Summary:

- Micron stock is currently well-positioned for strong FY25 returns. Despite a high valuation, especially after sentiment improved following its strong Q4 report, this could be sustained for now.

- Toward the end of FY25, it is reasonable to expect downside volatility as a result of lower growth forecasts for FY26. Therefore, this is a substantial short-term opportunity.

- That being said, Micron is investing heavily in its long-term capacity with new fabs being built and an effort to compete in HBM4 with SK Hynix and Samsung.

- Micron could grow its market cap by approximately 60% within the next 12 months, but at that valuation, I would consider selling. Otherwise, the long-term thesis contains significant volatility.

Oat_Phawat/iStock via Getty Images

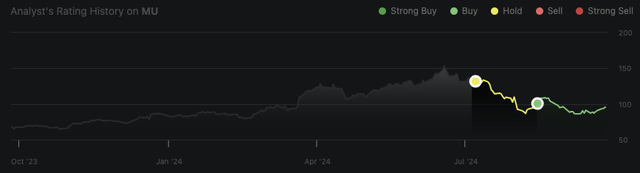

I last covered Micron (NASDAQ:MU) in August, and I put out a Buy rating at the time after a Hold rating in July, where the stock collapsed 25% in price following it. As a value investor, I look for opportunities that are unlikely to show significant downside volatility following my Buy ratings. In this analysis, I reaffirm my bullish sentiment for Micron stock now that its valuation is more appealing.

Oliver Rodzianko’s Performance (Seeking Alpha)

Micron is extremely well-positioned in the memory markets, with major competition from only two other established firms. It currently has a technological lead in HBM3E, which is setting the stage for a formidable FY25 for Micron stock alongside a reasonable valuation at the moment. Based on my analysis, it is quite conceivable for the company’s market cap to grow by approximately 60% within the next 12 months, with a caveat of downside volatility to follow this based on slower growth rates and associated valuation contractions in FY26.

Strong Q4 Earnings Set the Stage for a High Price Return in FY25

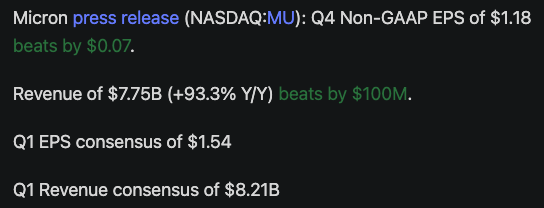

Micron had a strong Q4 earnings report:

Seeking Alpha

Furthermore, the resounding note is that management is forecasting record revenue for Q1 2025, driven by high-volume production of advanced technology nodes to meet the demand from data centers and AI markets.

Notably, Micron’s YoY revenue growth was 93% in Q4. It achieved record revenue here, with a gross margin up by over 8 percentage points on a sequential basis. This is extremely strong, and such heavy revenue expansion is only likely to continue in FY25, which is expected to be a remarkably high-growth year for the company.

On the earnings call, management mentioned that HBM (High Bandwidth Memory) is its key growth driver at the moment. Management is aiming for multi-billion-dollar HBM revenues in FY25. Furthermore, management outlined that the HBM total addressable market is expected to grow from $4 billion to over $25 billion in 2025. Micron’s formidable position is being consolidated here through the fact that its HBM3E offering provides a 20% lower power consumption and 50% higher capacity than competitors’ solutions.

Furthermore, DRAM is another area where demand is high at the moment, with mid-teens percentage demand growth for FY25 following high-teens percentage demand growth in FY24. This is supported by the broader trends in AI-enabled smartphones and PCs, with higher DRAM content in these devices. The demand for these new AI-enabled devices is expected to expand significantly in H2 FY25.

Micron Is a Strong Near-Term Investment and a Viable Long-Term Holding

In the earnings call, management mentioned its current strategic capital expenditures, including its investments in new fabs in Idaho and New York, as well as expansions in India and China. These investments are positioning the company for long-term production capacity growth, and the company expects to increase its capital expenditures in FY25 to support these projects. This is a good sign, as it indicates that Micron is positioning itself with a strong competitive advantage in terms of technology and capability to meet demand in areas like AI, 5G, and automotive applications.

Notably, Micron’s HBM capacity is sold out through 2025, which demonstrates the high long-term revenue visibility and shows that the company’s capital expenditures are well-justified. Given these points, Micron will likely continue to be foundational to the proliferation of advanced and intelligent technology over the coming decades. This is a primary reason why Micron does indeed work as both a near-term cyclical trade and a long-term growth investment.

Turning to the valuation, Micron is still reasonably valued, even after a 10.5% increase in price since my August analysis of the company. When I first covered Micron in July, the P/S ratio was nearing 7. Now, it is around 5. Such a significant contraction in the valuation was certainly warranted, in my opinion. I estimate that the company is slightly overvalued right now, with the high growth forecast for FY25 somewhat priced into the stock amid a sentiment boost from the strength of its Q4 report. It is worth remembering that with such high growth on the horizon, Micron stock is prone to further overvaluation over the next 12 months, and it is likely to face momentary downside volatility as growth slows down in FY26. As ever, Micron will remain a cyclical stock even amid higher capacity and growth trends in intelligent technology, particularly as the upgrade supercycle related to AI-enabled devices will not last forever.

Micron Revenue Growth Estimates (Seeking Alpha)

In my August analysis, I was conservative with the P/S ratio I considered fair for the stock over the next 12 months, indicating a ratio of 4 would be reasonable. However, in reality, the market could expand the multiple significantly for short-term bursts during the period based on the high growth rates the company is likely to deliver. Therefore, despite what might be conservative and fair, I am redefining my price target to include the likelihood of this market psychology factor while still being reserved in my prediction. If the P/S ratio is 4.5 toward the end of the next 12 months and the FY25 revenue estimate of $38.35 billion is achieved, the company’s market cap will be approximately $172.5 billion. Its current market cap is $106.2 billion. Therefore, the near-term growth of the company with a moderate P/S ratio contraction could deliver a 12-month market cap return of over 60%. There may be periods where this return is higher, and it could be much lower than this toward the end of FY25 as sentiment adjusts for FY26. However, after a market cap gain of around 60% within the next 12 months, I would deem this as a reasonable reason to sell the stock if allocating now for a high-alpha, near-term trade. It is worth noting that the company currently has over double the expense in stock-based compensation compared to share buybacks. Based on TTM data, it has bought back $300 million of shares and given stock-based compensation of $833 million. Therefore, stock price returns will be lower than the 60% market cap growth due to share dilution.

Long-Term AI Slowdown Concerns and Competition in HBM4

Quite rightly, Micron is capitalizing on the current growth trends related to AI with its expansion of its HBM production. However, there is certainly a risk that growth related to AI will slow down considerably, especially as the return on investment and financial viability of AI infrastructures are questioned as time progresses and balance sheets and cash flows are assessed on merit. At the moment, AI spending is largely a herd behavior driven by the ongoing need for all industries, companies and products to keep up with technological capabilities. However, as the field progresses and this initial demand is met, the practicality of AI-enabled devices and infrastructures is likely to become more nuanced. In my opinion, many companies will find viable distinct business models that rely less on AI infrastructures in an effort to be leaner in terms of initial capital expenditures and product development margin benefits. Therefore, Micron does run the risk of overvaluing the importance of HBM and the demand for intelligent technology over the long term. However, in the next 12 to 24 months, I see it as highly unlikely that the company will run into demand constraints.

Furthermore, the long-term competitive risk from SK Hynix (OTCPK:HXSCF) and Samsung (OTCPK:SSNLF) is significant. Both of these have significant economies of scale, enabling them to potentially offer HBM products at more competitive prices than Micron. Both competitors are aggressively expanding their HBM capacity due to AI demand, and SK Hynix was the first to launch HBM3 in 2021; now, it is developing HBM4, as is Samsung. If Micron’s HBM4 roadmap lags behind or suffers from technological or yield issues, it could lose significant market share. Furthermore, SK Hynix and Samsung have stronger partnerships with major big tech firms; this includes Nvidia (NVDA), which is the leading producer of AI GPUs, historically sourcing HBM from them over Micron. While Micron currently holds the lead in HBM3E, this competitive advantage is likely to be relatively short-lived considering its competitors’ development of the next-generation HBM4, likely to begin deployment in 2026. To stay competitive, Micron has outlined its plans for HBM4 deployment in 2026 and 2027 and HBM4E by 2028.

Conclusion

Micron stock is extremely well-positioned for high 12-month returns right now. While I am not usually a short-term investor, there is some argument to be made that this investment works better as a short-term holding due to the cyclicality inherent in Micron’s business model. However, its long-term outlook is also robust, but investors must prepare for high levels of volatility with a buy-and-hold strategy. My analysis shows that Micron stock currently deserves a 12-month Strong Buy rating, with the potential for around a 60% market cap increase over the period.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.