Summary:

- Shares of Micron Technology, Inc. dipped ~15% after printing FQ1 results, owing to the market’s perception of a weaker FQ2 outlook.

- The company notes that consumer end-markets are responding slower to AI innovation than initially expected, leading to softening NAND ASPs and a need to trim NAND capex.

- On the flip side, AI-fueled data center demand is surging, with data center revenue up 400% y/y in Q1.

- The company boosted its expectations for the HBM (high bandwidth memory) market, now expecting a ~36% CAGR to a $100 billion annual market opportunity by 2030.

- MU stock trades at an incredibly cheap ~7x forward P/E ratio, a terrific buy amid an expensive stock market.

gremlin/iStock via Getty Images

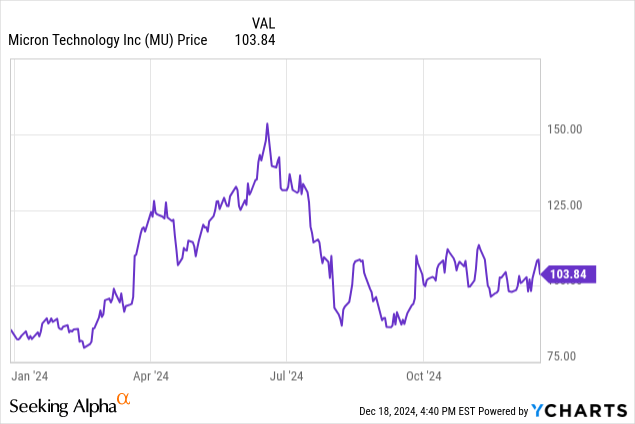

After peaking mid-summer around $150, shares of Micron Technology, Inc. (NASDAQ:MU) have had a whiplash over the past two quarters, largely missing out on the post-election rally. The memory supplier just posted fiscal Q1 (calendar Q3) results, and despite a large earnings beat, Wall Street reacted sharply to the company’s FQ2 guidance, which caused a ~15% drop in the stock.

Now at its post-earnings price around ~$90, Micron has almost wiped out all of its YTD gains. In my view, this is a great chance for investors to buy the dip and position themselves for a rebound in FY25.

I last wrote a buy article on Micron in September, when the stock was trading closer to $110 per share. In my view, success in the markets in FY25 will require investors to shift out of bandwagon names (particularly in the large-cap growth space) and pick up more contrarian plays that have fallen out of favor recently. Micron, which is enjoying tremendous enterprise AI demand fueling its data center business, is a perfect stock to pick up while it’s weak.

I’m reiterating my strong buy on Micron, and I am using the post-earnings dip as an opportunity to dollar-cost average downward.

Softer consumer demand hitting NAND pricing: should we be concerned? Not in my view

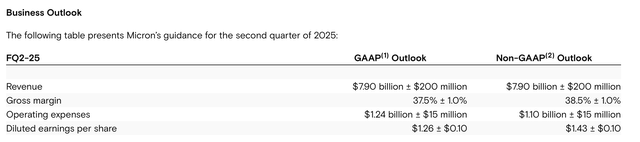

Of course, we can’t ignore the sharpness of Micron’s post-earnings fall, and we should acknowledge the risks that the company is flagging. Investors reacted most sharply to the company’s Q2 guidance, which calls for just $7.7-$8.1 billion in revenue, representing a 36% y/y revenue growth pace at the midpoint: a sharp deceleration from 84% y/y growth in Q1.

Micron outlook (Micron Q1 earnings deck)

It’s also weaker seasonality than usual: last year, the company achieved 23% sequential growth between Q1 to Q2, whereas this year, the company’s $7.9 billion guidance midpoint represents a -9% sequential decline: a weak signal in the critical holiday quarter.

Micron Q1 results (Micron Q1 earnings deck)

Moreover, the company’s gross margin guidance implies that the current FQ1 represented the peak of gross margins (after several quarters of consistent sequential expansion, owing to elevated DRAM demand fueling higher ASPs), with midpoint guidance of 38.5% falling 100bps relative to pro forma gross margins of 39.5% in the current quarter.

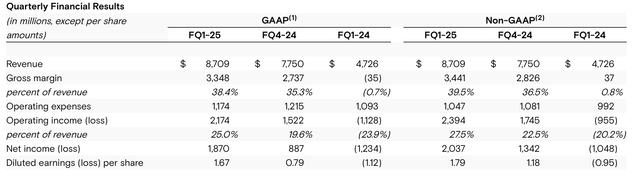

The core culprit here is weaker demand in the consumer end-markets, particularly in PCs and smartphones. These products heavily utilize Micron’s NAND storage chips, and the earlier expectation that new AI features on both phones and computers would drive an immediate upgrade cycle is now being re-evaluated. As such, as shown in the chart below, the company is now expecting low double-digit growth in NAND bits in 2025, which is below prior expectations.

Micron demand outlook by memory type (Micron Q1 earnings deck)

Because of these weaker bit growth assumptions, the company is also reducing its planned capex to serve NAND manufacturing capabilities.

Of course, we’d have preferred healthier results in the consumer end-markets. But should we be immediately concerned? Not necessarily. In my view, just because consumer demand is taking longer to respond to AI innovation doesn’t mean that the refresh cycle won’t happen.

Investors should be aware of two specific catalysts that will drive improved NAND demand in FY25. First, Microsoft (MSFT) intends to end support for Windows 10, one of its most popular and best-selling operating systems, next year in October 2025. If the allure of AI-enabled PCs isn’t enough to move more casual consumers off the shelf, the prospect of an aging machine with no more OS support almost certainly will.

Micron PC end market overview (Micron Q1 earnings deck)

And as shown in the chart above, Micron expects that the new AI-enabled PC models will have an entry-level storage capacity of 16GB (or 24GB for higher models), versus an average entry point of 12GB in current models. With a 33% bump in entry-level requirements for new PCs, plus the expectation of PC market unit growth next year, I view Micron’s expectations of low-double digit NAND growth in FY25 to be quite reasonable, if not even easy to surpass.

Smartphones, too, are expected to benefit from AI refresh cycle benefits, even if the uptake this year was slower than initially expected. Micron is also expecting smartphone unit shipments to grow in the single digits next year, while average entry-level storage requirements for phones are gradually also moving upward.

Robust data center demand, fueled by HBM

Micron is expecting to see more tepid demand in the consumer segment until the second half of 2025: but while I encourage patience for the consumer business to take off, investors already have a lot to cheer on the enterprise/data center side of the house. In Q1, Micron reported data center revenue growing 400% y/y, and data center revenue also surpassed over 50% of Micron’s revenue for the first time.

Micron HBM and data center commentary (Micron Q1 earnings deck)

As shown above, the company also noted that the HBM (high bandwidth memory) portion of the enterprise business is expected to hit a $100 billion TAM in 2030 (versus $30 billion in 2025, and $16 billion in 2024 — representing a massive 36% CAGR through 2030).

And importantly, as shown in the chart below, HBM is already sold out for calendar 2025 at fixed prices, giving the company high visibility into its plans to generate “multiple billions of dollars of HBM revenue” in FY25 (consensus is currently calling for $46.6 billion of total revenue in FY25, or 22% y/y growth).

Micron data center end market overview (Micron Q1 earnings deck)

It’s important to recognize that HBM is still an early-stage growth lever for Micron. The company noted that it just started shipping high-volume sales to several large enterprise customers in Q1, and is striving to boost its manufacturing capacity for this sold-out business segment. Worth noting as well is that Micron says HBM is accretive to both DRAM segment and total company gross margins. We should infer, then, that with Micron’s revenue mix tilting into high-margin HBM and away from NAND (which started seeing ASPs decline sequentially in the single digits in Q1), the company should have gross margin tailwinds for FY25.

Valuation, risks, and key takeaways

Consensus is currently calling for $12.99 in pro forma EPS in FY25 (+46% y/y) on 23% y/y revenue growth, which is quite achievable on the back of Micron’s expected high-teens bit supply growth in DRAM and higher pricing driven by HBM shipments. At post earnings share prices near $90, Micron trades at just a 7.0x FY25 P/E ratio.

Of course, there are risks to consider here:

- Micron’s expectations of a back-half recovery in the consumer segment may not occur, especially if macro conditions continue to be tight and consumers delay big-ticket purchases like computer and smartphone refreshes.

- Competitors SK Hynix and Samsung may step up HBM manufacturing capacity faster than Micron, which may pressure HBM/DRAM ASPs (though we note that Micron has locked in orders at fixed pricing for FY25; FY26 is likely still to be variable).

Still, with Micron trading at such a sharp discount to the broader S&P 500 (SP500), I see an excellent risk-reward profile here. Historically, Micron has traded discounted to the market because its revenue and earnings were cyclical, much in the way that oil & gas and airline companies saw widely varying results from year to year depending on macro conditions. However, with AI demand providing an expected ~36% CAGR through 2030 for HBM chips, this old prejudice against Micron’s cyclicality is starting to lose its validity.

Take the post-earnings dip as a well-timed buying opportunity and hold out for a broader rebound in 2025.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.