Summary:

- Micron’s FQ4 ’23 earnings call outlined quite a few 2024 trends and plans pointing toward a very bullish upcycle.

- Contrary to headline conclusions, its plan to raise its CapEx budget in FY24 over FY23 is very bullish.

- Add in the bottoming of DRAM and NAND pricing and repurposing idle WFE equipment to leading nodes, and Micron’s FY24 looks very promising.

- The memory upcycle has begun due to these signals.

nazarethman

There’s never a shortage of opinions on Micron (NASDAQ:MU), especially during a memory cycle transition period, and it hasn’t let us down this time, either. The company has been raked over the coals for cutting production first, yet its competitors followed suit. Bears have thrashed it because the cycle continues despite the supply changes, yet the memory market has started to respond in the company’s favor. Now, the company is raising CapEx, and everyone is losing their minds because a memory company “can’t” increase CapEx during the throes of a downcycle because not adding supply is so critical. Yet, by reading between the lines, a different kind of emergence from the downcycle is taking hold, and one aspect has not been seen before in the industry – one that could change the course of this coming upcycle to Micron’s complete advantage.

The Signals Of Micron’s Stock

The forward-looking data points provided on its recent earnings call, which wrapped up FY23, were quite detailed and said as much between the lines as the lines themselves. It’s why I like fourth quarter calls so much; they provide a nice outlook over the coming fiscal year. There were three points from the call I found to be the most noteworthy, and they all point toward a Micron that’ll be stronger than before:

- Raising CapEx and the plans therein

- DRAM and NAND demand and supply trends

- Utilization plans and product focus

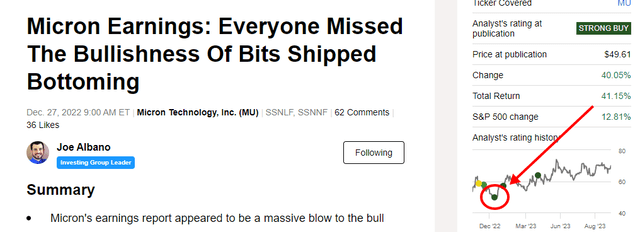

Before I get into these ideas, remember I called the first cycle-shift signal in December, just three quarters ago. This, of course, was bits shipped and the bottoming of this metric. So far, it turned out to be the exact bottom of the stock for this downcycle.

The three points I’ll be getting into shortly signal the start of the upcycle, where bits shipped bottoming signaled the ending of the downcycle. The bits shipped shift meant the cycle bottom needed to play out, but it was beyond the apex.

Now, for those who think the financials are the most important and not the memory market metrics, keep in mind EPS is the last metric to prove either the bull or bear case. EPS doesn’t track the cycle; it’s a lagging indicator. Without getting too far into the weeds on this concept, here’s how this downcycle started in terms of share price and EPS:

Therefore, don’t follow EPS, and quite honestly, don’t follow most of the financial metrics. They all lag the stock price movement. The best indicators are the memory market metrics like bits shipped, bit supply, bit demand, CapEx, and utilization decisions.

This is why I’m focusing on the three ideas I outlined earlier in this article – they tell us the story of where we are with the sentiment of the share price. If you waited till EPS was rising and waited till it peaked, you would’ve gotten in late and gotten out late, potentially for a loss on the trade.

With that, here are the main points I see as most constructive for understanding where the industry and Micron are going.

The Counterintuitive CapEx Signals

The headline following the earnings report read, “Micron plans to increase CapEx over 2023.” While this is an accurate statement, the conclusions from there ran in a predictable yet very wrong direction. The exact phrasing used by management was not precise on the number front, but the detail was reasonably good.

We project our fiscal 2024 capital expenditures to increase slightly versus fiscal 2023…

– Mark Murphy, CFO, FQ4 ’23 Earnings Call

Construction CapEx will be elevated to support our plans to build leading-edge memory fabs in Idaho and New York, for which we filed CHIPS applications in August…

Assembly and Test CapEx is projected to double year-over-year in fiscal 2024, predominantly driven by investments to support HBM3E production. Our planned fiscal 2024 CapEx investments in HBM capacity have substantially increased versus our prior plan in response to strong customer demand for our industry-leading product.

– Sanjay Mehrotra, CEO, FQ4 ’23 Earnings Call

Consistent with our comments the last few quarters, we do see WFE CapEx decreasing from fiscal 2023 to fiscal 2024.

– Mark Murphy, FQ4 ’23 Earnings Call

There are three very clear areas of interest within the planned CapEx spend.

1. WFE Spend Isn’t Up

First and foremost is WFE (wafer fab equipment) spend. This is what most see as the “supply” investment number. More equipment means more bit supply, or so goes the thinking. This is erroneous for several reasons. However, even with the improper correlation of WFE spending and bit supply, management expects this number to decrease further in FY24 as it did in FY23 over FY22. So, regardless of one’s understanding of WFE dollars and what they mean, the company isn’t growing it in FY24; it’s actually decreasing. At best, then, the argument for increased overall CapEx bringing more supply doesn’t hold.

While this reduced WFE spend is enough to be optimistic about CapEx plans, it’s the other components of the 2024 agenda where the majority of the bullish outlook comes from.

2. Construction CapEx

Construction CapEx is another aspect sometimes seen as foreboding to more supply as WFE needs a place to be installed. But when it comes to the technology leadership Micron has established across the different product verticals, new and larger fabs are required whether supply would grow or remain the same. For one, EUV is within the next two years for Micron for production volume, and the footprint of an EUV line is much bigger than a DUV or equivalent line to the point where EUV machines are the size of a bus while non-EUV machines are more or less the size of a pickup truck.

As nodes advance, more and more layers requiring EUV will be inserted, requiring more EUV systems. Add on the transition from legacy nodes to advanced nodes, and all of the company’s output will require multiple EUV systems per layer over the coming years. The bottom line is the future requires quite a few very large systems across its fab footprint, meaning more fabs are necessary to maintain wafer output since the much larger EUV machines crowd out other steps.

But this is only one part of the fab footprint equation. HBM3E requires more process steps than other DRAM flavors. Since HBM3E is taking center stage at the company due to its high demand and high revenue center, more capacity for HBM3 means a bigger fab footprint than its more generic 1β chip end-products.

Combining the need to move to EUV for advanced process nodes (WFE must be installed quarters ahead of production time) with the new high-demand HBM3E product and current fab space runs out very quickly. To prepare for this and onshore much of the new capacity, the company must start construction on new fabs now, hence the increase in construction CapEx.

3. Packaging And Testing Allow More Throughput, Not Output

The final aspect of the increased CapEx plans is the largest growing piece of it: packaging and testing. This backend piece of the process has nothing to do with increasing capacity. Packaging and testing only processes what has been made on the cleanroom floor. In other words, it can act as a bottleneck if it’s taking in hundreds of thousands of wafers and can only package and test anything less than. And since HBM3E requires much different packaging than server or PC DRAM DIMMs, it requires a different kind of packaging to ship. Combined with Micron’s minimal market share of HBM memory in 2023 (10%), additional packaging and testing capacity is not only expected but necessary to ramp this new product to global levels.

Moreover, Micron has had bottlenecks in the past with packaging and testing and issues with multiple sources for it. Developing more capacity on the backend with multiple lines – and in other regions – allows Micron to be less impacted by supply chain issues and even shipping costs.

Higher CapEx Paves Way For Future Needs, Not Bit Supply

Overall, the increased CapEx is welcomed to further its technology lead, ramp a new product line (HBM3E), and package and test all of its products without bottlenecks. The one thought remaining is how WFE spending can be down year-over-year with the additional need for longer and more complicated processes (read: more steps, more fab equipment), with and without EUV. I’ll get to that in a bit.

DRAM And NAND Trends

But first, the stabilized pricing of DRAM and NAND over the recent few months isn’t surprising to anyone following the industry. Basically, every source out there has seen a shift in pricing from free fall to stop-gap since around August, with producers unwilling to negotiate lower. The trend is clearly showing a slowing of downward price revisions.

For Micron, specifically, the quarter-to-quarter rate of changes has begun trending in the right direction after bottoming in Q1 ’23 for DRAM and Q2 ’23 for NAND.

| Pricing Q/Q | Q3 ’22 | Q4 ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | Q4 ’23 |

| DRAM | -1% | -14% | -22% | -20% | -10% | -8% |

| NAND | -1% | -8% | -22% | -25% | -16% | -16% |

For FQ1 ’24, the company sees pricing improving for DRAM and NAND to the point where “it will be up actually in the first quarter.”

We also will see a slight benefit in price indeed in the first quarter. As we’ve mentioned in the last several quarters, we first saw pockets of improvement. And then, we mention that prices bottoming. We are mentioning on this call that it has bottomed and we are seeing in the first quarter price improvement and we expect that in this transition period to be somewhat muted in the first half and then pick-up momentum and strengthen considerably in the second half.

…

We do see price and NAND improving in the first quarter. It will be up actually in the first quarter.

– Mark Murphy, FQ4 ’23 Earnings Call Q&A

The company expects the worst of pricing to be behind it regardless of the slow move toward positive pricing.

We believe pricing has now bottomed. Ongoing demand growth, customer inventory normalization, and industry-wide supply reductions have set the stage for increased revenue, along with improved pricing and profitability throughout fiscal 2024.

– Sanjay Mehrotra, CEO, FQ4 ’23 Earnings Call

Much of this pricing shift is due to supply coming well under demand in 2023. This will continue into 2024 as the industry is shooting well under the demand profile.

Significant supply and CapEx reductions across the industry have helped to stabilize the market and are enabling the recovery that is now underway. We see both DRAM and NAND year-over-year supply growth in calendar 2023 to be negative for the industry. We expect Micron’s year-on-year bit supply growth to be meaningfully negative for DRAM. We also expect to produce fewer NAND bits in calendar 2023 than in calendar 2022.

In calendar 2024, we expect industry DRAM and NAND supply growth to be below industry demand growth and meaningfully so for DRAM.

– Sanjay Mehrotra, CEO, FQ4 ’23 Earnings Call

Much of this is due to the underutilization of fabs, cutting as much as 50% from some producers, such as Samsung for NAND, with 30 and 40 percent cuts for DRAM across the industry. This is obviously not a great position to be in for profitability. However, the expectations for 2024 are set due to the strategy set forth from underutilization and the long tail effects of it, plus the next topic.

Repurposing, Not Purchasing, WFE

My final bullish point about the plans for the underutilized equipment cinches the supply end of the deal. Obviously, running a fab at less than 100% pushes fixed costs on the lesser amount being produced rather than spread out over the entire fab’s capacity. So, keeping a fab at only 60 and 70 percent utilization means idle equipment continues to depreciate and not produce revenue.

But Micron announced plans to repurpose this idle equipment to areas where capacity needs to be ramped up, namely, HBM3 and other leading node products.

Amid an intense focus on capital efficiency over the last few quarters, we have redeployed a portion of the underutilized equipment to support production ramp of leading-edge nodes in both DRAM and NAND.

– Sanjay Mehrotra, CEO, FQ4 ’23 Earnings Call

This means the original capacity for other legacy products is permanently offline. In other words, as an example, if DDR4 PC equipment was being underutilized, it has now shifted – continuing the example – to HBM3-sided production (the underlying node is the same for HBM3 as it is for DDR5 and other products – 1β), permanently reducing DDR4 PC production and creating a new lower baseline for this product’s bit volume. In this example, production capacity isn’t returning for PC products. Yet, through this process, the company can move back to higher utilization with a product in demand, both strategically reducing supply (and underutilization costs) and strategically ramping supply in a precise manner.

Given the higher process step count of these leading-edge nodes, transitioning this equipment results in a significant and structural reduction to our overall wafer capacity in both DRAM and NAND. Due to this structural reduction in capacity, our DRAM and NAND wafer starts will remain significantly below 2022 levels for the foreseeable future.

Our industry supply projections assume a similar structural reduction in wafer capacity industrywide. Lead times to increase this wafer capacity will be long and will depend on improving demand, pricing and financial performance. We expect underutilization to continue in our legacy nodes well into calendar 2024. We see our demand at leading-edge nodes exceeding our supply in fiscal and calendar 2024, particularly in the second half of the year.

– Sanjay Mehrotra, CEO, FQ4 ’23 Earnings Call

And further driving the point home with more specifics:

In the past, we would have done this with more CapEx. But we are being extremely mindful of CapEx spend, extremely disciplined about supply. So as a result, when we move the equipment from older nodes to support the ramp-up of leading-edge nodes, it results in a net reduction in overall – in a net reduction and the structural reduction in the wafer capacity as well.

…

And you know, some of the phenomena that we have described regarding structural wafer capacity reduction, this is not unique to Micron. We believe this is happening with other suppliers as well as they grapple with the same supply profitability and CapEx considerations as we are adjusting.

– Sanjay Mehrotra, CEO, FQ4 ’23 Earnings Call Q&A

This is how the company can save on CapEx and why WFE spend is planned to shrink year-over-year. By repurposing equipment, it creates a strategic shift in supply with a one-way street.

This is not the strategy of cycles past. You might say this time is different, and you’d be correct regarding being disciplined in capacity on the upcycle side of this trough so far. DRAM producers, specifically, are not simply turning machines on again as demand returns to prior levels. In fact, it’s removing the temptation to turn the equipment back on by moving equipment once providing an oversupply to other product lines with many more steps involved and in demand, structurally reducing wafer starts.

Even the capacity adds in HBM3 and other products are not on a one-to-one basis for equipment. In fact, it takes a double hit to bit output because the products it has moved the equipment to produce fewer bits per die.

…[T]he new products in the leading-edge nodes also do require more wafer capacity for the same gigabits of production given the nature of like HBM that – where the die-size is twice as big. So, these new products also actually have a favorable impact on the industry supply growth capability.

– Sanjay Mehrotra, CEO, FQ4 ’23 Earnings Call Q&A

Although I listed this topic last as my favorite aspect, this might have the most significant impact on 2024 and 2025 regarding supply. Removing the “temptation” to turn underutilized equipment back on in place by transitioning it to leading node lines and products requiring more equipment anyway may have the largest impact on how undersupply takes shape over the next two years. It’s almost like the memory industry is resetting the last few years of supply additions.

Achieving Goals All-Around

Remember Micron’s goal to shift revenue away from PC and Mobile and toward Data Center, Auto, Graphics, etc.? This CapEx plan and shift of WFE from legacy, less-margin products is a very quick and efficient way to achieve this goal.

With the improving DRAM and NAND pricing trends and the continued undersupply into 2024, the upcycle has begun. Add in the strategic reallocation of WFE from former oversupplied end products to high-in-demand products, and 2024 and 2025 could lead to favorable DRAM and NAND pricing. The industry has never seen such a shift in production lines in its history, mainly because it has never seen such an underutilization of fabs.

The bottom line is the cycle bottom was past the worst point in December, and now the beginning of the upcycle has come to fruition due to the actions taken by the DRAM Big Three over this year. This coming upcycle may be one of the best ones due to the shift in strategy coming out of a downcycle by removing supply completely from legacy lines. It is an excellent setup for Micron’s business and stock over the next year.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Decrypt The Cash In Tech With Tech Cache

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Second, become one of my subscribers risk-free with a free trial, where you’ll be able to hear my thoughts as events unfold instead of reading my public articles weeks later only containing a subset of information. In fact, I provide four times more content (earnings, best ideas, trades, etc.) each month than what you read for free here. Plus, you’ll get ongoing discussions among intelligent investors and traders in my chat room.