Summary:

- Micron investors suffered a sharp pullback recently, as the company expects a near-term revenue impact due to the China ban.

- Despite that, MU remains well above its December 2022 lows, as dip buyers returned to defend the stock. MU has also regained its long-term uptrend bias.

- The memory supply chain is confident that the market could bottom out in the second half of 2023, lending more credence to early dip buying in MU.

- MU has also not benefited significantly from the generative AI hype, which could help bolster its earnings recovery.

- I assessed that investors should not wait for the coast to be clear before returning to MU for a potentially sharp recovery through FY25.

hapabapa

Memory leader Micron Technology, Inc. (NASDAQ:MU) is scheduled to report its third-quarter earnings scorecard for FY23 on June 28, as dip buyers returned to help lift MU’s recovery from its March lows.

I assessed that MU had staged a potentially crucial breakout in May, even though some dip buyers likely took profit, as they anticipate a further fallout from China’s decision to ban Micron’s chips.

Keen investors should recall that China completed its cybersecurity review on Micron recently and “concluded that Micron’s products posed a cybersecurity risk.” As such, it ordered that Micron products cannot be used in “critical information infrastructure.”

CFO Mark Murphy shed more light on the company’s assessment at a conference in late May. Management anticipates the impact to affect total revenue by a “high single-digit percentage.” The effect is expected to be concentrated in “networking and server products.”

As such, Micron expects a near-term revenue impact but remains confident that “lost volume can potentially be recovered elsewhere.” I assessed that the market seems to have bought into Micron’s optimism, even if it could not have come at a worse time, given the memory market downturn.

However, the saga also demonstrated my belief that Micron’s products are “more replaceable” than an A800 data center GPU from Nvidia (NVDA). DIGITIMES reported that the South Korean government “won’t encourage memory suppliers to gain market share in China amid the ban.” However, I assessed it’s too early to make a call on that, given the exposure Micron’s arch-rivals, Samsung (OTCPK:SSNLF) and SK Hynix, have in China. China could use that leverage to its advantage and “compel” them to replace Micron’s lost volume or face “potential consequences.”

As such, I concur with Morningstar’s assessment that Micron should be considered a “no-moat” company, and its valuation should be analyzed accordingly. Investors should classify the memory leaders as a separate subsegment within the semiconductor industry and not use the broad industry median as a valuation tool to discern MU’s valuation.

Notwithstanding, I believe the recent pullback is constructive and proffers investors who missed MU’s March lows another solid opportunity to add more exposure. Makes sense?

Murphy stressed that he saw signs of bottoming in the DRAM market, corroborating the conviction dip buyers have in MU, as it bottomed out in December 2022. However, he also cautioned that, given the “severe downturn,” investors shouldn’t expect a quick recovery. Also, Micron highlighted that the company would take reference from its days inventory outstanding, as it “aims to exit the year with inventories over 150 days,” down from 200 days currently.

Moreover, with market leader Samsung also participating in cutting capacity, I assessed it’s reasonable for MU dip buyers to expect an improvement in market dynamics moving ahead. Trendforce also highlighted that “buyer purchasing intentions will improve in the second quarter due to Samsung’s production reduction.” However, it also cautioned that inventory adjustments are not expected to be over. In addition, the memory supply chain is confident that “DRAM contract prices are likely to bottom out in the third quarter of 2023 while the NAND flash segment will reach the lowest point in the fourth quarter.” Therefore, the underlying market dynamics are expected to continue improving, helping Micron to exit the downturn with more confidence.

As such, I believe investors will need to assess whether they believe MU could stage a turnaround in its growth and profitability trajectory moving ahead. Micron is still expected to report negative forward earnings, with its forward adjusted P/E at -20.5x. However, analysts’ estimates suggest that Micron is expected to recover its profitability rapidly through FY25, with MU last traded at an FY25 adjusted P/E of 12.7x. As such, Micron could potentially stage an explosive earnings recovery if the memory market could bottom out this year.

Moreover, the company remains confident of the secular drivers in data center, automotive and industrial. In addition, Micron also expects the generative AI momentum to potentially lift its long-term projections more than it previously anticipated. As such, I believe long-term investors in MU are afforded another opportunity to brave the recent pessimism and add exposure.

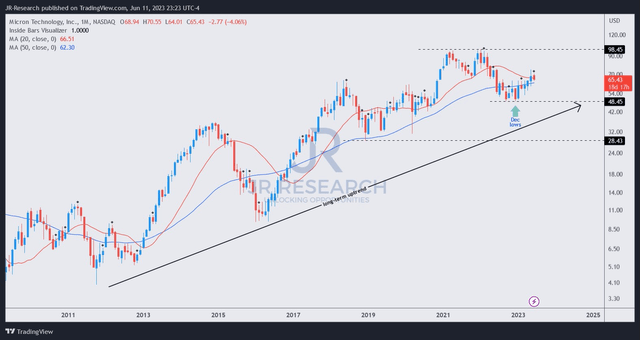

MU price chart (monthly) (TradingView)

Also, I gleaned that MU has recovered its long-term bullish flow, as seen by its price action in its long-term chart.

I believe it’s clear that MU remains in a long-term uptrend, with dip buyers returning to defend its bottom in December 2022.

However, MU has not benefited significantly from the generative AI rage that has lifted its leading semi-peers. Hence, dip buyers who don’t favor chasing upward momentum surges should consider buying the recent pullback in MU and not wait for the coast to be clear before returning.

With constructive market dynamics and more favorable price action, I upgrade my rating on MU.

Rating: Strong Buy (Revised from Buy).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!