Summary:

- New technologies, HBM and 128GB DDR5, will drive a recovery in the memory market.

- Micron has just a 10% share of the HBM (high bandwidth memory) market.

- Micron has yet to produce a 128GB DDR5 chip.

- SK Hynix monopolizes both sectors of the high-capacity memory market.

VITALII BORKOVSKYI/iStock via Getty Images

New preliminary 2Q data from Korean DRAM manufacturers SK Hynix and Samsung Electronics (OTCPK:SSNLF) indicate that they are pulling ahead of U.S.-based Micron Technology (NASDAQ:MU) in their memory recovery. I gave a preliminary analysis in my June 23, 2023, Seeking Alpha article entitled “Micron: Late To The Game AI Strategy And Politics Do Not Make For A Strong Company.”

The rise in generative AI (artificial intelligence) that includes ChatGPT and its demand for high bandwidth memory (“HBM”) has been a catalyst for growth of DRAMs. New data I was able to collect is that HBM market share in 2023 is evenly split between SK Hynix and Samsung with a 45% share, and Micron with a 10% share.

- SK Hynix is currently supplying HBM3 exclusively to NVIDIA for the H100 Tensor Core GPU.

- Samsung HBM products went into supercomputers such as Intel’s Aurora Project and AMD’s El Capitan at Lawrence Livermore National Laboratory in the United States along with AMD’s MI300 AI superchip.

I forecast dales of HBM chips to surge 45% YoY in 2023 and 40% YoY in 2024, leading to steep profit growth during the market upturn, according to The Information Network’s report entitled Hot ICs: A Market Analysis of Artificial Intelligence (“AI”), 5G, Automotive, and Memory Chips.

HBMs require a complex production process and highly advanced technology. HBMs’ average selling price – ASP – is at least three times that of DRAM.

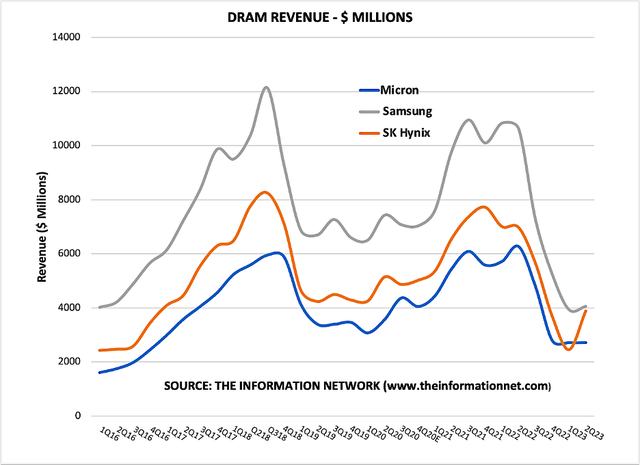

Chart 1 shows DRAM revenue for Q2 2023 (Micron’s fiscal Q3 2023). SK Hynix reported preliminary Q2 DRAM revenues of 58% compared to just 3% for Samsung and 0% for Micron. The uptick in revenue at SK Hynix and Samsung suggests that customers have significantly reduced inventory overhang and are beginning to purchase chips again albeit at low prices.

Chart 1

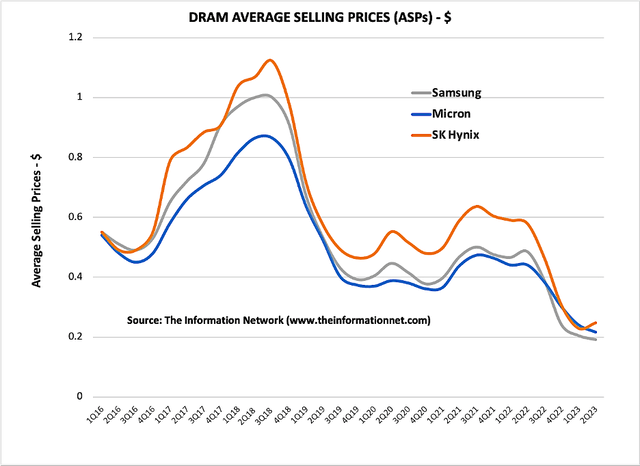

Another factor influencing the strong revenue growth of SK Hynix is the higher ASP of 128GB DDR5 chips, the company has been able to limit the decline in ASPs, as shown in Chart 2. SK Hynix dominates the market with an estimated 90% yield.

Chart 2

DDR5 has twice the performance of DDR4 DRAM currently in widespread use, the current leading DRAM for servers and the largest source of revenue for memory semiconductor makers. I estimate DDR5 will make up 30% of server memory demand by the end of 2023.

So, while DDR4 DIMMs (dual in-line memory module) can have capacities of up to 64GB (using SDP), DDR5 SDP-based DIMMs quadruple that to 256GB.

Investor Takeaway

The DRAM market is growing unevenly as the technological advantages of HBM and DDR5 foster a recovery in the server market, the sector demanding the greatest amount of memory. This resurgence is aided by Intel (INTC), the dominant number one player in the server central processing unit (CPU) market, which introduced a DDR5 DRAM-capable Sapphire Rapids CPU. And of course Nvidia (NVDA) with its dominance in the AI GPU market for servers.

Micron has made little headway in the AI/HBM business, and is scheduled to begin mass-producing HBM3 in early 2024. According to EETimes:

“SK Hynix has developed MR-MUF technology and has been applying it to HBM products. This technology improves the quality in more than 100,000 micro bump interconnections of HBM. In addition, this packaging technology has sufficiently increased the number of thermal dummy bumps while excelling in heat dissipation compared to its competitors as it applies a molded underfill (MUF) material which has high thermal conductivity.

MR-MUF refers to the process of attaching semiconductor chips to circuits and filling the space between chips and the bump gap with a material called ‘liquid EMC’ (Epoxy Molding Compound) when stacking up chips. So far, NCF technology has been used for this process. NCF is a method of stacking chips by using a kind of film between chips. The MR-MUF method has about twice the thermal conductivity compared to NCF and affects the process speed as well as the yield.”

The MR-MUF package has a significant impact on the external structure of the HBM chip. SK Hynix increased the capacity by about 50% by increasing the amount of DRAM stacked in one product from 8 (16 gigabytes) to 12 when creating a 12-layer HBM3.

For DDR5, while SK Hynix is the only company in full production of the 128GB chip, and Samsung is just starting production, MU has only just introduced a 96GB chip.

Overall, the memory downturn may be reaching its nadir and an upswing will start in 2H 2023, which I detailed in a March 7, 2023 Seeking Alpha article entitled Micron: A Bad 2022, A Dire 2023, A Positive 2024.

Another affirmation came from ASML’s recent earnings call regarding revenue from memory companies. ASML (ASML) reported that memory revenues decreased from 30% of total revenues in Q1 2023 to 16% in Q2, 2023. Memory Bookings improved and were €1.4B vs. €788M in the prior quarter (+77% QoQ) and €3.38B a year ago (-59% YoY).

I reiterate my Sell rating on MU.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here.