Summary:

- Micron Technology’s stock has surged recently, driven by strong demand for AI memory chips and impressive earnings, warranting a “strong buy” rating.

- Fiscal Q1 2025 guidance indicates potential record revenues of $8.5-8.9 billion and earnings of $1.66-1.82 per share, surpassing analyst expectations.

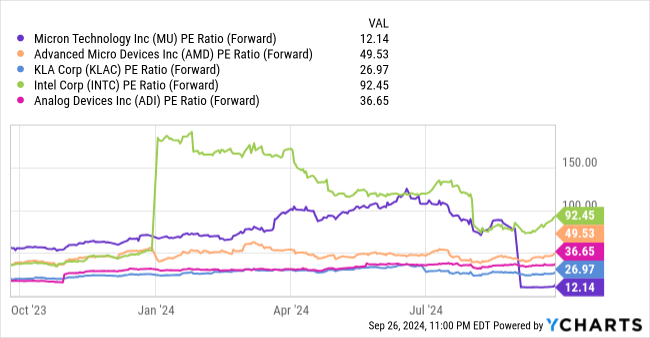

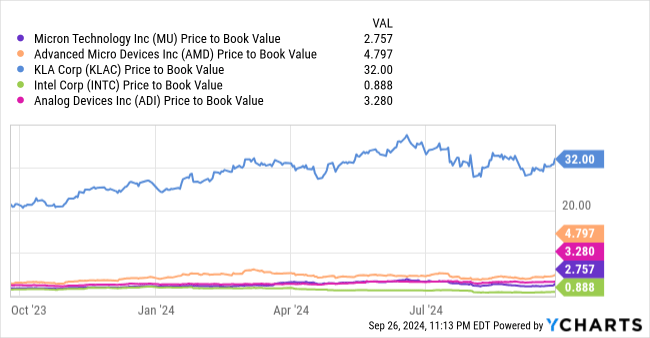

- Despite recent price volatility, Micron’s forward P/E and price-to-book ratios remain attractive compared to industry rivals, suggesting undervaluation.

- Conservative investors should consider waiting for market stabilization and normalization of short-term overbought conditions before entering new long positions in MU stock.

NorGal/iStock via Getty Images

When I last covered Micron Technology with “Micron: Stay Long Into New Year’s Earnings Risk”, the stock was trading below $77 per share and several key operational risks clouded the outlook in a negative light for many analysts. However, since then, share prices have posted extremely impressive long-term rallies and the stock is now trading higher by 43.75%. Of course, the ride has been bumpy along the way, with several major peaks and troughs developing in Micron’s price history during this period of time. But now that we have seen very clear evidence of sustainable demand for Micron’s artificial intelligence memory chips and broad strength in the company’s most recent earnings report, I feel that the stock deserves an upgraded rating based on Micron’s continued ability to surpass analyst expectations by a wide margin.

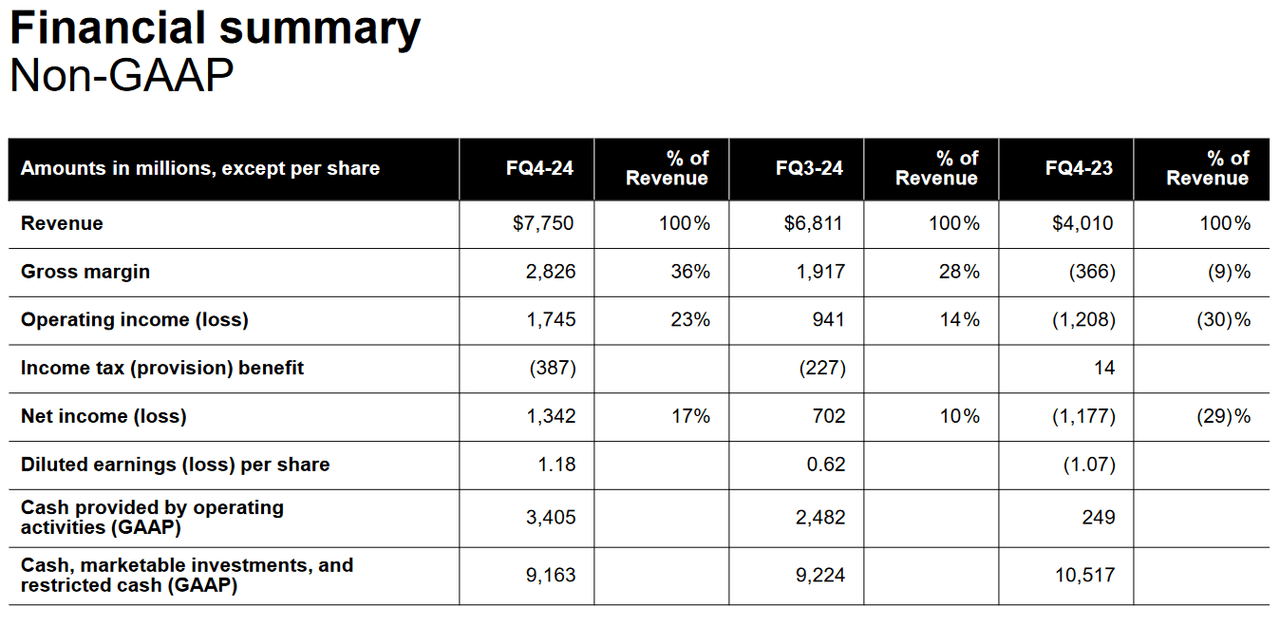

Q4 Financial Summary (Micron Technology Earnings Presentation)

For the fiscal fourth-quarter, Micron reported revenues of $7.75 billion and per-share adjusted earnings of $1.18. In both cases, these figures easily beat analyst expectations calling for revenues of $7.65 billion and adjusted EPS of $1.11 per share. However, these beats are much more impressive when compared to the performances that were posted during the cyclically weak fiscal fourth-quarter in 2023, when Micron recorded losses of -$1.07 per share alongside $4.01 billion in revenues. Interestingly, it seems quite that these quarterly results took the market by surprise because it has also been reported that there were as many as seven prominent tech stock analysts that downwardly revised their price targets for MU share prices in the two-week period leading up to the release.

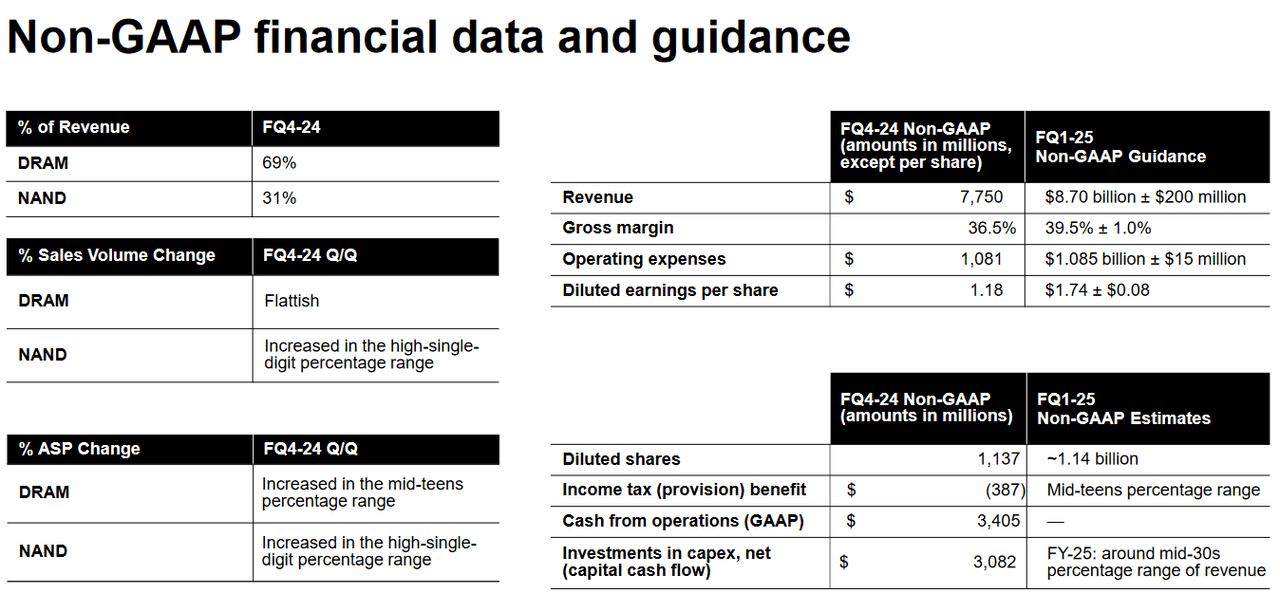

Non-GAAP Financial Data and Guidance (Micron Technology Earnings Presentation)

More importantly, however, were Micron’s guidance figures which make it very clear that these strong operational performances are unlikely to end any time in the near-future. For the first-quarter of fiscal 2025, management expects to see potential for record revenues that could post within an $8.5-8.9 billion range and this is also firmly above prior consensus estimates calling for $8.27 billion in revenues. Additionally, earnings figures are expected to post with a range of $1.66-1.82 per share, and gross margin figures are expected to rise from 36.5% to 39.5% for the current quarterly period.

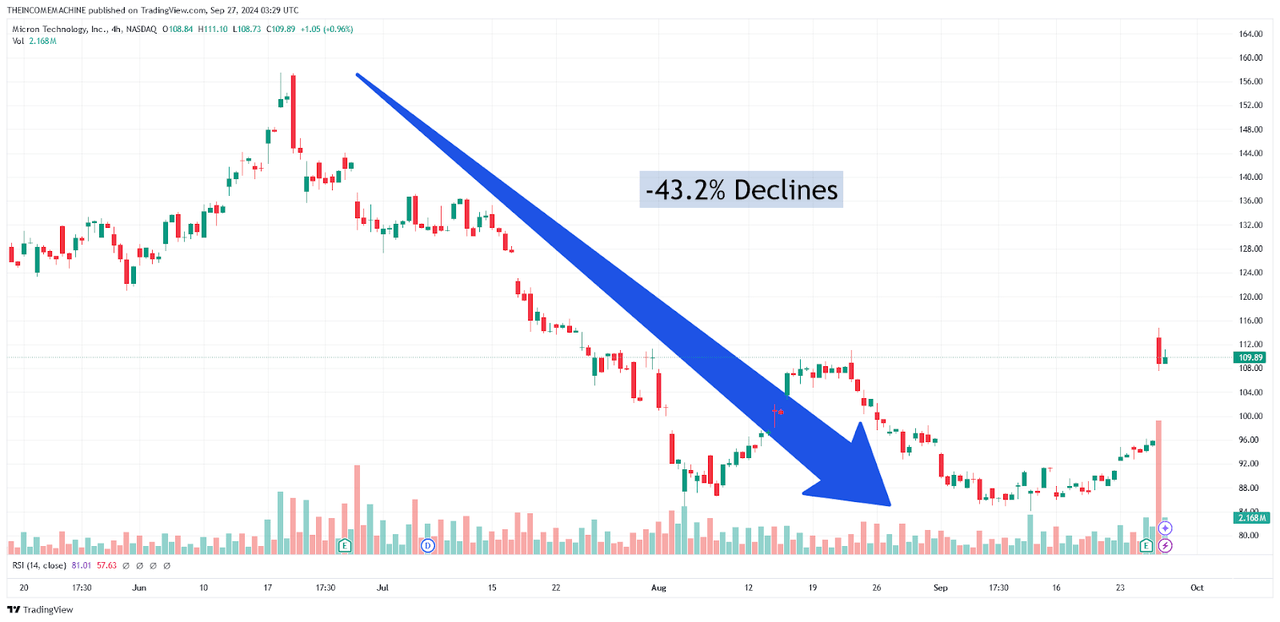

Given all of these positives, it seems that the stock’s sizable June to mid-September sell-off (which saw share prices lose nearly -43.2% in value) might have been excessive in nature. As a result, I think that all of these supportive factors create highly favorable risk-reward scenarios and enough potential for upside that the stock now warrants an upgrade into the “strong buy” category.

MU: Recent Stock Declines (Income Generator via Trading View)

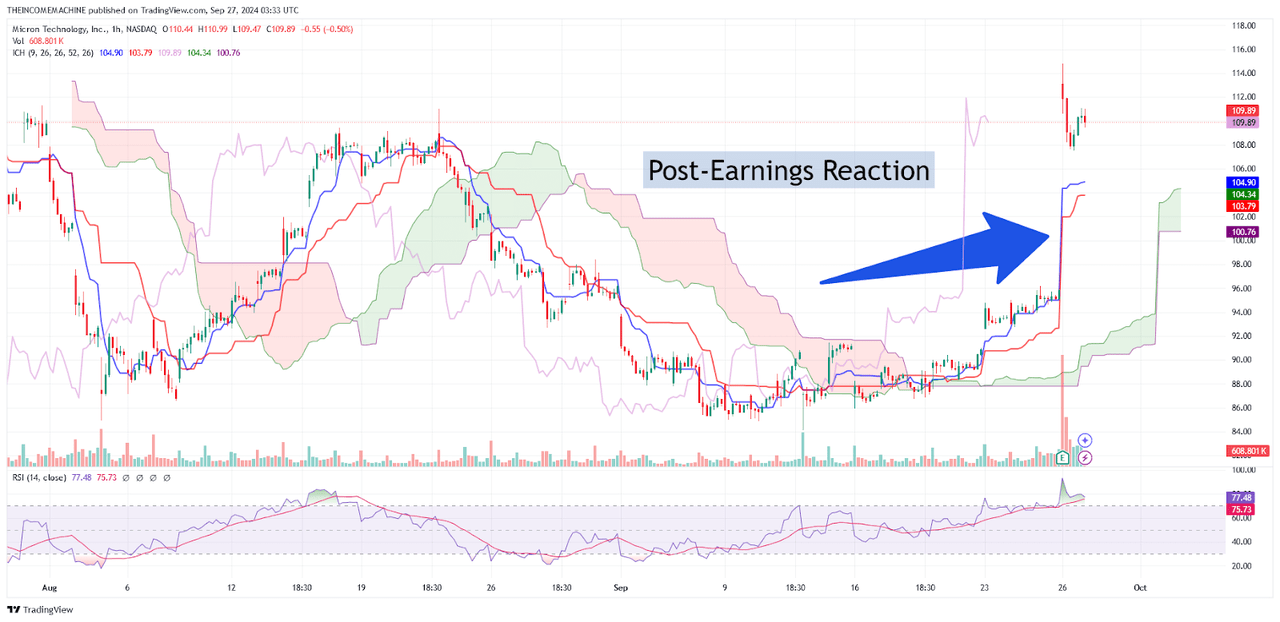

Of course, the market is already responding quite favorably to Micro’s guidance and most recent earnings figures and this has left a substantial gap on the stock’s price charts, which could lead to continued volatility for shareholders that are trading the stock near-term. However, in my view, the real issue at hand here is the current risk-reward prospect for this stock – and when we compare current valuations to Micron’s longer-term averages, it becomes much easier to see that the stock is still trading at incredibly reasonable levels (despite recent spikes in the upward direction). Specifically, Micron’s forward price-earnings metric is not only trading far below its own five-year historical averages but also well below the forward price to earnings ratio metrics of key rivals within the industry:

Comparative Forward Price-Earnings Ratios (YCharts)

Somewhat similar scenarios can be seen when viewing Micron in terms of its historical price to book ratio valuation. In this case, we can see that Micron’s price to book ratio valuation is trading far below key industry rivals like Advanced Micro Devices (AMD), KLA Corp. (KLAC), and Analog Devices, Inc. (ADI). Currently, the only major competitor trading with a lower price to book ratio valuation would be Intel Corp. (INTC). However, recent troubles at Intel have been extremely well-publicized and, at the moment, it seems fair to say that Intel can be viewed as a bit of an exception relative to the broader industry rule.

Comparative Price-Book Value Ratios (YCharts)

With all of this in mind, I think it makes the most sense to assess the stock’s current potential for volatility because this seems to be the most significant potential risk at the moment for investors that might be considering new long positions in MU stock. In the chart below, we can see that the market reaction to Micron’s most recent quarterly report has been quite forceful, with share prices reaching near-term highs of $114.80 in the process. When we consider the fact that the stock was trading in a trough below $90 per share less than one week earlier, it can be easy to see why some conservative investors might be wary of the potential for declines back toward that region in the weeks and months ahead.

MU: Post-Earnings Reaction Gap (Income Generator via Trading View)

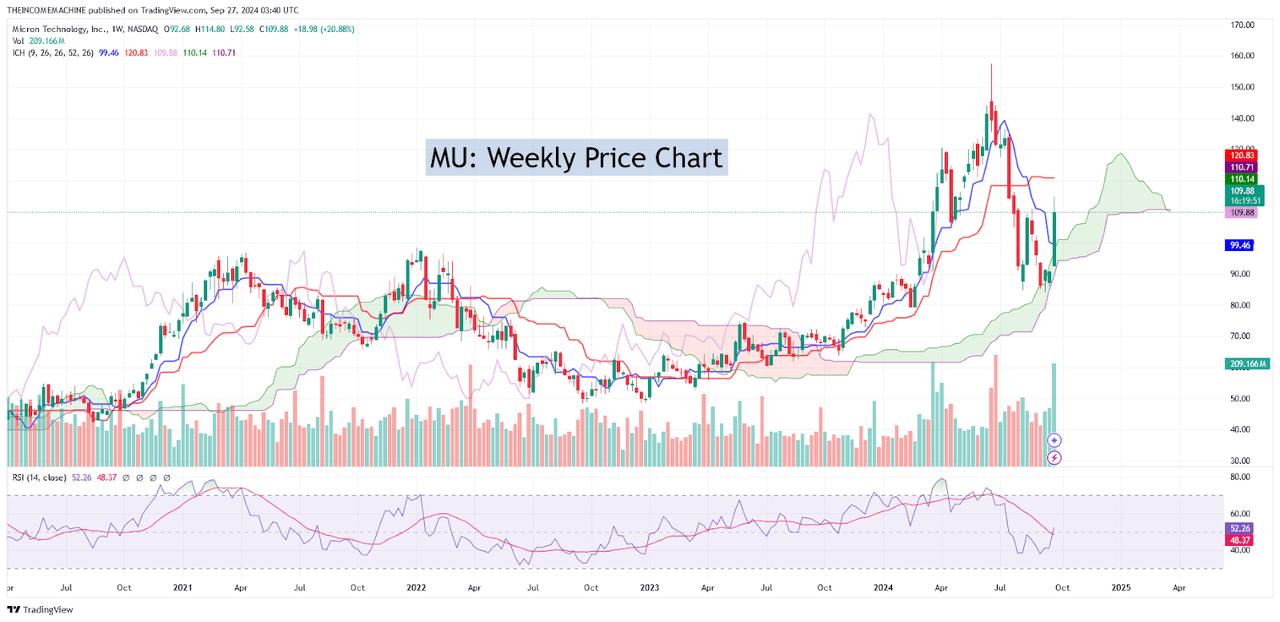

But if we pull out a bit further, and view the stock from the long-term perspective of the weekly time frame, the recent price gap starts to look less intimidating because share prices have actually shown some evidence of stabilization near a double-bottom support zone that has recently formed near the $85 level. In many cases, an upward price gap will eventually need to be filled once share prices start to settle following a major event risk like a quarterly earnings report. While this does increase the potential for an increase in downside volatility near-term, we can see that the bottom of this price gap rests near the $96 mark. Relative to current market prices, this indicates a potential decline of roughly 12.6%. Fortunately, this would still give investors a fair bit of distance between the lower end of the recent price gap and the double-bottom support zone that is currently found near $85 per share.

MU: Weekly Price Chart (Income Generator via Trading View)

With this in mind, conservative investors with a lower risk tolerance might want to wait for markets to settle and allow the recent enthusiasm for MU stock to abate before entering into new long positions. Currently, hourly readings in the relative strength index are holding above the 75 mark, which suggests that overbought conditions remain in place (indicator readings over the 70 level suggest that an asset’s upward price movements might be reaching a point of exhaustion). Fortunately, readings in the relative strength index on the weekly time frame are much more subdued (currently resting just over the midpoint of the histogram at 51.7). Ultimately, what this suggests is that short-term indicator readings have become overextended to the topside while longer-term readings are actually holding at levels that are quite stable. For these reasons, conservative investors can avoid some of the potential volatility that might be associated with this stock by either waiting for share prices to fill the post-earnings reaction gap or to wait for readings in the short-term relative strength index indicator to roll over out of oversold territory and normalize in ways that are more in line with current readings on the weekly time frames.

Overall, I have been highly encouraged by Micron’s recent earnings beats and the forward guidance suggestions explaining that demand for the company’s memory products is expected to remain quite robust for the foreseeable future. Recent price volatility does present a problem for investors that might be more risk-averse. However, exercising a bit we well-timed patience in these scenarios would be the most prudent way to proceed with investments in MU stock going forward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.