Summary:

- Micron’s share price has remained strong as investors still have fond memories of the recent bull market.

- The company’s financials are expected to become worse during the upcoming quarters before they take a turn for the better.

- The company is struggling to generate the FCF to justify its valuation, which will cause continued underperformance.

Hyunho Song/iStock via Getty Images

Micron (NASDAQ:MU) is one of the three memory companies in the oligopoly along with Samsung (OTCPK:SSNLF) and SK Hynix. The company has recently been put in a difficult position by a changing market, doubling up with the commodity nature of the memory markets along with the associated capital expenses.

As we’ll see throughout this article, changing markets and Samsung’s continued capital can hurt the company’s ability to drive future shareholder returns.

Micron Overview

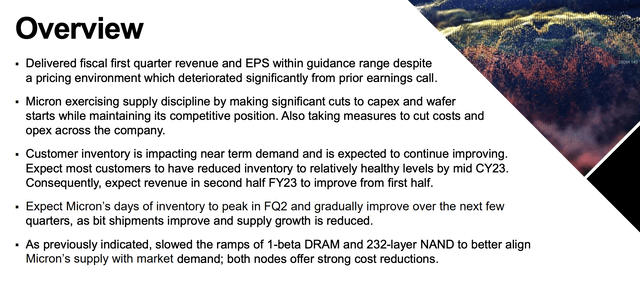

Micron had a tough quarter, but in some parts it managed to perform. Unfortunately, the company can’t change the macroeconomic environment.

Micron managed to deliver revenue and guidance both within range. The company is making substantial cuts to capex, but it’s in an industry where capex requirements are still enormous every year. That’ll make it difficult for the company to continue generating reasonable FCF. The company expects that inventory reductions will hurt it in the FH and improve afterwards.

However, we don’t expect the company’s situation to return to the recent strong levels until the 2024-2025 time period. It’s also worth noting that the company is slowing ramp, which presents a short-term benefit, but might also hurt its market position in the long-term depending on the company’s competitor capital positions.

Micron Industry Adjustments

The company is dealing with a tough industry that it’s working to accommodate.

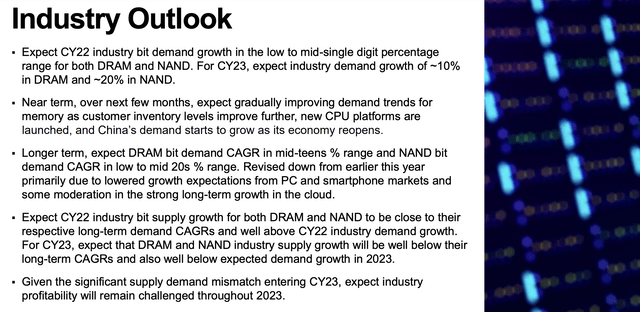

The company has reduced its capex for the year to a midpoint guidance of $7.2 billion, although the company is losing 50% of its WFE. The effects of just a few billion in capital reductions are pronounced, the company is expecting 2024 WFE to be 50% lower than 2023 even though construction spending will increase Y/Y.

Wafer starts for both DRAM and NAND are expected to reduce by 20% as well. As a result of these capital cuts and delays, the company expects its 1-gamma node will now be introduced in 2025. 1-gamma is thought to be the first node to use the latest EUV technology and while DRAM has some scaling issues for its components, it can be expected to be a big technological leap.

The company expects profitability to remain challenging through 2023, which we agree with, and we expect 2024 will be a tough year as well for FCF on the bottom line.

Micron Financial Performance

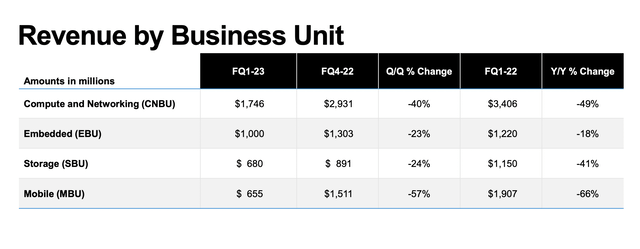

Financially, Micron had a tough quarter, highlighting the market’s struggles.

Through the quarter the company had $940 million in CFFO from $4.1 billion in revenue. Across the company’s segments revenue is down roughly 50% both QoQ and YoY. The company’s higher capex spending for the quarter was $2.5 billion, with -$1.5 billion in FCF not counting the company’s $425 million in buybacks at roughly $50 / share.

The company has substantial liquidity of almost $15 billion, which can help it whether the downturn. However, the company’s $1.8 billion in net cash is quite low and can dwindle quickly putting the company into a negative cash position. Even with the company’s $1.6-1.7 billion capex forecast, FCF can still be expected to push its net cash to negative by YE.

That doesn’t include any share buybacks that the company is undergoing. Whether or not those pan out remains to be seen.

Micron Guidance

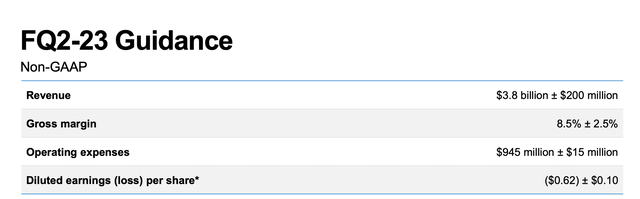

Micron’s guidance agree with the company’s views that the next quarter will be the hardest.

The company is expected another almost 10% revenue drop with an 8.5% gross margin. That implies FCF generation of -$1 billion for the quarter, utilizing roughly half of the company’s net cash position. The company is tentatively guiding for improvements in the subsequent quarters, but it’ll need substantial improvements to start earning cash.

Our View

The last time Micron went through a similar crisis from 2014 through 2016, the company’s share price dropped to less than $10 / share. The company went through a strong bull market after that where its share price hit almost $100 / share. Even with the company’s recent almost 50% share price decline, we think it’s still overvalued.

At an almost $64 billion market capitalization, the company eventually needs to earn roughly $6 billion in FCF annually. Even in the company’s strongest quarters of the most recent bull market it earned roughly $2 billion in quarterly FCF. From the start of 2020 through the most recent quarter, a just over 3-year period encompassing a normal market cycle, it earned $5 billion.

That’s a 3-year period which means a 3% annual FCF yield. For a company that isn’t growing its financials substantially over the upcoming years that’s poor. The company can keep improving efficiency and the oligopoly can benefit it, however, Samsung’s continued massive capital spending implies all members of the oligopoly might not care about the same savings.

In fact, rumors are that Samsung is using the downturn to improve its market share in the industry, potentially setting the stage for a massive capital show-off.

Thesis Risk

The largest risk to our thesis is the oligopoly can still generate massive profits in a popular industry. DRAM and NAND are fundamental technologies to our current lifestyle and demand can be expected to continue growing dramatically in the upcoming years. That could result in Micron generating massive FCF for shareholder returns.

Conclusion

Micron has an impressive portfolio of assets and is a key member of the memory oligopoly. The company is spending billions annually to maintain that position, even the company’s reduced capital spending for the year is expected to be $7.2 billion. However, unfortunately, the company participates in commodity markets where it’s susceptible to strong price fluctuation.

The company’s FCF was negative for the most recent quarter and can be expected to remain negative. That could quickly push the company’s net cash position to negative. The company isn’t generating the FCF even in good times to justify its valuation, meaning at current levels it’s expensive and isn’t worth investing in.

Let us know your thoughts in the comments below.

Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.