Summary:

- We’re still buy rated on Micron Technology, Inc. after its Q3 FY23 earnings results as we see memory industry demand-supply dynamics improving into 2024.

- While we understand investors’ disappointment in Micron’s gm% outlook for the next few quarters, we think the industry wafer starts, and capex cuts will reduce excess supply and stabilize prices.

- Additionally, we understand the CAC ban will have an impact on the company’s recovery, but we expect increased content-per-box coupled with new product launches like HBMx to drive demand recovery.

- We expect the stock price to remain volatile in 2H23 as we continue to see a mixed-demand environment for PCs, smartphones, and servers, but we think revenue has bottomed.

William_Potter

Micron Technology, Inc. (NASDAQ:MU) reported 3Q23 earnings earlier this week; we’re seeing our investment thesis regarding memory industry demand-supply dynamics improving in 2H23 and 2024 playing out. We continue to be buy-rated on MU, recommending longer-term investors explore favorable entry points into Micron stock as demand and pricing improve in 2024.

The company beat top and bottom estimates this quarter, reporting revenue of $3.75B, down 56.6% Y/Y but up 2% sequentially, and Non-GAAP EPS of -$1.43. We believe memory revenue bottomed and see sequential performance improving in 2H23. MU’s guiding for sales to grow 4% sequentially next quarter to $3.9B, with Non-GAAP gross margin expected to improve -10.5% due to negative impact on price pressure, underutilization, and improved NAND sales mix. We understand investors are disappointed in the company’s gross margin outlook for the new few quarters, but we expect the memory market recovery due to the production cuts across the industry, from MU and also SK Hynix and Samsung, and WFE spending cuts that helped reduce excess supply. MU, SK Hynix, and Samsung make up the top three companies by share in the DRAM market; hence, Samsung’s commitment to cut production after the company flagged a 96% drop in Q1 profits in April aided in moving along inventory correction cycles. We now believe the inventory correction cycle is over, consistent with our expectations earlier this year that the corrections would be completed by 2H23.

The stock is up roughly 29% YTD, outperforming the S&P 500 (SP500) by 13%. The stock is up only slightly by 16% since we upgraded to a buy; our bullish sentiment on MU has been targeted at longer-term investors, and we continue to see the upside ahead for MU as memory demand and pricing improve in 2024.

The following graph outlines our rating history on MU.

Q3 2023 & Memory Recovery Underway

DRAM sales dropped 2% sequentially this quarter to $2.67B; DRAM sales account for the bulk of MU’s revenues at 71% this quarter. Our bullish sentiment on MU is driven by our belief that DRAM demand will recover in 2024; DRAM bit shipment already showed sequential growth, up 10% QoQ. NAND sales that account for roughly the rest of total sales rebounded 14.5% sequentially; we don’t attribute the NAND sales sequential growth to real end-market demand but to customers taking strategic positions in the low memory prices. NAND bit shipments were up 38% sequentially this quarter.

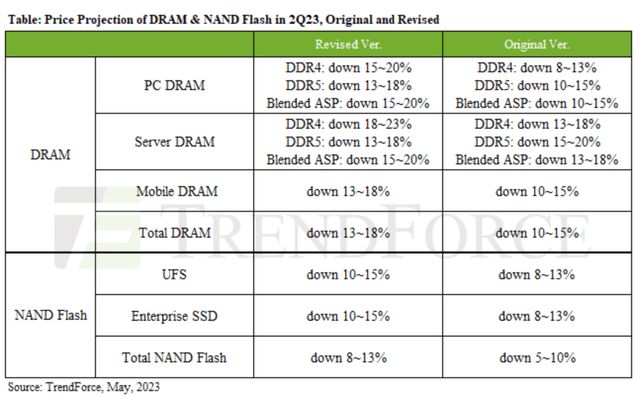

The sequential growth of NAND and DRAM bit shipments, however, was offset by ASP declines. DRAM bit shipments ASP dropped 10% sequentially and NAND ASP by 15% sequentially. A core issue in the memory recovery is improved memory pricing after prices reached historical lows this year; DRAM ASP dropped 20% sequentially in Q1 2023 and is expected to have declined further in 2Q23 according to TrendForce’s May report on DRAM and NAND Flash prices. The following table outlines price projections of DRAM and NAND Flash in 2Q23.

We think the significant price drop in DRAM resulted from the high inventory levels of DDR4 and LPDDR5. We’re more constructive on memory price declines moderating in 2H23, as the inventory correction cycle has been completed, and hence excess supply has been reduced substantially. Of course, we don’t expect prices to go back up overnight, but we’re seeing signs of pricing recovery in 2H23. Management elaborated on this in the 3Q23 earnings call, noting,

“As a result, pricing trends are improving, and we have increased confidence that the industry has passed the bottom for both quarterly revenue and year-on-year revenue growth.”

We agree that the bottom is behind us and expect prices to stabilize after the industry wafer starts and capex cuts.

The CAC Ban Impact

MU CEO Sanjay Mehrotra emphasized the Cyberspace Administration of China (CAC) ban is a “significant” headwind slowing recovery; last month, the CAC banned Chinese customers from purchasing MU products due to “network security risks.” The company’s 8k filing highlighted that the ban could impact up to 50% of its China-based sales, which represent 25% of total sales. Our bullish sentiment considers the CAC ban, but we believe it will slow growth, not halt it entirely. We continue to see favorable entry points into MU’s growth prospects for 2024 and see demand tailwinds that can help offset the CAC ban’s impact on revenue.

We also expect MU’s top line to grow in 2H23 and 2024 due to memory content growth driven by new products like the HBM3+ that customers have already begun sampling. We also expect demand tailwinds from the industry transition to higher-density DDR5 from DDR4; the DDR5 “splits the memory module into two independent 32-bit addressable subchannels to increase efficiency and lower the latencies of data accesses for the memory controller.” We’re also constructive on the A.I. boom driving demand for high-bandwidth memory for A.I. servers that use 6-8x DRAM content than regular servers and 3x the NAND content. We think MU will experience demand tailwinds in 2H23 and 2024; we recommend investors buy the stock on pullbacks.

Valuation

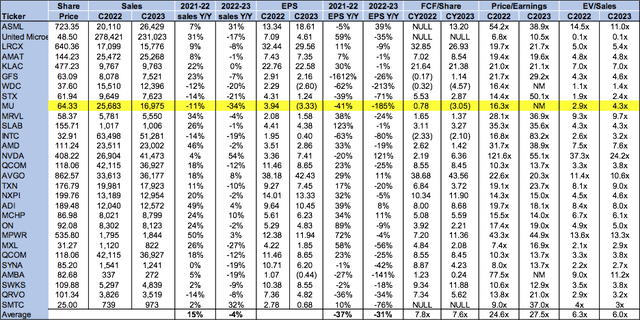

MU stock is relatively cheap. The stock is trading at 4.3x EV/C2023 Sales versus the peer group average of 6.0x. The stock is undervalued, trading well below the peer group average. We continue to recommend longer-term investors explore favorable entry points into the stock at current levels.

The following chart outlines MU’s valuation against the peer group average.

Word on Wall Street

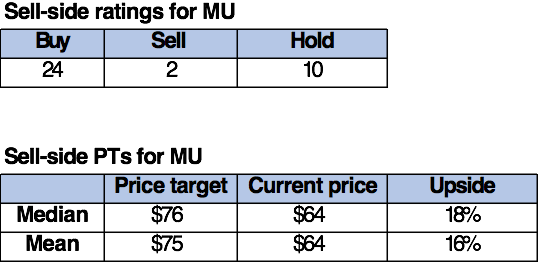

Wall Street shares our bullish sentiment on MU. Of the 36 analysts covering the stock, 24 are buy-rated, ten are hold-rated, and the remaining are sell-rated. The stock is priced at $64 per share. The median sell-side rating is $76, while the mean is $75, with a potential upside of 16-18%.

The following charts outline the sell-side ratings and price targets for MU.

TSP

What to do with the stock

We maintain our buy rating on Micron Technology after 3Q23 earning results. We expect the stock price to remain volatile in 2H23, as we continue to see a mixed-demand environment for PCs, smartphones, and servers, but we think revenue has bottomed. We now see top-line growth in 2H23 and 2024 driven by new products and higher-density DDR5. We think the CAC ban will be a continued headwind weighing on the company’s China-based sales and expect it will slow recovery but not stop it. We also see a contraction in PC, smartphones, and server total addressable market Y/Y, but we believe the mixed-demand environment is factored into the company’s outlook for the next few quarters. We recommend investors explore favorable entry points into Micron Technology, Inc. stock, as we believe memory demand and pricing are improving.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2 week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2 week free trial so we hope to see you in our group soon.