Summary:

- Micron faces deteriorating pricing power in its core DRAM and NAND segments due to a downturn in the PC market after the pandemic.

- China’s ban on Micron’s memory products adds to the company’s valuation pressure and increases revenue risks.

- Micron is restructuring its business and cutting costs, but there are significant EPS risks and uncertainties in the consumer electronics market.

- Shares are currently trading at a forward P/E ratio of 93X and the EPS revision trend is negative.

vzphotos

Micron (NASDAQ:MU) has suffered from a deteriorating pricing environment for its DRAM and NAND products in the last few quarters due to slumping demand for consumer electronics product after the pandemic… and headwinds are growing in other areas as well: at the end of May, the Cyberspace Administration of China has said that a review of Micron’s memory products has revealed cybersecurity risks. With uncertainty surrounding the macro picture growing and Micron submitting a weak forecast for the current fiscal quarter, I believe the memory maker faces escalating EPS risks. MU stock is currently valued at a 93X forward P/E ratio and the risk profile remains unattractive!

Deteriorating operating (pricing) environment, restructuring measures

Due to the downturn in the PC market after the pandemic, Micron has seen a serious deterioration in its pricing power in both its core operating segments, DRAM and NAND. As I said earlier, the downturn in the PC market has been driven chiefly by shrinking demand as consumers already upgraded their equipment (PCs, laptops, tablets) during the pandemic so that they could work and study remotely. According to Gartner, worldwide PC shipments declined a massive 30% in the first quarter of 2023, year over year, due to a post-pandemic normalization of consumers’ purchasing behavior. This decline in demand, paired with increases in inventory, has resulted in manufacturers drastically lowering average selling prices.

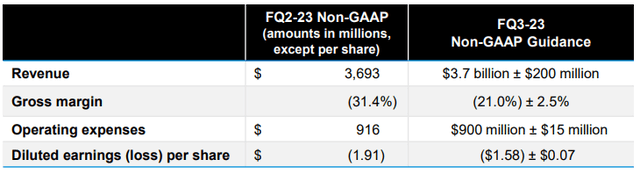

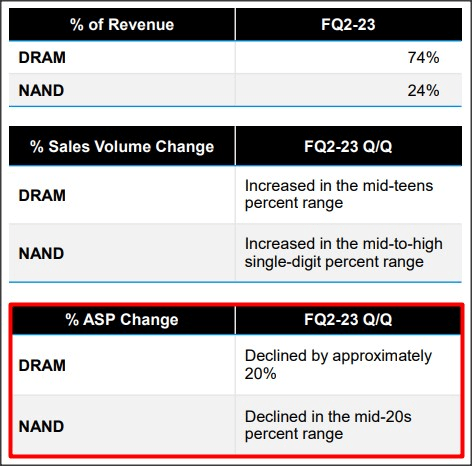

In Micron’s second fiscal quarter, average DRAM selling prices declined by 20% quarter over quarter while NAND ASPs declined at an even higher rate, reflecting a fundamental change in operating conditions in the market for memory products.

Source: Micron

Falling consumer demand and crashing average selling prices have resulted in a very weak outlook for Micron’s current fiscal quarter, FQ3’23. For the third fiscal quarter, Micron expects $3.7B +/- $200M in revenues, showing a potential 57% year over year top line decrease. Micron also guided for a negative gross margin (due to pricing and volume pressure in core memory products) of 21% +/- 2.5%. In the year-earlier period, Micron posted a gross margin of 47.4%.

Micron has taken countermeasures in order to respond to the massive decline in gross margins that has occurred in the last few quarters. Micron has said that it is aggressively reducing bit supply and cutting back on capital expenditures as well: Micron now expects capital spending of approximately $7B (compared to an earlier forecast of $8.0B) and a 50% drop-off in wafer fab equipment capital expenditures. Micron is also laying off people and reducing its headcount by approximately 15% in order to take pressure off of operating expenditures.

China bans some of Micron’s memory products, adding to revenue headwinds

The Cyberspace Administration of China said at the end of May that Micron’s memory chips pose cybersecurity risks and that it was banning some of the company’s products as a result, increasing revenue risks for Micron and increasing tensions with the U.S. China banning Micron’s memory products is largely viewed as retaliation for the U.S.’s export ban of high end chips last year.

China-related revenues represent a moderate portion of Micron’s revenues and the company has said recently that it expects a “high single digit” decline of its annual revenues as a result of China’s sanctions. The China ban unfortunately compounds Micron’s problems because it comes at a time of heightened top line risks when a demand slump and weaker prices are already weighing heavily on Micron’s top line and gross margins.

Micron’s valuation

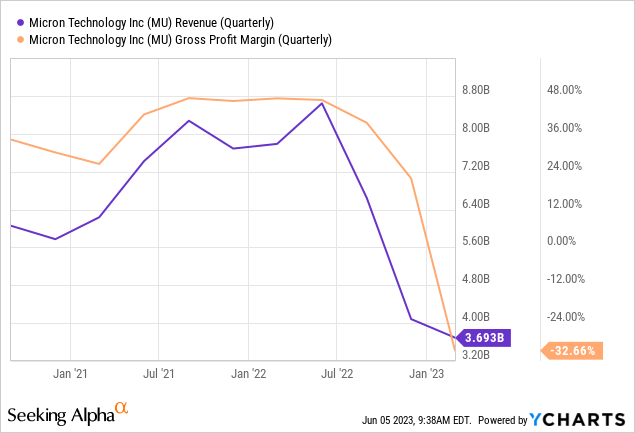

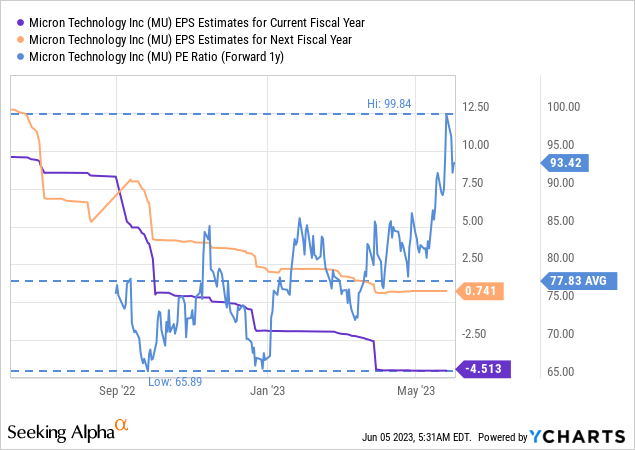

As I have said last year, Micron’s gross margins already peaked in 2022 and pressure on both the company’s top line and gross margins is mounting. As a result of slumping PC shipments and a softening pricing environment for DRAM/NAND products, EPS estimates for Micron have sharply reset to the downside in recent months.

Micron is currently expected to earn $(4.51) per-share in FY 2023 and $0.74 per-share in FY 2024. Based off of next year’s estimates. As a result, Micron is valued at a forward (FY 2024) P/E ratio of 93.4X which is materially above the company’s 1-year average P/E ratio of 77.8X. The forward P/E ratio for FY 2025, however, is 13.5X as the market expects a recovery in DRAM/NAND demand.

Nonetheless, I see significant EPS risks, as well as EPS revision risks for the memory maker in the short term, considering that the macro environment remains soft, the PC market may not have bottomed yet and China’s Micron sanctions further add pressure on an already challenged top line.

Based off of expected revenues, Micron is valued at a P/S ratio of 3.4X which is slightly above the 1-year average P/S ratio of 3.3X.

Other firms in the semiconductor/memory space are also trading at high P/S ratios, but Micron is especially expensive. Intel (INTC), as an example, is trading at a 2.1X price-to-revenue ratio and the company has also delivered multiple negative stock events lately, including the cut of its dividend.

Risks with Micron Technology

The biggest commercial risk for Micron Technology is continual pricing weakness in the company’s core product segments, DRAM and NAND, as well as China’s ban on Micron’s memory products. As a result, I expect continual revenue pressure and negative gross margins. If the PC market continues to slump, there is a considerable risk of EPS revisions to the downside. What would change my mind about Micron is if the company saw a demand rebound in its core DRAM market — which accounts for 74% of the company’s revenues — and stabilizing average selling prices.

Final thoughts

Micron is already restructuring its business due to top line and gross margin pressure that results from a weakening consumer electronics market. On top of that, China’s ban of Micron’s memory products due to national security reasons last month is an additional headwind. I further see EPS revision risks that could weigh on the memory maker’s valuation in the near term. Given a high degree of uncertainty in the consumer electronics market, China’s ban on Micron’s memory products, a negative EPS trend as well as a high valuation (forward P/E ratio of 93X), shares of Micron remain a sell!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.