Summary:

- Micron’s next earnings report is scheduled on March 27, 2023. And consensus estimates of its earnings are showing enormous variance.

- As such, investors could consider an option play targeting its next earnings date to either benefit from or hedge such variance.

- This article details the use of a put option that can provide a ~10% return in 106 days or let you buy the stock at an entry price of $50.

- Such a setup appears favorable either for short-term swing trading (if the option expires) or long-term holding (if the option is assigned).

remco86

Thesis

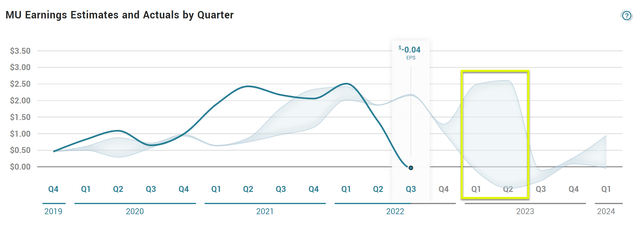

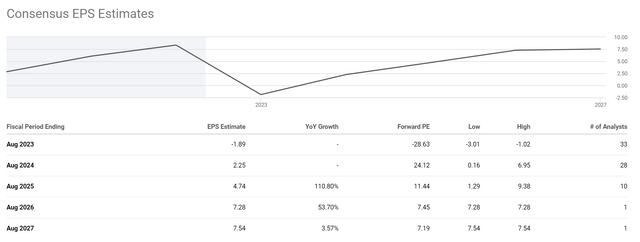

According to MarketBeat, the next earnings report (“ER”) from Micron Technology (NASDAQ:MU) is scheduled on March 27, 2023. I am sure most MU investors already know about its cyclical business nature and the large swings in its earnings. And indeed, consensus estimates of its incoming earnings are showing enormous variance as highlighted by the yellow box below.

I see good reasons for such a large variance. The business is facing so many large uncertainties in the near term. In my mind, the most two important uncertainties include A) the degree and duration of the weakened consumer demand, and B) the extent and duration of the inventory adjustments made by its key clients. I have touched on both issues in my earlier articles and won’t further belabor these points.

In this article, I will analyze the use of options targeting its next earnings date to either benefit from or hedge such variance. For investors new to options, there are both similarities and differences compared to directly trading shares. Similar to trading shares, you could use options to express either a bullish or bearish view too by going long or short. But a key difference is that options let you express your view on an additional parameter: volatility. While trading stocks only let you express your view on stock prices. And volatility is more of the focus of this article as to be detailed in the next section.

Since I am bullish on the stock, the remainder of this article will detail the writing of a put option with expiry on April 21, 2023, 106 days from today. You will see that this option provides a setup that can either return ~10% return in 106 days or let you buy the stock at an entry price of ~$50.

Source: www.marketbeat.com

MU April put option

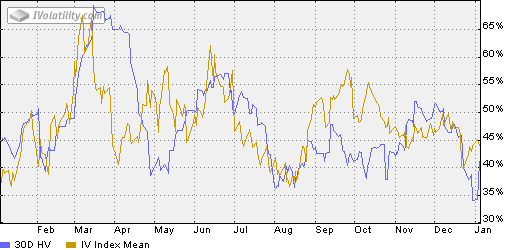

As aforementioned, a key difference between the use of options vs. directly trading shares is that options let you express your view on volatility in addition to stock prices. And the following plot shows MU’s historical volatility (the blue line) and also its IV (implied volatility, the orange line). To put things under a broader perspective, During the past 52 weeks, MU’s historical volatility peaked at 69.34% (back in Mar 2021) and bottomed at 34.01% (back in Dec 2021). And its IV peaked at 67.56% (back in Mar 2021) and bottomed at 36.5% (back in August 2021).

Source: IVolatility.com

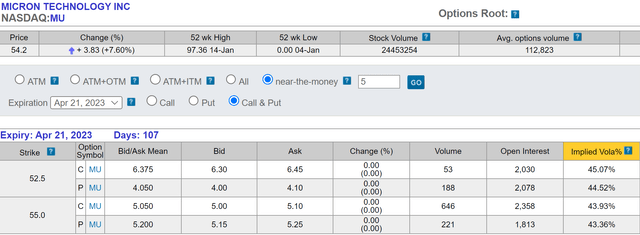

And from the next chart, you can see that a put option with a $55 strike price and expiration date of April 21, 2023 (shortly after its next scheduled ER), the option premium is around $5.2, translating into about 10% (9.45% to be exact) if the option expires. Considering the option’s duration is 106 days, this further translates into an annualized return of 32.5% – not a bad deal for a short-term swing trade. Note that in this article, I quote all option parameters on a per-share basis even though options are traded in batches of 100 shares.

On the other hand, if the option is exercised, then you would (have to) buy the shares at ~$50 (or $49.8 to be exact, which equals $55 – $5.2). And next, you will see why a ~$50 entry price is very appealing for long-term holding the way I see things.

Source: oic.ivolatility.com

MU: long-term return potential with $50 entry

As detailed in my blog article,

For long-term investors, the return on investment (“ROI”) only comes from two sources: the owner’s earning yield when we made the investment (“OEY”) and the long-term growth rate (“LTR”) of the owners earnings. That is:

Longer-Term ROI = OEY + LTR

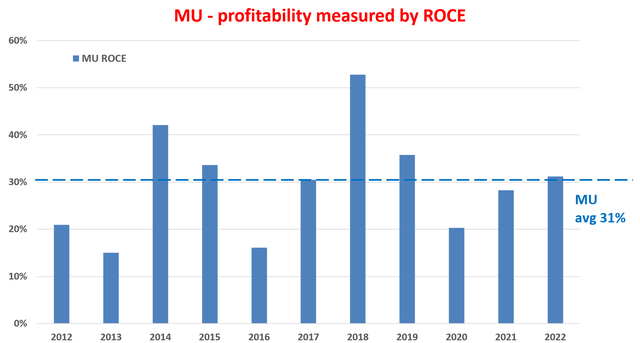

Next, I will analyze both the LTR and OEY terms for MU. Readers familiar with my writings know that the LTR term is simply the product of return on capital employed (“ROCE”) and the reinvestment rate (“RR”). MU’s ROCE has been on average 31% as shown in the chart below. For its RR, my estimate is that MU has been maintaining a RR of 10% to 15% in recent years.

Hence, as a base case, if we assume a 31% ROCE and 10% RR, MU could maintain long-term growth of around 3% (31% ROCE * 10% RR = 3% growth rate). However, there are good reasons to expect an expansion of both its ROCE and also RR in the years to come, as to be elaborated later. For example, admittedly, management has announced plans to reduce CAPEX spending in the immediate future. However, I expect its RR to be in the upper end of this range in the next few years with the CHIPS act’s support and also the secular growth for memory chips.

Source: author and Seeking Alpha.

MU’s OEY at $50 entry

Now, onto its OEY at an entry price of $50. The difficulties of estimating the OEY for MU are twofold. Firstly, as a cyclical stock, its earnings are negative in some of the years as you can see in the next chart below. And secondly, the OEY requires the use of the owners’ earnings (i.e., the true economic earnings of the business), not the accounting EPS.

Here, to solve the first problem, I will use the cyclical adjusted PE (i.e., CAPE) over the past five years for the analysis of its OEY. A period of 5 years roughly spans one business cycle. And for the second problem, the method for analyzing the owners’ earnings has been detailed in my earlier article.

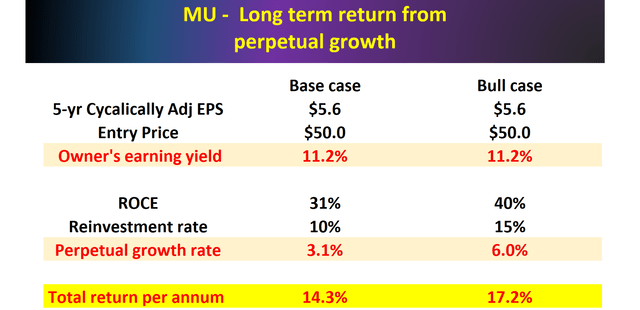

With the above approach, its 5-year cyclically adjusted EPS is about $5.6, which translates into an OEY of 11.2% at a $50 entry price (if the option is assigned) as shown in the next chart.

Source: Seeking Alpha.

With the OEY estimated, the chart below also summarizes my return projections combining the LTR and OEY. A few key observations:

- In the base case as aforementioned, the total annual return potential from a $50 entry price would be 14.3%, out of which 11.2% is from the OEY and 3.1% is from the OEY.

- However, I see the above base case to be too pessimistic and conservative. I see good reasons to expect an expansion of both its ROCE and also RR in the years to come. For example, the CHIPS act’s support could effectively boost its RR to 15% as argued in my earlier article focusing on the impacts of the CHIPS act. Also, I see the issue with its non-memory semiconductor shortages that have hurt Dynamic Random Access Memory (“DRAM”) and NAND inventory balances to be only temporary. In the longer term, I see the demand from automotive producers enjoying secular growth. And finally, I see it likely to benefit from volume ramps of next-gen infotainment and advanced driver assist systems too. Combining these catalysts, I think a bull case with an expanded 40% ROCE and 15% RR is very plausible, leading to 6% growth rates and a total return potential of 17.2%.

Source: author and Seeking Alpha.

Risks and final thoughts

To recap, MU is scheduled to report its next earnings on March 27, 2023. The stock is facing a few large uncertainties in the immediate term (with demand weakening and inventory renormalization being the top two in my mind). As such, consensus estimates of its incoming earnings are showing enormous variance. And the purpose of this article is to analyze the use of options targeting its next earnings date to either benefit from or hedge such variance.

Since I am bullish on the stock myself, this article focused on the writing of a put option. This option play could provide a return of ~10% return in 106 days or let you buy the stock at an entry price of ~$50. However, as aforementioned, you could use other variations of the option play to express a bearish view too.

A final word about the risks of using options and especially the writing of put options:

At least in theory, there is always a risk that the stock price could go to zero, but you still have to buy the shares at $55 if you write puts on MU.

Also, the option strategies I mentioned in this article are all based on the assumption that you write COVERED options. If you write uncovered (aka naked) options, then your risk/return calculus would change depending on the specific terms of trades (like the margin rates et al).

Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.