Summary:

- My previous sell recommendation on Micron Technology, Inc. underestimated how strong cyclical forces can be.

- Especially when there is a secular tailwind in the background.

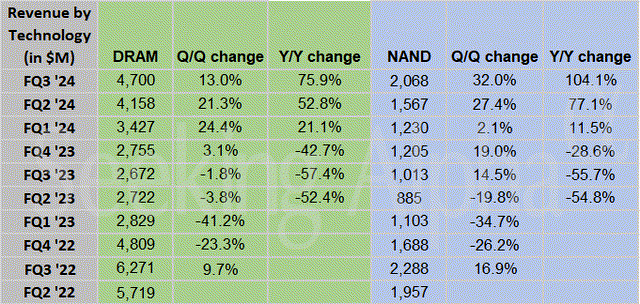

- Since my last writing, Micron reported 76% YOY growth in DRAM revenues and over 100% growth in NAND revenues thanks to AI-related demands.

- With the updated financials, an updated assessment leads to a rating upgrade to HOLD from my earlier SELL rating.

Prostock-Studio

MU stock: cyclical forces kept surprising me

My last article on Micron Technology, Inc. (NASDAQ:MU) stock was titled “Sell Cyclical Stock Near Cyclical High.” The article was published a little more than 3 months ago on April 14, 2024, as illustrated by the chart below. At the time the article was published, the stock price was $123, and the article recommended selling MU stock for the following considerations:

Micron is expected to benefit from the AI revolution and increased demand for its memory products. I will argue it is near/at its cyclical high under current conditions, judging by the stock price advancements and revenue growth. MU has historically experienced cyclical patterns of rapid growth followed by deep corrections, and I expect the same this round, too.

Since the publication of the last article, there have been some new developments. First, the stock prices have shown quite drastic fluctuations and could indicate a market sentiment change. Second, on the fundamental side, the company has released the quarterly earnings (for its fiscal Q3 of 2024). Given these new developments, I think an updated analysis is warranted. In this article, I want to focus on two topics. First, I would like to share two lessons I have learned (or really relearned) on the analysis of cyclical stocks. After being in the market for almost 3 decades, I seem to keep underestimating the potential of cyclical forces. Second, I will provide an updated assessment of the stock valuation relative to its growth potential given the AI tailwinds. And you will see why my assessment leads to a rating upgrade to HOLD from my earlier SELL rating.

MU stock: lessons learned

I have been investing in cyclical stocks for close to 3 decades. Many investors dislike cyclical stocks due to their large earnings and price volatility. However, my fundamental view is that volatility is not the same as risk. My winning rates with cyclical stocks are far better than my overall investing performance. And the lesson I’ve learned in the past is that such winning rates are precisely because cyclicality offers overwhelming odds at cyclical peaks and bottoms.

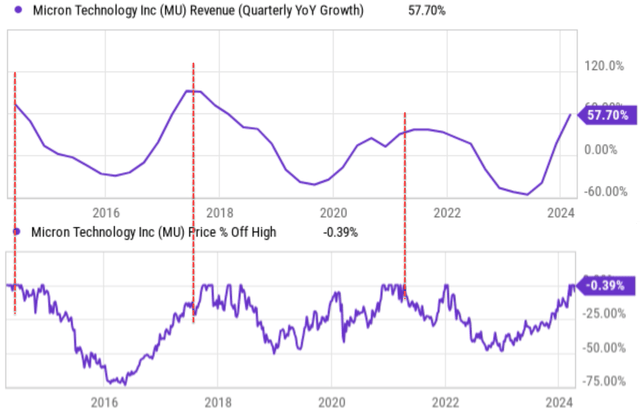

However, I kept underestimating how strong cyclical forces can be. Shortly after I published my SELL rating, the stock price went up to an all-time high of around $157, translating into a rally of more than 27% relative to the price at my last writing. In my last article, I correctly argued that MU was well into the expansion phase judging by the revenue growth, as illustrated by the next chart below. At that time, the stock just reported a 57% top-line growth YOY and the stock price has already almost doubled from the bottom level from the contracting phase.

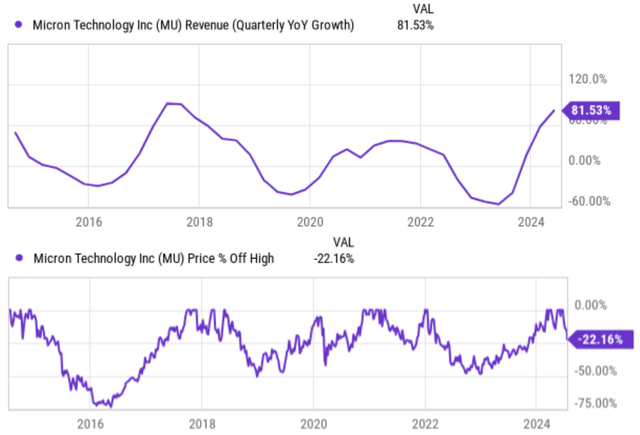

Well, fast-forward to now, largely thanks to the strong demand for its dynamic random access and Flash memory (DRAM and NAND), the company’s latest earnings report shows an 81% YOY revenue growth (as illustrated by the next chart below, top panel).

To recap, the lesson I learned here is to not underestimate the cyclical force, especially when there is a secular tailwind in the background (the AI tailwind in this case, more on this a minute later).

The saving grace is that the stock prices have pulled back by about 22% from the all-time-high recently due to various factors, and I will elaborate more on these factors in the risk section. Such roller-coaster movements urge me to reiterate the other lesson I mentioned earlier – volatility is not equivalent to risk. Large price volatility only provides entry/exit opportunities more frequently as long as we have a good grasp of the business fundamentals, as detailed next.

MU stock: AI tailwinds and valuation

Judging by the information provided in its earnings report, I think Micron is well-positioned to benefit from the spread of Artificial Intelligence (“AI”) applications. The expanded deployment of AI means an increase in the need for more computer memory and storage. As a leader in DRAM and NAND, I expect Micron to enjoy robust growth in the years to come.

As illustrated by the next chart below, its DRAM revenues have increased by about 76% YOY in Q3 and NAND revenues more than doubled. Furthermore, the projected advancement of High-Bandwidth Memory (HBM) products for use in data centers and devices such as PCs and smartphones, should continue to benefit MU too. MU’s arrangement to support Nvidia’s newest AI chip (H200) is a strong reflection of such secular tailwinds. Thanks to the agreement, Micron’s HBM memory portfolio has been sold out for calendar year 2024 and most of its 2025 supply has been allocated too.

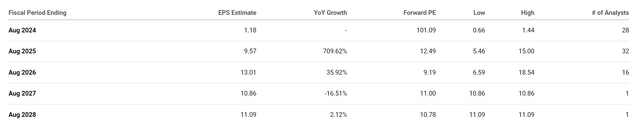

I expect these tailwinds to translate into rapid EPS growth and thus attractive P/E ratios (on an FWD basis, that is). As seen in the second chart below, analysts’ consensus expects Micron’s EPS to grow significantly over the coming years. The consensus estimate is for EPS to reach $1.18 in FY 2024, only to be followed by another strong year of growth to $9.57 in FY 2025. With these projections, Micron’s FY2 P/E ratio is about 12.5x, quite attractive considering its leading position in a growing market segment.

Other risks and final thoughts

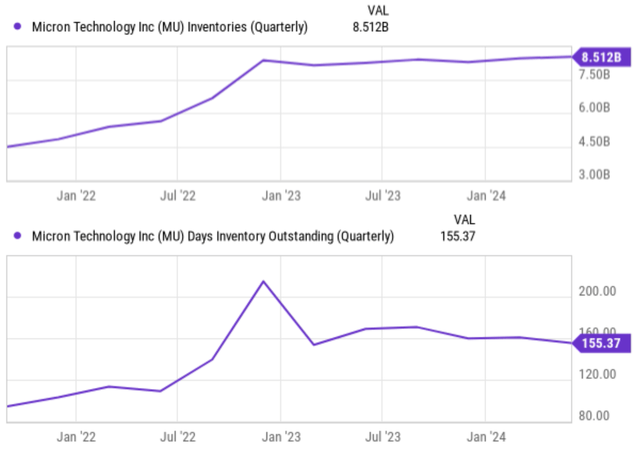

Before closing, there are a few downside risks that I’d like to mention. MU’s current inventory is at an elevated level, as shown in the next chart, both in terms of dollar amount and days of inventory outstanding (“DIO”). The forward demand mentioned above could reduce the inventory level to historical averages. However, until then, a large inventory entails several risks (e.g., tying up cash, driving up storage and maintenance, creating obsolescence risk, etc.). The memory chip market is competitive (similar in many ways to commodities), with a few major players vying for market share. The competition often boils down to price and can lead to intense margin pressure on MU’s products. Finally, MU has a large exposure to China, a market with ongoing trade tensions with the U.S. and unpredictable regulations. The market’s fear about export control and Republican Presidential nominee Donald Trump’s recent remarks regarding Taiwan are good reflections of this risk (which triggered a correction of close to 5% in MU stock prices in one day, July 17).

All told, I think these downside risks are well-balanced by the upside potential under current conditions. And to reiterate, investors should not equivalent price volatility with risks or underestimate the cyclical force, especially when there is a strong AI secular tailwind. The sizable Micron Technology, Inc. stock price pullback from its peak levels, combined with the updated growth outlook, has improved its return potential from that at my last writing. Based on these considerations, I am upgrading my rating to HOLD from my earlier SELL rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.