Summary:

- Mixed guidance leads to a drop in the company’s share price despite better-than-expected Q4 and full-year results.

- The demand for DRAM and NAND is expected to decline in the PC and mobile markets, but growth is anticipated in 2024.

- The automotive segment is the strongest performer, while China revenue risks are seen as short-term noise.

- My hold rating stands as I believe the company is still overvalued.

hapabapa

Intro and Results

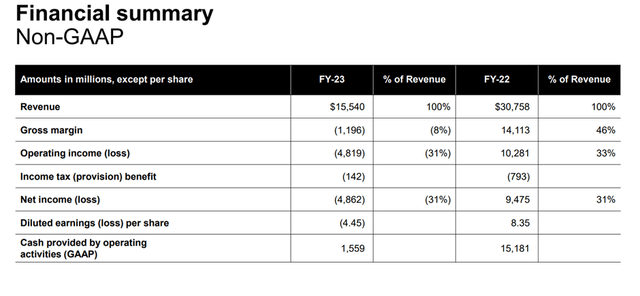

Micron (NASDAQ:MU) just reported Q4 and full-year results that weren’t as bad as many have thought. However, the company’s share price tumbled in after-hours due to mixed guidance. Non-GAAP loss per share came in at $1.07 and beat estimates by 11 cents while revenues of $4.01B beat estimates by $80m. The results are pretty much in line with what I have modeled for my valuation, so I wasn’t surprised to see that the company met my expectations.

Full year results (MU investor presentation)

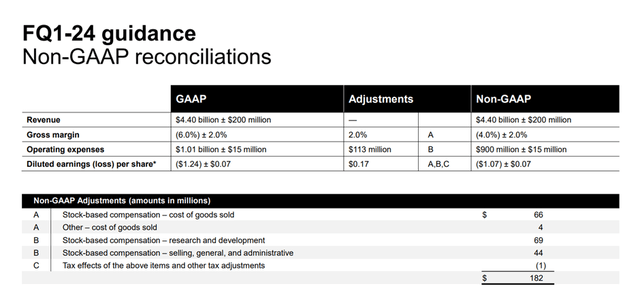

The reason the company’s share price is down is because of lackluster guidance for Q1 ’24, which shows not much improvement from the situation. I don’t know why it garnered such a reaction because it was going to happen due to the negative sentiment in the semiconductor sector for the longest time, especially the PC and mobile markets.

Q1 ’24 Guidance (Investor Presentation)

Outlook

Demand for memory

The demand for DRAM and NAND continues to see a slump and the management expects to see a decline in PC and mobile markets for the remainder of 2023 (low-double-digit for PC and mid-single-digit for mobile). As I mentioned in previous my article in July, I expect to see growth returning only sometime in around 2024, and management agrees with me on this as they see growth return to “low to mid-single digits in CY24” for both segments. So, again, nothing I didn’t anticipate coming from management. What I liked to see is what the management thinks will be the driver for these segments, and that’s AI-enabled PCs and mobile phones, which will drive “content growth and a stronger refresh cycle.”

The company is a leader in market share and quality in automotive, which I hardly touched on previously. However, this segment seems to be the strongest performer as it achieved record revenues. I’ve covered many semiconductor companies in the past and the ones that are in the automotive industry all see strong demand for the products and the only bright light in most of the reports from these companies.

So, nothing too out of the ordinary in that regard. I’ve been assuming the negativity to continue throughout the rest of the year and even into Q1 ’24, so the reaction after the announcement of results is warranted in my opinion as I’m still under the impression that the company is overvalued and needs a proper pullback before I get in, which I’ll touch on later.

What’s in store for NAND and DRAM going forward?

As I mentioned earlier, and management agrees with this, the demand for products will pick up next year. According to Gartner, NAND and DRAM will see an incredible bounce back in ’24 where revenues are set to increase a whopping 86% as pricing rebounds. This ties in well with what the management expects for 2024:

While macroeconomic factors remain a risk, we expect robust year-over-year bit demand growth in calendar 2024 for both DRAM and NAND, driven by improving end-market demand, normalized customer inventory levels, content growth across products, and ongoing growth in AI. Calendar 2024 bit demand growth is expected to exceed the long-term CAGR for DRAM and to be near the long-term CAGR for NAND.

The company continued to decrease prices in DRAM (decline in high-single-digit percentage) and NAND (declined in mid-teens percentage), so it’s good to hear that pricing is going to pick up next year as anticipated.

Management expects to see “mid-single-percentage” growth for DRAM for the rest of 2023, while NAND demand seems to be growing a little better as the management updated their expectations and have increased “from high-single digits to high-teens percentage.” It looks like the trough has been reached and the demand is starting to pick up already, however – for 2023, the numbers will still look negative due to the tough start of the year.

On the AI front, the company sees strong demand for AI-enabled servers. I’m confident that the company will be able to achieve some sort of mark share when it releases its HBM3E product as management is seeing a lot of interest from customers. Market leaders in this segment are Samsung (OTCPK:SSNLF) and SK hynix, so if MU manages to get some market share from these two juggernauts, it will further play into the turnaround of profitability for the company. MU “expects to begin production ramp in early CY24 and achieve meaning full revenues in FY24.”

China Revenue Risks

Management is optimistic about the future in China, which of course is going to be somewhat impacted by the decision of the CAC. However, as I mentioned in my previous article, the revenue impacted is not too big, around 12%-13%, so it’s not the end of the world. This is still a short-term noise for me as I mentioned in my previous article, and the long run, this risk is going to be mitigated. An analyst at Barclays agrees with me on this and has raised MU’s PT to $80 a share (I don’t agree with that PT though).

Closing Comments

Overall, the company performed just as I expected given the broad market sentiment. The pain is not going to go away for companies like MU very soon, however, I believe that by the second half of the year, the company will see a good turnaround in revenues and demand will be massive for its products.

I still believe the company is slightly overvalued at this price and maintain my hold rating as I believe the next couple of quarters will continue to chip away at the company’s share price and make it a much more enticing investment idea once it is at around $50 a share, as I believe that is the fair value of MU.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.