’s over-optimistic rally offering a minimal margin of safety.

- While its dividend safety may be graded as a B+, anyone looking for rich payouts may have to temper their expectations as well, with its future Dividend Per Share Growth likely to underwhelm until things normalize.

- While MU expects “improved margins and financial performance throughout 2024 and record industry TAM in calendar 2025,” we are unlikely to see an NVDA-like jump in MU’s top/ bottom lines ahead.

alberto clemares expósito

We previously covered Micron Technology (NASDAQ:MU) in July 2023, discussing its uncertain near-term prospects as the memory chip correction continued with bloated global inventory.

Combined with its overly aggressive capex plans, impacted profitability, and the stock’s overly optimistic rally thus far, we had chosen to rate it as a Hold then.

In this article, we shall discuss why Mr. Market continues to reward the MU stock with the premium valuations, attributed to the refreshed PC replacement cycle and potential tailwinds from generative AI.

However, we maintain our previous conclusion that the stock is likely to trade sideways over the next few quarters (if not years) as it grows into its pulled forward upside potential. With these levels offering a minimal margin of safety, we do not recommend anyone to chase this rally.

The Memory Investment Thesis Has Bottomed – With The MU Stock Pulling Forward Much Of Its Upside Potential

First, the good news.

For now, MU has delivered a mixed FQ1’24 earnings call, with revenues of $4.72B (+17.7% QoQ/ +15.7% YoY) and adj gross margins of 1% (+10 points QoQ/ -21.9 YoY/ -44.7 from FY2019 levels).

The sequential improvements in its top/ bottom lines are notable indeed, significantly aided by the stable inventory levels of $8.27B (-1.3% QoQ/ -1% YoY), though still elevated by +61.8% from FY2019 levels of $5.11B.

This is further aided by the MU management’s commentary that “inventory levels for memory and storage are at or near normal levels for most customers across PC, mobile, auto, and industrial end markets.”

The same has been reported by other South Korean suppliers, namely Samsung (OTCPK:SSNLF) and SK Hynix, with the memory market already bottoming out and profit margins turning positive in the latest earning calls.

Part of the tailwind is also attributed to the dramatically slashed Average Selling Prices, as observed in MU’s impacted gross margins, allowing restocking to occur at an accelerated pace as the new PC replacement cycle occurs three to four years after the 2020 boom.

This is on top of insatiable demand for generative AI SaaS, which requires immense “storage solutions that can handle vast volumes of data, deliver high throughput, offer low-latency access, and store data securely.”

We reckon that these promising events may very well balance part of the headwinds posed by the elongated smartphone replacement cycle, as similarly reported by Qualcomm (QCOM).

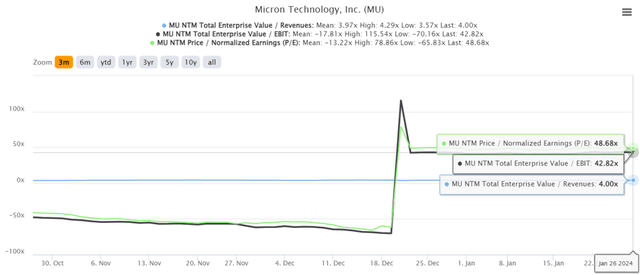

MU Valuations

As a result of the potential reversal, it appears that Mr. Market has decided to award MU with eye-watering valuations, with FWD EV/ Revenues of 4x, FWD EV/ EBIT of 42.82x, and FWD P/E of 48.68x.

This is compared to its 2Y hyper-pandemic mean of 2.54x/ 10.17x/ 11.88x, 3Y pre-pandemic mean of 1.99x/ 7.97x/ 8.57x, and sector median of 2.94x/ 20.35x/ 24.77x, respectively.

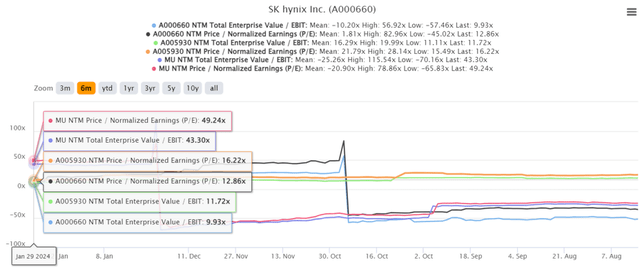

MU/ SK/ Samsung Valuations

However, it’s not all good news.

Readers must note that MU is trading way above its South Korean memory peers, namely SSNLF at FWD EV/ EBIT of 11.72x and FWD P/E valuations of 16.22x and SK Hynix at 9.93x/ 12.86x, respectively.

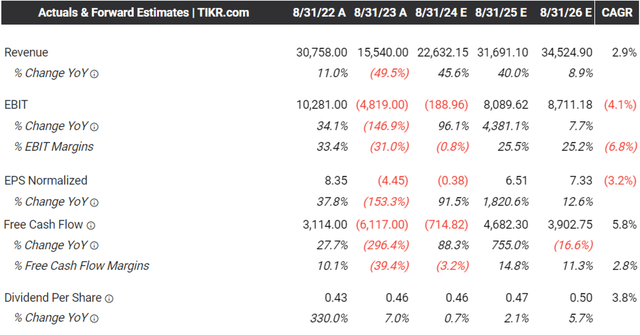

The Consensus Forward Estimates

The premium embedded in MU’s valuations is surprising indeed, since the company is not expected to record massive profitable growth ahead, with things only normalizing to its historical trends.

Most importantly, its EBIT margins are expected to underwhelm at ~25% through FY2026, well improved from the -31% reported in FY2023, though still impacted compared to its pre-pandemic averages of ~37%.

At the same time, MU has guided a higher FY2024 capex of $7.75B at the midpoint (+10.7% YoY from $7B in FY2023), though still moderated than the original FY2023 plans of $8B and FY2022 levels of $12.06B, implying its minimal FCF generation in the near-term.

Combined with the management’s guidance of FQ2’24 gross margins of 13% (+12 points QoQ/ +44.4 YoY) and impacted adj EPS of -$0.28 (+70.5% QoQ/ +85.3% YoY), we may see its net debts grow from the $2.29B reported in the latest quarter (-2.5% QoQ/ +76.1% YoY/ +160.58% from FY2019 levels).

This is on top of the $516M in annualized dividend obligations (inline QoQ/ YoY) and $528M in annualized interest expenses (+2.3% QoQ/ +158.8% YoY), despite the steady variable interest rates of 3.33% (inline QoQ/ YoY).

As a result, while MU’s dividend safety may be graded as a B+, anyone looking for rich payouts may have to temper their expectations indeed, with its future Dividend Per Share Growth likely to underwhelm until things normalize for the memory market.

In addition, while MU is already in the qualifying process of its industry-leading HBM3E memory storage samples with Nvidia (NVDA), it remains to be seen if KeyBanc Capital Markets’ analyst, John Vinh’s prediction may occur: in that MU may command up to 70% in market share for NVDA’s next-generation AI chip platform.

For context, readers must note that all three memory producers have strategically reduced their production-related capex from the hyper-pandemic heights and diverted their underutilized equipment toward ramping new technology nodes.

With a substantial portion of MU’s contracts at fixed short-term durations, “future performance obligations beyond one year as not significant,” and its leading-edge DRAM/ NAND nodes reported as oversubscribed in 2024, it is apparent that the producer is not aiming to increase its production capacity in the intermediate term.

This is on top of the MU management’s early guidance of only “several hundred millions of dollars of HBM revenue in fiscal 2024” and the intensifying memory market competition from its South Korean peers, with SK hynix also guiding sold out production capacity for both HBM3 and HBM3E in 2024.

From these commentaries, it appears that the memory producers aimed to boost prices by compressing the supply of higher demand products, while cycling through its existing inventory.

Therefore, while MU expects “improved margins and financial performance throughout 2024 and record industry TAM in calendar 2025,” it appears that we are unlikely to see an NVDA-like jump in MU’s top/ bottom lines ahead.

So, Is MU Stock A Buy, Sell, or Hold?

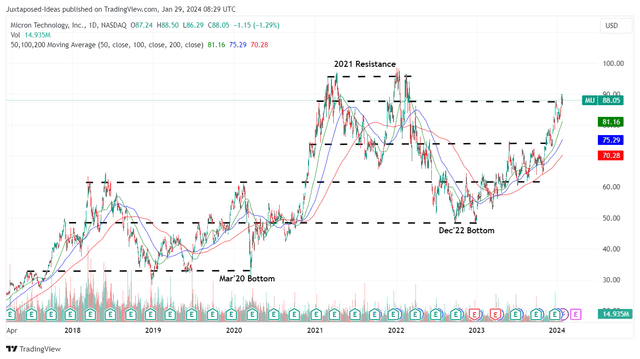

MU 5Y Stock Price

On the one hand, it is apparent that bullish support continues to be present, as observed in the MU stock’s sustained recovery from the December 2022 bottom, with it already trading near its 2021 resistance levels.

On the other hand, we maintain our belief that most of its upside potential is already baked in, with the stock likely to trade sideways as it grows into its premium valuations.

This is attributed to the MU stock currently trading near our long-term price target of $87, based on the consensus FY2026 adj EPS estimates of $7.33 and its normalized P/E valuation of 11.88x.

Combined with the +76.3% hyper-rally since the December 2022 bottom, well-outperforming the SPY at +29.4% and QQQ at +63% over the same time period, we prefer to prudently maintain our Hold (Neutral) rating.

Do not chase this rally here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM, MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.