Summary:

- Micron Technology, Inc.’s stock is downgraded to “hold” in my opinion due to Nvidia’s Blackwell chip delays and concerns about cash flow and compressed margins.

- Despite strong AI demand, Micron’s financial pressures and Nvidia’s delays create uncertainty, making the upcoming earnings report crucial for the future outlook.

- In the long term, Micron is poised for growth with AI-driven demand for high-performance memory chips, but near-term risks and cyclical industry concerns remain.

- Investors should watch for management’s qualitative data on Nvidia orders during the earnings call to gauge the impact on Micron’s short-term performance.

Alex Wong/Getty Images News

Investment Thesis

Micron Technology, Inc. (NASDAQ:MU) shares have fallen 28.26% since my last write-up in early July, driven mainly by investor concerns around cash flow and compressed margins after their last earnings call.

In their fiscal Q3 earnings call, management revealed that both metrics were under pressure, even as NVIDIA Corporation (NVDA) continued to see massive demand for AI chips. To counter this, Micron’s CEO Sanjay Mehrotra clarified that the company remains highly focused on continuing to ramp up their production and improve their yields. While cash flow missed and margins were compressed, this is not the reason I have downgraded from a “buy” to a “hold.”

Micron’s growth strategy in a big way revolves around supplying high-bandwidth memory (HBM) products to Nvidia’s next-generation Blackwell chips used in AI applications. Management noted on their last earnings call that advanced AI chips (like Blackwell) are a big use case for HBM DRAM architecture.

The company has already begun mass production of the HBM3E, kicking off earlier this year, which the market anticipates will get featured prominently in Nvidia’s H200 GPUs.

However, Nvidia’s delays with their Blackwell chip lineup put a cloud over a big source of future HBM demand. Already, analysts have cut their estimates for server maker Dell Technologies Inc. (DELL) on the back of Blackwell delays. In essence, these delays are real. And the impact is tangible.

Given this backdrop, I now view Micron shares as a hold rather than a by going into the quarter. I believe the current quarter will be important, since it’ll likely determine whether Nvidia’s delays and Micron’s financial pressures around margins and cash flow will result in further weakness.

Why I’m Doing Follow-up Coverage

Micron is one of the leading players in the memory and storage industry due to their powerful, bleeding-edge memory products that are key to the future of AI. Their impressive portfolio of solutions around DRAM, NAND flash memory, and more recently, the advanced HBM3E memory used in AI high-performance computing applications means their tech is the foundation for the future of AI.

The company’s collaboration with AI leaders such as Nvidia has offered a lot of confidence to investors, especially when they sold out their entire HBM3E supply for 2024 after Nvidia announced their original production plans.

Chief Business Officer Sumit Sadana said in an interview in June:

We are very optimistic because after Nvidia, Micron has a bigger exposure to AI growth than perhaps any other semiconductor company

They are more than just a supplier to Nvidia, they are a problem solver as the company is incorporating power-efficient designs into their products to address growing concerns around data center energy consumption (this is a big concern from Nvidia customers).

As CEO Mehrotra noted at a recent conference:

When we look ahead at 2025, we see HBM consuming around 6% of the industry bits and industry TAM in 2025 greater than $25 billion. So it’s an exciting market. Micron is well-positioned with our HBM product. And HBM has — given the 3:1 trade ratio that is there with HBM, it has the impact on tightening the supply market and providing a ripple effect on pricing for non-HBM market as well. So, we see a healthy demand-supply environment in 2025 and we see a healthy pricing environment in 2025 as well leading to our projection of substantial revenue record and robust profitability in 2025.

HBM4E that enables us to bring potentially more — some of the customer logic into the HBM product solution. Keep in mind that HBM solution consists of a stack of eight or 12, as Manish has discussed, memory die and then there is a base die, which is the logic die. And in that base die opportunity with HBM4, 4E kind of solutions where you can bring customer logic into the base die. And that brings memory and logic closer together and that’s goodness in terms of driving performance in terms of driving power efficiency.

So working closely with the customers and we are working on those kinds of solutions right now, and these are — customization opportunities are with HBM4E. We are working closely in terms of defining the architecture and the features related to this. And absolutely it is an opportunity that gives us customization opportunities, which really brings even greater value to the customers -Mehrotra.

In essence, Nvidia’s relationship with Micron is a cornerstone of the future of Micron.

This is the reason I am doing follow-up coverage. Because when Nvidia faces a delay, Micron gets impacted. We’re about to find out how much they’ve been impacted.

Q4 Preview

As the company approaches their FY Q4 earnings report on Wednesday, September 25th after the bell, Wall Street analysts expect the company to post EPS of $1.11 on revenues of approximately $7.64 billion. Estimates represent 90.49% YoY growth in sales.

Earnings will be crucial for addressing the concerns I (and other analysts) raised after their Q3 report, when their operating cash flow fell short by 23.5%, coming in at $2.48 billion versus the expected $3.24 billion.

Despite a jump in revenue (both then and expected now), driven by growing AI demand and a strong partnership with Nvidia, cash flow lagged, driven by a heavy investment cycle.

Last quarter, they posted a gross margin of 28%, which marked an 8-percentage-point improvement sequentially, driven by better pricing and product mix.

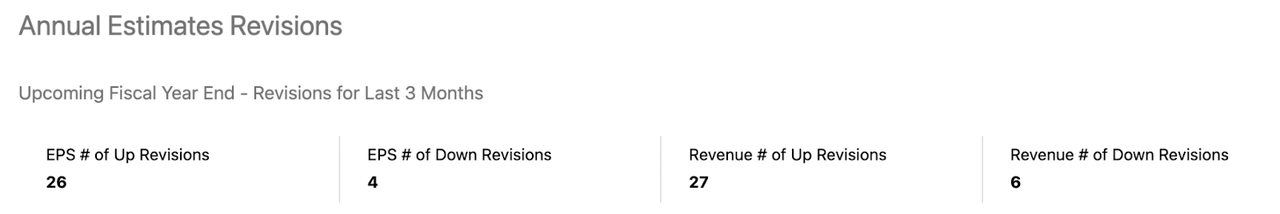

To be honest, I think there is a chance that analyst estimates are running high this quarter. Over the last 3 months, we’ve seen 26 upward EPS revisions and 27 upward revenue revisions. That’s really bullish, even when one of their main customers is signaling that they’re going to be late taking orders for HBM memory chips.

For this upcoming quarter alone, we’ve seen 17 upward EPS revisions and 15 upward revenue revisions.

What I’m Looking For

Personally, the delays with Nvidia’s Blackwell chips are what the market really should be weighing. As I mentioned, pushing the release of the Blackwell chips into early 2025 is a problem for Nvidia and their suppliers, including Micron. This is the elephant in the room.

For me, I like it when management is explicit. I’m looking for management on Micron’s upcoming earnings call to offer strong qualitative data indicating that orders from Nvidia have not slowed, but have accelerated. Micron is spending big to build out infrastructure for their new memory customers (hence the lower cash flow last quarter). Those customers need to order, take delivery, and pay for their HBM chips.

For this reason, I am not going to estimate a fair value of Micron’s stock going into the quarter (as I have before and after previous earnings calls this year). The Nvidia delay is a big question mark. I am not going to make too many assumptions with a big question overhanging the stock.

Bull Thesis

To be clear, over the long run, I am really optimistic about Micron. Earnings expectations for Micron over the next three to five years are extremely bullish (and I think rightfully so).

Forward EPS Estimates (Seeking Alpha)

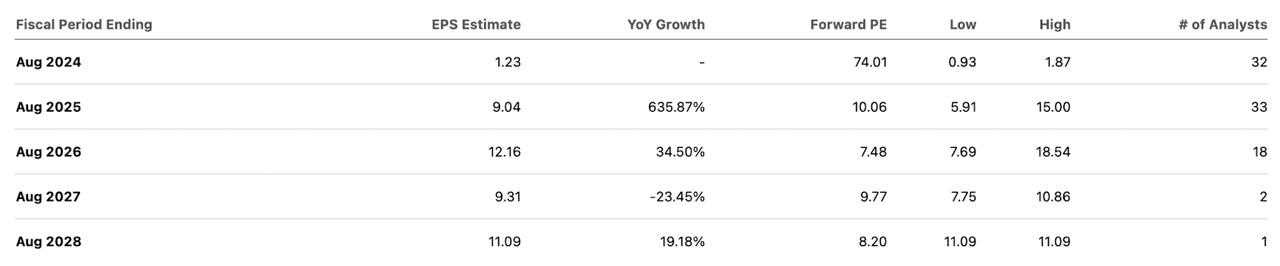

Analysts project significant growth, with EPS estimates jumping from $1.23 in FY 2024 to $12.16 by FY 2026, driven by strong demand for high-performance memory chips used in AI applications (Blackwell revenue will show up at some point).

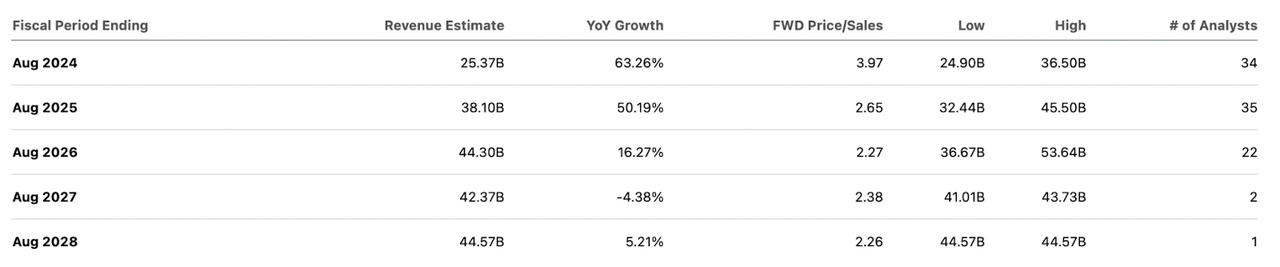

Revenues are expected to surge as well, growing from $25.37 billion in 2024 to $44.3 billion by 2026, as a result of their link to the AI megatrend, and the development of AI infrastructures like Nvidia’s GPUs.

Forward Revenue Estimates (Seeking Alpha)

Micron is more than capable of benefiting from the expansion of the AI market, but they still need to execute better than expectations.

The rise in demand for HBM products has the potential to make the traditionally cyclical memory industry less prone to drastic swings (the stock trades at a low forward P/E to reflect these swings).

AI applications require a consistent and exponentially growing supply of memory, theoretically creating more stable demand, which could transform the business model for Micron, moving away from the traditional boom-and-bust cycle in memory supply.

However, investors who have held Micron stock for the last five years have experienced these cycles firsthand (and the promise of multiple boom-bust cycles before this one).

While the long-term outlook for AI demand could smooth out these cycles, there is a risk that current expectations are overly optimistic. Investors could be getting ahead of themselves by pricing in this long-term AI demand too early, really, given the uncertainty surrounding near-term order volumes from Nvidia. This is why I have downgraded my view to a hold. Great stories get ahead of themselves all the time. For investors, timing here is a big deal.

Takeaway

Nvidia’s Blackwell chip delays really emphasize the risks surrounding Micron’s short-term outlook. Nvidia is one of Micron’s largest AI customers, and I am not sure the market is pricing in all the concerns surrounding potential order slowdowns from Nvidia. These concerns need to be addressed during the upcoming earnings call by management, since Nvidia is a big part of the bull thesis.

If Micron provides strong qualitative data indicating that orders have not decreased but are instead accelerating, this could definitely calm down investor fears (including mine). Currently, Micron’s shares remain below their all-time highs, and I’m sure management would like to see a return to the mid-$150 range.

Over the long run, I believe AI demand is expected to smooth out the typical cyclical nature of the memory chip business, but near-term risks remain. At this point, Micron Technology, Inc.’s valuation feels uncertain to me, and predicting the fair value of shares before more clarity on these orders is challenging. For now, I believe shares are a hold. I am willing to move back to a “buy” or a “strong buy” if we see the company outperform.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DELL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.