Summary:

- Micron Technologies is experiencing a profitability upswing due to high demand for memory and storage products.

- The company beat profit estimates for 3Q24, with sales skyrocketing and plans for increased capital expenditures to meet demand.

- Micron Technologies’ stock is undervalued, selling for less than 13.9x leading earnings, with potential for significant sales growth in 2025.

D-Keine

Micron Technologies Inc. (NASDAQ:MU) is enjoying a cyclical upswing in profitability, driven by roaring demand for its memory and storage products.

As a consequence, Micron Technologies beat profit estimates easily for its 3Q24 last week, its sales are skyrocketed and the chip company is guiding for a substantial ramp in capital expenditures in order to accommodate surging demand for its chips.

Most importantly, Micron Technologies’ stock is still quite a bargain, selling for less than 13.9x leading earnings (2025).

In my view, the stock has re-rating upside and I would not be surprised to see much stronger sales growth in 2025.

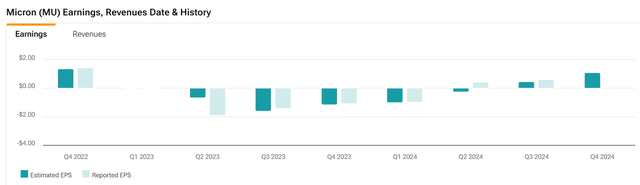

Beating Estimates

Micron Technologies blew profit estimates out of the water last week when it delivered earnings for its third quarter. The chip company reported profits of $0.62 per share, a 48% rise QoQ, which beat the Street estimate of $0.48 per share. It was the fifth straight profit beat for Micron Technologies and it indicates a substantially improved profit outlook for the company.

Earnings And Revenues (Yahoo Finance)

Micron Technology: Solid Growth And Upside

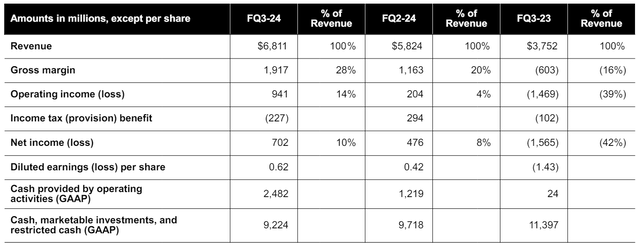

In the third quarter, quarterly sales for the chip company clocked in at $6.8 billion, reflecting a growth rate of 17% QoQ on strong demand for memory and storage products.

It was a great quarter for Micron Technologies, particularly because the company posted soaring operating losses a year ago which is when the memory market went into a downturn. Micron Technologies’ operating income more than quadrupled QoQ to $941 million in the last quarter which compares against a whopping $1.5 billion loss a year ago.

The operating picture has drastically improved since, predominantly because of Nvidia’s mind-blowing growth in the data center segments. Since Nvidia needs Micron Technologies’ products, particularly its HBM3E high bandwidth memory, for its computer chips, Micron has found itself at the very heart of the AI frenzy.

Quarterly Sales (Micron Technologies)

With the exception of Mobile, Micron Technologies really had a banger of a quarter with all segments seeing robust growth in sales. One segment that is doing very well for Micron Technologies is storage which enjoyed a 50% rise in sales to $1.4 billion in the last quarter.

Storage demand, particularly for solid-state drives, is also driven by data centers. Solid-state drives help accelerate high-capacity data center workloads and help lower operating costs for data center operators.

Storage Sales Growth (Micron Technologies)

Capital Expenditure Rebound Predates Profit Upswing, Mind-Blowing HBM Market Forecast

Demand for high bandwidth memory is surging, forcing semiconductor makers like Micron Technology to substantially upgrade their capital expenditure forecasts.

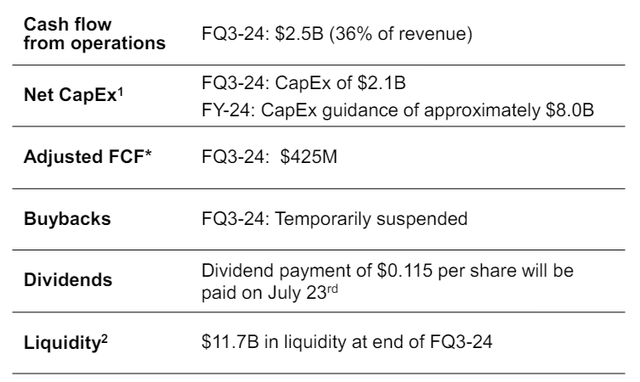

HBM is now the main driver of Micron Technology’s sales and profit upsurge, which in turn requires the company to step up and accelerate its capital spending on HBM production capacity. For the present year, Micron Technology anticipates to shell out a whopping $8.0 billion in capital expenditures, which reflects a $1.0 billion increase over 2023.

The acceleration in capital spending, in my view, is the clearest indication yet that Micron Technology is seeing a fundamentally improved operating landscape in the memory and storage markets, driven primarily by exploding demand for data center GPUs.

Capital Expenditures (Micron Technologies)

What is driving the capital expenditure rebound is growth in HBM3E, Micron Technologies’ high bandwidth memory product that is used in Nvidia’s GPUs. The outlook for the high bandwidth memory market is juicy, to say the least, which shouldn’t be a surprise since Micron Technologies’ memory is used in Nvidia’s latest AI chips.

With skyrocketing demand for Nvidia’s artificial intelligence chips, the demand outlook for Micron Technologies’ HBM products has also drastically shifted in favor of the chip company.

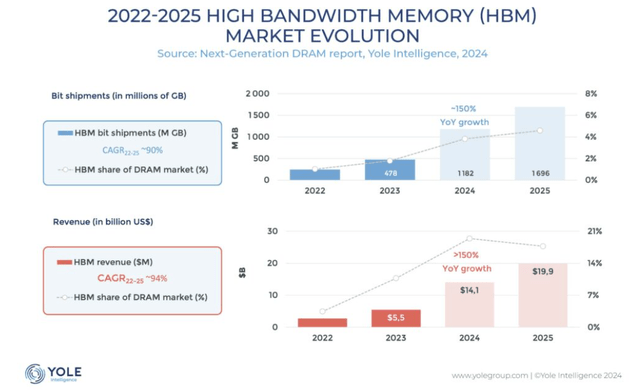

HBM shipments and associates sales for manufacturers are poised to soar more than 150% in 2024 which creates the backdrop for Micron Technologies’ improved profit outlook.

HBM sales are anticipated to skyrocket 156% this year as chip manufacturers like Nvidia heavily invest in their AI chips targeting the data center market.

HBM Market Evolution (Yole Intelligence 2024)

Micron’s Profits Are Exploding And The Stock Is A Steal

The key pillar of my investment thesis is that demand for Micron Technologies’ HBM3E memory is catalyzing an explosion in company profits, particularly next year.

In 2025, Micron Technology anticipates a severe ramp in HBM3E shipments and sales (the company has so far only said that it expects to grow HBM-related sales to ‘billions’, up from ‘hundreds of millions in 2024’) which is poised to lead to an unprecedented profit jump for the chip company.

In 2025, if consensus estimates hold true, Micron Technology could be on track to rake in $9.41 per share in profits, reflecting a mind-blowing YoY growth rate of 778%.

Earnings Estimate (Yahoo Finance)

Micron Technology’s profit surge, in my view, is not yet fully reflected in the chip company’s earnings multiple. Based on leading (2024) earnings, Micron Technology is selling at a profit multiple of 13.9x which is not a particularly excessive multiple when taking into account that the company’s profit are expected to surge 780%.

Micron Technology is undervalued, in my view, and could re-rate to an earnings multiple of 18-20x when taking into account the substantial HBM catalyst and Nvidia-link that is catalyzing a change in the chip company’s fortune.

If my thesis is correct and the market maintains a favorable outlook on HBM sales, my earnings multiple range could equate to an intrinsic value range of $169 to $188.

Why The Investment Thesis Might Not Work Out

One reason: Cyclicality. Micron Technologies is a memory investment, which means the company is rising and falling with the general flow of demand in the semiconductor industry.

If semiconductors do well, which one would assume given the surge in demand for computer chips right now, then Micron Technologies is poised to do fantastic.

On the flip side, if the tide turns and demand for semiconductors falls, then Micron Technologies is poised to experience yet another serious profit recession and, as a consequence, multiple compression.

My Conclusion

It is not too late to participate in the growth of the memory market, which is attached to the growth of the much bigger data center market. Data centers need GPUs in order to run their models, which in turn rely on Micron Technologies’ memory products.

Skyrocketing demand for high bandwidth memory is the catalyst that is behind Micron Technologies’ anticipated profit growth, and the outlook is very bullish. Micron Technologies’ more aggressive capital expenditure guidance suggests that the company is betting big on accelerating HBM shipments and sales.

Most importantly, I think that Micron Technologies’ 13.9x profit multiple is woefully inappropriate given the strength of the underlying growth driver in the HBM market.

Micron Technologies is an absolute steal at this multiple, and I think that investors have not seen anything yet when it comes to the company’s sales ramp.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.