Summary:

- Micron Technology, Inc. stock has rallied due to AI narrative, but recent dip prompts consideration for buying opportunity.

- Micron is not a suitable alternative to Nvidia Corporation stock due to lower growth, profitability, and competition.

- Micron’s current valuation may not be justified, but potential entry points for investment exist based on technical analysis.

hapabapa

Thesis Summary

Micron Technology, Inc. (NASDAQ:MU) has rallied strongly in the last year on the back of the AI narrative.

The latest earnings gave us a dip in the stock. Is this a good chance to buy?

Investors looking for the next Nvidia Corporation (NVDA) or a good Nvidia alternative, might be tempted, and while I don’t completely dislike Micron, this is not the next Nvidia.

We will compare both stocks looking at their business, growth, profitability, and valuations.

Ultimately, I am rating Micron a sell after this recent rally, although using technical analysis I will point out entry points that I would find appealing.

Business Overview

Micron has caught a bid with many other stocks in the semiconductor business, but what does the company do exactly?

Micron Technology, Inc. designs, develops, manufactures, and sells memory and storage products worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit.

Source: Seeking Alpha.

In essence, it develops memory and storage solutions like DRAM and RAM. Now, let’s see how the revenue breakdown by segment:

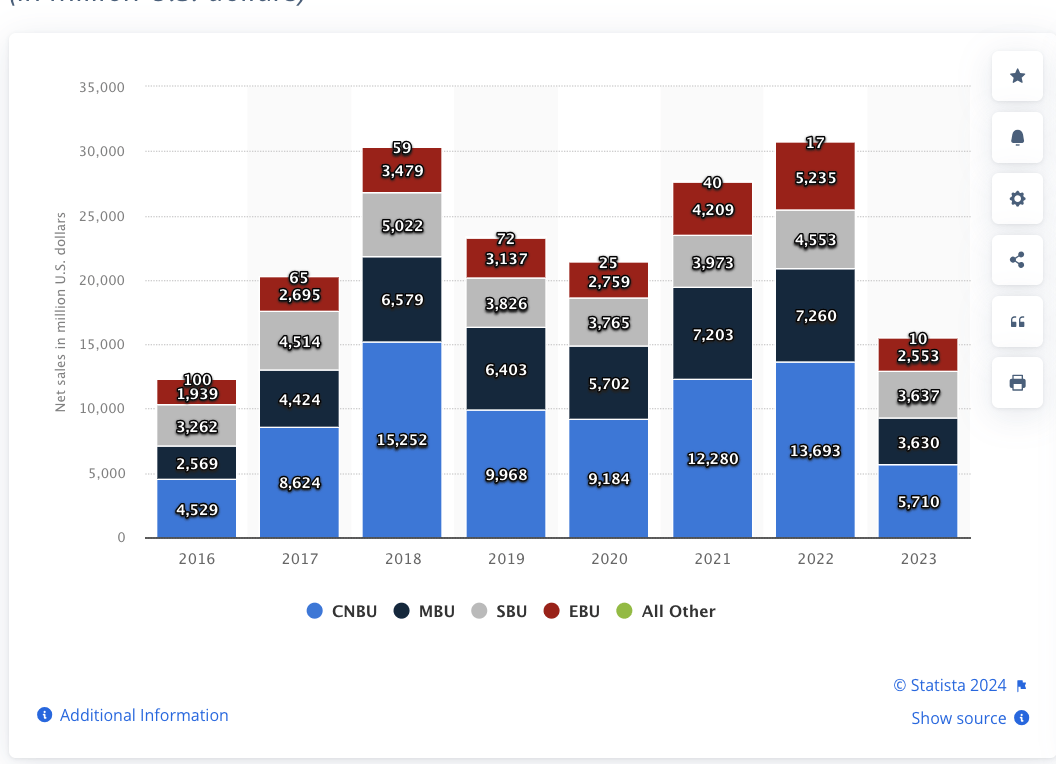

Micron revenue by segment (Statista)

CNBU makes up most of the revenue, followed by MBU. It’s interesting to see that revenues in 2023 actually fell by 49% in 2023.

This was actually largely due to a dispute with its Chinese and Hong Kong clients, which raised concerns over security issues with Micron’s products.

With that said, the company has ambitious plans for the coming couple of years.

Latest Results

The latest earnings results are worth looking at, especially since they prompted a 20% pull-back.

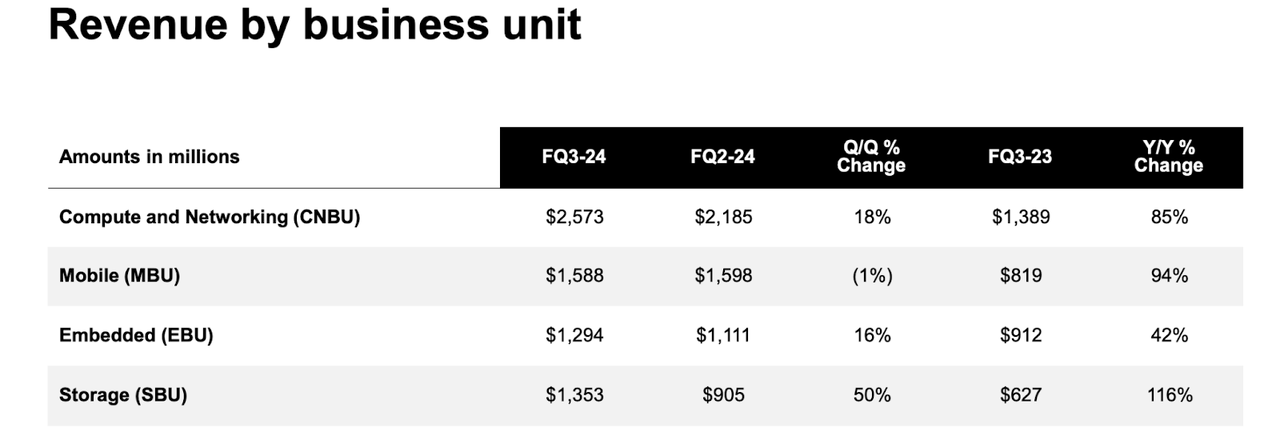

Revenue by business unite (Investor slides)

The company’s CNBU segment grew 85% YoY, and the Storage SBU segment grew 116%. One could believe this has been an explosion driven by AI, but we have to consider that we are dealing with very easy comps given the “unusual” performance of 2023.

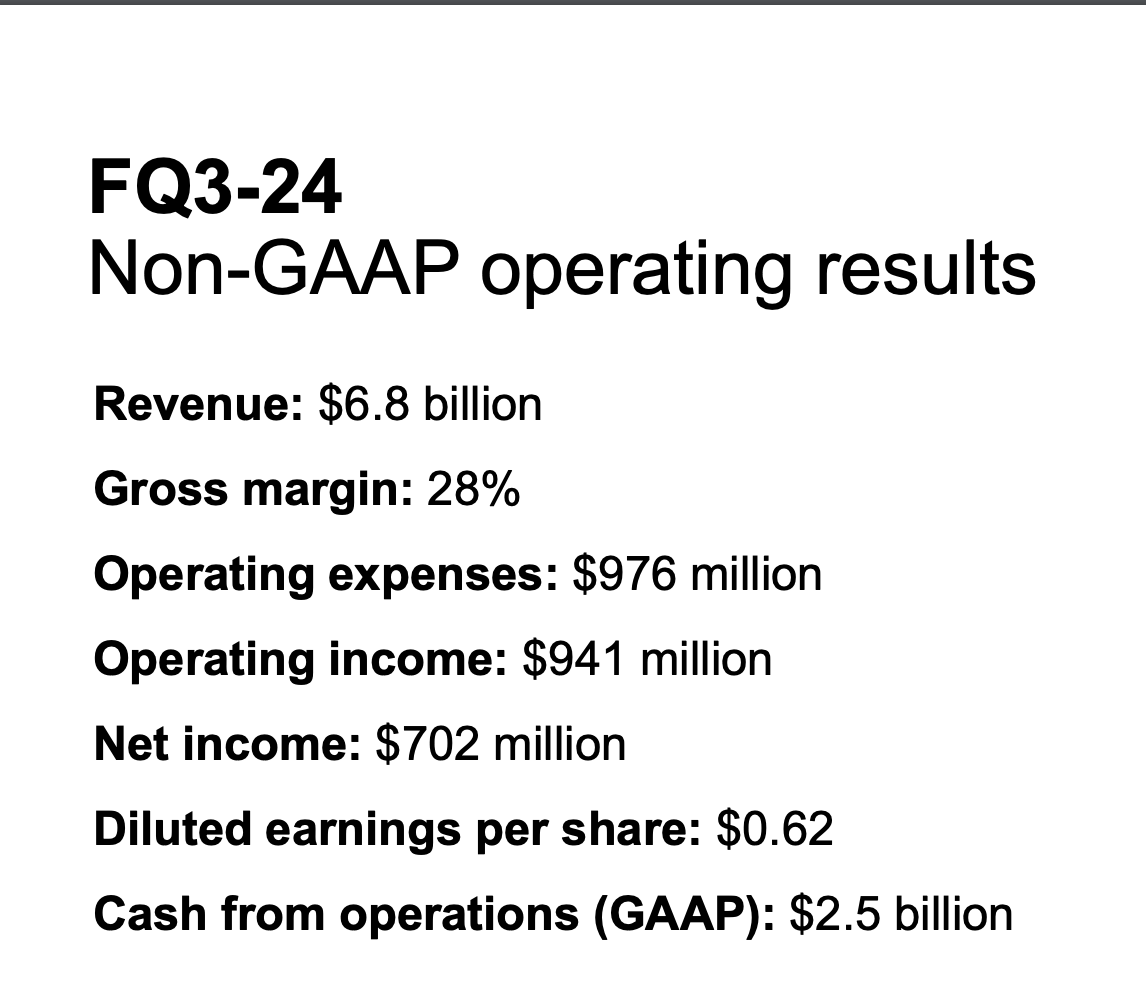

Quarterly overview (Investor slides)

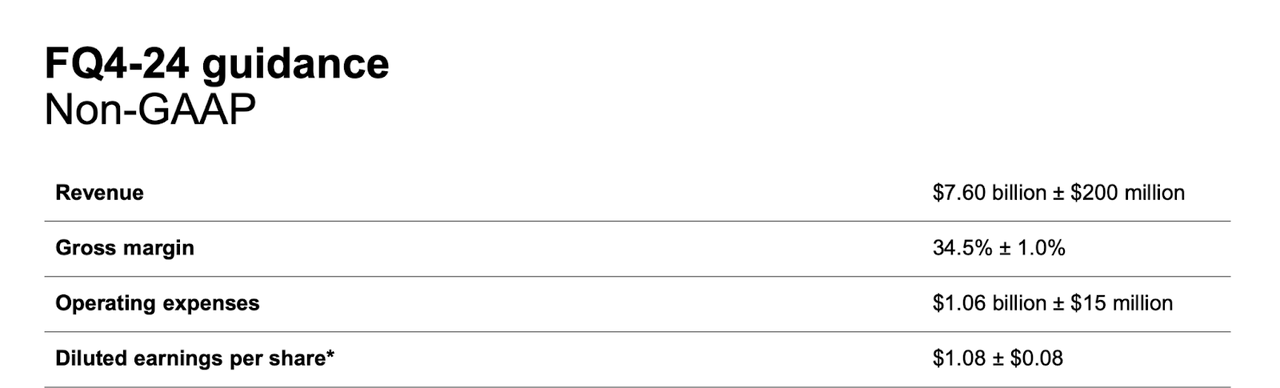

The company made $6.8 billion for the quarter, with a 28% gross margin and achieving positive EPS of $0.62.

For the next quarter, the company expects to see the gross margin increase to 34.5%, revenues of $7.6 billion, which would be a quarterly growth of around 11% and EPS of around $1.

Ultimately, we have seen some AI-driven growth. The company states that AI demand helped achieve a 50% sequential basis growth.

Moreover, this is also creating tightness in their products, which should allow Micron to increase its margins.

As we look ahead to 2025, demand for AI PCs and AI smartphones, and continued growth of AI in the data center, create a favorable set up that gives us confidence that we can deliver a substantial revenue record in FY25, with significantly improved profitability underpinned by our ongoing portfolio shift to higher margin products.

Source: Investor Presentation.

Micron vs. Nvidia

Micron is no doubt benefitting from AI, but this is in no way an Nvidia alternative.

Growth

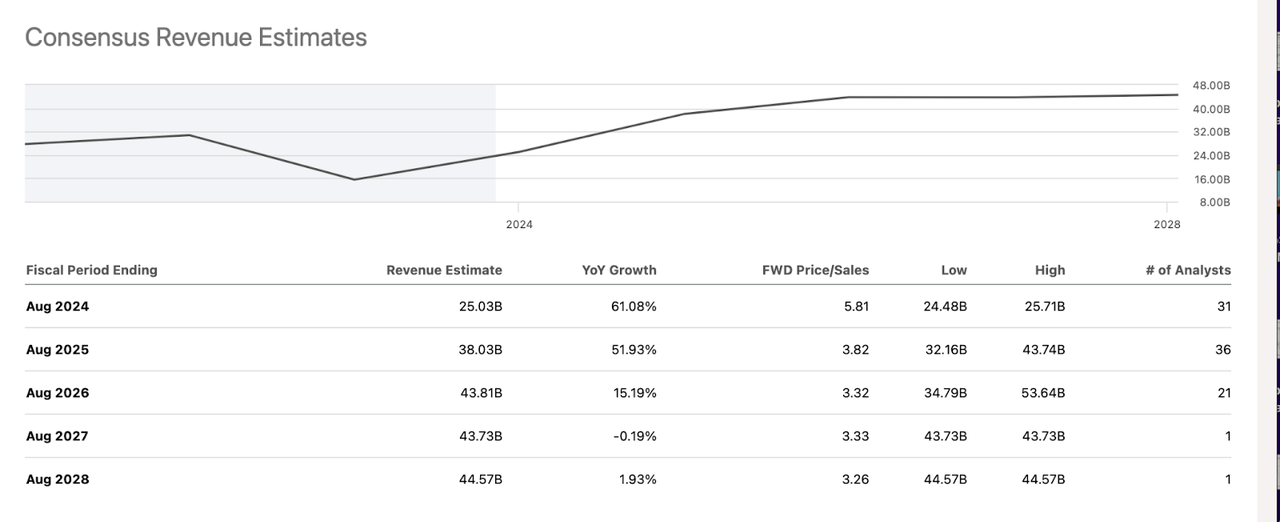

Starting with growth, while this year we have seen significant revenue growth, this has only been possible after a 49% drop in the previous year.

Even with some nice AI-driven growth, analyst estimates suggest that from 2022-2027, revenue will have grown at a CAGR of 9.18%.

We can see that revenue estimates as far out as 2028 actually project negative revenue growth. This is unreliable, as it is based on 1 analyst and is quite far in the future, but it gives us an idea of what investors are thinking.

Micron’s business is cyclical, and as we will see below, a highly competitive one.

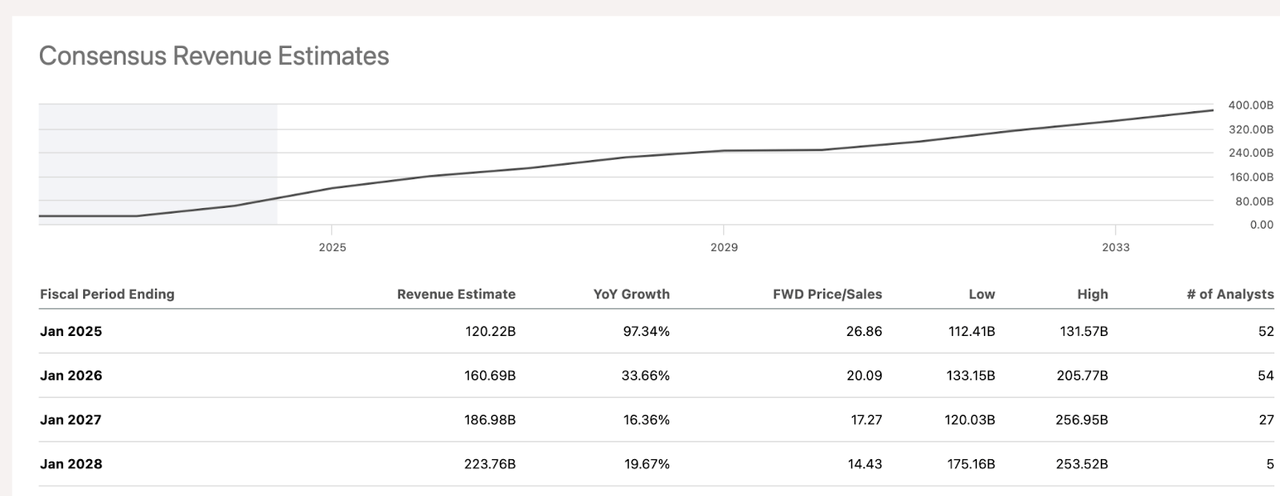

This is a far cry from what we have seen happen with Nvidia’s revenues and the much more bullish estimates going forward.

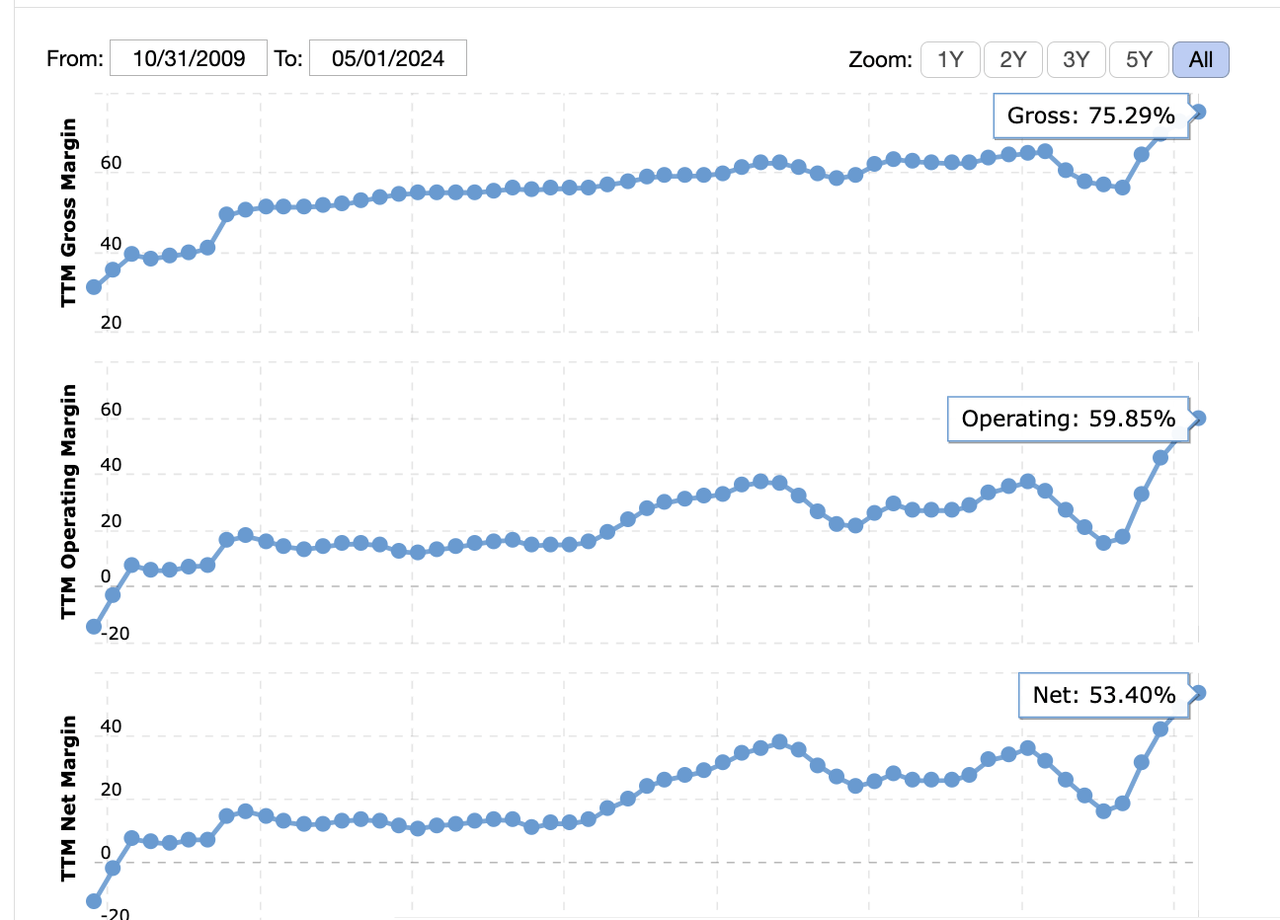

Profitability

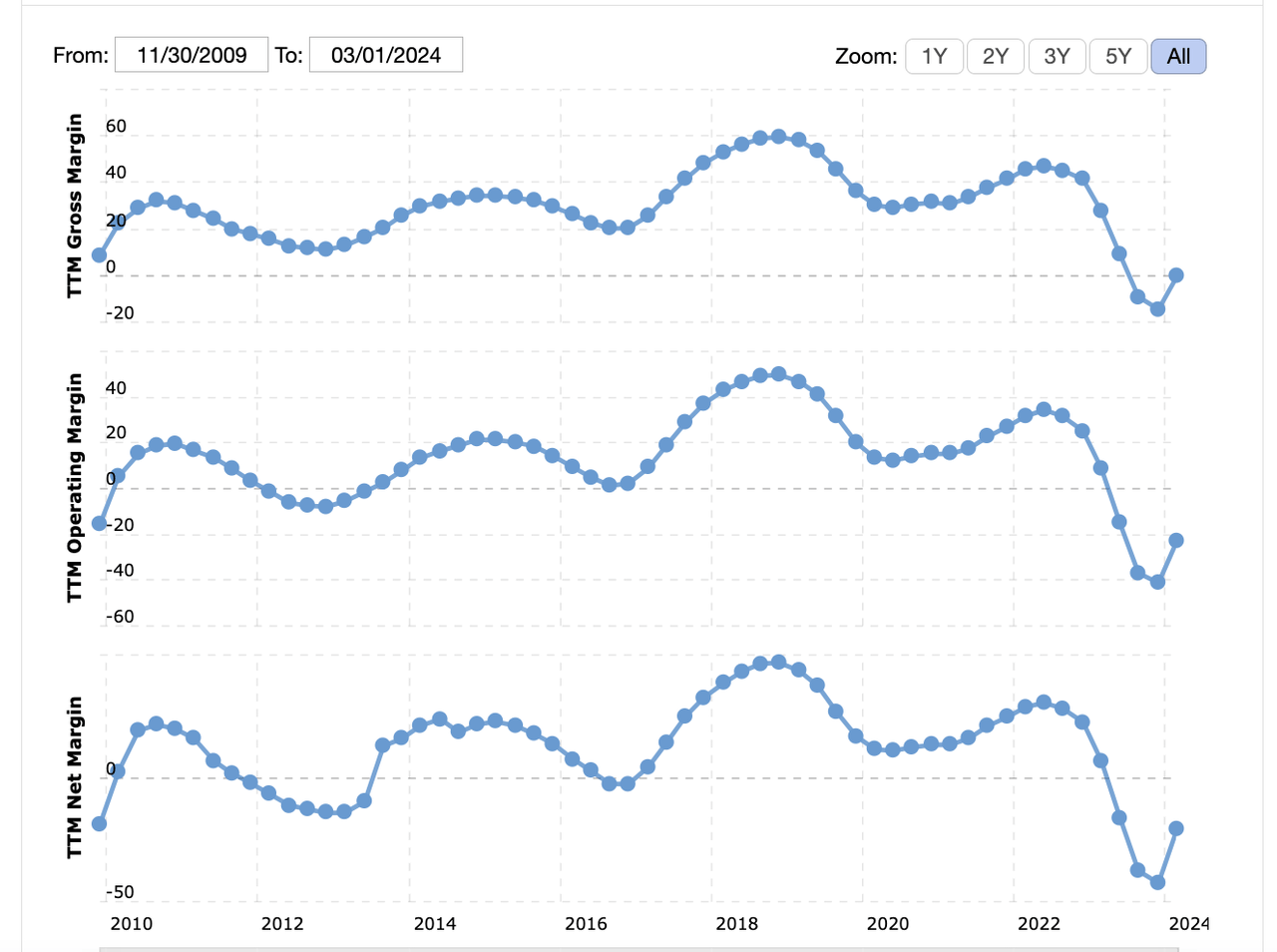

Now, let’s look at the evolution of Micron’s margins.

While the company has reached gross margins of 60%, notice that the company has always struggled to maintain positive operating margins and has often had negative net margins in the past 10 years.

Pretty different from Nvidia’s margin trajectory and overall margins. Nvidia now has a net margin of over 53%, and this has been consistently climbing.

Competition

A big reason for this is competition, and that’s yet another strong differentiator.

We all know that Nvidia has set itself apart from competitors, proof of this is in the strong pricing power it commands.

Is this the case with Micron? Not as far as I can see.

Micron’s margins are still below their historical average, and I don’t see how its products are differentiated from its competitors. Micron faces strong competition from Samsung (OTCPK:SSNLF), for example.

This is ultimately preventing Micron from achieving a dominant market share and also higher margins. It is also one of the reasons the company has to invest heavily in Capex.

Micron is investing $100 billion in a new mega fab in New York. It has also invested $825 million in a new facility in India.

While it is good to see Micron actively making moves to keep up with demand, this highlights the nature of its capital-intensive business, which, again, sets it far apart from Nvidia.

Is Micron A Buy?

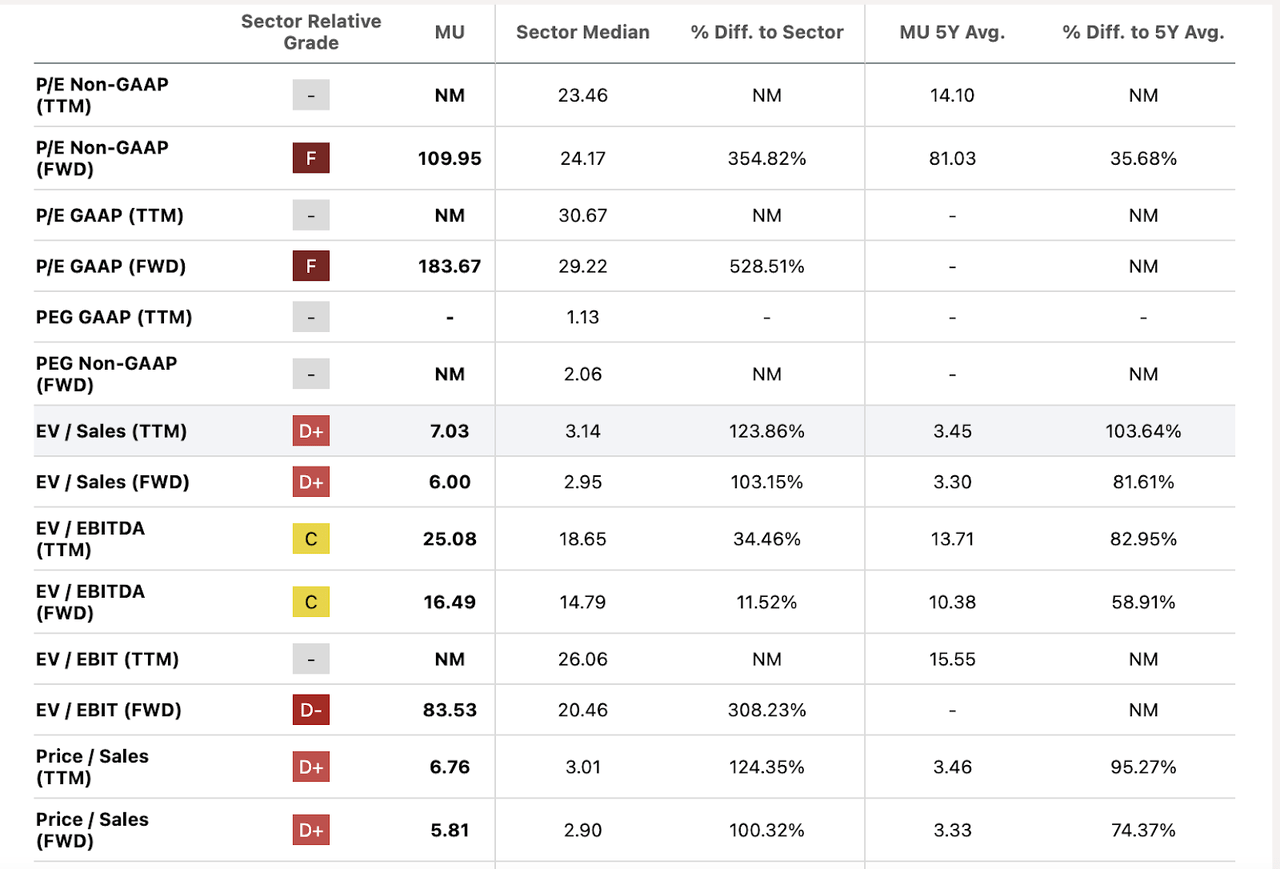

Clearly, Micron is not a valid Nvidia alternative, though you might think it is based on its valuation.

Micron currently trades at 109x its forward non-GAAP earnings. However, it’s already difficult to value this stock since its earnings were negative last year and are normalizing.

Still, its P/S is over twice that of the industry. This doesn’t make much sense, given that its operations aren’t that much more profitable than the industry.

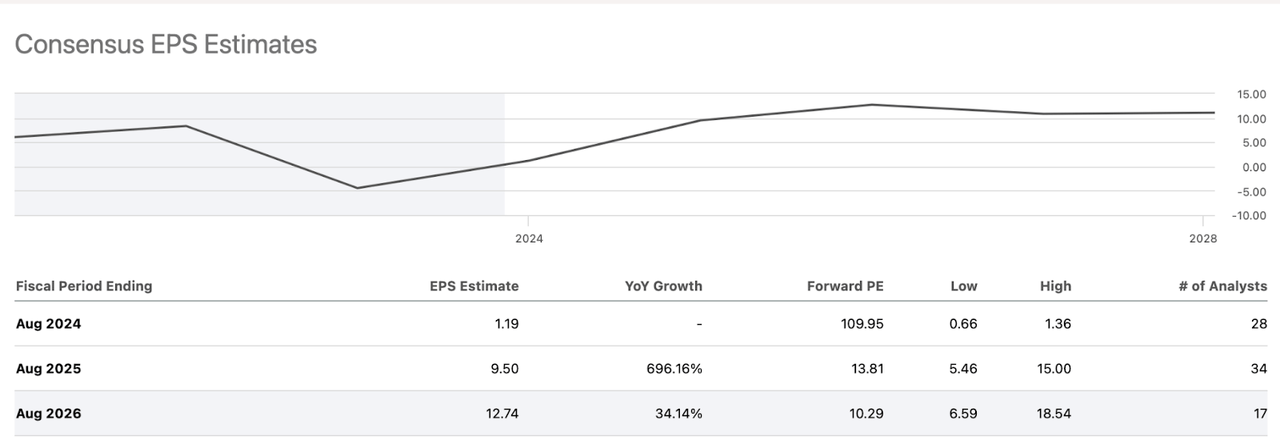

With that said, we must point out that the forward P/E is not crazy high.

EPs should normalize, which actually means they should come in at $9.50 by 2025, and that implies a forward P/E of 13. Given that the sector median P/E right now is 23, this seems okay.

We could also try to estimate a PEG ratio. If we take the P/E of 13.81 and divide it by, let’s say a generous growth of around 10%, then the PEG would come out to 1.3. Yes, this is projected to grow 34% according to estimates, but I doubt that is sustainable.

Still, it seems like the forward P/E and implied PEG could be reasonable.

Overall, I don’t love Micron. It is a competitive market, and I think its price has been bid up too high. However, the valuation isn’t crazy based on some estimates.

Technical Analysis

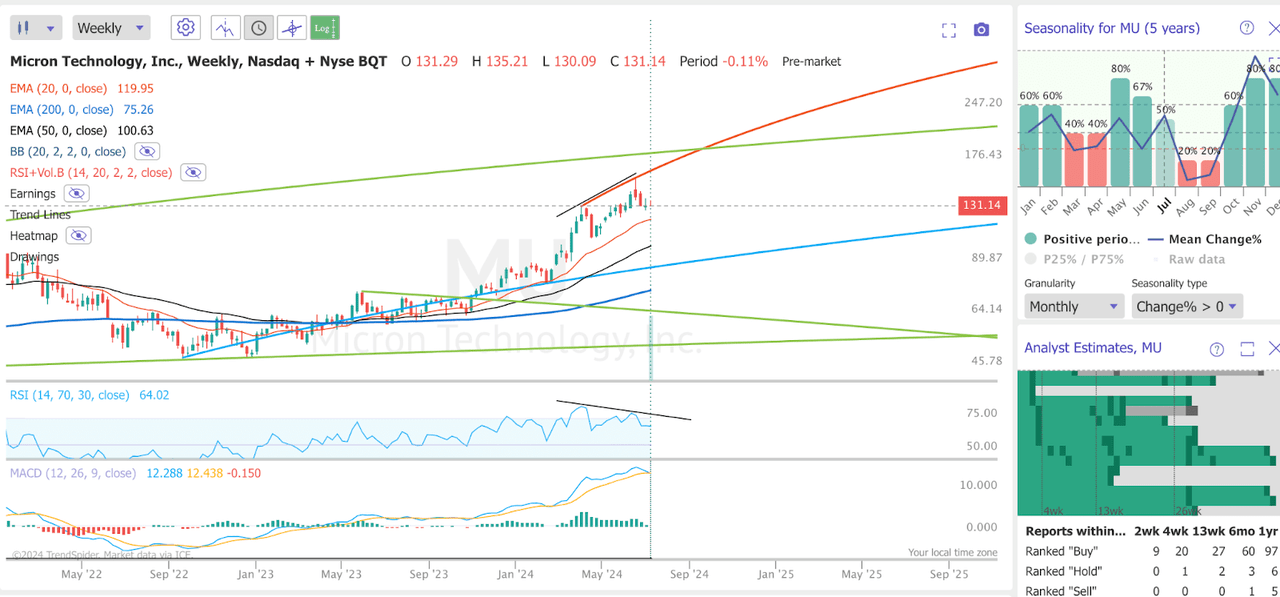

I could definitely be tempted to add some Micron at lower levels:

The current weekly chart does not look great. We can spot a bearish divergence in the RSI, and the MACD is about to give us a bearish crossover.

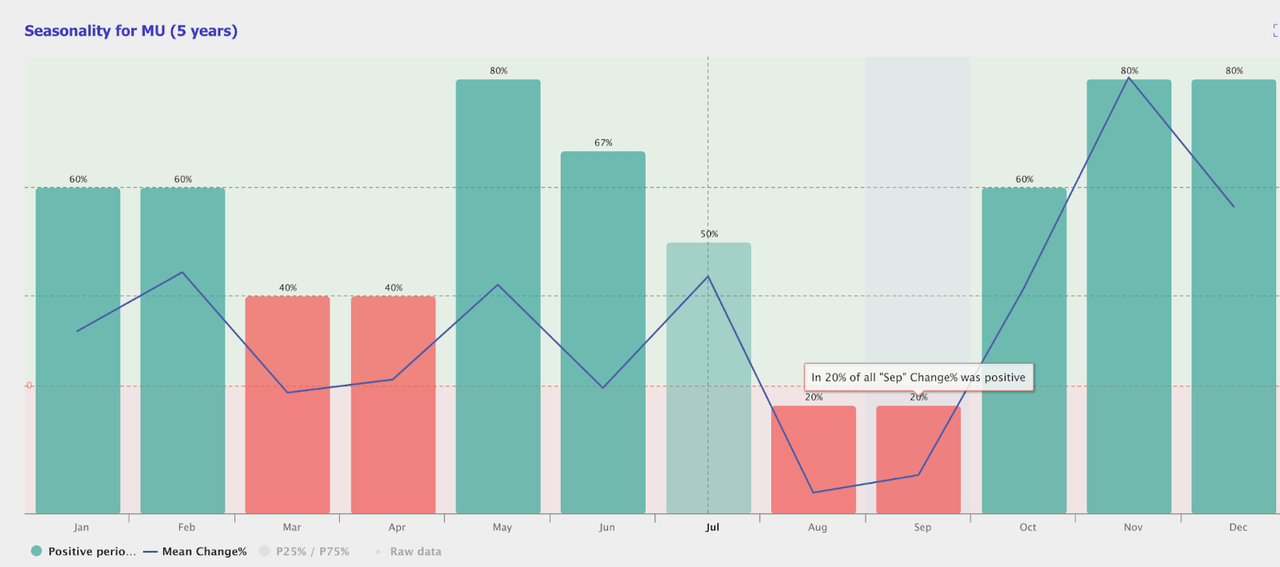

Micron seasonality (Trendspider)

Note also that over the last 5 years, July, August, and September have not been strong months for Micron in terms of price. August and September have actually seen negative returns 80% of the time over the last 5 years.

Therefore, I’d be looking to add this on a deeper pull-back. The 20 EMA has acted as good support for this rally, and that comes in around $115.

Final Thoughts

All in all, I don’t dislike Micron Technology, Inc., but I think the stock has been hyped up too much. The current valuation isn’t super high, but it isn’t attractive enough. However, I’d be interested in buying if we can get closer to my target.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sometimes technicals and fundamentals line up, and these produce great risk-reward opportunities.

This is what I look for at The Pragmatic Investor.

Join now and get instant access to:

– My portfolio

– Trade Ideas

– Technical Analysis Opportunities