Summary:

- Micron’s heavy investments in U.S. and global semiconductor facilities drive short-term losses but promise long-term capacity and innovation, positioning it strongly for future AI and tech demands.

- Current high valuation and speculative gains make Micron unattractive for value investors, with significant short-to-medium-term downside risk despite projected revenue growth.

- Competitive pressures from Samsung and SK Hynix, along with the cyclical nature of the semiconductor market, pose risks; the long-term AI market potential is better captured in undervalued small-cap stocks.

natasaadzic

Before I begin, let me start by saying that I consider the long-term growth trajectory of Micron (NASDAQ:MU) stock to remain intact. However, my analysis shows me that this is clearly not a good time to initiate a position based on valuation factors. Investors are opening themselves up to a high potential of near-term volatility if investing at present levels, in my opinion. Micron is making huge investments in the United States and abroad, but the market has already priced in the future gains expected in the coming upcycle. In addition, I think that the market has overvalued the stock, and one of the primary contributing reasons is speculative enthusiasm surrounding AI.

Operational Analysis

Micron, one of the world’s largest semiconductor designers and manufacturers, has been investing $100B in the largest semiconductor fabrication facility in the history of the United States in New York State. In addition, Micron confirmed an investment of up to $825M in a new chip assembly and test facility in India. Management is also building a new DRAM plant in Hiroshima, and Micron’s Ventures Fund II, the firm’s venture capital arm, is investing in deep-tech startups. Its manufacturing expansion has been supported by CHIPS Act funding.

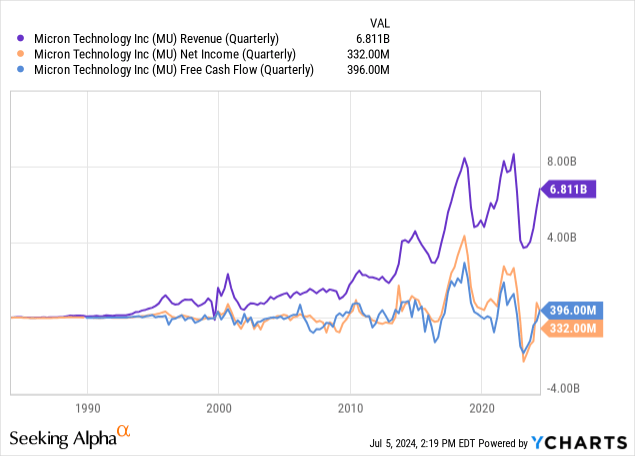

These developments have impacted the company’s financials in the near term, particularly in free cash flow but also in higher operating costs, increasing the net loss more than usual in the present down cycle. However, the long-term benefits include increased production capacity to meet scaling global demand. Its investments in EUV and DRAM production will also position it at the forefront of semiconductor innovation. However, the current valuation as a result of these future anticipated gains reminds me of Nvidia (NVDA) stock. I believe that the price for Nvidia has become too high, and I am not a momentum investor, I am a GARP investor primarily, so I think that Micron investors are lacking value if buying at present levels.

That being said, Micron has a lot of long-term potential, which should not be underestimated and which I think makes it worthwhile for earlier investors to consider holding despite any high short-term volatility that may occur. The demand for high-performance memory and storage solutions is increasing as AI and ML applications become more prevalent. Its High Bandwidth Memory (HBM) and GDDR6X are crucial for AI workloads and data centers. In addition, the automotive industry is increasingly incorporating advanced electronics and memory solutions for autonomous driving, infotainment systems, and other smart features. In addition, the IoT market is expanding, and it is undeniable that the global shift toward intelligent machines and digital ecosystems is a long-term driver for Micron, as it has positioned itself with one of the biggest semiconductor design and manufacturing moats in the business.

Financial & Valuation Analysis

The following chart shows the cyclicity inherent in Micron, which has been further exacerbated recently by the investments I have outlined above. As the stock is so popular, the market does not always price Micron according to the current cycle. Instead, it prices Micron according to the next year, toward the next cycle.

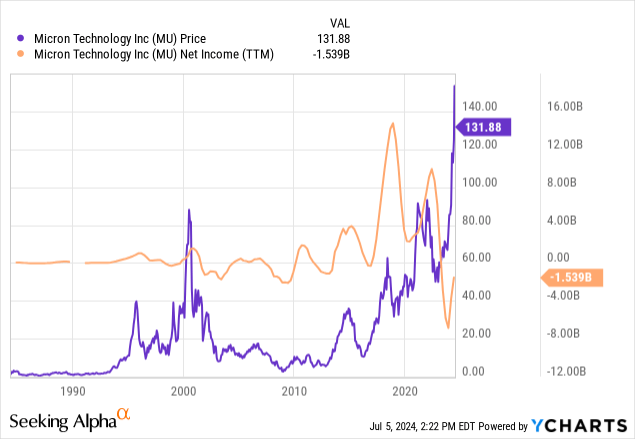

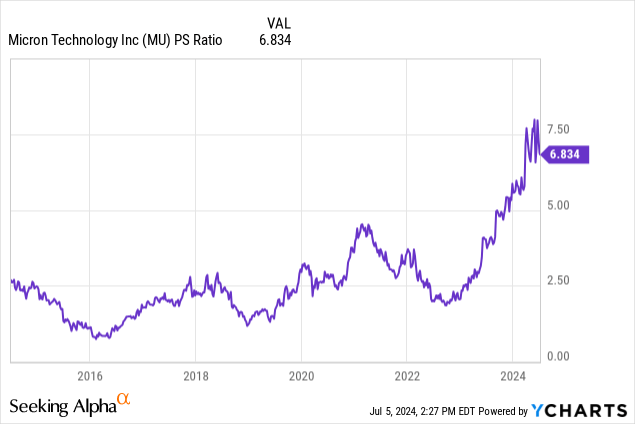

In this instance, we can see quite clearly that the stock price has risen with very high fervor in advance. Primarily, this can be attributed to revenue growth of 52% forecasted by analysts for 2025. However, this comes down steeply to 15% for 2026. As a result of the fact that this growth will not be forever, investors have largely missed the bulk of the price action related to next year’s earnings, in my opinion. I could be wrong, but any higher gains in price are largely speculative, in my opinion, and I would rather miss out on speculative gains as well as speculative losses. Again, I stress the valuation, which has rapidly expanded:

The problem that I have here is that I am a long-term investor primarily. The reason I adopt this strategy is that it allows me to find great undervalued companies and be more passive in my investments. Micron is a stock that would take massive attention to real-time detail to ensure not losing if investing at present levels because put simply, the valuation currently does not support the contraction in growth rates, which is likely to arrive in 2026 and onward. I believe there are too many short-term-oriented momentum investors in this stock at the moment to make it a good long-term value-oriented growth investment.

Because of the cyclicity of the investment, I think a 12.5% revenue CAGR over the next 10 years is conservative and reasonable to predict. It is still optimistic, which allows for the trends in AI underway and notices the large investments Micron has made recently, but it also reflects the cyclicity of the business. In addition, if the P/S ratio contracts toward a more reasonable P/S ratio of 5 by 2034, the stock will be worth $315, implying a 9% price CAGR from the present stock price of $131.50, as the present revenue per share is $19.39. I have to stress that even in this optimistic and favorable long-term outlook, the stock underperforms my S&P 500 market estimate of a 10% 10Y price CAGR; this is based primarily on present valuation factors because I expect MU’s valuation multiples to contract significantly over the time frame.

Risk Analysis

There are a myriad of competitors to Micron, including Samsung and SK Hynix. These South Korean companies compete in DRAM and NAND—both firms have secured key contracts with Nvidia. SK Hynix and Samsung are planning to unveil advanced HBM3E and HBM4 products, which could outpace Micron’s offerings and potentially reduce its market share.

Furthermore, I think investors should not underestimate the high capital intensity of this business. While I understand that long-term investors are willing to weather the volatility in free cash flow, it does present a further need for caution on investing at a good long-term valuation.

In addition, I am further outlining that the long-term macro growth related to AI, machine learning, deep learning and automation is significant. In my opinion, arguably it will develop the next economic revolution, akin to the industrial revolution. However, growth expectations should be moderated because results are unlikely to appear overnight. That being said, many AI stocks that are large-caps are unattractive to invest in right now. Instead, I am finding a multitude of small-cap and micro-cap companies that are exposed to niche portions of the AI markets, which offer much better valuations and, in some cases, deep value with high growth potential. I urge investors to consider whether investing in mainstream AI stocks is the most proficient way to capitalize on the growing trends in AI and automation. There are exceptions, but in the case of MU stock, I think that the valuation is absolutely a red flag that should prevent long-term investors from allocating if they are seeking 5-10Y alpha.

Conclusion

In my opinion, MU stock is overvalued. I think investing at present levels opens up the possibility of short-to-medium-term downside, and it certainly does not make a case for a long-term investment thesis. While the long-term growth trajectory of MU stock remains intact due to high levels of development infrastructure currently committed to by management, solidifying its moat in core areas of memory semiconductor design and manufacturing, there are established and growing competitors and changes to demand can induce periods of high losses, inducing periods of high capex to remain competitive in design and infrastructure. The cyclicity opens up risks for investors in the near term, as when 2026 nears, the lower valuation multiples are likely to contract the stock’s total 5-10Y price CAGR significantly as a result.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.