Summary:

- Micron Technology, Inc.’s delivery of robust F3Q24 results were overshadowed by a weaker than expected guidance, underscoring limitations to its ability in matching resilient industry growth levels.

- A deeper dive into its revenue drivers during F3Q24 also shows emerging cracks in the durability of Micron’s long-term growth trajectory, given extended capacity restraints and intensifying competition.

- With elevated reliance on gradually dampening price tailwinds in the near-term, investors’ focus will likely shift towards longer-term considerations, including execution risks on the Idaho and New York greenfield fabs.

JHVEPhoto

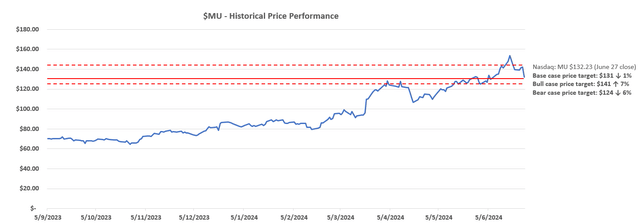

Despite the robust showing for F3Q24, Micron Technology, Inc.’s (NASDAQ:MU) post-earnings pullback continues to underscore the lack of durability to its valuation premium at current levels as expected. As discussed in our previous coverage, we believe Micron’s valuation upsurge over the past year continues to reflect AI-driven growth expectations that are beyond what the company is capable of delivering. Specifically, we believe Micron’s upsurge over the past year continues to reflect robust industry growth expectations, instead of the company’s actually limited capability in monetizing them. In the following analysis, we will discuss why we believe focus will increasingly shift towards Micron’s management of longer-term risk exposure rather than near-term growth tailwinds coming out of its latest earnings update.

Specifically, Micron’s elevated reliance on ASP expansion in driving revenue growth due to the currently supply constrained environment is a cause for caution, especially given the influx of new capacity for AI-related memory products from competition. And this risk is becoming increasingly evident based on Micron’s F3Q results.

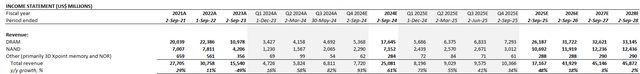

The company grew DRAM revenue by 13% q/q and NAND revenue by 32% q/q. Yet, DRAM bit shipments actually declined sequentially in the mid-single digit percentage range, while NAND bit shipments only increased slightly. This reflects Micron’s increasing reliance on ASP expansion as a key growth driver, which is destined to slow in the coming quarters and thwart topline performance expectations currently reflected in the stock’s price. And Micron’s weaker than expected growth forecast for F4Q24 is also reflective of how near-term price tailwinds can only drive so much growth for the company if not supplemented by volume expansion.

More importantly, its current supply bottleneck – particularly for AI-related products – is unlikely to ease anytime soon. Current greenfield expansion projects in Idaho and New York are not expected to start productions until at least FY 2027, exposing Micron to incremental execution risks. Although Micron has sold out its high bandwidth memory (“HBM”) capacity through CY 2025, which improves revenue visibility and reinforces management’s guidance for a “significant” revenue uplift next year, its growth trajectory will likely moderate drastically in the medium term without complementary volume growth to support market share gains. This is further exacerbated by both HBM qualification and incremental capacity from larger rivals SK Hynix and Samsung (OTCPK:SSNLF).

Looking ahead, Micron’s margin expansion capabilities from ramping HBM volumes, the sustainability of its mix shift to higher value AI-related products, and progress in realizing front-end cost reductions will be key near-term focus areas beyond growth. Meanwhile, investors will also likely place greater emphasis on the longer-term resilience of Micron’s demand environment – particularly in AI-related product segments. This will be key to ensuring ROI expansion, which is needed to make sense of its elevated capex spend on greenfield expansion projects over the next two years.

Recall that the memory market remains inherently cyclical, with elevated sensitivity to relevant risks compared to the broader semiconductor sector. While HBM demand compensates for some of these cyclical dynamics given the anticipated AI replacement supercycle, intensifying competition remains an immediately growing risks for Micron, nonetheless. Micron is especially prone to risks of changes in market conditions and demand dynamics ahead, given materialization of additional capacity critical to ensuring durable growth is still years away. Taken together, we believe the stock’s latest pullback continues to provide a better reflection of Micron’s fair pricing, as its growth trajectory is likely to lag the industry’s given extended capacity constraints.

Near-Term Pricing and Mix Shift Considerations

What we like:

Micron is continuing to benefit from increasing prevalence of a favorable mix shift towards higher value AI-related products, such as HBM, high-capacity DIMMs and data center SSDs. This is consistent with our previous expectations that Micron’s industry-leading HBM and DDR product portfolio continues to position it well for the upcoming accelerated computing replacement cycle and general-purpose data center upgrade cycle.

Admittedly, market interest remains concentrated in Micron’s share capture capabilities in GPU-attached memory, particularly HBM, to support the influx of AI/ML workloads and broader market transition to accelerated computing. Yet opportunities remain in CPU-attached memory, especially in enterprise applications.

Specifically, Advanced Micro Devices (AMD) has recently highlighted observations of increasing enterprise urgency in upgrading existing general purpose compute infrastructure to better optimize support for AI training and inferencing requirements.

In the enterprise we have seen signs of improving demand as CIOs need to add more general purpose and AI compute capacity, while maintaining the physical footprint and power needs of their current infrastructure.

Source: AMD 1Q24 Earnings Transcript.

This remains favorable to the demand environment for Micron’s CPU-attached memory, which is evident in the accelerated ramp of its industry-leading DDR RDIMM product based on the latest 1-beta node. Specifically, management expects “several hundred million dollars of revenue” contribution from high-capacity DIMMs exiting FY 2024, underscoring Micron’s mission-critical role in ensuring optimization of existing general purpose data center infrastructure.

This is further corroborated by Micron’s robust market share gains in data center SSDs as well during F3Q24, driven by its product portfolio’s competitive value proposition to the enterprise storage market. Specifically, the company reported a three-fold increase in bit shipments for its 6500 ION NVMe SSD during early ramp in F3Q24. The product represents industry’s first “200+ layer data center NVMe SSD”, which is optimized for AI applications by improving scalability and total costs of ownership without sacrificing performance for the enterprise storage market.

The robust demand environment for Micron’s higher value data center memory products are further reinforced by ongoing pricing tailwinds. As discussed in the earlier section, Micron continues to benefit from robust pricing power stemming from the supply constrained environment. Recall that HBM demand continues to ride on the coattails of the lucrative market for data center GPUs. Yet, production for this memory segment remains a challenge. Specifically, the latest HBM3E technology offered by Micron “consumes approximately three times the wafer supply” as DDR5 CPU-attached memory. This has accordingly led to tight supply conditions, supportive of Micron’s pricing strength in recent quarters.

Admittedly, the continued ramp up of Micron’s HBM volumes are expected to help the product segment achieve market share parity with its overall DRAM sales next year. Yet, Micron has disclosed that its incremental HBM capacity for FY 2025 has already been sold out, as customers remain incentivized to secure long-term supplies “ahead of their typical schedule.” Management has further added that HBM3E revenue contributions are expected to grow from $100 million F3Q24 to “several hundred million dollars” by FY 4Q24 and “multiple billions of dollars” through FY 2025. This suggests that favorable pricing observed today has likely already been considered in recently contracted forward volumes, which also improves revenue visibility for Micron in the near-term.

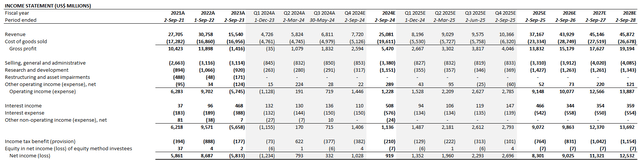

We believe these near-term pricing tailwinds will continue to complement ongoing front-end cost reductions at Micron as well. Specifically, management expects front-end cost reductions in DRAM and NAND to reach the single-digit percentage range and low-teens percentage range, respectively, exiting FY 2024. And consistent positive progress on this front is already evident in sequential gross and operating margin expansion in recent quarters. This accordingly reinforces confidence in management’s earnings guidance for the year, especially given margin accretion from an increasing mix shift to higher value AI-related data center memory products.

What we dislike:

Yet limited volume growth in F3Q24 continues to solidify the emergence of capacity risks on Micron’s longer-term financial outlook. These risks continue to be overshadowed by management’s optimism for a favorable product mix shift and ASP expansion in the near-term, in our opinion. Yet limited volume growth elevates Micron’s exposure to a waning outlook on longer-term market share gains, nonetheless, especially given intensifying competition.

As discussed in our previous coverage, Micron faces near-term capacity risks that could potentially weaken the durability of its long-term growth profile. The company already “lacks the dominant position in AI memory” compared to larger rivals SK Hynix and Samsung. And competitive risks are imminent, considering Samsung’s recent qualification progress with Nvidia (NVDA) – the market’s currently largest buyer for data center GPU-attached memory – for the provision of its HBM technologies alongside Micron and SK Hynix. While Micron plans to diversify its HBM customer base beyond Nvidia through FY 2025, which underscores a robust demand environment for the product segment, near-term capacity constraints continue to harbinger margin contraction risks in the longer-term. Price tailwinds in the immediate term are likely to alleviate for volumes beyond those contracted for FY 2025, which will potentially transition Micron into a market price taker instead. This accordingly introduces downside risks to its longer-term growth trajectory, which remain underappreciated in the stock’s current performance, in our opinion.

Longer-Term Capacity Considerations

What we like:

Additional capacity for Micron remains crucial for its long-term market share gain prospects. And this is reflected in its current greenfield expansion projects in Idaho and New York, which will complement existing capacity in its Asia facilities when they come online in FY 2027 and FY 2028, respectively. As America’s largest homegrown memory maker, Micron also remains a key beneficiary of the U.S. government’s ambitions in rebuilding self-sufficiency and reducing reliance on overseas supplies and technological advancements, particularly in Asia. This is corroborated by the company’s recent singing of a nonbinding preliminary memorandum of terms with the U.S. government, which earmarks $6.1 billion in grants under the CHIPS and Science Act towards Micron’s Idaho and New York fabs currently under construction.

This bodes favorably with the anticipated multi-year data center replacement cycle, as general-purpose compute infrastructure transitions to accelerated computing to support increasingly complex workloads like AI training and inferencing. Nvidia is currently predicting a $2 trillion data center infrastructure upgrade cycle, underpinned by the transition of general purpose to accelerated computing. And memory will capture a large share of this emerging opportunity, which is in line with Micron management’s anticipation for content growth in “generative AI-based technologies”. This is also corroborated by semiconductor peer Broadcom’s (AVGO) recent remarks regarding the larger memory requirements in supporting AI accelerators.

What we dislike:

Yet with the greenfield fabs in Idaho and New York still years out from start of production, Micron faces elevated execution risks ahead. Specifically, the company is already exposed to inherent cyclical risks in the broader semiconductor industry, with heightened sensitivity to changes in memory market dynamics as observed in the depth of the latest downturn. And upfront construction capex spend alongside near-term growth limitations driven by volume constraints are likely to weigh on cash flows.

Specifically, Micron’s recent revenue guide has not ventured far from our previous forecast, which already considers near-term pricing tailwinds that fall within broader industry levels. The company had benefitted from price increases in the 20% range during F3Q24 for both DRAM and NAND bit shipments, which helped maintain sequential revenue growth despite declines in volume over the same period. This is in line with average industry price increases in the 30% range and 20% range for NAND and DRAM, respectively, during the March quarter.

Looking ahead, price increases in the June quarter are expected to decelerate to about 20% and 15% for NAND and DRAM, respectively, according to industry trends recently tallied by Wedbush Securities. This is consistent with management’s guided sequential growth for F4Q24, which continue to rely heavily on ASP expansion with limited improvement to bit shipments.

Yet, the near-term capex outlook reported is much higher than our previous expectations. While management’s guidance for $3 billion in F4Q24 capex spend is consistent with our previous expectations, given consideration for the Idaho and New York greenfield investments, the amount earmarked for FY 2025 is to a much greater extent. Specifically, management expects FY 2025 capex spend to land in the mid-30% range of anticipated revenue. This implies close to $13 billion in FY 2025 capex based on our forecast, or a close to 60% y/y increase. Management has attributed more than half of the estimated FY 2025 capex spend increase towards current greenfield expansion projects in the U.S. And these elevated levels are likely to persist through FY 2028 when both the Idaho and New York facilities start to ramp up productions.

The combination of what we view as in line revenue growth expectations alongside a heavier than expected investment outlay suggests ROI compression risks, which is adverse to Micron’s valuation prospects. This is further exacerbated by the extended materialization timeframe for both the Idaho and New York facilities, which increases Micron’s exposure to changing market dynamics. These include exposure to risks of shipping additional supply into a downturn or moderated demand environment, alongside the absence of pricing power, especially as competition is already ramping up in data center memory applications today.

Fundamental Considerations

Adjusting our previous forecast for Micron’s latest earnings update and longer-term outlook as discussed in the foregoing analysis, we expect the company to grow revenue by 61% y/y to $25.1 billion in FY 2024. This will be followed by 48% y/y growth to $37.2 billion in FY 2025 revenue, underpinned by expectations for protracted pricing tailwinds in line with observed industry trends. Near- to medium-term revenue visibility through FY 2025 are also reinforced by sold-out HBM volumes, in our opinion, which management has confirmed already includes consideration of anticipated incremental price increases.

And you can see that we are pointing to a substantial revenue record in 2025, of course leveraging some of these contracts that we have put in place. And we have also pointed to a significant improvement in profitability. So, I think we are well positioned in these contracts with respect to not only the supply and demand fundamentals, but also with respect to the financial aspects.

However, in addition to consideration of extended capacity constraints beyond FY 2025, which stymies market share gain prospects, Micron also faces emerging competition that risks dampening price tailwinds. This is already evident in decelerating industry average price increases anticipated through the June and September quarters, as discussed in the earlier section. Paired with Micron’s lack of market share dominance still in AI-related data center memory product segments, we expect risks of substantial growth deceleration for the company over the longer-term.

Meanwhile, continued margin expansion will likely remain a key focus area and compensatory factor for topline risks. ASP expansion, alongside an increasing mix shift towards higher value data center memory products, will continue to propel margins higher. This will be additive to ongoing front-end cost reductions realized through disciplined spend management in recent quarters.

Valuation Considerations

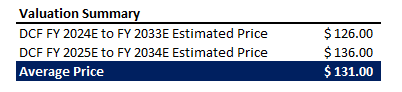

We are maintaining our hold rating on the stock, with a price target of $131 apiece.

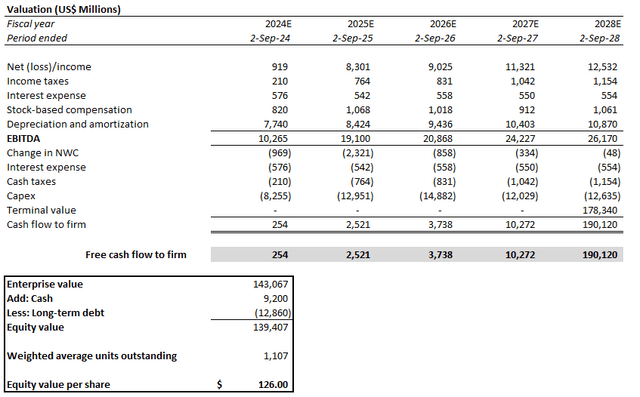

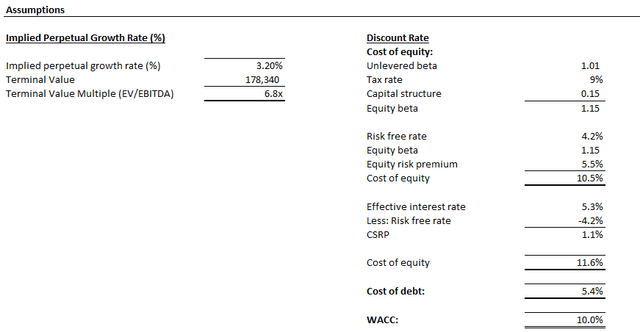

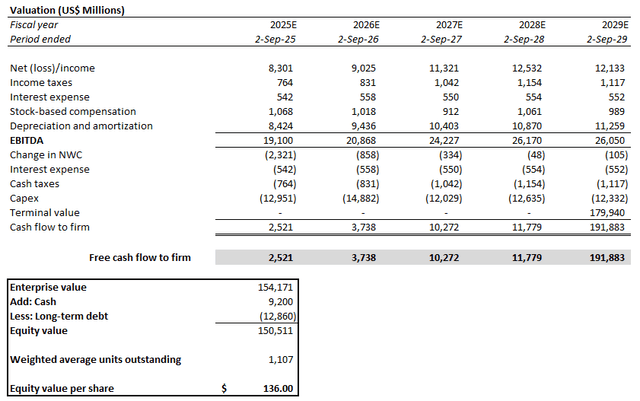

The price is determined by equally weighting the outcomes of a discounted cash flow approach considering Micron’s projected cash flows over a five-year discrete period from FY 2024 to FY 2028, and from FY 2025 to FY 2029. We believe the weighted approach provides a better reflection of Micron’s estimated intrinsic value by considering also its forward cash flows as the current fiscal year approaches an end.

Author

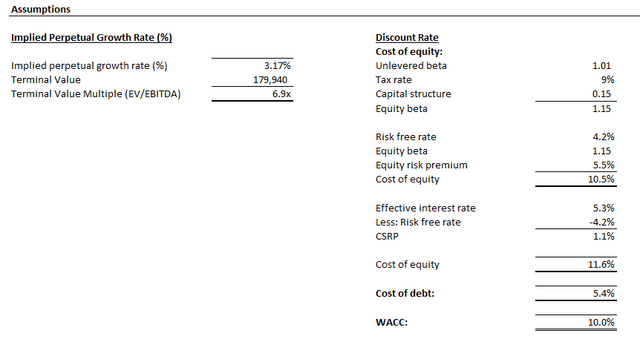

Micron’s DCF analysis on projected cash flows over the five-year forecast period between FY 2024 and FY 2028 yields a price of $126 apiece. The analysis considers a 10.0% WACC in line with Micron’s capital structure and risk profile. An implied perpetual growth rate of 3.2% is also applied on FY 2028E EBITDA to determine Micron’s terminal value.

We believe the slight premium perpetual growth rate to the estimated pace of economic growth in Micron’s core operating regions is warranted, given secular demand for AI-related memory products. The 3.2% implied perpetual growth rate applied in the five-year DCF analysis yields the same terminal value as applying a 2.5% implied perpetual growth rate on FY 2033E EBITDA when Micron’s growth profile is expected to normalize closer to steady-state.

Meanwhile, Micron’s DCF analysis on projected cash flows over the five-year forecast period between FY 2025 and FY 2029 yields a price of $136 apiece. The analysis considers the same key valuation assumptions (10.0% WACC; 2.5% perpetual growth rate on forecast year-10, or FY 2034E, EBITDA to determine terminal value).

Conclusion

We believe Micron Technology, Inc.’s capacity deadlock is becoming an increasingly prevalent pressure on its near- to midterm financial performance. Meanwhile, the extended materialization timeframe for additional capacity from the Idaho and New York greenfield fabs also does little in alleviating immediate volume constraints to its growth trajectory, while simultaneously elevating Micron’s exposure to longer-term execution risks. Although Micron has outperformed recent earnings expectations, its underlying growth drivers are reinforcing our view that the revenue outlook currently priced into the stock’s lofty upsurge over the past year lacks durability despite secular industry tailwinds.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.