Summary:

- Recently, the Street loved all things AI… now investors are out on AI.

- And for a long time, Micron was an ordinary cyclical memory-chip company.

- But as they say, past performance doesn’t assure future outcomes… so don’t over-rely on what’s been happened lately.

- Micron’s new high bandwidth memory chips leapfrogged over rivals… and its in hot demand because of AI.

- Micron fares better than many may realize when we examine the company as Graham and Dodd counsel, over enough years to see full business cycles.

Wipada Wipawin/iStock via Getty Images

I hate the word “foreshadow.”

Teachers in high school and college literature classes said it often. They were trying, I suppose, to tag things authors said early on as secret spoilers.

That sounded pretty pompous to me.

But watching Wall Street is leading me to reconsider. That’s especially so with regard to all things AI.

I think George Orwell foreshadowed today’s AI disdain in his dystopian classic “1984.”

Oceania, led by Big Brother had been warring with Eurasia. It had also been allied with Eastasia.

Then, at a rally…

(With) no admission that any change had taken place…. it became known, with extreme suddenness and everywhere at once, that Eastasia and not Eurasia was the enemy….

[T]he speaker had switched from one line to the other actually in midsentence, not only without a pause, but without even breaking the syntax….

Oceania was at war with Eastasia: Oceania had always been at war with Eastasia. A large part of the political literature of five years was now completely obsolete. Reports and records of all kinds, newspapers, books, pamphlets, films, sound-tracks, photographs–all had to be rectified at lightning speed.

That’s from Chapter 9, pages 161-63 of the free Project Guttenberg pdf version of the text.

Doesn’t the Eastaisa ally-to-enemy switch “foreshadow” Wall Street’s sudden turn with regard to AI. It feels that way to me.

But sentiment can turn back the other way just as easily.

This is why I’m not apoplectic over AI stocks right now.

It’s also why I’m going to end this article by assigning a “Buy” rating for shares of Micron Technology, Inc. (Nasdaq: MU). It makes high end memory chips vital for AI.

Mr. Market (our answer to 1984’s Big Brother) is not on board.

AI-related stocks have lately been falling. MU is down 30% since its June 18, 2024 peak.. The SPDR S&P 500 ETF is down only 2% over this time frame. And the Invesco QQQ Trust is down just 5%.

1984’s protagonist Winston opposed the Big Brother largely on his own. But here, with MU, I’ve got some great company.

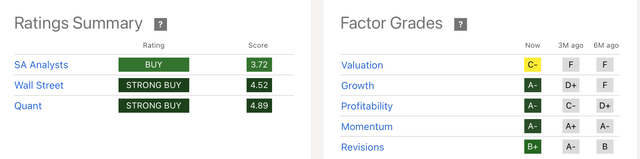

Here’s MU’s standing among Seeking Alpha constituencies.

Seeking Alpha

I’m especially impressed with the “C-“ Valuation Grade. Even today, after AI stocks have been coming down from peak pricing, many still rate in the “D” to “F” range. Indeed, MU rated “F” just three months ago.

I don’t know Seeking Alpha’s proprietary secret quart sauce for determining the grades.

But that’s OK. Using a different approach, I’ll get to a conclusion that’s compatible with the Seeking Alpha result.

MU’s Strong AI-Based Prospects

MU’s main products are DRAM and NAND flash memory chips.

DRAM memory is “volatile.” When you turn off the device, the chip loses all stored information.

NAND is “non-volatile.” Here, even when you turn off the device, the chip retains its

Computers need both. And AI, given its data and processing intensity, needs a heck of a lot more of both than ever before.

MU is one of just a handful of companies that dominate these products

Historically, MU has been the smallest within these oligopolistic groups. (Seeking Alpha Analyst Star Investments published an excellent analysis of these markets on April 19, 2024.)

But MU’s latest generation of HBM (“high bandwidth memory”) looks to be leapfrogging its DRAM competition. On the June 26, 2024 earnings call, CEO Sanja Mehrotra told analysts:

Customers continue to provide feedback that our HBM3E solution has 30% lower power consumption compared to competitors’ solutions…. We expect to achieve HBM market share commensurate with our overall DRAM market share sometime in calendar 2025.

Our HBM is sold out for calendar 2024 and 2025, with pricing already contracted for the overwhelming majority of our 2025 supply.

Lower power consumption is a huge thing in the increasingly power-gluttonous AI area.

And it’s not just about market share. MU’s entire market is growing. According to Mehrotra:

Enabling AGI (artificial general intelligence) will require training ever-increasing model sizes with trillions of parameters and sophisticated servers for inferencing. AI will also permeate to the edge via AI PCs and AI smartphones, as well as smart automobiles and intelligent industrial systems. These trends will drive significant growth in the demand for DRAM and NAND, and we believe that Micron will be one of the biggest beneficiaries in the semiconductor industry of the multi-year growth opportunity driven by AI.

Most data center customer inventories have normalized, and demand from customers continues to strengthen. PC and smartphone customers have built additional inventories due to the rising price trajectory, the anticipated growth in AI PCs and AI smartphones, as well as the expectation of tight supply as an increasing portion of DRAM and NAND output is dedicated to meeting growing data center demand. Due to expectations for continued leading-edge node tightness, we are seeing increased interest from many customers across market segments to secure 2025 long-term agreements ahead of their typical schedule.

So MU’s enterprise and data center businesses are booming right now.

But even the recently lackluster PC business is likely to get a jolt from AI. Describing a recent tradeshow, Mehrotra said…

During Computex in Taiwan, we saw several announcements of next-generation chipsets and AI PCs. These devices feature high performance neural processing unit chipsets, and we expect these devices will have 40% to 80% more DRAM content than today’s average PC. Microsoft’s minimum system requirement for Copilot+ PCs, such as the Surface Pro, is 16 gigabyte of DRAM. We expect next-gen AI PCs to make up a meaningful portion of total PC units in calendar 2025, growing each year until most PCs ultimately support next-gen AI PC specs.

He also observed that “Smartphones have tremendous potential for personalized AI capabilities that offer greater security and responsiveness when executed on device.”

This echoes investment themes I recently offered for Apple (AAPL) and Dell (DELL).

So, in terms of business, MU is very much part of the AI world. Even so, it, like many semiconductor firms, has been brutally cyclical…

Semiconductor Cyclicality

Semiconductors arguably trace back to 1874. That’s the debut of AC-DC conversion. We can date the advent of the transistor as being somewhere, depending on one’s definition, between 1946 and 1957.

The semiconductor market as we now think of it, started in the late 1970s. That’s when VLSI (Very Large Scale Integration) came about. This means embedding many (hundreds of thousands) of transistors onto a silicon chip.

This ushered in the digital era we know today. Chips (ICs – Integrated Circuits) became more progressively more sophisticated. So, too, did the devices into which they wen t.

Todays’ emergence of AI is a sort-of continuation of this well-established multi-decade trend.

So far, it seems as if I’m talking about growth, not cyclicality. That’s certainly the way it looked early in my career (the 1980s).

Digitization was spreading from nothing to something. That was growth… the best kind of growth!

But surface appearances can and do deceive.

Developing ever more advanced chips is expensive. Moreover, it’s incredibly hard to predict need.

Earnings estimates aren’t the only place where we miss forecasts. It’s much harder to pinpoint future supply and demand for things (like chips) that were just invented. It’s exponentially harder for newer chips still being invented.

And the stakes are much higher.

If an earnings estimate misses the mark, the stock will adjust. That can bold and quick if the miss is large. But such moves are often short lived.

Semiconductor production misses are harsher.

Chip development often means new kinds of equipment and processes. Producers need to spend very heavily to address future demand.

Those that don’t will fall fall behind rivals who get it right. So, the temptation to over invest, especially when demand is strong, is irresistible.

Device makers are also under pressure to make sure they have enough of what they need… and when they need it. So, the temptation to buy too much is also compelling.

As a result, inventories often get out of whack.

Producers and/or users periodically wind up with too much of what they need. That leads to sharp cutbacks in new purchases. (They need to work down excess stockpiles.)

These imbalances which will probably persist. Humans predict. And humans can’t see the future. (This includes AI. Even when we think machines are thinking and predicting, they really aren’t. Humans are behind all of it.)

For manufacturers — including MU – these inventory excesses and retrenchments are brutal. They have a lot of fixed costs. So, when sales falter, producers can’t cut costs 1-for-1. So net results (profits) fall further than sales.

It works the other way on the upside. When the world rushes to rebuild depleted inventories, sales rise. But the largely fixed costs don’t grow 1-for-1. In these phases, profit gains can appear stupendous.

Few forecasters have the foresight – or courage – to build models that predict the kinds of dramatic moves we see.

That’s especially so in the Excel-era. There’s a natural tendency to smooth forecasted trends.

When I started at Value Line just ahead of the circa-1981 recession, the research director was constantly yelling at us to chop sales forecasts that were way too high. Young analysts couldn’t envision how sharply they would eventually drop.

Conversely, I and my peers drastically underestimated the recovery. On one stock, a manager ordered me to slash my 3- to 5-year projections. Ultimately, though, the company blew past my original numbers in less than 3- to 5-months.

So, cyclical moves — up and down — often turn out surprisingly huge!

MU’s Growth and Cyclicality

MU is at the bottom of a semiconductor cycle.

We need not discuss the numbers. Just imagine as many synonyms for “horrible” as you can.

The good news is that MU is transitioning to the next up cycle. That means we can also start imagining synonyms for “fantastic.”

In my July 13, 2024 Amazon.com (AMZN) writeup, I quoted a portion of the Graham and Dodd Securities Analysis classic. Those famous gurus stressed the importance of analyzing results over “a number of years … to absorb and equalize the distorting influences of the business cycle.”

I’m going to do that now for MU. I’ll use an electronic version of the “basic charts” I was taught to use as a rookie Value Line analyst.

Back around 1979-80, when I started, we actually used graph paper and rulers (and lots of erasers). Today, fortunately, Seeking Alpha’s charting capabilities make life much easier.

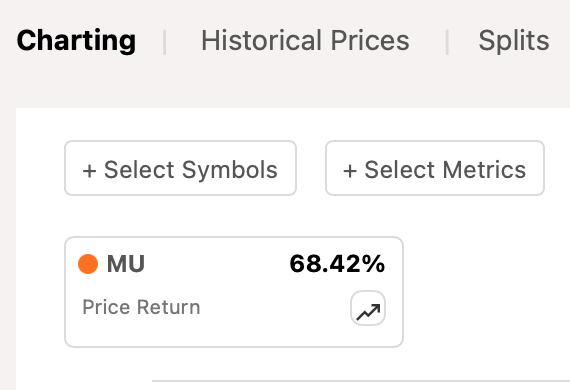

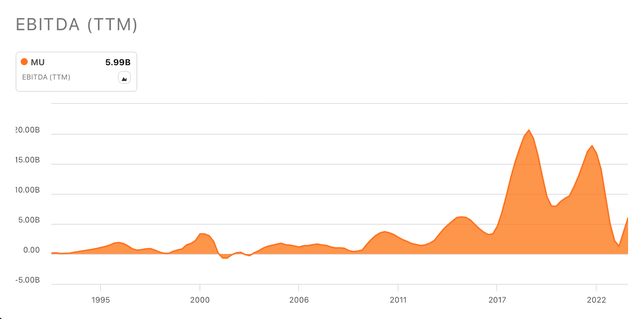

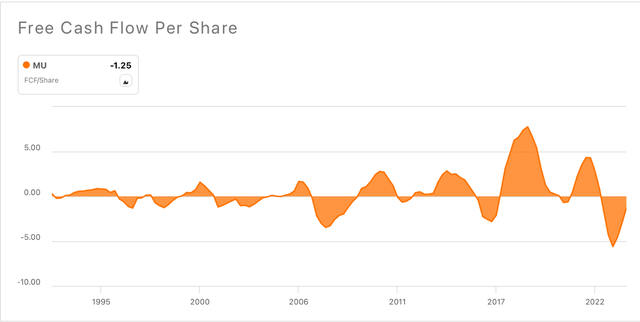

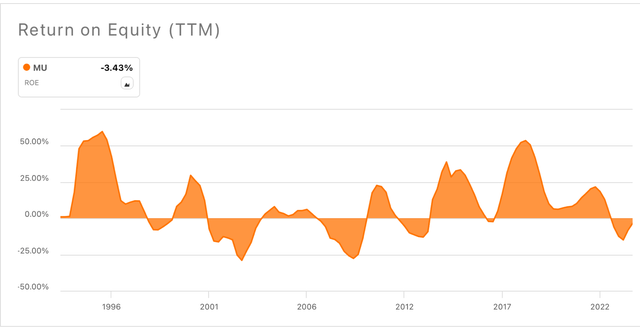

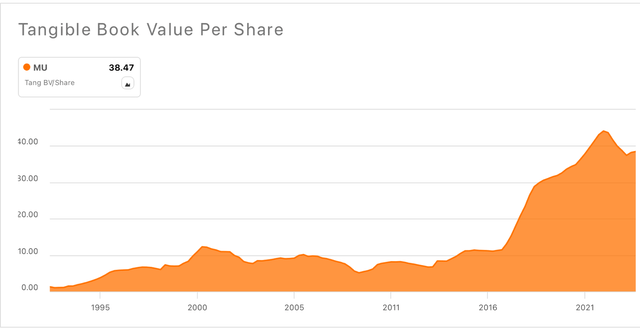

The upcoming charts were created here, using MU’s Seeking Alpha Charting tools.

Seeking Alpha

I used just one symbol, MU. And then I dug into the wealth of fundamentals (not just stock prices) you can choose under “+ Select Metrics.” (If you haven’t yet graphed fundamental metrics try it!)

In all cases, I used the “Max” time period. For MU, this stretched back to 1990.

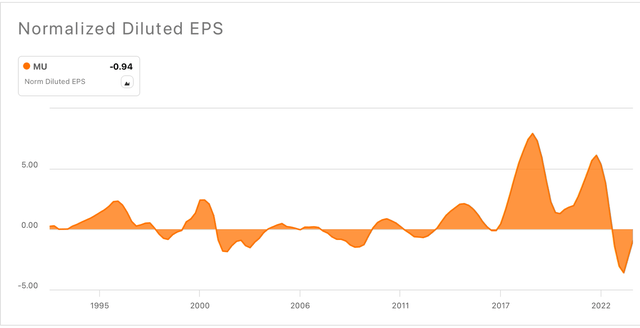

Here’s the first thing at which investors probably look, the EPS trend:

Seeking Alpha

That’s a lot of volatility over time.

Several other widely-consulted metrics confirm this.

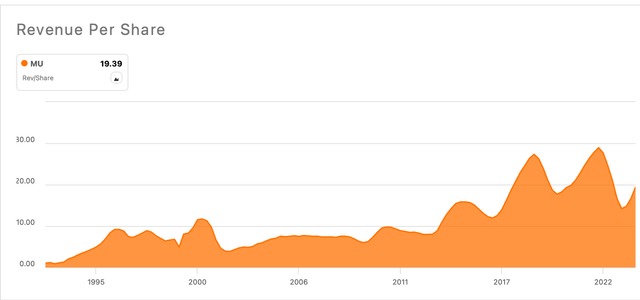

Seeking Alpha

Seeking Alpha

Seeking Alpha

Seeking Alpha

The volatility is evident.

These fluctuations don’t necessarily match the general economy. So, MU is not conventionally cyclical.

Different sectors have their own business cycles. When investors describe MU as being cyclical, they’re usually referring to the semiconductor cycle.

There’s something else you should be seeing besides cycles. The magnitude of changes has been increasing since the late 2010s.

And if you were to impose some sort of straight trend-line on the above charts, they would probably be sloping upward.

Are the uptrends enough to call MU a growth company too? Let’s see.

Book value isn’t as fashionable as it once was. It doesn’t count what may, for many companies, may be their best – intangible – assets.

But we just have to interpret book value with a dose of common sense. It’s an approximate proxy for a company’s asset value. It’s not a literal price tag.

I hope you agree if you’ve ever considered Return on Equity (ROE). That’s one of the most revered measures of profitability. It uses book value. Actually, it’s Net Income divided by Book Value. (The latter is just another name for common equity).

Here it is for MU.

Seeking Alpha

Notice how it’s a lot less volatile than what we saw so far.

That’s because it isn’t a year-by-year picture. Instead, it shows an accumulation over time.

Companies constantly add to their capital bases. So, for example, there’s a lot of growth when a company earning a 12% return on $100 million becomes a bigger company that earns a 12% return on $1 billion in equity.

In fact, even 4% on $1 billion of capital means there was a heck of a lot of growth.

ROE is great. I use it all the time. But it doesn’t exist in isolation. Growing the capital base counts too.

Capital grows through “retained earnings.” That’s the amount of profit the company keeps after it pays dividends. MU’s dividend is very modest. It retains most of its earnings.

I showed capital using tangible book value per share. “Tangible” eliminates the portion of capital that’s based on accounting theory. And by-making it per-share, I removed changes that result from changes in shares outstanding.

So, all those exceptionally large up-swings we saw after the mid 2010s matter. The ups were usually bigger than the downs. They all combined over time to have made MU the sustainably bigger.

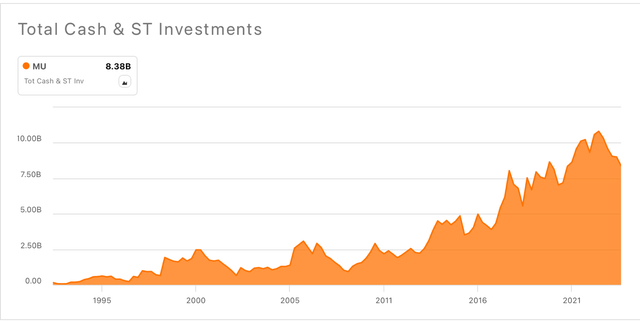

This is supported by a metric that’s especially dear to many investors, cash and cash equivalents. (The latter are short-term investments like money market funds. They can be converted to cash immediately.)

Seeking Alpha

So yes, MU has recently been showing itself to be a legitimate growth company.

This wasn’t always so. Early on, it looked just plain cyclical. The growth phase began as digitization really started to accelerate.

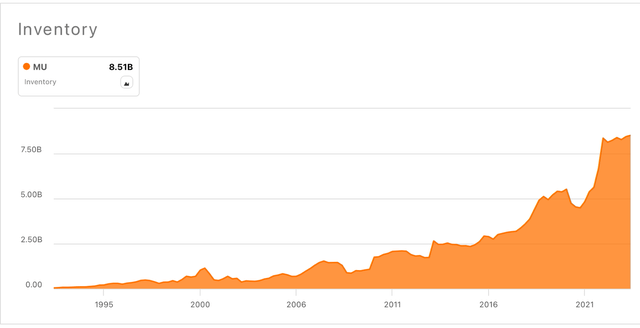

Here’s something interesting…. Inventories.

Seeking Alpha

It’s not a straight line. Nothing, or almost nothing, in real life ever is. But notice it’s a lot less volatile than some of the other trends we’ve seen.

As MU has been getting bigger, it’s had to invest more in inventory. It had to have items on hand from which to fill customer orders.

And in a business like this, one can’t flip the production switch on or off as often as one might wish.

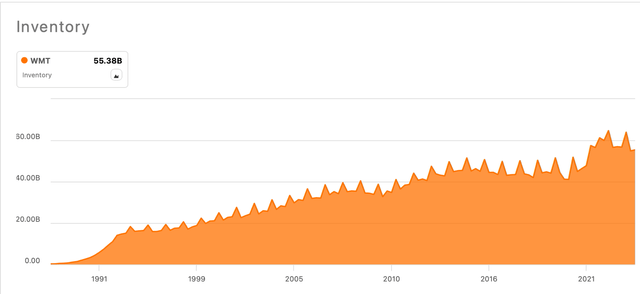

MU isn’t like Walmart (WMT). MU can’t control inventories by sending out mass emails (or whatever) to vendors telling them to stop, or re-start shipments. WMT’s inventory slope (subject to seasonal stockpiles) is much gentler.

Seeking Alpha

MU’s need to hold inventory, and its lesser ability to quickly start and stop producing, contributes to its volatility.

In fact, MU arguably wishes it had even more inventory right now. Recall the CEO’s remarks above. 2025 HBM product is already sold out.

MU is among chip companies using federal support to boost domestic capacity. That’ll eventually help it capture more of the industry’s upsde. But downside volatility will persist, probably even become more pronounced.

That’s the nature of the industry. And it’s also why Graham & Dodd teach us to value companies over long enough periods to avoid cyclical distortions.

When we look beyond annual up and downs, we see the sorts of accumulations that make MU a true growth company.

Now, let’s tackle valuation. We’ll do the best we can considering the way powerful cyclicality can play havoc with the metrics on which we usually rely.

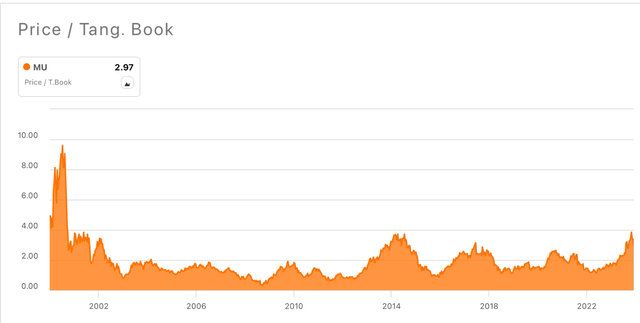

Here’s Price-to-Tangible Book Value.

Seeking Alpha

It’s high.

But it’s not at all outrageous to the degree we saw during the circa-2000 bubble.

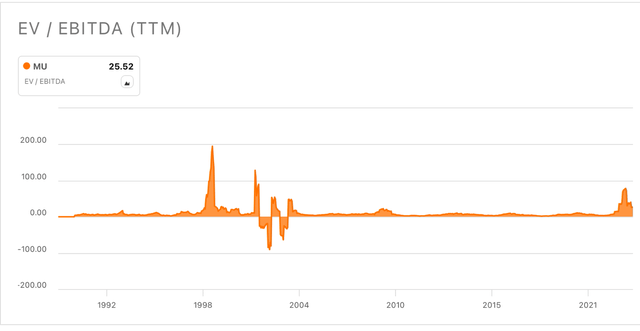

Ditto for EV to EBITDA.

Seeking Alpha

(This ratio recently looked for a while like it was heading up into orbit. But that’s no longer the case today. Note the right edge of the image… it shows the ratio’s recent decline.)

2000 and its bubble-like hysteria don’t apply to MU.

Its valuation is still high. But that makes sense. Good things don’t come cheap.

You can’t get a Lamborghini for the price of a Hyundai. And you can’t get a powerful growth company for the price of a company that’s on a slow boat to nowhere. (I explained this more fully in my May 28, 2024 Nvidia (NVDA) writeup.)

Consider too that the valuations shown here are based on TTM (trailing 12 months) metrics. For cyclical companies, when such results are unusually depressed, we expect valuations based on them to be abnormally high.

Expected future growth is a major portion of assessing valuation. That’s especially so when at or near a cyclical trough, as is the case now with MU.

So, once we properly recognize the cyclical and (AI based) secular factors coming together here, MU’s valuation becomes more acceptable. (In other words, I land at pretty much the same place as Seeking Alpha’s Valuation grade).

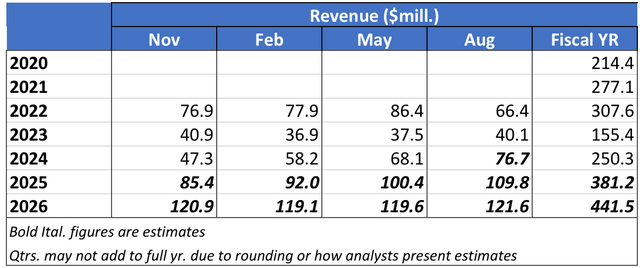

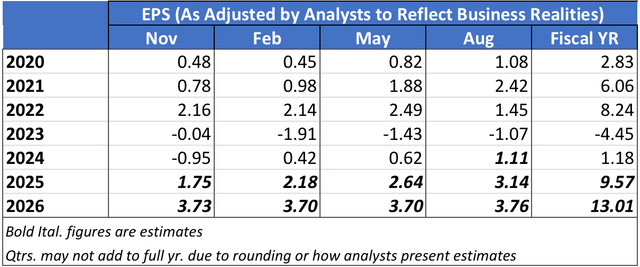

Finally, here’s a quarter-by-quarter look at MU’s results.

Analyst Compilation based on Data from Seeking Alpha Earnings and Financials Presentations

Analyst Compilation based on Data from Seeking Alpha Earnings and Financials Presentations

By comparing numbers to past and estimated future, we see things we miss when we obsess, as investors usually do, over comparisons to prior estimates.

These tables don’t try to serve as a report card grading analyst forecast accuracy. Instead, they give a clear picture of MU’s path down the semiconductor cycle and its expected path back up.

Risks

The post-2000 crash has become and may for a while remain a recurring feature of the investment narrative. See, for example, the 2000-Cisco (CSCO) to 2024 Nvidia (NVDA) comparisons being bandied about.

Comparisons in some instances will be dead wrong. Many commentators stay on the surface. Few drill down into company details. And few appreciate differences between today’s leading stocks versus those of yesteryear.

But the market is based on the realities of supply and demand, not objective company facts. So, persistence of bearish sentiment could hit stocks out of proportion to what they deserve.

MU is one of the legitimate AI plays that bears the risk of unjustified negative market sentiment.

We must also recognize MU’s chip-market position.

As discussed above, it once had smaller shares within its DRAM/NAND oligopoly. It recently leapfrogged its rivals. But there’s risk another rival could, in turn, leapfrog MU.

What to do About MU Stock

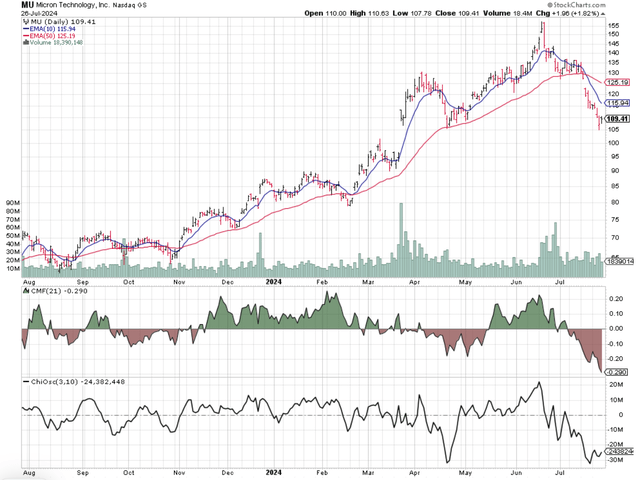

Doctrinaire technical analysts probably cringe at the prospect of owning, much less buying MU stock.

StockCharts.com

MU presently shows badly in all the chart factors I consider.

This calls to mind the popular adage “Don’t try to catch a falling knife.”

To own these shares, you’ll need steel-plated gloves. (You won’t want the metaphorical falling knife to cut your hand.)

As I’ve said before, my investment stance depends mainly on whether I think a stock will be better than, in line with, or worse than market.

Here’s how I apply that to the Seeking Alpha rating system:

- “Strong Buy” means I see the stock as being better than the market and I’m bullish about the direction of the market.

- “Buy” means I see the stock as being better than the market but am not confident about the market’s near-term direction.

- “Hold” means I see the stock as moving in line with the market.

- “Sell” means I see the stock as being worse than the market but am not confident about the market’s near-term direction.

- “Strong Sell” means I see the stock as being worse than the market and I’m bearish about the direction of the market.

Those who are gifted in catching peaks and troughs should wait till they know it’s bottomed. Many of us love to imagine ourselves like spotting peaks and troughs.

I don’t have that rare talent.

Ideally, I want to buy a good company at a good price, and ride with it.

Unfortunately, and consistent with intrinsic valuation challenges such as I described with Nvidia, I admit I can’t really calculate what a “good price” looks like here.

So, I’ll just stick MU being a “good company.” And I believe, based on secular and cyclical factors, it’ll look a heck of a lot better a year from now.

Based on that, and the fundamental/valuation charts discussed above, I’m rating MU as a steel-glove “Buy.”

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Growth Idea investment competition, which runs through August 9. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.