Summary:

- Consumer electronics demand is recovering, leading to an improvement in the memory chip market.

- The supply/demand imbalance in the memory chip market is easing.

- Micron has an attractive valuation.

hapabapa

Introduction

In my previous article, I have been bullish on Micron (NASDAQ:MU). At the time, I viewed Micron’s CAPEX cuts, memory chip industry progression, and macroeconomic environment positively. All these factors were moving in the direction likely to benefit Micron. Today, I continue to stand by my previous bullish thesis. The macroeconomic condition surrounding the memory chip industry is continuing to recover from the demand trough while Micron’s action to cut CAPEX and limit supply is coming to fruition as the supply and demand imbalance is starting to normalize. Further, despite about 20% stock price appreciation since the publication of my last article, Micron, in my opinion, still has an attractive valuation multiple. Therefore, I am continuing my buy thesis on Micron.

Consumer Electronics Demand Recovering

After the pandemic time boom in the consumer electronics demand, consumers’ demand for new electronics has quickly died down. As a result, 2022 and 2023 have not been a favorable year for companies operating in these markets, including Micron. There were too many supplies with very little demand. However, today, the demand is showing consistently strong trends of growth.

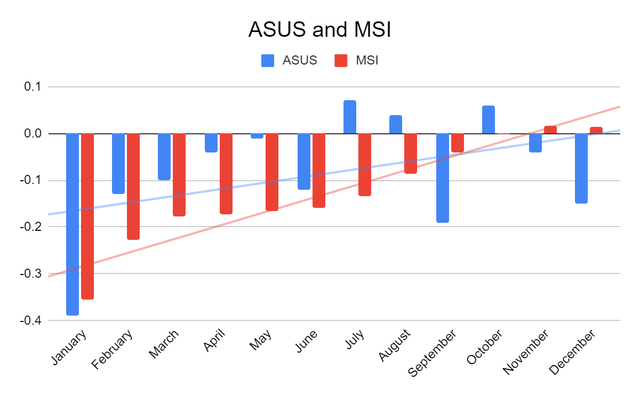

Consumer electronics manufacturers Asus and MSI report monthly revenue data. These companies sell computer parts and computer peripherals to laptops representing a wide range of consumer electronics products, and as the chart below shows, throughout 2023, the monthly revenue trend has been steadily growing. The magnitude of the slope of the trendline differs between the two companies, but I believe the positive trendline slope reflects the recovering consumer electronics demand.

Further, according to the Consumer Technology Association, the US retail sales of consumer electronics are expected to grow 2.8% year-over-year in 2024, which is an improvement from a contraction of 3.1% in 2023.

Micron is one of the biggest memory chip makers. As such, the company is exposed to the business cycles in the consumer electronics market. The recovery in the demand of the consumer electronics industry, therefore, likely creates a tailwind for Micron.

Memory Chip Market Recovery

The recovery in the consumer electronics market will certainly act as a tailwind for Micron in 2024. Beyond consumer electronics, the memory chip market is also expected to see demand growth creating a favorable business environment for Micron.

2023 saw a massive imbalance of supply and demand in the memory chip market. There was simply too much supply compared to demand. As a result, starting in late 2022 in November, Micron started to aggressively cut its CAPEX to artificially limit the supply in the market. Micron’s biggest competitors, Samsung (OTCPK:SSNLF) and SK Hynix, also limited the supply by cutting CAPEX around this time. Given the massive CAPEX cuts by all of the major memory chip producers for about a year, the memory chip market’s supply and demand imbalance is finally easing as SK Hynix and Samsung have signaled for the reversal in the memory chip business cycle.

Further, during Micron’s fiscal 2024Q1 earnings call, the management signaled for the normalization in the memory chip industry by saying that “the improved supply-demand environment in the current calendar quarter gives [the company] additional confidence in the trajectory of [the] business,” which was the result of the “strong inflection in industry pricing this calendar quarter.” Finally, regarding the entire 2024 outlook, the company said “we expect our pricing to continue to strengthen through the course of calendar 2024.”

Therefore, considering both Micron’s management commentary and the industry peers’ outlook, I believe it is reasonable to argue that the memory chip industry is normalizing, which will likely create a tailwind for Micron in 2024. Not only is the demand returning, but the supply and demand in inventories and the market have mostly normalized.

Financials and Valuation

(Micron’s fiscal year ends in August)

Micron’s valuation, in my opinion, is attractive at current levels. Today, Micron has a negative 2024 forward price-to-earnings ratio for the fiscal year ending in August 2024. This is the result of the company continuing to navigate the turmoil experienced during the market downturn from the previous year. Although the outlook is bright, the near-term profitability for Micron continues to be gloomy. However, the company has a 2025 forward price-to-earnings ratio of only 12.65 as the expectation is for the company to continue recovering throughout 2024. Therefore, considering the macroeconomic tailwinds in the progression of the memory chip industry, I believe the forward valuation multiple of about 12.65 provides an attractive upside opportunity.

Micron also has a healthy balance sheet. The company has about $8 billion in cash and total long-term liabilities of about $11.3 billion. The healthy cash balance and expected future earnings will likely be more than enough for the company to manage its long-term debt. Further, Micron’s total assets stand at about $63.78 billion while the total liabilities stand at about $20.89 billion bringing the total liabilities to asset ratios to only about 32.75%. Therefore, Micron’s balance sheet is healthy enough to sustain the company’s operations, future endeavors, and reasonable fluctuations in the market.

Risks

My bullish thesis has a major risk. The continual recovery in the consumer electronics demand along with the normalizing supply and demand imbalance for the memory chip market relies heavily on the health of the underlying economy. If the economy achieves a soft landing or only minor slowdowns, there may not be a significant impact on my bullish thesis; however, if there are any major weaknesses in the economy, the recovery trend in both the demand, supply, and consumer electronics could be at peril.

Summary

Micron is in a favorable position going into 2024. The company is expected to benefit from multiple tailwinds that are growing stronger. First, the consumer electronics demand is steadily accelerating showing signs of growth once again. Second, the memory chip market’s inventory, supply, and demand imbalance is normalizing setting up the market for a favorable pricing opportunity for Micron. Finally, while these tailwinds are forming and growing, Micron’s current valuation still leaves room for a continual appreciation potential today. Therefore, I continue to believe Micron is a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.