Summary:

- The macro environment is bad for Micron.

- Samsung’s production cut will be positive.

- While the longer-term outlook is solid, the upside in 2023 could be limited.

gorodenkoff

Article Thesis

The current fiscal year will likely be pretty bad for Micron Technology, Inc. (NASDAQ:MU). But the market is always forward-looking, and there are some signs that the issues in the memory market could be improving. Not too surprisingly, Micron stock has already recovered from the lows, and enthusiasm is building for the eventual recovery. That being said, the stock price is far from low considering that the near-term operational performance will likely not be strong.

Near-Term Problems And An Eventual Recovery

During the midst of the pandemic, consumers were staying at home and spent more of their time on their phones, PCs, notebooks, gaming consoles, and so on. At the same time, the working-from-home environment made many employees upgrade their work-related electronics equipment. Add near-zero interest rates that made it easier to finance purchases, and the environment was great for companies that are exposed to the sales of electronics (consumer) goods. Many chip companies, including Micron, benefitted from that trend, which is why Micron saw its revenues (on a trailing twelve months basis) soar to $32 billion.

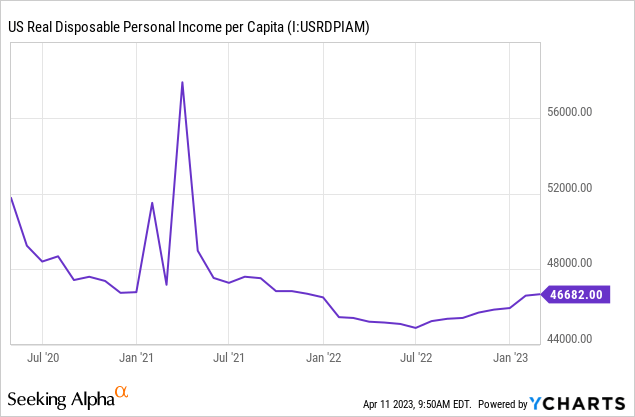

The good times didn’t last, however, as consumers have cut back on spending on new electronics due to two reasons. First, as many upgraded their equipment during the pandemic, replacement demand has temporarily waned. Second, since high inflation in essentials such as gasoline, food, energy, and shelter has pressured consumers’ ability to spend on non-essentials, demand for PCs and similar items has waned:

In the above chart, we see that real (i.e. inflation-adjusted) disposable personal income is down significantly from the highs seen during the pandemic when lower inflation and additional fiscal stimulus made for massive consumer spending power.

In the current environment, sales of PCs have been declining at a pretty sizeable pace. Seeking Alpha has just reported that global PC shipments were down 29% year over year during the first quarter, to 57 million, versus 80 million during the previous year’s period. That naturally results in lower memory demand, all else equal, which hurts DRAM producers such as Micron. Lower volumes aren’t the only headwind, however, as the weak demand environment also results in lower average prices per unit, which further pressures revenue and which hurts MU’s margins (and those of its peers).

These macro headwinds explain why Micron is forecasted to have a rather bad Q3 report when it reports its next quarterly results, while the company’s second quarter was rather bad already as well — the company lost $1.91 per share during the period, on revenues of just $3.7 billion. That revenue performance pencils out to $15 billion a year, which is less than half the peak seen during the pandemic.

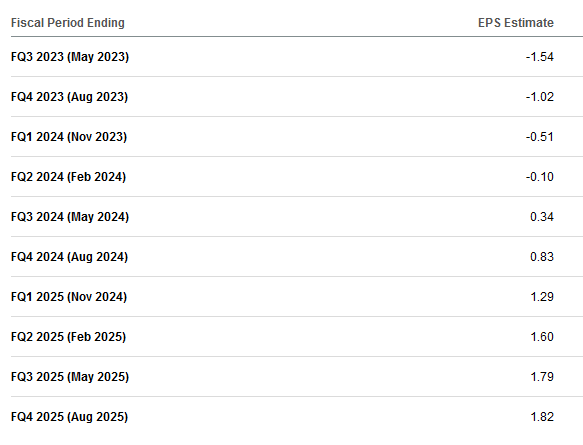

However, it is expected that things won’t remain this bad forever. In fact, Micron could experience a recovery a couple of quarters from now, at least according to Wall Street analysts:

Seeking Alpha

Current expectations see Micron reporting improving results on a quarter-to-quarter basis for the next ten quarters, although MU will continue to generate losses for the next couple of quarters. There are several factors at play that should help Micron improve its profitability over the next two years or so, but investors shouldn’t assume that the company will be highly profitable in the near term — after all, declining losses mean that results are improving, but they are still bad.

First, Micron will benefit from the fact that demand for PCs, notebooks, etc. should improve eventually. While consumers are cash-strapped right now while many of them also still own pretty new electronics that were bought in the recent past, that will not be the case forever. Inflation is still high but keeps declining, thus consumers could be in a better position in the not-too-distant future. At the same time, replacement demand should improve, as existing notebooks, PCs, and so on age, which should make more consumers buy a new product eventually. Some analysts see PC demand improving in the second half of the current year and in 2024, which seems realistic to me — although demand still won’t be at the ultra-high level seen during the pandemic.

Second, Micron should benefit from what one could call the benefits of the memory oligopoly. There is a small number of memory producers, and they generally aren’t interested in growing their market share at all costs. Instead, they are interested in keeping supply and demand in balance, which, in turn, should allow all members of the oligopoly to generate solid margins over the cycle while also keeping returns on capital at an appropriate level. Of course, the oligopoly can’t control demand, which is dependent on macro factors such as a potential recession or the pandemic, but the oligopoly can control supply in order to keep markets in balance. Micron shareholders got some positive news when it comes to this subject over the last couple of days: Peer Samsung (OTCPK:SSNLF) has announced that it will cut its memory output “meaningfully”. This move was driven by profit motives on Samsung’s side, as the company had generated below-average profits during the last couple of quarters. Reducing memory output in order to drive up average sales prices and margins is one way for Samsung to improve its profitability — and luckily, others such as Micron will benefit from that move as well. While we don’t know by how much Samsung will lower its production, it is pretty likely that they have decided on a production cut that will have a sizeable impact on the supply-demand situation, opting for a production cut that is not large enough to impact the situation would not make too much sense. The market liked this move by Samsung, and MU stock was among the winners from this announcement. Other members of the oligopoly have also made moves to improve the market situation, which includes capital expenditure cuts by Micron and SK Hynix.

Between these two factors, I believe that the current analyst forecasts of improving profitability are likely to come true — supply control and a normalizing PC and notebook demand level should result in improving pricing for memory which will positively influence Micron’s profitability.

What Is Micron’s Long-Term Outlook?

It will take some time for Micron to recover, but in the long run, the MU stock forecast isn’t bad. As one of the major memory producers, Micron benefits from market growth in several areas. While PC demand, laptop demand, etc. will likely not grow much, Micron is also exposed to other themes. Artificial intelligence, virtual reality, augmented reality, cloud computing, autonomous driving vehicles, and so on require massive computing power, and that, in turn, will be good for memory demand. Micron should benefit from that long-term demand growth, although it should be noted that results will likely always be cyclical due to ups and downs in demand in the short term.

Analysts believe that Micron’s earnings per share could climb to $7-$8 in fiscal 2026, which ends a little more than three years from now. If one were to put a 10x earnings multiple on that, MU stock could trade at $75, or a little less than 20% higher than today. That would make for mid-single-digit annual returns, with MU’s dividend adding another 0.7% per year. The longer-term return potential is thus solid, but not necessarily outstanding.

What Is MU’s Forecast For 2023?

While the longer-term forecast is very solid, it does not look like Micron will necessarily be a good investment this year. The company will generate substantial net losses, and cash flow will be weak. This, in turn, will limit Micron’s ability to return cash to its owners via buybacks.

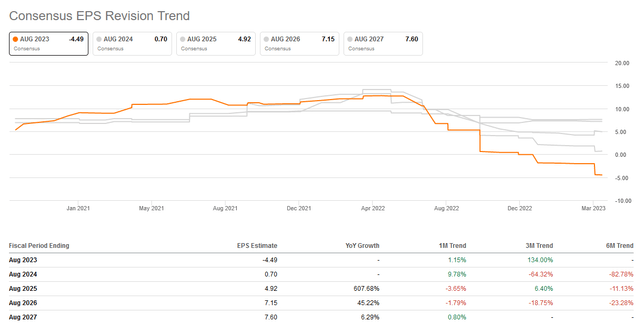

And yet, despite the unconvincing near-term picture, Micron’s shares have rallied quite a lot from their recent lows. Today, MU stock trades at $64, which is more than 30% above the lows from a couple of months ago. This was not really the result of an improving outlook, however:

We see that Micron’s earnings per share estimates have not improved from last fall. EPS estimates for the current fiscal year have gotten massively worse over the last couple of months, while EPS estimates for 2024 and 2025 are down to stable over the last half year or so. This does not really warrant a 30%+ rally, I believe, thus MU has become less attractive as it became more expensive. Wall Street has a price target of $69 right now, which implies a couple of percentage points of upside potential over the next 12 months. Some might argue that Wall Street price targets tend to be optimistic, but even if we disregard that, the upside potential doesn’t seem sufficient for a buy rating for MU stock today.

Takeaway

Micron has always been a volatile stock, and to some degree, this will hold true in the future as well. Micron is suffering from a bad macro environment today, which is why revenues will be down this year, which will cause Micron to report substantial losses. That being said, things should improve over time, and Samsung’s recent supply reduction announcement could bring balance to the market.

Micron stock has rallied in recent months, which limits its upside potential from here, I believe. While MU could generate solid returns over a multi-year time frame, upside potential in 2023 seems limited, and Micron’s dividend isn’t high enough to move the needle, either.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

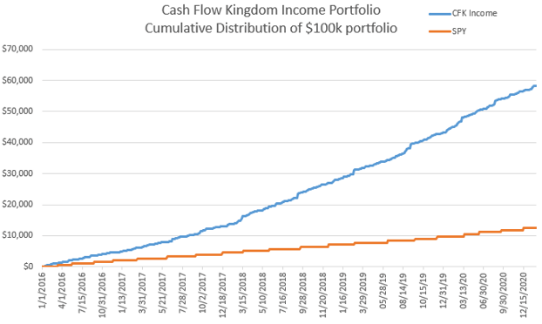

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!