Summary:

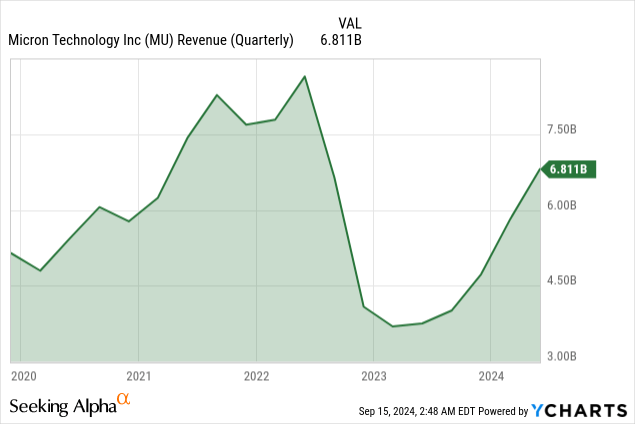

- Micron’s Q3 2024 revenue surged to $6.8 billion, an 82% YoY increase, driven by AI and data center demand.

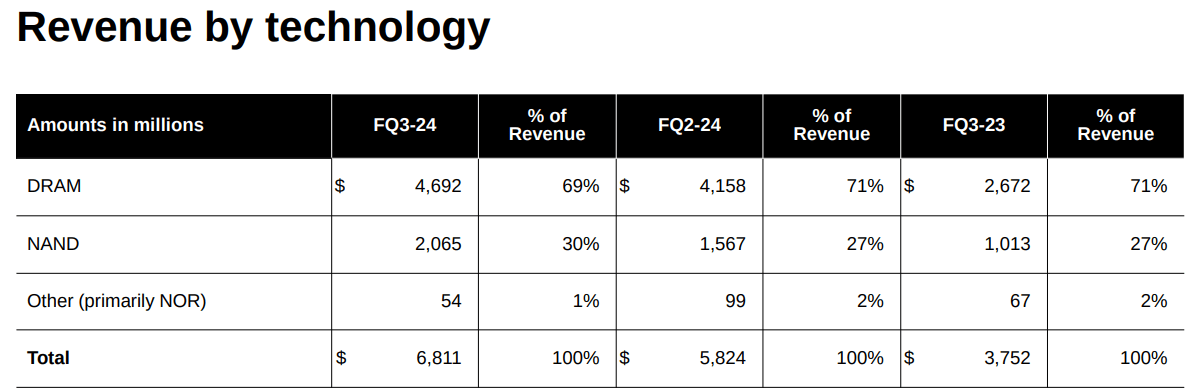

- DRAM contributed 69% of total revenue with 13% sequential growth, while NAND grew 32%, reflecting strong market positioning.

- AI-related products like high-bandwidth memory led to a 50% revenue increase in the data center segment, and continued growth is expected.

- Micron’s $8 billion CapEx plan focuses on expanding advanced manufacturing and infrastructure to support long-term growth through 2025.

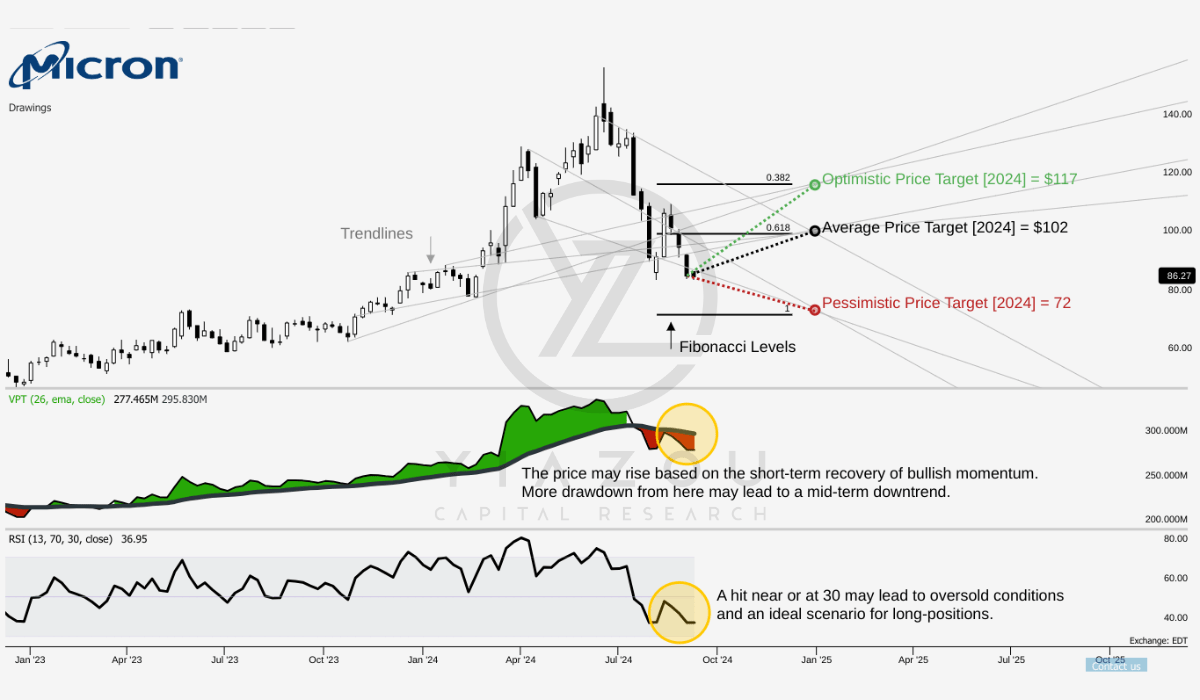

- MU’s RSI at 37 indicates it’s nearing oversold territory, while Fibonacci retracement levels suggest a potential bullish reversal if price trends hold.

imaginima/iStock via Getty Images

Investment Thesis

With the increasing demand for AI and data centers, Micron Technology (NASDAQ:MU) is well-positioned for long-term solid growth. The recent performance underlines that Micron manages its ups and downs with robust recoveries and expansion in key segments.

Micron’s laser focus on advanced memory technology and strategic pricing improves its competitive advantage, and improvements in operations drive profitability. As AI adoption accelerates, along with higher demands for high-performance memory by data centers, Micron is poised to capitalize on these trends.

Record Revenue, Boosted Margins, and Strategic Expansion

Micron’s fiscal Q3 2024 had strong growth, with top-line exceeding expectations (beat by $136 million). The company had $6.8 billion in top-line growth with a 17% sequential boost and an 82% YoY surge. This growth is derived from favorable industry trends, strategic pricing, and a strong product mix. Similarly, the sequential revenue increase is vital, considering seasonal demand fluctuations common in the semiconductor industry. The YoY growth of 82% indicates a significant turnaround from the previous year and highlights a recovery in market conditions.

Breaking down revenue, Micron’s DRAM segment contributed $4.7 billion, 69% of total revenue. This segment grew by 13% sequentially based on a 20% price rise. The bit shipments saw a mid-single-digit percentage decline, yet higher prices boosted revenue. The price increase points to Micron’s sharp pricing strategies in a favorable market. Meanwhile, the NAND segment contributed $2.1 billion, about 30% of total revenue. The NAND revenue rose 32% sequentially, with bit shipments rising in the high single digits. Lastly, prices increased by 20%, indicating strong demand for NAND products.

Toward the bottom line, Micron’s gross margin reached 27%, with an over 7-percentage-point improvement sequentially. This margin expansion was derived from higher pricing, better product mix, and cost reductions. Without inventory write-downs from fiscal Q2, the gross margin improvement would have been 15%, indicating enhanced profitability and sharp cost management.

As a result, operating income was $941 million, with an operating margin of 14%. This represents a 10% sequential increase and a 53% improvement from the prior year. Hence, the improved margin reflects Micron’s operational edge and cost control, contributing to profitability.

Moreover, Micron’s adjusted EBITDA was $2.9 billion, which led to an EBITDA margin of 43%. This margin improved by 6% sequentially and 3% YoY. The substantial EBITDA margin highlights Micron’s progressive execution of its business strategy. Pricing, cost management, and product mix optimization led to this improvement.

The semiconductor industry is recovering at the macro level, which has helped the growing demand for data center products and AI advancements. AI demand has driven rapid growth, especially in the data center segment. Micron saw a 50% sequential increase in revenue from this segment, driven by AI-related products. These include high bandwidth memory (HBM) and data center SSDs, which are high-margin items.

Looking ahead, Micron expects continued growth in the data center segment. It anticipates record levels of data center revenue in fiscal 2024 and strong growth in fiscal 2025. AI-driven demand and higher-margin products will drive growth in the top and bottom lines. The rise of AI PCs and smartphones may boost demand in the PC and smartphone markets. Finally, new generations of AI products will accelerate PC replacements and increase the need for high-performance memory.

Earnings Presentation

Micron’s Cutting-Edge DRAM and NAND Innovations Power Long-Term Growth Potential

Micron’s investment in advanced tech leads in DRAM and NAND development. More than 80% of DRAM production occurs on 1-alpha and 1-beta nodes, and over 90% of NAND production uses these advanced nodes. These transitions boost performance and cost-efficiency, positioning Micron competitively.

The 1-alpha node improves power efficiency, density, and overall performance. The 1-beta node will further improve those aspects above, further consolidating Micron’s strength in the DRAM marketplace. In NAND, the focus is on advanced solutions such as the 232-layer NAND. Thus, this technology has tripled bit shipment and could continue to capture rising demand for high-capacity storage.

Nevertheless, Micron’s technology roadmap indicates that the company is working toward continuous advancements in both its DRAM and NAND units. It is expected that 1-alpha DRAM, fabricated on EUV lithography technology, may be volume-produced as early as 2025. This new generation of memory will be much faster than the current one. In addition, the next-generation NAND node arriving in 2025 would offer even greater storage. Manufacturing investments also reveal Micron’s long-term intentions.

For instance, the fiscal 2024 CapEx plan is $8 billion and focuses on expanding infrastructure and technology. The company aims to allocate around 30-35% of revenue to CapEx in 2025, which includes investments in HBM assembly, fabs, and technology transitions.

Lastly, Micron is also building new manufacturing facilities like Greenfield fabs in Idaho and New York to ensure long-term competitiveness. These facilities will support long-term top-line growth, but won’t impact bit supply until fiscal 2027. Micron’s investments in leading technology and infrastructure may improve the company’s share in the memory market.

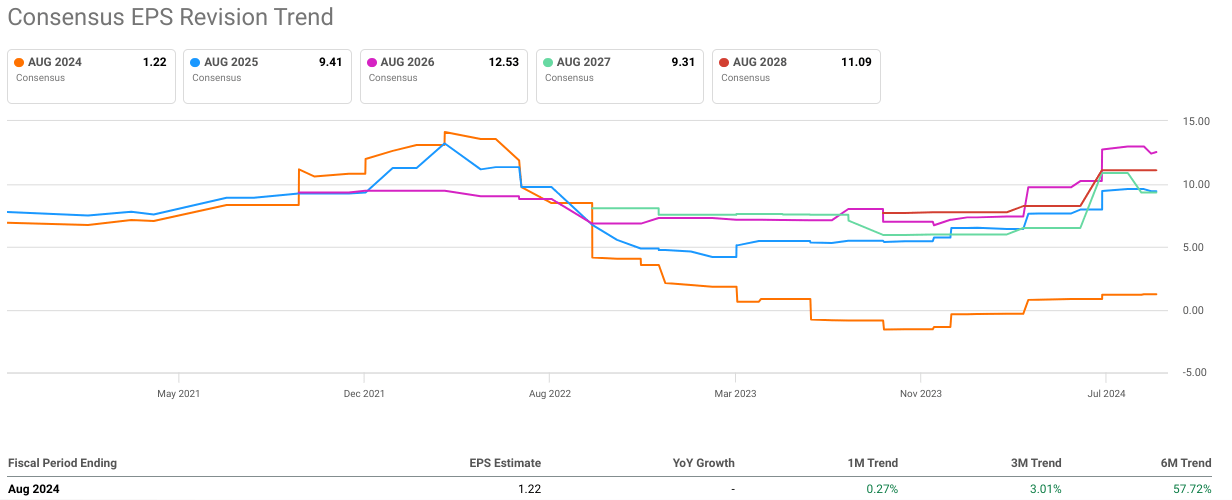

Overall, based on these developments, the street has extremely positive estimates for revisions in the upcoming fiscal years. There are 27 EPS upward revisions and only two downward ones. Similarly, revenue estimates have 29 upward revisions against one downward. For Q4 fiscal 2024 (Non-GAAP), the company may beat both EPS normalized ($1.12) and revenue estimates ($6.67 billion) based on a surprising history of 12 months (4 out of 4 EPS beat) and the company’s guidance (EPS = $1.08 ± $0.08).

Seeking Alpha

Oversold RSI Hints at Potential Rebound or Deeper Correction

MU is currently trading at $91, with the stock’s average price target for 2024 set at $102. This aligns with the Fibonacci 0.618 retracement level, often a critical point for reversals for a potential bullish rebound if the stock approaches this target.

On the optimistic side, the price target is $117, aligned with the 0.382 Fibonacci level, indicating stronger upside potential. Conversely, the pessimistic price target of $72 matches the 1 Fibonacci level and is often viewed as a full retracement and indicative of a deeper correction. These targets are derived from short-term price trends projected along Fibonacci levels.

Moreover, the RSI currently stands at 37, which indicates MU stock is approaching oversold territory. However, no bullish or bearish divergence is present. The downward trend in the RSI suggests continued selling pressure, and a potential long setup emerges at the 30 RSI level that may lead to a possible bottom for a future rebound.

The Volume Price Trend (VPT) is also trending downward. The VPT line is currently at 277 million compared to a moving average of 297 million, which indicates a bearish price-volume relationship. However, if the VPT hits its moving average back, signaling a possible bottom, this points to a potential long setup.

Yiazou (trendspider.com)

Downsides: Amid PC, Smartphone, and Data Center Market Uncertainties

Micron’s growth is influenced by demand for PCs, smartphones, and data centers. Fluctuations in these markets can impact its growth sustainability. The company expects moderate growth in AI-related PCs and smartphones. The PC market is forecasted to grow at low single-digit rates, and smartphone volumes are projected to increase by low to mid-single-digit percentages. Any challenges or slowdowns in these areas could affect Micron’s revenue and market share.

Micron’s focus on data center products driven by AI demand creates opportunities and risks. While AI-driven demand is robust and effective, supply management is critical, as inventory imbalances can harden companies’ bottom lines. Similarly, fluctuations in AI-related demand or competition could impact Micron’s market share and growth in the mid-term. However, normalizing customer inventories and interest in long-term agreements are positive signs.

Micron’s forward P/E ratio (non-GAAP) is 75, much higher than the sector median of 23, indicating massive overvaluation relative to sector peers. Analyst estimates for Micron’s fiscal 2024 EPS are $1.22. By 2025, EPS is expected to rise to $9.41 with a 668.27% growth. EPS for 2026 may reach $12.53, with a growth of 33.11%. These bottom-line estimates and P/E ratio point to high variability in the mid-term.

Takeaway

With leading-edge DRAM and NAND developments, MU is ready to reap benefits from AI and data center product demand. While the PC and smartphone markets have cyclically weakened, Micron’s strategic pricing, technological edge, and concentration on AI-infused memory solutions lay the bedrock for solid multiyear growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.