Summary:

- We’re downgrading Micron Technology stock as we think the positives of DRAM and NAND recovery have been priced in.

- The memory market began to recover this year due to better demand-supply dynamics and AI-led demand for HBM; we think the good news from this recovery was priced into MU’s stock.

- We see limited room for outperformance at the back end of the year as the end demand environment for PC, smartphone, and AI server unit growth remains soft.

- We recommend investors stay on the sidelines for the near term until a more favorable risk-reward profile appears for 2025 tailwinds.

PM Images

We’re downgrading Micron Technologies (NASDAQ:MU) to a hold. Simply put, we think the DRAM and NAND price recovery has been priced in for 2024. MU’s outperformance is closely tied to the demand-supply dynamics of the memory market, as the company derives 69% of its total sales from DRAM and 30% from NAND. We rode MU stock +80%, up from $55 per share to its 52-week high of $157 per share to roughly $102 today. We now update our thesis on the stock as we believe the market has digested the positives from this year’s DRAM and NAND spot price recovery and demand compared to 2023.

Last year, DRAM and NAND prices declined significantly due to oversupply in a weak end-demand environment post-pandemic; the following report from last year captures how bad the memory price decline was: “DRAM prices have fallen 57% since Q3-21 ($0.54 to $0.30 in Q1-23) while NAND prices have fallen 55% during the same period.” The downturn began to ease in 2H23, which is when we pushed our bullish sentiment on the stock, and also when MU management raised their forecast for 1Q24. And, indeed, we’ve seen DRAM and NAND prices recover this year: Taiwan’s TrendForce reported in late July that “DRAM and NAND Flash revenues are expected to see significant increases of 75% and 77%, respectively, in 2024.” The upside this year is on a recovery from the lows of last year instigated by 1. better memory demand-supply dynamics as “memory manufacturers’ strict control of supply and output has led to increasing prices from the start of November” 2023 and 2. Heightened demand for high bandwidth memory or HBM due to AI value and use. We think both these factors remain at play, but the market has already priced in the positives. Hence, we don’t see a favorable risk-reward profile for the stock for the back end of the year.

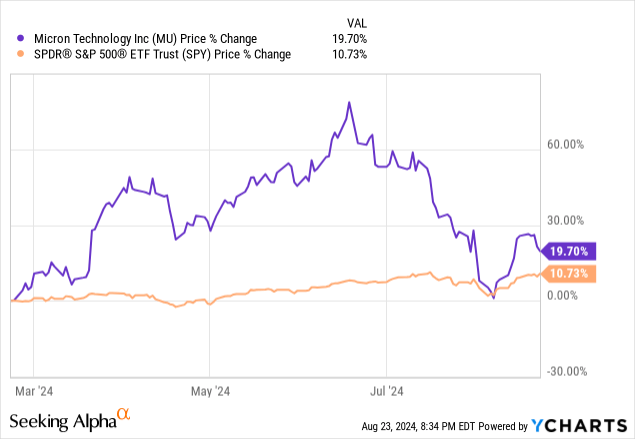

The chart below shows MU’s stock price performance over the past six months against the S&P 500. The stock visibly outperformed the S&P 500 benchmark, and its outperformance has materially moderated since early July in response to investors trimming their positions due to the broader semi-pullback but also in reaction to declines in DRAM and NAND spot prices. For reference, spot price refers to the “current price in the marketplace at which a given asset—such as a security, commodity, or currency—can be bought or sold for immediate delivery.” And DRAM and NAND spot prices are often used as a leading indicator of the trajectory of the memory market, particularly demand. We think spot prices are stabilizing but not entering hyper growth/recovery due to the muted end demand in core end markets (i.e., PC and smartphone). This year should have provided a good setup for 2025, but we don’t see material outperformance next in 2H24.

YCharts

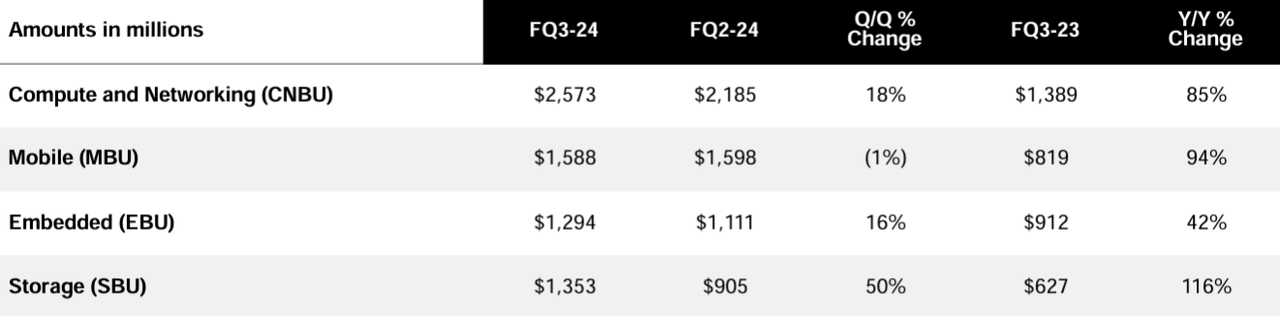

We do see more material upside for MU in 2025, primarily driven by a healthier demand environment for PCs, smartphones, and AI servers in terms of unit volume. We specifically mention unit volume recovery here across these markets due to MU’s specific exposure to these markets (as shown in the chart from the 3Q24 earnings presentation) and concern over Q/Q growth momentum at the back end of the year.

Micron Technology Earnings

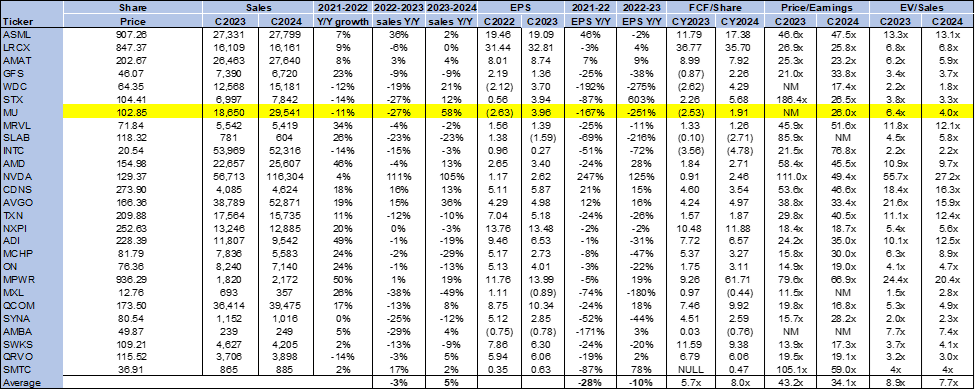

Valuation & Word on Wall Street

MU stock is cheap but doesn’t provide a favorable risk-reward profile in the near term, given that the positives have already been factored into the stock price. On a P/E basis, the stock trades at 26.0x C2024 compared to the peer group of 34.1x. The stock is trading at 4.0x EV/C2024 Sales, comfortably lower than the peer group average of 7.7x. We like MU for longer-term investors but don’t see the stock outperforming in the near term due to 1. the priced-in positives mentioned above and 2. a lack of a near-term catalyst quickening the pace of end demand recovery and triggering a new wave of investor confidence.

The following chart outlines MU’s valuation against the peer group average.

TechStockPros

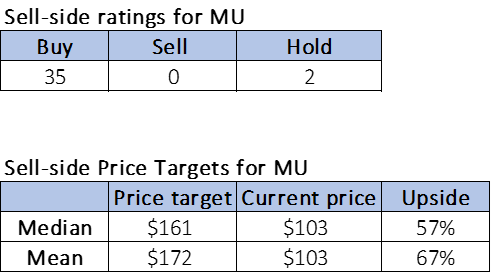

Wall Street’s sentiment on the stock hasn’t shifted too much this quarter, with the majority of sell-side analysts pushing for a buy. Of the 37 analysts covering the stock, 35 are buy-rated, and the remaining are hold-rated. Sell-side price targets on the stock also convey a similar positivity, with the median price target set at $161 and the mean at $172 for a potential upside of 57-67%. We don’t see MU realizing this upside over the next quarter and, hence, would recommend investors stay on the sidelines for now. The following chart indicates MU stock’s sell-side ratings and price targets.

TechStockPros

What to do with the stock?

MU continues to be one of our top memory picks, but we don’t think it’ll be favored at the back end of the year. Our thesis on MU is centered around the question: what has been priced in? We think the market is pricing MU as if it were in its eighth or ninth inning, although it is still in its sixth, considering the potential DRAM demand that could come from HBM demand for AI servers and AI PCs requiring more DRAM content earlier in the manufacturing process. We don’t see the stock outperforming in 2H24, but we’re more optimistic about 2025. Next year, we expect to see two things. The first is end demand recovery for PCs and smartphones, with more favorable interest rates as a catalyst, coupled with AI PC for the former. And the second is an increase in capex focused on HBM supply and all that goes under that umbrella to support the demand growth; management now expects to see “significantly improved profitability in FY25 will help support average quarterly capex in FY25 to be meaningfully above the FQ4 2024 level of $3B.” We think MU will be more attractive near the end of the year and would recommend that investors be patient during that window once the market has digested the near-term potential lull post-rally.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.