Summary:

- Micron Technology stock declined by 4.4% after reporting its fiscal fourth quarter results, but this shouldn’t have surprised investors.

- MU has outperformed its semi-peers since my previous update. Hence, some profit-taking is justified, as investors reacted to its less optimistic gross margin guidance.

- Investors worried about the reported numbers and near-term headwinds could miss out on a significant profitability growth inflection as Micron emerges from the market malaise.

- I urge MU holders to focus on what’s ahead over the next two fiscal years, as the company is well-poised to ride the ongoing recovery.

- High-conviction investors should capitalize on the recent pullback and buy while MU is still early in its recovery phase.

hapabapa

Micron Technology, Inc. (NASDAQ:MU) attracted negative headlines yesterday as the company recently reported its fiscal fourth quarter or FQ4 earnings release. Accordingly, MU led the decliners in my semiconductor coverage, while most semi-stocks were in the green, as the tech sector (XLK) finished yesterday’s session up by 0.7%.

As such, bearish prognosticators picked on MU’s 4.4% decline for the day, which could have been worse if dip buyers hadn’t helped stem a further slide against its session lows. However, looking at MU’s decline with such a limited focus would have provided a flawed understanding of MU’s ongoing recovery, in my opinion.

I last updated MU investors in early July, urging MU holders to buy while others remained pessimistic. That thesis has panned out well as MU outperformed the S&P 500 (SPX) (SPY) and its semi-peers represented in the iShares Semiconductor ETF (SOXX). As such, for MU to “take a break” with yesterday’s steep selloff shouldn’t have surprised investors as dip buyers likely engaged in profit-taking, given the company’s less optimistic gross margin guidance.

Accordingly, management presented a gross margin guidance range of between -2% and -6%, with a midpoint outlook of -4%. As such, it’s well below analysts’ estimates of 0.66%. Therefore, it suggests that Micron’s profitability recovery could be extended, even as the company believes that the worst is likely over.

Given MU’s outperformance from July against its peers, I believe the market remains aligned with management’s optimistic outlook as they look past the worst hammering in the memory market in recent years. Also, I think Micron and its peers have learned their lessons well as they remain focused on their capacity growth, looking to under-ship demand and allowing inventory levels to normalize further.

Management also highlighted that some pull-forward demand could have occurred recently as customers capitalized on what it terms as “unsustainably low pricing, signaling the market’s recovery.” As such, Micron discerned that its customers have loaded up on DRAM and NAND “strategically.” Moreover, the company added that its customers were increasingly “less aggressive in price negotiations,” indicating that the normalization phase is proceeding well, sustaining the underlying price infection.

With that in mind, I’m confident that Micron is still early in its recovery, further lifted by its engagement with Nvidia (NVDA) as the company’s high-bandwidth memory or HBM product enters the qualification phase. It should be noted that Micron is expected to compete against SK Hynix, the market leader in HBM, as it attempts to gain share. I wouldn’t be betting against Micron, as it has demonstrated its technological leadership against its peers in the leading nodes. Furthermore, the tight demand/supply dynamics for AI chips should facilitate healthy competition in this segment. Micron also noted it “anticipates that the industry will see a record TAM in calendar year 2025, with more normalized profitability levels.”

Therefore, I urge investors to stop looking backward at reported numbers (remember, the market is forward-looking). Instead, they should focus their attention on the projected recovery of the memory market. MU’s adjusted EBITDA is expected to experience a significant recovery based on the updated analysts’ estimates. Accordingly, Micron reported an adjusted EBITDA of $2B for the recently concluded FY23. Analysts expect Micron to see a sharp inflection into growth, with an FY25 adjusted EBITDA of $15.3B, about 10% below FY22’s adjusted EBITDA of $16.82B.

With that in mind, MU last traded at an FY25 EBITDA multiple of 5.1x, slightly below its 10Y average of 5.4x. In other words, I assessed that MU is still relatively attractive, as it’s expected to continue its recovery phase.

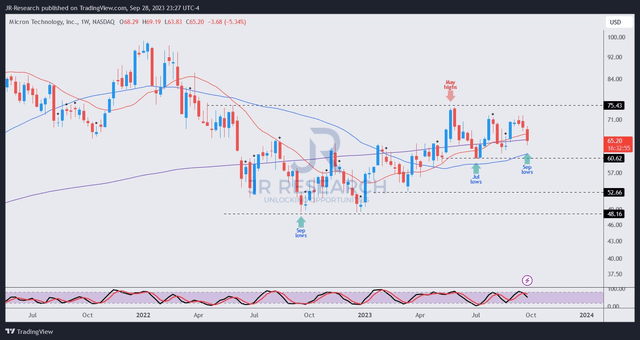

MU price chart (weekly) (TradingView)

As seen above, dip buyers haven’t been affected by the downbeat updates on the memory market over the past year, as they focused on what’s ahead (not what happened).

MU has regained its medium-term uptrend, with dip buyers supporting higher lows and higher highs. While MU’s May highs ($75 level) saw robust selling pressure, dip buyers underpinned its May lows ($60 level) with conviction.

As such, I assessed that MU remains within the Buy range, with its May lows considered its critical support zone, which could attract firm buying sentiments if MU pulls back further.

Rating: Maintain Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!