Summary:

- Growth and market share gains are expected in Micron’s DRAM business, driven by both price and volume tailwinds.

- Although data suggests that Sep 2024 has been good for Micron’s NAND business, the outlook is more challenging with pricing cuts and a slowdown in order demand.

- MU valuations are at a premium relative to both its peers and the broader historical P/B valuation band, reducing the attractiveness of buys.

- There are no bullish signs on the MU vs SPX charts as the ratio prices are stuck in a range.

- Anti-China chip policies inhibit Micron via limitations on its sale of high-bandwidth memory (HBM) chips. This risk may also become more meaningful under the incoming Trump administration.

BrianAJackson

Performance Assessment

My last note on Micron (NASDAQ:MU) expressed a rather contrarian view as I took a neutral stance amid the bullish cries of analysts from Seeking Alpha, Wall St and even the Quant Ratings. I think my bias has avoided a mistake of commission since the stock has underperformed the S&P500 (SPY) (SPX) (IVV) (VOO) since then:

Performance since Author’s Last Article on Micron (Seeking Alpha, Author’s Last Article on Micron)

Thesis

Micron is due to report its Q1 FY25 earnings (as Micron has an Aug-ending fiscal year) during market hours on 18 Dec 2024. Going into this earnings release, I am forming a cautious view based on the following:

- Growth and market share gains are likely in Micron’s DRAM business.

- A slowdown in orders and pricing headwinds may reduce NAND Flash revenues.

- Valuations are at a premium.

- There are no bullish signs on the MU vs SPX charts.

- Curbs on chip access to China is a key risk monitorable.

Growth and market share gains are likely in Micron’s DRAM business

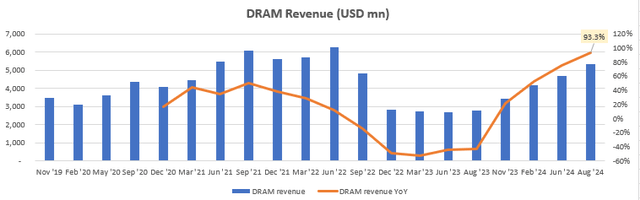

DRAM revenues make up the majority of Micron’s top-line, contributing 68.7% of overall revenues in Q4 FY24. It has grown at more than 50% YoY over the last 3 quarters, driven by increased shipments and higher prices:

DRAM Revenue (USD mn) (Company Filings, Author’s Analysis)

The latest data for the Sep 2024 quarter reveals that Micron’s DRAM business is growing strongly at 28.3% QoQ, with a jump in the global market share position from 19.6% to 22.2%:

3Q CY24 Global DRAM Revenues and Market Shares (TrendForce, Author’s Highlights)

For the key reasons of this growth, commentary by market research firm TrendForce points to growing demand from data centers, and increased prices (from 8% to 13%) that have partly been due to a higher mix of high bandwidth memory (HBM) production. Micron in particular is benefiting from a 13% QoQ increase in HBMe shipments.

This data gives us a small clue on how Sep 2024, which is the 1st month of Micron’s Q1 FY25, has panned out. Hence, I interpret it as a positive sign for Micron’s DRAM result release next week.

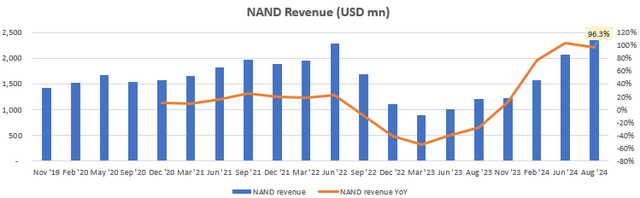

A slowdown in orders and pricing headwinds may reduce NAND Flash revenues

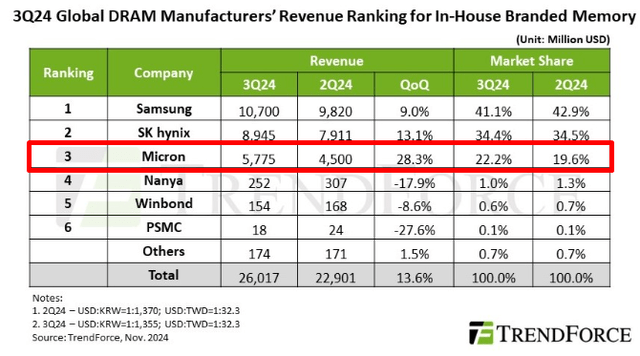

Micron’s NAND Flash business is another major chunk, making up 30.5% of the total revenues mix in Q4 FY24. Here too, the YoY growth has been very strong at more than 70% YoY over the past 3 quarters, driven primarily by higher prices despite flattish volumes:

NAND Revenue (USD mn) (Company Filings, Author’s Analysis)

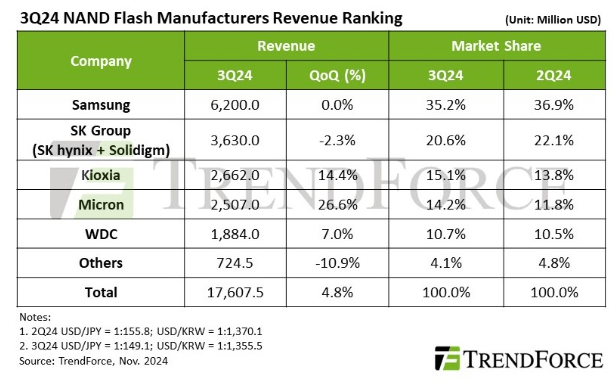

Data for the Sep 2024 ending quarter shows us that Micron is outperforming its competition in this segment too, growing 26.6% QoQ and increasing its share from 11.8% to 14.2%, driven by increasing prices particularly in enterprise SSD, which, I believe, make up 11.5% of Micron’s overall revenues or 39% of the NAND Flash segment:

3Q CY24 Global NAND Flash Revenue and Market Shares (TrendForce, Author’s Highlights)

However, the outlook in this segment is weaker with headwinds on both volumes and prices, particularly in the non-enterprise SSD side:

Looking ahead to 4Q24, the NAND Flash industry is expected to face more significant challenges. Although enterprise SSD prices are projected to remain stable, contract prices for other product categories have begun to decline. Additionally, consumer brands are expected to lower inventory levels by year-end, weakening overall demand. TrendForce predicts that NAND Flash industry revenue will decline by nearly 10% QoQ in 4Q24.

– DRAMExchange, Author’s bolded highlights

| Enterprise SSD Mix of NAND Revenues | Q2 CY24 |

| Samsung | 40% |

| SK Group | 49% |

| Micron | 39% |

Relative to its major competitors Samsung and SK Group, Micron’s mix of enterprise SSD within the overall NAND segment is lower. Hence, I believe Micron is likely to be hit harder by the volume and pricing challenges expected.

Valuations are at a premium

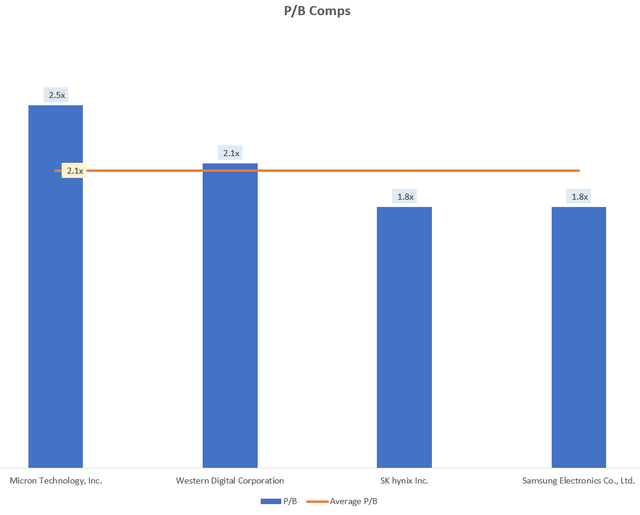

MU is trading at a P/B of 2.5x; a 22.0% premium to its competitors:

P/B Comps (Capital IQ, Author’s Analysis)

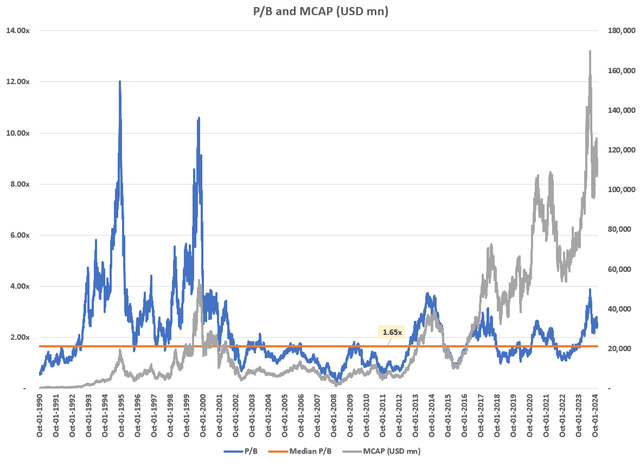

Even compared to the historical valuation band, MU is trading at a 50.3% to its overall median P/B of 1.65x:

P/B and MCAP (USD mn) (Capital IQ, Author’s Analysis)

Hence, I believe MU stock is also not priced attractively for buys right now.

There are no bullish signs on the MU vs SPX charts

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

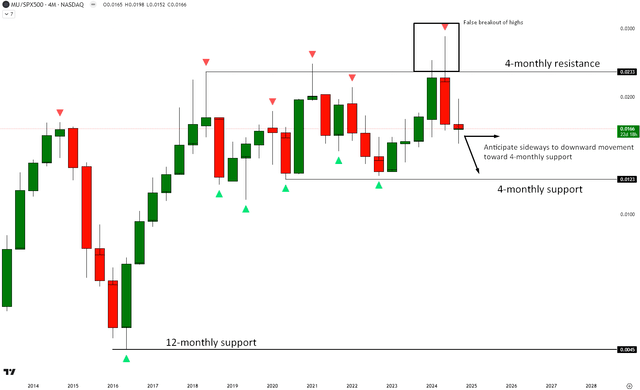

Relative Read of MU vs SPX500

MU vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

MU vs SPX500 is still stuck in a range on the multi-quarterly charts. I do not see any signs of bullish intent. Rather, my expectation is toward more sideways to slightly downward movements.

Curbs on chip access to China is a key risk monitorable

The current US government has restricted sales of cutting-edge AI chips to China in order to maintain a technological and military edge, as this would curb China’s military modernization. As the world’s 2nd largest producer of HBM chips, Micron will be hit by the new rules, which curb sales of 27 types of HBM and related products.

I think the incoming Trump administration is likely to maintain or escalate similar anti-China semiconductor policies, extending the duration of this headwind for Micron.

Takeaway & Positioning

I have a mixed outlook on Micron going ahead into the company’s Q1 FY25 earnings next week. Industry data suggests that the DRAM business is poised well, benefiting from both volume and pricing growth. Within this, Micron is outperforming its peers by gaining market share. However, whilst the Sep 2024 quarter was positive for the industry and Micron due to contract price increases, the rest of the Q4 CY24 outlook seems more subdued as prices and volume pressures emerge. Micron is likely to be hit harder than its peers here because it has a lower mix of enterprise SSD exposure, which is expected to have more stable prices.

On valuations, Micron is trading at a premium to both its competitors and relative to its historical valuation band, making buys less compelling. Technically, relative to the S&P500, MU stock is not showing any meaningful signs of bullishness either.

A fresh risk monitorable for Micron is the impact of US curbs of chip sales on China, which I think may very well be exacerbated by the incoming Trump administration.

I rate the stock a ‘Neutral/Hold’.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis.

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis.

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis.

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence.

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.