Summary:

- Micron’s flagship chip for AI servers is already sold out for the next year, indicating strong demand and technological edge in the AI revolution.

- The company’s diverse segments and products help address revenue concentration risks and demonstrate impressive growth momentum.

- Micron’s expansion into the SSD market and its position to capture AI tailwinds make it an attractive investment with a low valuation.

- I believe such an AI powerhouse should trade at a premium to its fair value. However, MU stock currently trades at a double-digit discount.

JHVEPhoto

Introduction

Micron (NASDAQ:MU) enjoys the wave of ramping up investments in cloud computing and artificial intelligence (‘AI’). Its flagship chip for AI servers is already sold out for the next calendar year’s demand, indicating technological edge. Other segments also demonstrate massive growth momentum, and I consider expansion to SSD to be promising as well. MU is very attractively valued for an AI stock with a 10% discount to the fair value, while I believe that such an AI powerhouse deserves a premium to the stock price. Therefore, I am inclined to give MU a ‘Strong Buy’ rating.

Fundamental analysis

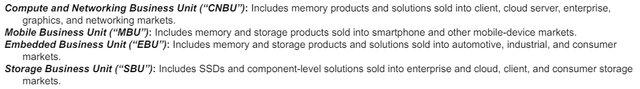

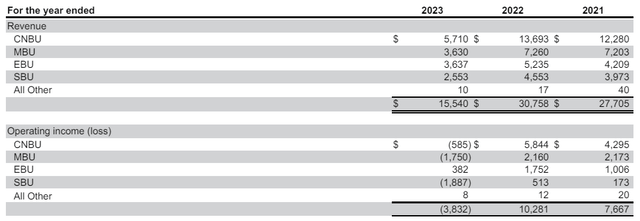

Micron is one of the world’s leading suppliers of semiconductor memory products. In its latest annual report, the company ranks itself as the ‘fifth largest semiconductor company in the world’. To better understand the company’s business, please take a look at Micron’s segments below.

Micron’s FY 2023 annual report

Wide diversity across various segments and products helps to address revenue concentration risks, which adds to any company’s fundamental strength. CNBU has historically been MU’s largest segment and generated 37% of the total revenue in FY 2023.

According to the last quarter‘s (fiscal Q2) performance, the business experiences positive momentum across all four segments. The YoY growth is impressive across all four business units, and three out of them demonstrated above 50% increases. At the consolidated level, MU delivered a 58% YoY revenue growth. The EPS has improved YoY from -$1.91 to $0.42.

Micron’s FQ2 presentation

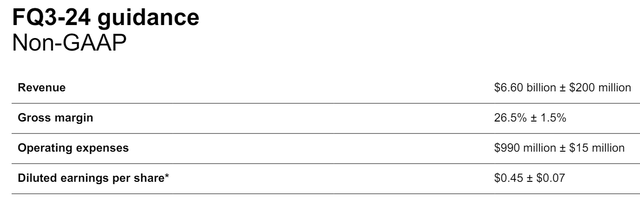

There was a notable guidance boost for fiscal Q3 as well. The management expects YoY revenue growth to accelerate to 76%. The EPS is also expected to demonstrate sequential growth, from $0.42 to $0.45. It is also crucial to mention that Mark Murphy, the CFO, said that the management expects record revenue in fiscal 2025. This means that the management considers the current growth momentum to be sustainable over the next several quarters.

Micron’s FQ2 presentation

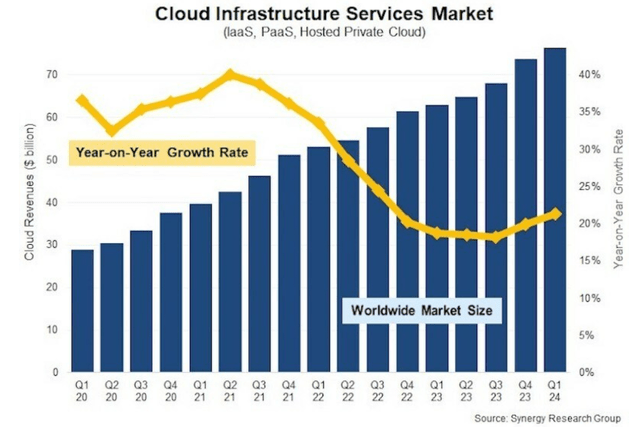

The management’s optimism appears to be reasonable. The company’s largest segment, CNBU, has strong exposure to cloud servers. Due to the AI race, the cloud industry gained robust momentum in recent quarters. According to Synergy Research Group, the cloud market’s growth rate has improved significantly in recent quarters compared to a 2022 dip. According to the presentation, strong AI server demand was one of the major positive catalysts for the company’s financial performance in fiscal Q2. Therefore, I expect MU to continue capturing the effect of positive developments around cloud and AI.

Synergy Research Group

It is also crucial that a rapid ramp up of investments in data centers, cloud and AI boosts the demand for Micron’s offerings. For example, Micron has already sold out the entire 2024 demand and most of the 2025 demand for its most technologically advanced solution for AI innovation, HMB3E. Having its most cutting-edge product sold out means that Micron indeed provides leading technologies in its niche. Moreover, strong demand allows Micron to exercise pricing power. This is another robust bullish catalyst for MU.

There is another massive positive catalyst for Micron’s solutions exposed to AI. Analysts of JPMorgan (JPM) expect the AI servers market to increase from $41 billion in 2023 to $283 billion in 2028, which is a 47% CAGR. Micron recently secured a $13 billion governmental support under Chips Act. This increases the probability that Micron will be able to meet the surging demand for its products.

Another promising trend is Micron’s recent aggressive expansion into the SSD market. As we saw in one of the above tables, Micron’s Storage business is the fastest growing segment at the moment. This segment includes SSD solutions, and the whole SSD industry is expected to deliver a 17.6% CAGR over the next five years. Diversification of the business mix is a strong strategic initiative which will help Micron to deliver smoother financial performance over the long term.

Valuation analysis

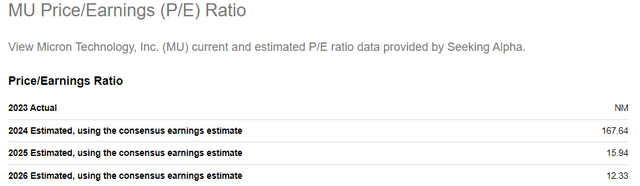

Micron’s above 100 forward non-GAAP P/E ratios should not mislead readers. Due to the robust EPS expansion, which is expected by consensus, the P/E ratio is expected to contract to just 12 in FY 2026. For a company that is positioned to capture massive AI tailwinds, a 12 P/E ratio is extremely low. For example, a highly defensive U.S. Utilities (XLU) sector which usually grows in low-single digits currently trades at an average 20.8 P/E ratio. Therefore, MU is cheap from the P/E perspective.

SA

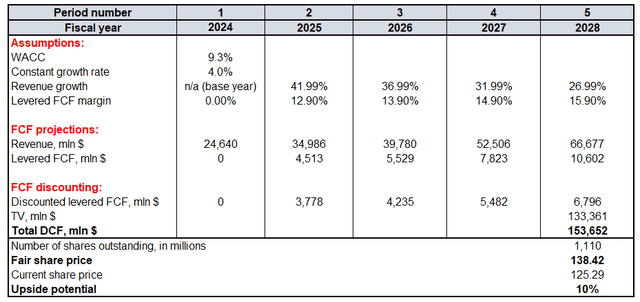

Running a discounted cash flow (‘DCF’) model will be useful in adding more conviction about Micron’s undervaluation. Future cash flows will be discounted with a 9.3% WACC. Revenue consensus estimates for 2024-2025 consists of opinions of more than 30 Wall Street analysts and I consider this sample to be representative enough to rely on. For years after 2025 I prefer to be conservative and incorporate a notable five percentage points revenue deceleration per year. Due to strong secular industry tailwinds, I think that Micron will be able to deliver a 4% constant growth rate, two times higher than historical inflation levels.

The same source, the consensus, expects the company’s EPS to be below one in FY 2024. That is the reason why I use zero FCF margin for the base year of my DCF. However, the adjusted EPS is expected by consensus to move closer to $8 per share. The last time MU delivered (fiscal year 2018) such an EPS, the company generated 12.9% in levered FCF margin. Therefore, I incorporate this FCF margin for FY 2025. Since my analysis suggests that MU is positioned well to benefit from AI tailwinds, I think that I have to incorporate FCF margin improvements. Since revenue growth assumptions are already aggressive, I think that for the FCF margin expansion I have to be more conservative and projecting a 100 basis points yearly expansion is reasonable. According to Seeking Alpha, there are 1.11 billion MU shares outstanding.

Calculated by the author

The fair share price is $138. MU trades with a 10% discount, which is an attractive deal for one of the AI boom powerhouses. To sum up, I believe that Micron’s current valuation is quite attractive.

Mitigating factors

My readers have to be aware that 2023 was a disastrous year for Micron, as the company significantly suffered from the Cold War between the U.S. and China. The ban on selling Micron’s chips in China was the reason for the company’s revenue almost halving in 2023 compared to 2022. The company’s exposure to the Chinese market is still notable. According to the FY 2023 10-K report, Micron generated more than $2 billion in Mainland China revenue. Moreover, the company has manufacturing facilities in this country. While it appears that the worst is behind for Micron in this situation, the exposure to China is still notable. That said, Micron faces significant geopolitical risks.

Micron’s FY 2023 annual report

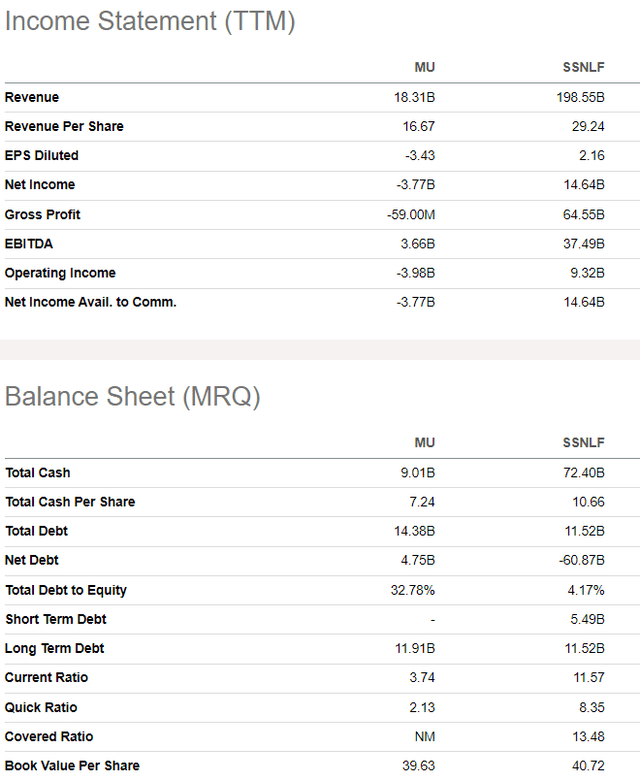

Micron is not alone in the industry. Direct competitors are formidable players, and Samsung Electronics (OTCPK:SSNLF) is one of the closest rivals. This giant is a by far larger player compared to Micron. Samsung contributes more than 20% to the South Korean GDP and possesses massive financial resources. Both companies are incomparable in terms of the income statement and balance sheet. That said, Micron faces substantial competition risks. On the other hand, memory solutions are not Samsung’s main business line, while Micron is laser-focused on one industry. This might give Micron a competitive advantage in terms of innovation where companies directly compete.

SA

Conclusion

Micron appears to be a robust AI powerhouse, in my opinion. The fact that its latest chip for AI servers is already sold out for the full-year demand speaks volumes about the company’s potential in this emerging industry. The valuation is attractive and all the company’s segments demonstrate strength.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.