Summary:

- We remain buy-rated on Micron Technology, Inc.

- We think Micron’s fiscal Q4 2023 earning results confirm that memory demand bottomed in FY23 and demand-supply dynamics are back in balance after wafer starts reduction and capex cuts.

- We now believe Micron is better positioned for revenue growth reacceleration and better gross margins due to new product cycles coupled with improved pricing towards H2FY24.

- Additionally, we think the CAC ban headwind has been priced into the stock and outlook for FY24.

- We believe the memory correction is over and see a more favorable risk-reward profile for Micron into 2024.

SHansche/iStock via Getty Images

We maintain our buy rating on Micron Technology, Inc. (NASDAQ:MU) after the company announced fiscal Q4 and FY23 results yesterday. The Q4 2023 earning results confirmed our belief that memory demand bottomed in FY23, and now we believe memory demand-supply dynamics are back in balance.

It’s important to note, though, that we think the balance is not the result of an end demand rebound but due to heavy wafer starts reductions and capex cuts across MU, Samsung, SK Hynix, Western Digital Corp (WDC), and the broader memory/storage space this year. In FY24, management expects demand-supply dynamics to improve sequentially as customer inventory levels stabilize and industry wafer starts cuts approach 30%. Now, customer inventory levels for memory and storage in PCs and smartphones have stabilized; we think the automotive market is currently undergoing a correction and believe the data center correction is underway and projected to normalize in CY24. We don’t think end demand has recovered yet, but our bullish sentiment on MU is based on our belief that now the company is in a better position to reaccelerate revenue growth and improve gross margins due to new products, including the HBM3+ and higher density DDR5, coupled with a better pricing environment.

The market didn’t react well to MU’s guidance; management guided for sales to grow 10% sequentially next quarter to midpoint of $4.4B (from a range of $4.2-$4.6B), above consensus of $3.97B, and estimate Non-GAAP gross margin to improve 500 basis points to -4%. We think MU gross margins should improve and exit the negative range in the H2FY24 as pricing improves and DRAM demand recovers. The stock has outperformed the S&P 500 (SP500) since our upgrade to a buy in late October, up 23%, versus the S&P 500, up 11%. Since our last post-earnings note, MU is up 12%, outperforming the S&P 500 by 15%. We see more material outperformance in FY24 as MU’s risk-reward profile becomes increasingly favorable post-memory market correction.

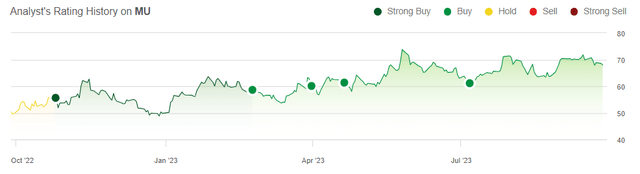

The following graph outlines our rating history on MU.

Memory correction is over

The memory correction is over, in our opinion, and we think management’s discipline execution during FY23 has better positioned it to grow in FY24. MU reported revenue of $4B this quarter, down 40% Y/Y and up 7% QoQ. FY23 revenue was also down Y/Y by 49%. Now, we expect the end demand rebound in FY24 to play out in MU’s favor as demand-supply dynamics are in balance. We think DRAM, which accounted for 69% of total revenues this quarter at $2.8B, will experience end demand recovery in FY24 driven by new product cycles in MU’s portfolio, specifically the HBM3+ and DDR5. We continue to expect the industry transition from DDR4 to DDR5 will be a substantial tailwind for MU into FY24.

Additionally, we think the A.I. boom will work in MU’s favor in the mid-to-long run, as A.I. servers utilize 8x the DRAM content as traditional compute servers and require higher complexity. We don’t expect to see a near-term tailwind from the industry shift to A.I. servers over compute servers due to the limited cloud capex pressuring data center business. Management touched on this yesterday, noting, “In data center, traditional server demand remains lackluster while demand for AI servers has been strong. Data center infrastructure operators have shifted budgets from traditional servers to higher-priced AI servers.” We’ve highlighted the materially higher ASP of A.I. servers versus compute servers (a 15-20x higher ASP) in our outlook on the data center business for Advanced Micro Devices (AMD) and Intel (INTC), and we think this sentiment applies to MU’s data center revenue in the near-term as well. We still expect and demand to rebound, but think the AI-driven tailwinds will take longer to play out.

Elephant in the room: CAC Ban

Earlier in 1H23, the Cyberspace Administration of China or CAC announced an investigation into the U.S. memory company and followed the investigation with a ban after MU reportedly failed to pass the cybersecurity review, noting:

“The review found that Micron’s products have relatively serious cybersecurity risks, which pose significant security risks to China’s critical information infrastructure supply chain and would affect national security.”

Management has estimated the ban’s impact to be in the low single-digit percent of total revenue at the low end and high single digit at the high end. We continue to expect the CAC ban to be a headwind for revenue growth, but we’re less concerned now that we believe the CAC headwind has been priced into the stock and factored into the outlook for 1Q24 and FY24.

Valuation

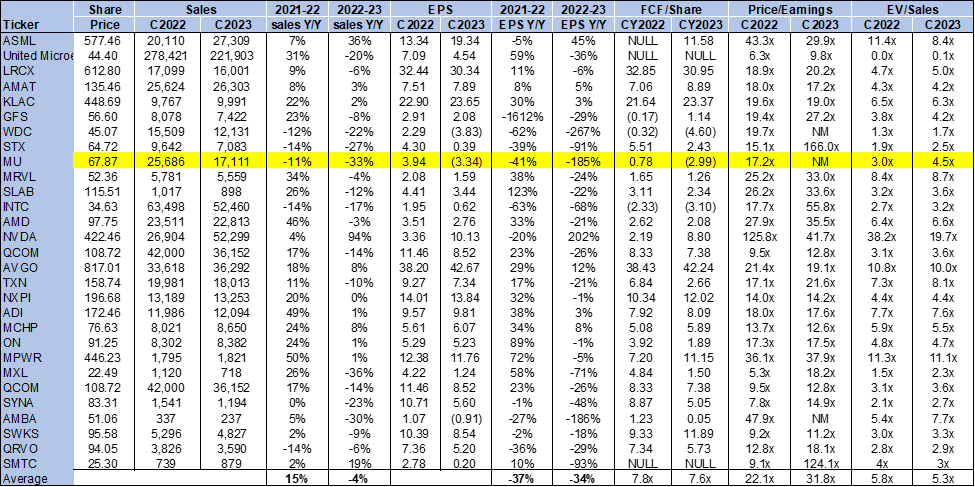

MU is undervalued, in our opinion. The stock is trading at 4.5x EV/C2023 Sales, versus the peer group average of 5.3x. MU is trading below the peer group average, and we see attractive entry points into the stock at current levels as the memory market recovers.

The following chart outlines MU’s valuation against the peer group.

TSP

Word on Wall Street

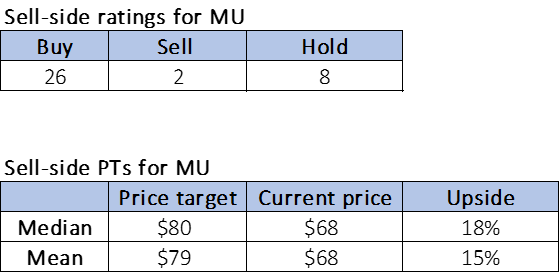

Wall Street shares our bullish sentiment on the stock. Of the 36 analysts covering the stock, 26 are buy-rated, eight are hold-rated, and the remaining are sell-rated. We attribute existing bearish sentiment to concerns over end demand recovering in the memory market and the CAC ban; while these concerns are understandable, we urge investors not to allow the already priced in headwinds to overshadow end demand tailwinds in FY24.

The stock is trading at $68 per share. The median sell-side price target is $80, while the mean is $79, with a potential 15-18% upside.

The following charts outline MU’s sell-side ratings and price-targets.

TSP

What to do with the stock

We remain buy-rated on Micron Technology, Inc. We think the worst is now behind the stock after the memory market bottomed regarding pricing and end demand in FY23. The company is now better positioned to reaccelerate revenue growth and expand into positive margins due to two factors. The first is balanced demand-supply dynamics due to severe wafer starts reduction and capex cuts this year. The second is recovered end demand and pricing dynamics driven by new product cycles for higher density. We recommend investors take advantage of the Micron Technology, Inc. pullback post earnings and explore favorable entry points at current levels to ride the upside in CY24.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This idea was discussed in more depth in our investing group, Tech Contrarians. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.