Summary:

- We remain bullish on Micron Technology, Inc.

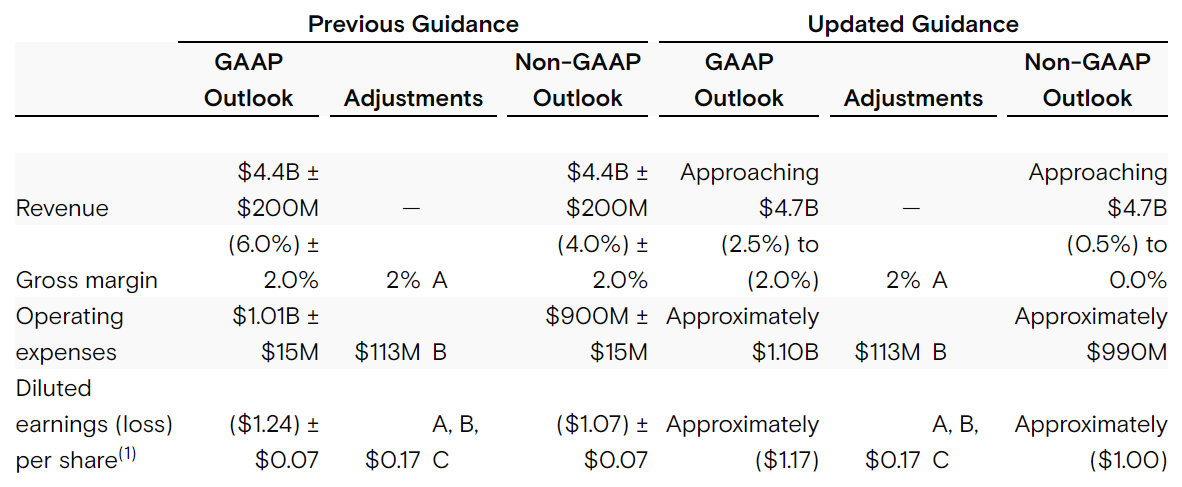

- Management’s updated guidance for Q1 2024 confirms our expectation of better memory demand dynamics and improved pricing in 2024.

- Management guides revenue higher from a previously projected $4.4B ± $200M to $4.7B and expects non-GAAP gross margin to approach breakeven next quarter.

- We believe the memory inventory correction is over.

- We see an increasingly favorable risk-reward profile for Micron next year and recommend investors buy the pullback.

vzphotos

We remain buy-rated on Micron Technology, Inc. (NASDAQ:MU). Management raised guidance for Q1 2024 earlier today from previously guided $4.4B ± $200M to $4.7B and now expects Non-GAAP gross margin to approach breakeven next quarter versus previous guidance of gross margins at minus 4%, ± 200 basis points. We think the better-than-expected guidance for next quarter confirms our expectation of a memory market rebound in 2024 due to improved demand and pricing dynamics. The following outlines MU’s updated guidance for next quarter.

MU 1Q24 Guidance Update

Management noted “improved supply and demand balance and improved pricing” as the drivers behind the higher guidance and, on the UBS Technology conference call, indicated that after forecasts of improved inventories and pricing bottoming out in Q4, management is now seeing “pricing starting to increase.” Tom’s Hardware research confirms more of the same:

“Memory makers are witnessing increasing prices as production reductions lead to price rises in both DRAM and NAND segments.”

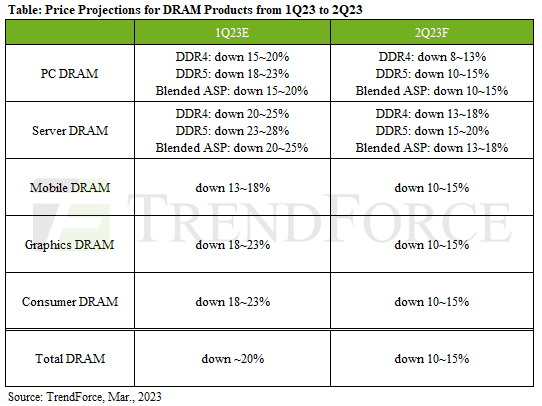

The improved pricing is an industry-wide shift after DRAM prices crashed earlier this year, dropping 20% QoQ in Q1 2023 and further in Q2, with DDR5 prices declining more than DDR4 prices. The following graph puts into perspective how bad the price crash was.

TrendForce

We think the cut in production from DRAM industry leaders, including MU, SK Hynix, and Samsung (OTCPK:SSNLF), has aided in creating a more balanced demand-supply dynamic in the back end of the year. Now, DDR4 and DDR5 prices are expected to improve subtly, and the consumer DRAM market is expected to see prices increase, with TrendForce forecasting a price increase of as much as 8% this quarter. Management left a lot unsaid aside from the raised guidance, but we believe this is a classic buy the rumor, sell the news type action with the stock.

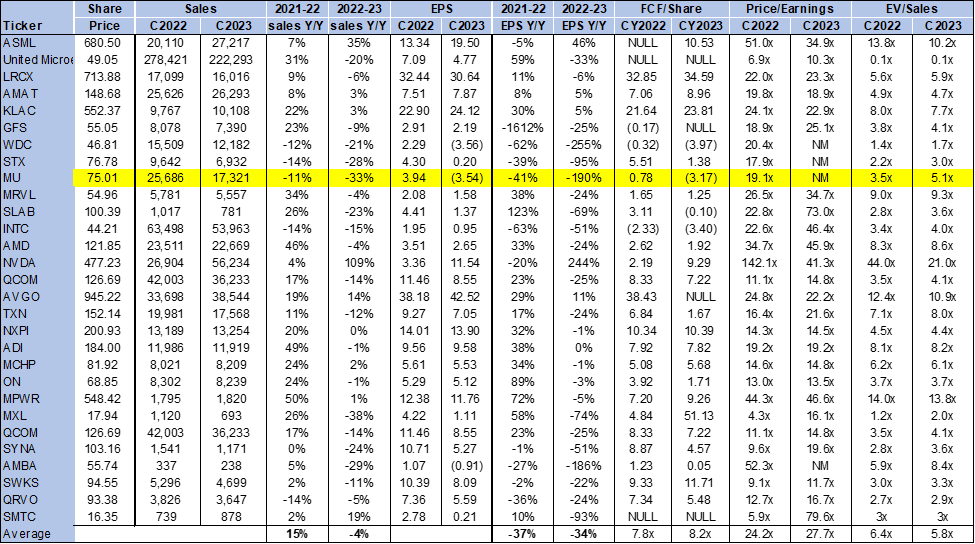

Valuation

Micron stock is trading below the peer group average; given the upside potential with the memory rebound next year, we think the stock is undervalued. The stock is trading at 5.1 EV/C2023 sales versus the peer group average of 5.8x. We see attractive entry points at current levels and recommend investors explore entry points into the stock.

The following chart outlines MU’s valuation against the peer group.

TSP

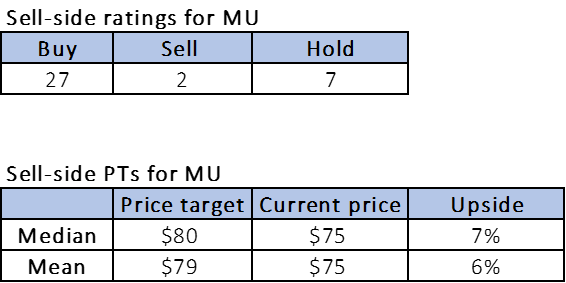

Word on Wall Street

Wall Street shares our bullish sentiment on the stock. Of the 36 analysts covering the stock, 27 are buy-rated, seven are hold-rated, and the remaining are sell-rated. The stock is currently priced at $75 per share. The median sell-side price target is $80, while the mean is $79, with a potential upside of 6-7%. The following outlines sell-side ratings and price targets for MU.

TSP

What to do with the stock

We continue to be bullish on Micron Technology, Inc. stock. We see more material upside for the stock in 2024 due to a recovery in demand and pricing for DRAM and NAND, with more emphasis on the former for MU’s outperformance in 2024. We continue to recommend investors explore entry points into the stock on the pullback to ride the upward trend in 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.