Summary:

- Micron’s FQ2 earnings report revealed a staggering $1.43B inventory write-down, dealing a heavy blow to its adjusted EPS with a $1.34 impact.

- However, the initial post-market reaction suggests investors aren’t unduly concerned. Management highlighted that FQ2 could be the bottom in its operating performance.

- We highlighted in our previous article that MU could have bottomed out in December. However, its undervaluation is less attractive, given its recent recovery.

- For investors who believe that the memory market has reached its bottom, the current market levels should still be attractive.

vzphotos

Micron Technology, Inc. (NASDAQ:MU) released its FQ2’23 earnings yesterday, worse than the previous consensus estimates.

However, the initial post-market reaction suggests that investors are less concerned about what happened in FQ2 and likely looking ahead as the memory market could bottom in H2CY’23.

Notably, Micron recorded a massive $1.43B inventory write-down leading to an inventory level of $8.1B. As a result, the company took a $1.34 impact against its adjusted EPS of -$1.91. If we exclude the write-down, its adjusted EPS would have been -$0.57, which would have been above the consensus estimates of -$0.88.

Despite that, it’s unrealistic to assume that Micron didn’t need to write down its inventory, given the scale of the memory downturn. Management also reminded investors that it’s the worst downturn the company has experienced in the past 13 years.

We revised MU to a Strong Buy in December, as we highlighted that MU is likely at peak pessimism. It has outperformed the S&P 500 (SPX) (SPY) since then, recording a total return of nearly 20%, relative to the SPX’s 3.3% gain.

However, since October, MU has underperformed the leading logic peers represented in the iShares Semiconductor ETF (SOXX), given the extent of the memory downturn.

Samsung’s (OTCPK:SSNLF) insistence not to reduce its production levels drastically has likely extended the recovery phase of the market. The Korean memory market leader attempts to gain market share while “[adjusting] production through ‘natural’ methods such as production line optimization and equipment update.”

Despite that, management highlighted its confidence in bottoming out in FQ2, with a recovery expected in H2CY’23.

Based on Micron’s outlook for FQ3, management expects a sequential gross margin recovery from -31.4% to about -21%. Notably, the incremental inventory write-down is expected to fall to -$500M in FQ3, which includes the impact of underutilization.

As such, the company has also reduced its CapEx by more than 50% for FY23, helping to mitigate the adverse effects on its operating and free cash flow or FCF.

Micron also highlighted that the automotive market (20% of revenue) remains a bright spot in its FQ2 operating performance. Accordingly, auto revenue increased by 20% YoY as it rides the secular trends in the automotive market.

Notably, management articulated its confidence that its data center business should recover further in H2, bolstered by the interest and adoption of AI technologies.

Furthermore, investors should also expect DDR5 to play a more important role over the next year, which sells at a “bigger premium in the data center,” helping to improve its profitability recovery.

However, the crossover is only expected to “happen in both segments around mid-calendar 2024 from a bit perspective.” Despite that, DIGITIMES highlighted that “industry sources are optimistic that DDR5 penetration in the server sector will increase in the second half of this year.”

Moreover, industry sources suggest that the price trends in the memory market are also expected to improve in H2, corroborating management’s confidence.

With that in mind, we believe it suggests that investors who bottom-fished MU in December should not expect those levels to be retaken.

However, the critical question is whether the current levels are still attractive for investors who missed buying its lows?

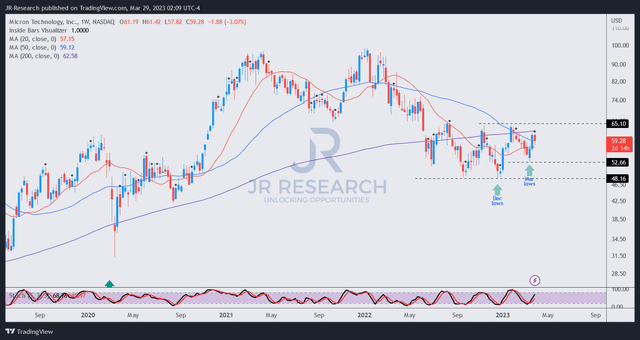

MU price chart (weekly) (TradingView)

MU has moved closer to the resistance levels that have bounded its recovery since August 2022.

Hence, MU must decisively clear the $65 level to resume its medium-term uptrend.

Our assessment suggests that MU’s price action doesn’t offer an optimal entry level for investors to consider, which would have strengthened its reward/risk profile.

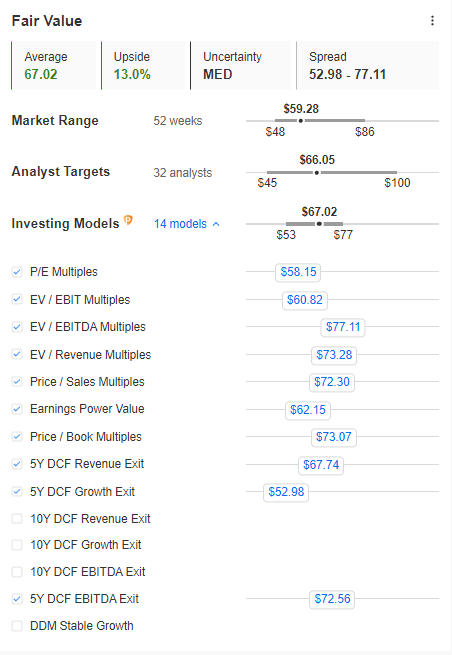

MU blended fair value estimates (InvestingPro)

However, the current levels still offer more than a 10% undervaluation relative to its blended fair value estimate of $67.

We also gleaned that its underperformance against the SOXX could level off soon as buyers returned, helping to stem significant downside volatility from these levels.

Rating: Buy (Revised from Strong Buy).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Spot a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment and let us know why, and help everyone to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.