Summary:

- Micron Technology, Inc.’s Q1 2025 results show strong revenue and margins, driven by record data center demand, but the company faces risks from concentrated customer dependency.

- DRAM and NAND markets show potential weakness, with slowing demand growth and reduced capital expenditures indicating limited pricing power and future challenges.

- Micron’s heavy reliance on the data center market and geopolitical risks, particularly with China, pose significant threats to its future performance.

- The consolidated DRAM market means any missteps by competitors could benefit Micron, but current indicators suggest continued underperformance relative to the S&P 500.

SolStock

Micron Technology, Inc. (NASDAQ:MU) surged with its 4Q 2024 results just a few months ago, despite us discussing in an article at the time how the earnings gave us no reason to change our bearish view. Since then, the share price has mellowed, with it underperforming the S&P 500 (SP500) by several %. Now, with the company’s 1Q 2025 results, despite the double-digit after-hour decline, we expect continued underperformance going forward.

Micron Results

Micron managed to achieve relatively strong results, but also gave some warning indicators that are worth noting.

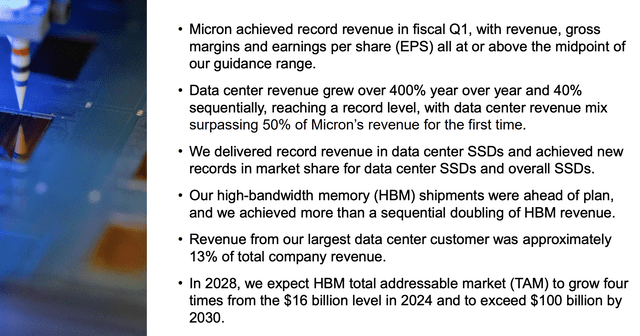

The company saw record revenue with strong margins and EPS, but that was all supported by record high data center demand. That was true not just for the company’s traditional DRAM products but all data center SSDs. The company has continued to see HBM growth but also remains heavily concentrated with 13% of revenue from a single data center customer.

That’s concerning because it means a shift in the deployment and demand for massive AI servers could hurt the company. The company expects the HBM market to quadruple over the next 4-years, but a lot of that depends on these large tech companies making even larger investments.

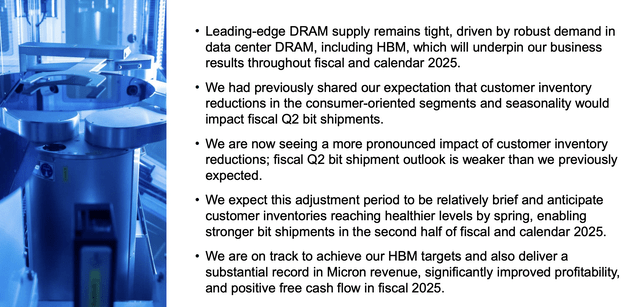

Demand for the latest and greatest in DRAM, such as HBM, remains tight and essential for the company’s performance. However, customers are accumulating less inventory, and the company expects a weakening at least for the 2Q 2025. The company does expect to achieve positive FCF for the year, but at a $100+ billion market that’s not enough.

Especially in a cyclical commodity market, you need to show an ability to earn billions a year and drive strong returns.

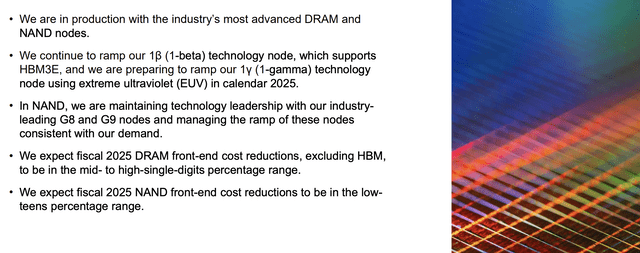

The company is continuing to produce leading technology and ramp up its latest nodes, including using EUV technology. The company also maintains competitiveness in NAND and is continuing to ramp up nodes. But again, this is a commodity, and the company’s peers are doing the same. The company does not have a massive DRAM or NAND pricing advantage.

Micron Outlook

The company’s outlook for the markets indicates some of this potential weakness.

The company expects DRAM bit demand growth to slow down from high-teens % in calendar 2024 to mid-teens % in calendar 2025. DRAM bit supply is expected to grow in line with bit demand, with an HBM supply ramp, indicating a minimal chance of substantial pricing power. At the same time, NAND bit demand growth is expected to be lower than expected.

Again we’re seeing some cracks in the data center market that has supported so much growth with a moderation of SSD purchases. While we don’t disagree that NAND SSDs could replace HDDs, we don’t see that as a fundamental game changer.

The company is implying weakness in the NAND market to the point of needing to cut spending on supply generation. The company has reduced capital expenditures and the pace of node transitions, while going so far as to reduce wafer starts. While the company is right that China’s supply is focused on the Chinese market, there is a risk here.

Specifically, China is working to build up a domestic chip industry and unlike its DRAM peers, Micron is a clearly American company. That’s visible through the more than $6 billion in Chips Act funding Micron received, versus $500 million for SK Hynix. That makes orders from Micron a tempting target in any trade war.

Micron Financial Performance

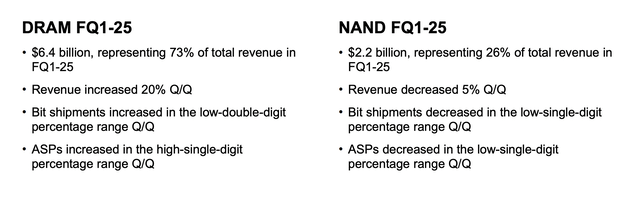

Financially, Micron is still primarily a DRAM company with $6.4 billion in revenue up 20%QoQ.

The company primarily benefited here from a high single-digit % increase in ASPs QoQ as demand remains high. At the same time, shipments also continued to increase. In NAND, the company saw $2.2 billion, or 26% of total revenue. However, here ASPs declined along with bit shipments, resulting in 5% QoQ performance.

The company, as we discussed above, has indicated additional weakness in its NAND segment.

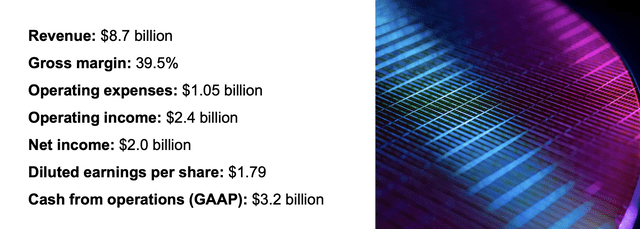

The company earned $8.7 billion in revenue at a 39.5% gross margin. Putting this all together resulted in $2 billion in net income and $3.2 billion in GAAP CFFO. However, with a massive $3.1 billion in net capex, the company’s FCF came in at a pitiful $100 million or a 0.4% annualized yield. From FY 22, in 13 quarters, the company has only repurchased $3.2 billion in shares.

Total share repurchases in those 13 quarters are $4.8 billion or a <2% annualized yield, nothing to get excited about. More so, the continued competition and commodity nature of the product means Micron hasn’t dramatically increased earnings potential with these efforts, it has simply remained competitive.

Micron Guidance

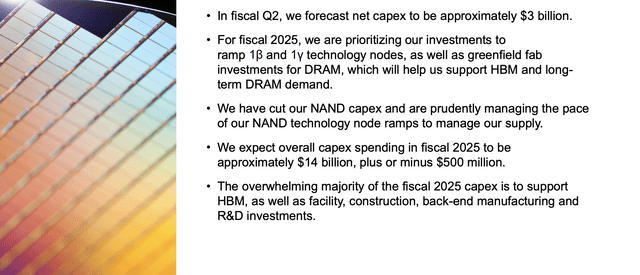

Going into FQ2 2025, the company expects minimal FCF with high capex.

The company is forecasting net capex of $3 billion for the quarter, however, capex spending for the year is expected to come in at $14 billion. That implies $4 billion per quarter for the 2H of the year, potentially making FCF negative for the company. The company is ramping up HBM but with the company currently losing the HBM race to SK Hynix, these again seem to be the minimal investments for competitiveness.

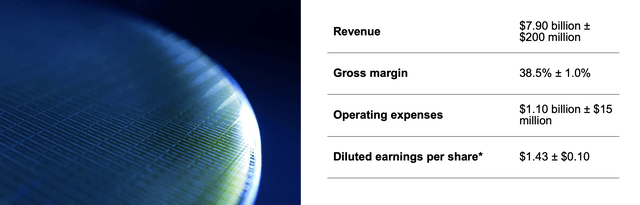

For the next quarter, the company is guiding $7.9 billion in revenue, walking down to $1.43 in EPS. That’s an almost 20% decline in QoQ EPS, not surprising given the revenue decline. We are pleasantly surprised the company is maintaining margins close to their 1Q levels. However, it doesn’t fundamentally change the thesis.

Especially with capex running higher, we wouldn’t be surprised if the company was FCF negative for 2025.

Thesis Risk

The largest risk to our thesis is the consolidated nature of the DRAM market with 3 main companies, Sk Hynix, Micron, and Samsung. A stumble by any of these companies could lead to a surge in market share and performance for the other two, enabling them to rapidly increase their profits and shareholder returns.

Conclusion

Micron makes cutting-edge tech, which is to be respected, and the company is critically important globally. However, it operates in a market with other dominant and well-paid companies that are also investing heavily, and those companies are also investing heavily in 2025 capex. The company is also seeing weakness in the NAND industry.

Going forward, we expect the company to continue to struggle to actually earn FCF and generate shareholder returns. That makes the company a poor investment for the long term. Please let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.