Summary:

- Several super-investors (e.g., Mohnish Pabrai and Li Lu) that I closely follow are currently betting heavily on Micron Technology, Inc.

- This article explains why Micron Technology, Inc. stock’s hidden P/E approaches the magical 1x promoted by Pabrai.

- This article also uses their Micron holdings to illustrate the cornerstone of value investing: value-driven, infrequent bets, but concentrated bets.

baona/iStock via Getty Images

Thesis

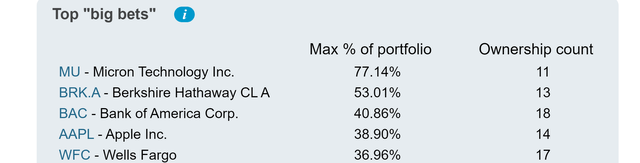

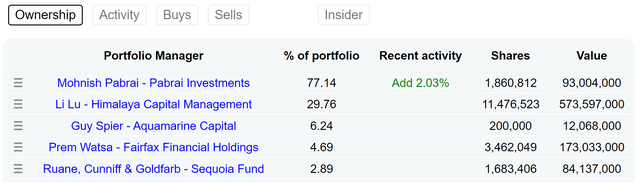

Micron Technology, Inc. (NASDAQ:MU) currently appears in the top spot of the top 10 “big bets” in super investors’ portfolios as seen in the first chart below. The chart shows the big bets along with the maximum percentage of the portfolio allocated to each. MU was owned by 11 super investors with a maximum allocation of 77.14%. All the rest of the spots were held by bigger and safer stocks like Berkshire Hathaway, Apple, et al. For example, the second spot was held by Berkshire Hathaway, with an ownership count of 13 and a maximum allocation of 53.01%.

It behooves us to ask why. Once you see the names of the super-investors who are betting heavily on MU, you will know why. The next chart provides information about the top 5 portfolio managers who are placing the heaviest bets on MU. As seen, the top 3 are Mohnish Pabrai (Pabrai Investments), Li Lu (Himalaya Capital Management), and Guy Spier (Aquamarine Capital).

I’ve studied and followed all three of them. More details of their style and my comments on their other picks can be found in my other SA articles. They are all successful value-driven investors who pushed valued investing to the extreme. They are all deep-value investors. For example, Pabrai is a big promoter of 1x P/E stocks, i.e., stocks with hidden P/E close to 1x (see his book, The Dhandho Investor, for more details. Highly recommended). Then once they find deep value, they bet heavily. They all like concentrated portfolios and only hold a few stocks in their portfolio. For example, Pabrai Investments holds a total of 4 stocks only and Li Lu’s Himalaya Capital holds a total of 5 stocks.

And clearly, MU is such a stock under current conditions. And in this article, I will explain why the stock’s hidden P/E, though not as low as 1x yet, is getting closer. My estimate of its hidden P/E is about 3x in 3 years.

MU’s P/E

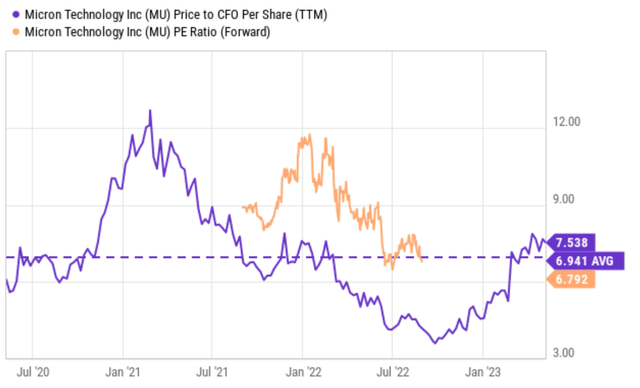

It is common knowledge that MU is currently trading with single-digit valuation multiples. As seen in the chart below, both its FW P/E and P/CFO (cash from operations) multiples are about 7x, far above the 1x P/E dream deal. Indeed, in today’s market, stocks with 1x P/E seem to have gone extinct after a prolonged period of bull run.

Although the secret sauce for successful investors lies in the interpretation of the “hidden” P/E. For example, the 1x P/E promoted by Pabrai is made possible by uncovering hidden assets and earnings potential. Take one of Pabrai’s most successful 1x PE picks, Fiat Chrysler, as an example:

Pabrai says when he bought Fiat Chrysler, it was trading at less than $5 a share and the company had forecast by 2018 it would be making about $5 a share. In 2016 it spun off Ferrari but including that it exceeded the forecast number. The PE of 1x materialized and the investment increased by 7 to 8 times in that time.

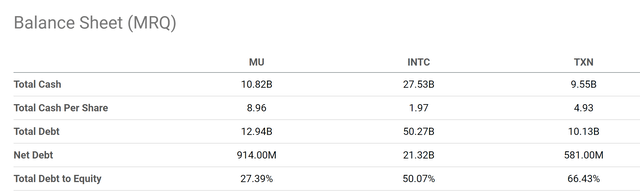

MU is currently in a similar situation. As illustrated in the second chart below, it holds a substantial amount of cash on its ledger: a total of $10.8B or almost $9 per share (or about 15% of its current stock price). If we compute its price-to-earnings ratio less cash, its P/E ratio decreases substantially to ~6x only.

Then next, we will see that it further approaches 1x when further hidden earnings are considered.

Source: Seeking Alpha data Source: Seeking Alpha data

Growth and Projected P/E

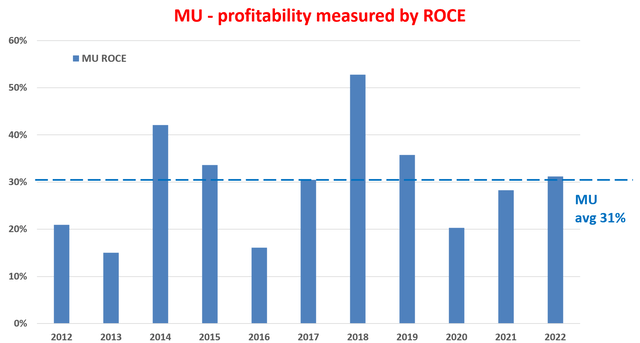

As detailed in my blog article, from a business owner’s perspective, the long-term growth rate (“LTR”) of earnings is ultimately governed by two factors: the return on capital employed (“ROCE”) and the so-called plow-back rate (aka, the reinvestment rate, RR). My results show that MU’s ROCE is about 31% on average (see the next chart below).

Source: Author based on Seeking Alpha data

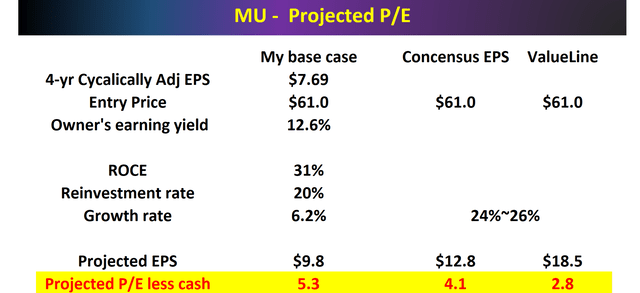

In terms of RR, MU has been sustaining a rate of 10% to 15% in recent years. Looking forward to the next few years, I project its effective RR to reach at least 20% due to the support from the CHIPS Act. As detailed in my earlier article, the CHIPS Act could effectively boost MU’s RR by providing subsidies for its domestic semiconductor manufacturing CAPEX projects, strengthening the domestic supply chain, and fostering R&D collaboration with universities and national labs. With a RR of 20%, its real growth rate (i.e., before inflation) would be around 6.2% (31% ROCE * 20% RR). My estimate of its cyclically adjusted EPS is around $7.7 (averaged over the past 4-years, about one business cycle). Under these assumptions, its projected P/E less cash would be about 5.3x in 3 years.

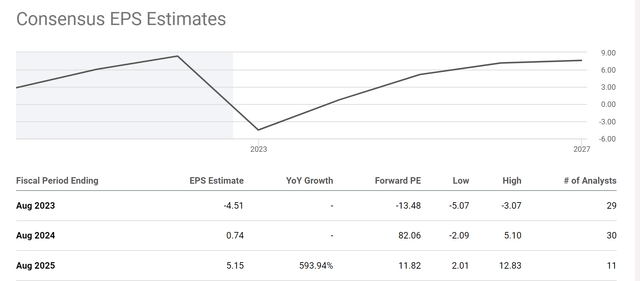

I consider my estimate to be a base case, as many other analysts project more bullish growth. For example, among the 11 analysts (see the second chart below) who provided forecasts for 2025, the high end of their estimate is an EPS of $12.8. And Value Line projects an EPS of $18.5 in the next ~3 years. These more bullish estimates imply growth rates in the range of 24% to 26% and protected P/E (less its current cash position) in the 2.8x to 4.1x range as seen.

Source: Author based on Seeking Alpha and ValueLine data Source: Seeking Alpha data

Risks and Final Thoughts

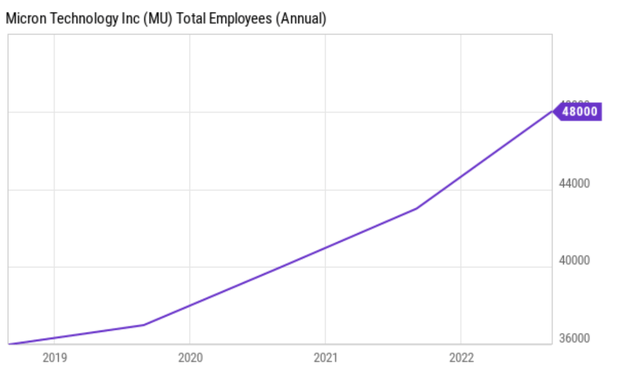

As a highly cyclical stock, Micron Technology, Inc. faces several risks. The company operates in a cyclical industry where supply and demand for memory chips can fluctuate greatly. And it is currently in the contracting phase of its business cycle. Micron’s financial results in recent quarters have shown a decline in revenue and profits due to factors such as lower demand for memory chips, oversupply in the market, and geopolitical uncertainties. Micron has a history of recovering from downturns and returning to growth in the past. And it currently holds plenty of liquidity as discussed. However, the length of the contracting phase is uncertain and can be prolonged. To add to the cyclical risks, Micron has overexpanded in recent years in my view. As seen in the chart below, the company has been on a hiring spree over the past few years. Its headcount increased by about 12k, or 1/3, from about 36k in 2019 to the current 48k. To put it another way, 1 in 4 of its current employees was added in the last 3~4 years.

Despite these risks, my conclusion is that Micron Technology, Inc. now represents a deep-value opportunity. The fact that it’s the top 1 “big bets” by super-investors exemplifies the gist of value investing. Make few and infrequent investments since fat pitches are rare. But once such a pitch is served, bet with concentration. And the thesis that MU is such a pitch under current conditions. Once it emerges from the current contraction cycle, its hidden P/E could be really close to the 1x dream deal.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.