Summary:

- Micron announced its HBM3 Gen2 offering earlier, which outperforms other competing solutions.

- I believe the HBM3 Gen2 will be the Key to Micron’s recovery.

- The China ban on Micron will only affect around 8% of its revenue.

- Micron has $12 billion in debt, which I believe should be manageable despite its cash burn.

vzphotos

Thesis

The whole memory market suffered at the start of the year from declining demand, and Micron Technology, Inc. (NASDAQ:MU) was no different. With the memory market set to recover by H2 2024 due to the production cuts across the industry, I believe Micron has a clear path towards recovery with its new HBM3 offering. While it was late for the party, the company has come up with a better product that will enable it to increase its market share.

Furthermore, the Cyberspace Administration of China’s (CAC) ban on Micron will only affect 50% of the company’s revenue from Chinese customers, which implies an 8% decline in revenues. While unfortunate, I don’t believe it is that big of a deal for the American semiconductor maker, as it focuses on improving its margins and getting the HBM3 Gen2 out to the market, which is why I’m giving Micron a buy rating.

Micron Financials

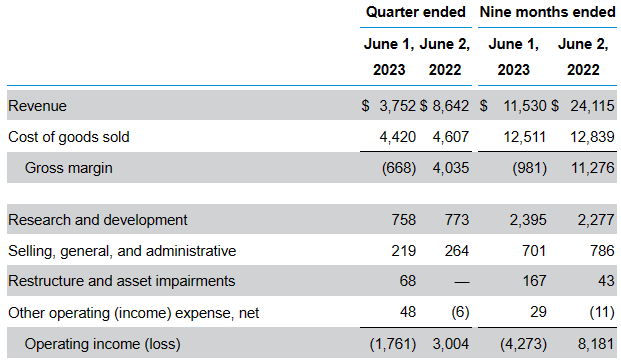

Micron ended Q3 2023 with $3.8 billion in revenue, representing a sequential increase of 3%, which could be the start of its recovery. The chip maker’s DRAM revenue made up 71% of its total revenues, which is slightly down from the 73% it made last year in the same period. The company has also seen improved sequential gross margins, from -30% to around -17%, which reinforces the management’s expectations to achieve positive margins again in the second half of FY ‘24.

Micron’s revenues, Q3 report

Additionally, its interest expenses were offset by its interest income, which has increased by 535% YoY.

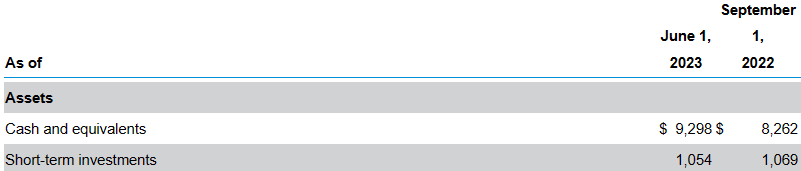

Micron’s interest income, Q3 report

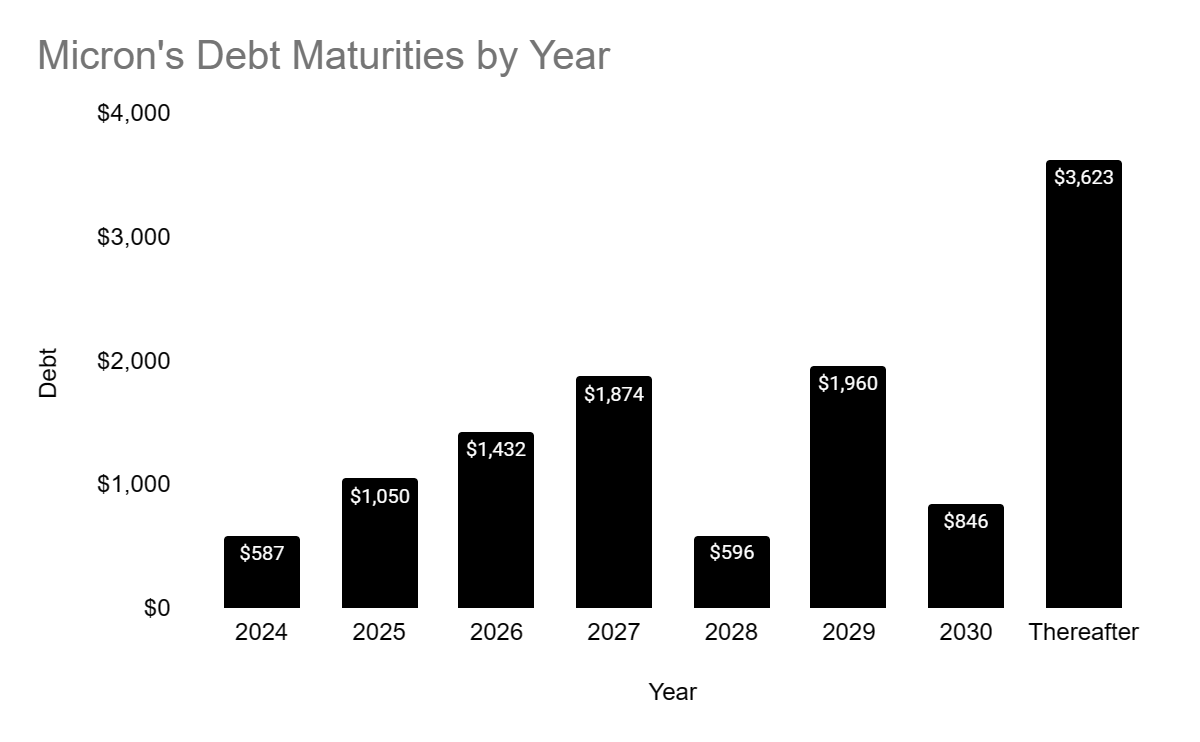

In Q3 2023, Micron increased its accumulated debt by around $1 billion, and its total debt is currently standing at $13 billion. Despite suffering from a high cash burn rate, which is forecast to be $7 billion in FY ‘23, I don’t think the debt will pose a problem for it as management expects to get its CapEx under $1 billion in Q4. That means it would have enough money to pay off its debt for the next two years even if it maintained its cash burn given its current cash position.

Micron’s cash balance, Q3 report

Furthermore, its debt maturities are stretched over multiple years, with maturities in 2041 and 2051 for example. That means that Micron can tackle debt maturities as they come and isn’t pressured to tackle the bulk of the debt in a single year, sacrificing growth to return to positive cash flow quicker.

Micron’s debt maturities by year, Q3 report

HBM Gen2 and Market Recovery

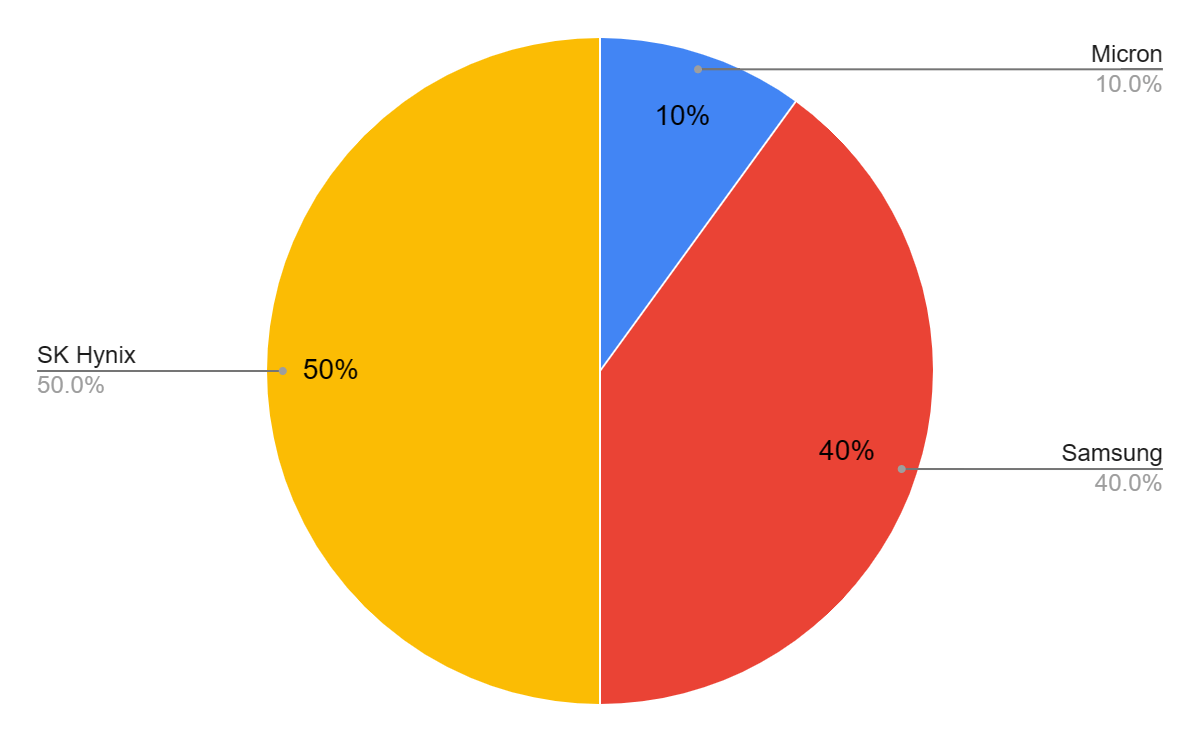

In July, Micron announced its HBM3 Gen2 offering after it had lagged behind its competitors, SK Hynix and Samsung (OTCPK:SSNLF), in terms of HBM3 offerings. Now the company is trying to win over Nvidia (NVDA), the biggest AI server maker, to use its HBM3 offering. While the company is late to the party, I don’t believe that will be a deciding point for Nvidia. Micron isn’t a small company that lacks the credentials, and even if it is late, it can still capture market share since HBM3 Gen2 is 2.5 times more efficient than other HBM3 solutions. Moreover, HBM3 Gen2 offers 50% more capacity and can reduce training time for large language models by 30%.

If Nvidia deems the product suitable for its AI servers, then it will probably choose Micron to be its future HBM3 module supplier, especially since both companies have a good relationship and have worked together on multiple projects before. Since Micron expects to begin ramping up its HBM3 Gen2 production at the start of 2024, I expect its revenue growth to pick up again and its margins to improve since HBM3 has a better gross margin than NAND products and is sold at triple the price of its current DRAM offerings.

Micron currently has only a 10% market share of the HBM market. While it may look disappointing at the moment, it also means that it should see a high growth rate in the future as it starts production of the HBM3 Gen2.

Companies’ earnings respectively

Putting aside the HBM market, the DRAM market is also expected to recover after all three major players, Micron, SK Hynix, and Samsung, cut their production to reduce supply and counter the memory price decline. The production cut will also enable the company to reduce its inventory to more acceptable levels, since it is currently too high and leads to unnecessary expenses.

Risks

While I believe Micron’s debt is manageable, it still poses a risk if it doesn’t generate positive cash flow in the next couple of years, since its current liquidity wouldn’t be enough to sustain cash burn and pay off its debt for a long time. Furthermore, Nvidia could decide to continue using SK Hynix’s HBM3 solution even if HBM3 Gen2 has better specs. If that were to happen, the company’s recovery would take longer, and it would probably lose more market share to both SK Hynix and Samsung, both in the HBM market and the DRAM market as a whole.

Conclusion

With all major DRAM producers cutting production, the memory market is set to recover in the second half of 2024 as demands start to ramp up again. Also, I don’t believe the CAC ban will affect Micron’s overall business by that much, and it can easily navigate the revenue loss it will suffer from it. I believe the company has a clear path to recovery with the announcement of its best in class HBM3 Gen2, which has extremely better margins than its current offerings, which is why I’m giving Micron a buy rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.