Summary:

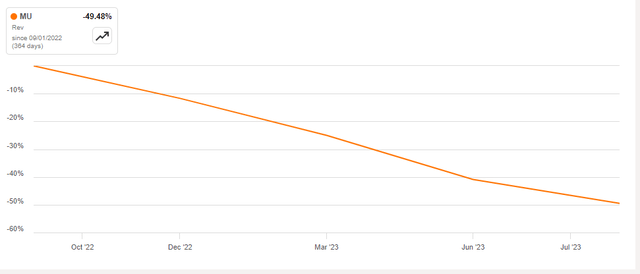

- Micron Technology’s fiscal year 2023 revenue decreased by 49% compared to the previous year, with negative gross profit and losses per share.

- The loss of sales revenue in China and Hong Kong due to a dispute with China has greatly impacted Micron’s financial metrics.

- Despite poor financial performance, Micron’s share price has increased by 30% in the last 12 months, potentially driven by market trends rather than company performance.

BING-JHEN HONG/iStock Editorial via Getty Images

Overview:

Micron Technology, Inc. (NASDAQ:MU) is one of the ten largest semiconductor companies in the world.

However, for the fiscal year ending August 2023, revenue was down by an amazing 49% compared to 2022’s results.

Other financial metrics were just as bad or, in some cases, even worse. For example, gross profit was actually negative for fiscal year 2023 compared to an almost $14 billion gross profit in 2022. This led to losses of $5.34 a share in 2023 compared to profits of $7.81 in fiscal year 2022.

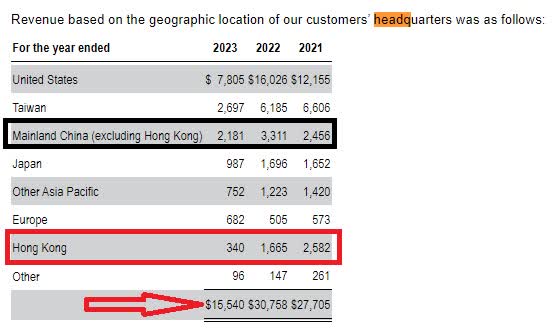

Much of this loss was due to the loss of sales revenue in China and Hong Kong because of a dispute with China concerning security issues in Micron’s products that were sold in China.

In addition, the latest iteration of Micron’s Chinese problems is with Chinese chip maker YMTC, who is suing Micron for alleged patent infringement. The reason this is so important is that a large part of Micron’s revenue comes from mainland China and Hong Kong.

Micron 10-K

As can be easily seen in the table above, Mainland China’s revenue is lower than in 2021 and 2022, as is Hong Kong’s revenue. Hong Kong’s revenue has dropped by over 80% over the last two years. This is devastating to Micron’s financial metrics and certainly does not support the fact that their price has increased by 30% over the last 12 months.

Micron’s most recent 10-K is full of warnings about the potential damage done by the Chinese policy towards Micron. Here are a couple of examples:

Our revenue with companies headquartered in mainland China and Hong Kong, including direct sales as well as indirect sales through distributors, is approximately a quarter of our worldwide revenue and remains our principal exposure to the CAC decision. Although the impact of the CAC decision remains uncertain, we believe that approximately half of that China-headquartered customer revenue, which equates to a low-double-digit percentage of our worldwide revenue, is at risk of being impacted.

When a company uses its 10-K to tell you that a double-digit percentage of revenue is at risk, that is not a buy recommendation from an investor’s standpoint.

Here’s another 10-K quote:

For example, following the May 21, 2023 decision of its cybersecurity review of our products sold in China, the CAC determined that critical information infrastructure operators in China may not purchase Micron products, impacting our revenue with companies headquartered in mainland China and Hong Kong, including direct sales as well as indirect sales through distributors. Some revenue with customers headquartered outside of China has also been impacted.

The 10-K further indicates that the cybersecurity review could impact revenue outside of China.

Add to both of these issues, and the recent intellectual property lawsuit, and you have to wonder what direction Micron will go in over the next year or so. Based on the above, it is certainly not looking good at this point in time.

Financial metrics look even worse than last quarter

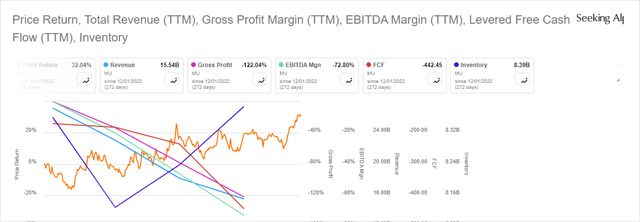

When we look at the financial metrics key on a chart basis and compare them side by side, we see one of the ugliest financial charts I’ve ever seen

As you can see, every important metric has decreased over the last year, including revenue, gross profit, EBITDA, and free cash flow. The only two things that have increased significantly over the last 12 months are the share price and the inventory.

As an analyst, I look at this and scratch my head; why would the price go up when all these other metrics went down?

Now, there are several potential issues here with the inventory. It could be that this is an overhang related to the COVID problem of three years ago, although that seems unlikely. Then there are the recent inflationary price spiral, shipping problems, and logistics issues that may have played a role in some of this, but still, that is a terrible-looking number for a stock that’s gone up by 30% in the last 12 months.

That’s not to mention that they’ve lost money every quarter for the last four quarters.

All in all, the financial metrics, as I stated before, looked terrible, and I have a hard time justifying an investment in Micron based on all the numbers I’ve shown above.

How did Micron’s price go up by 30% over the last year with the terrible metrics it had?

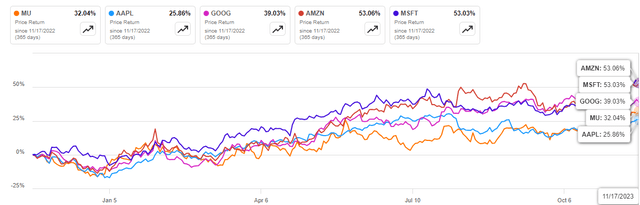

The main reason why I think Micron’s price has gone up despite the lousy performance they’ve had over the last year. Mainly, Micron is being pulled up by the Magnificent 7, who have been the rage in the market over the last several months, starting with Nvidia’s (NVDA) super revenue breakout. If we look at the four largest tech stocks by market cap and Micron, we can see a similarity in the share price performance of those five stocks.

Note that Micron is right there in the mix and has gone up more than Apple over the last year, even with the terrible financial results that it’s shown over that time. The question that must be asked is if the Magnificent 7 becomes more magnificent on the downside due to interest rate issues, financial market issues, and perhaps political issues such as Gaza, China, and the coming U.S. elections, what happens to Micron’s share price? I would say, in that case, Micron’s price will drop much more than the members of the Magnificent 7.

We can even see that Micron has gone up by 5% just in the last five days.

One of the reasons for that rise was the statement by Nvidia about how much memory would be needed for their new H200 GPU. If you read the article, it only says that Micron will be one of the companies competing for those sales along with other big-hitter memory producers such as Samsung (OTCPK:SSNLF) and SK Hynix.

Also, note the statement from Nvidia did not give a specific time frame for large deliveries of the memory. It could easily slide toward the end of 2024, so what happens to Micron’s share price between now and then if that delay occurs?

And you must wonder how much, if any, the huge inventory overhang includes raw material needed for Nvidia’s new GPUs?

Conclusion:

Looking at the above, I cannot recommend investing in Micron at this point in time. Is there a potential for a huge increase in sales? Of course, there is. However, that can be problematic, especially when dealing with China.

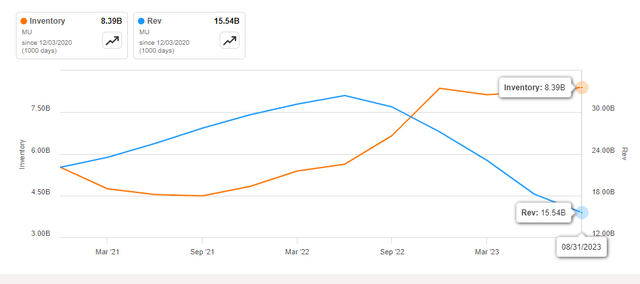

Another issue with Micron, in my opinion, is the huge inventory increase over the last year. One has to wonder what management was doing as those inventories increased substantially, even as their revenue continued to decrease. In fact, inventory levels went up last quarter even though revenues continued to fall.

Optimism in Micron Technology, Inc.’s future results is out of place, and Micron is, at best, a Hold until results improve considerably.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you found this article to be of value, please scroll up and click the "Follow" button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.