Summary:

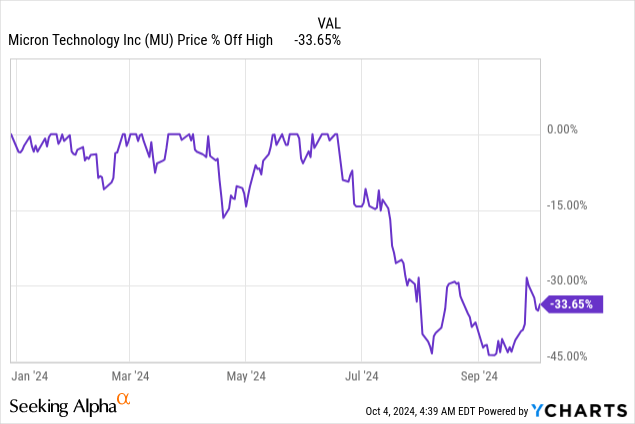

- I believe Micron is now undervalued after its 33.6% year-to-date dip off its highs, trading below its 10-year median EV/EBITDA on a forwarding basis.

- Strong Q4 performance driven by record revenues in NAND and Storage segments, with significant advancements in memory technologies like 1-beta DRAM and G8/G9 NAND.

- AI-driven demand and strategic investments in cutting-edge technologies are expected to sustain growth, despite industry cyclicality concerns.

- I understand the market’s perception of cyclicality and the reasons for the sell-off, but I don’t think they’re justified. I see growth potential of at least 15-20% from current levels.

- I therefore believe that the market is wrong in this case and that Micron Technology deserves a “Buy” rating.

vzphotos

Intro and Thesis

Micron Technology (NASDAQ:MU) is one of the major players in the memory and storage sector worldwide with a market cap of >$110 billion. According to Seeking Alpha’s description, MU produces fundamental components such as DRAM and SSDs for everything from phones and cloud servers to cars and industrial equipment, serving their clients through direct sales, distributors, and online platforms, offering their innovative solutions across the globe.

I’ve never covered Micron Technology stock before here on Seeking Alpha, and given the stock’s recent weakness (it’s down 33.6% off its high on a year-to-date basis) I decided to give my unbiased take on what’s happening and assess MU’s medium-term recovery chances.

From what I see today, MU’s decline can be explained by fundamentals on the one hand, but on the other hand, the dip seems to be exaggerated as the stock is trading at a discount to its 10-year median EV/EBITDA (on a forward basis). I therefore rate MU as a “Buy” today.

Why Do I Think So?

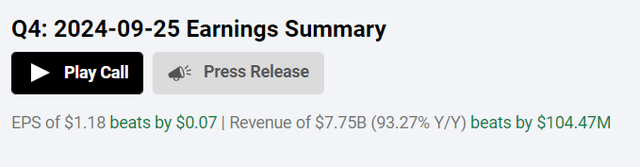

Micron Technology announced impressive financial results for its fiscal Q4 FY2024 in late September, with revenue of $7.75 billion, up 93% QoQ and 14% YoY – this outcome exceeded the consensus estimate of ~$7.63 billion and was in the upper quartile of management’s guidance. It generated a non-GAAP EPS of ~$1.18, up from a $1.07/share loss last year and $0.62/share profit last quarter, also topping the $1.13 consensus estimate:

Seeking Alpha, MU

Among the underlying factors for this strong performance in Q4 were record revenues in both the NAND and Storage segments. Non-GAAP gross margins improved over 30 percentage points vs. FY2023 as full-year revenue increased more than 60% YoY. And Micron’s dominance of new memory technologies like 1-beta DRAM and G8/G9 NAND was key to those successes. More than 80% of DRAM bits were produced on leading-edge nodes, and Micron seems to have led the industry in QLC NAND production, Argus Research analysts noted (proprietary source, September 2024), accounting for more than 20% of NAND bit production and shipments.

Micron’s drive to pursue cutting-edge technology translates into its FY2025 strategy with plans to increase the production of 1-gamma DRAM, EUV-lithography machines, and prepare for the production of next-gen NAND nodes at large. Back in April this year Micron signed a nonbinding preliminary memorandum of terms with the U.S. government for $6.1 billion in grants under the CHIPS and Science Act to aid in its memory growth in Idaho and New York. Its new plants are being built including a test-and-assemble unit in India and an upgrade at its back-end manufacturing site in China. Such steps should further support Micron’s global production capacity and competitive pricing, in my estimation.

So the moat under MU’s belt will likely fuel further business expansion in the next 1-2 years, bolstered by an expansion period for the industry triggered by generative AI hype. As the management noted during the earnings call, they’re preparing to respond to the growing demand for advanced memory solutions required by AI applications, which will infect data centers, AI PCs, and autonomous cars.

Based on those expectations, Micron made some important positive adjustments to its Q1 FY2025 guidance. Micron’s strong guidance for the November quarter now implies 12% sequential revenue growth and 300 bps of gross margin expansion – this aligns with the view that tight supply will likely fuel another year of strong growth in fiscal 2025 despite cyclicality concerns.

MU’s Q4 FY2024 press release

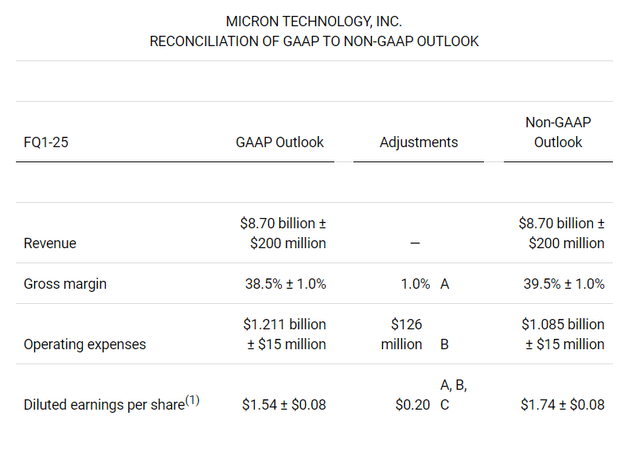

I attribute the recent behavior of Micron’s stock price to the inherent cyclicality of its industry. The market has grown more skeptical about Micron’s ability to navigate the business cycle effectively – this skepticism is evident in the stock’s recent trading patterns, particularly when examining key fundamentals like EBITDA and valuation metrics such as the EV/EBITDA multiple. As you can see in the below chart, despite the company’s growth prospects and efforts, Micron’s financials have not yet returned to pre-COVID levels (in terms of revenue and EBITDA), while at the same time, its valuation skyrocketed since 2023 quite sharply. No wonder this situation eventually led to a sharp dip from the previous highs.

TrendSpider Software, MU weekly, notes added

However, the current enthusiasm for artificial intelligence and strong demand for semiconductors is likely to sustain the upward cycle over the next 12-24 months, as I mentioned earlier. This outlook is supported by both market momentum and recent financials and corporate plans in the sector (and Micron in particular).

This is why I recommend evaluating the stock’s prospective growth not on the basis of the current trailing EV/EBITDA multiple, but with a forward-looking perspective for the next 1-2 years. So if you look at the forward EV/EBITDA multiple, you’ll notice that MU is priced to fall below 5x, which is about 15% below the 10-year median of 5.8x that Micron currently holds.

At the same time, as you can see, the multiple for calendar 2026 suggests that the situation won’t change significantly: For cyclicality reasons, the market still anticipates that Micron’s EBITDA in two years will be lower than next year. Consequently, MU’s EV/EBITDA 2026 multiple is expected to increase slightly, yet it will remain below the company’s 10-year median. Anyway, looking 12 months ahead, it looks like Micron has become undervalued indeed after the more than 30% fall in its stock price since the beginning of the year.

Moreover, the semiconductor industry‘s median EV/EBITDA (TTM) today is 16.86x (based on my Excel calculations), which is ~37% higher than MU’s TTM multiple (12.33x, YCharts data above) right now.

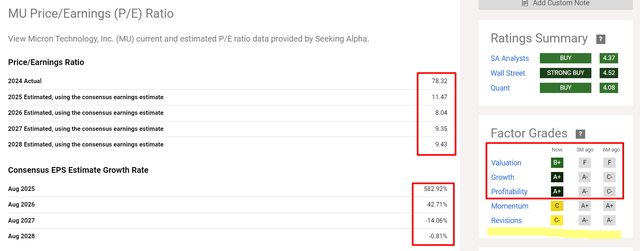

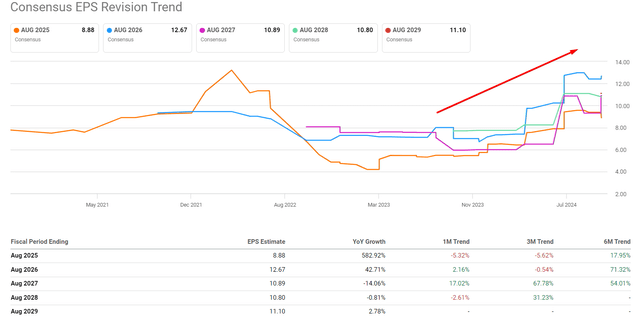

My interim conclusions are further supported by insights from Seeking Alpha’s Quant Rating. If we examine the recent dynamics of MU’s Factor Grades, we’ll see that Micron’s Valuation score has significantly improved after the stock lost a third of its market cap. Meanwhile, the Growth and Profitability grades have remained stable. What has notably changed is the Revisions of estimates by Wall Street analysts who have become more pessimistic about the company’s future EPS and revenue over the next few years. But a closer look reveals that the medium-term trend of these estimates is actually quite positive – while short-term expectations have been tempered, the overall outlook actually remains quite optimistic as far as I see it.

Seeking Alpha, MU, notes added

Seeking Alpha, MU, notes added

As we can see, even with the forecasted decline in EPS for the 2027 financial year, the expected figure should still allow the company to revert to levels below its historical averages in terms of the P/E ratio. This may indicate that, despite anticipated short-term challenges, Micron’s valuation could remain attractive relative to its historical norms, potentially offering a compelling opportunity for investors. So I believe it’s reasonable to anticipate a potential upside of at least 15-20% from the current stock price level – consequently, I’ve decided to assign a “Buy” rating to Micron Technology stock.

Where Can I Be Wrong?

Of course, my bullish thesis on Micron Technology today has several areas in which my gleaned assumptions may face significant risks.

First, there’s an inherent cyclical nature to the semiconductor sector. While I see strong demand fueled by AI and other technological innovation, historically volatility may result in ups and downs which may have a bigger impact on Micron’s revenue and profit than anticipated.

Second, much of my thesis will materialize in case Micron is successful in continuing to lead with cutting-edge products such as 1-gamma DRAM and NAND technologies. If competitors catch or exceed Micron, the market position and pricing influence of the company may fall, skewing my growth assumptions.

Third, while I believe the AI-induced demand will continue to drive growth, the possibility exists that it will be less than robust or swift. When AI is slowing or shifting in unexpected ways, the revenue- and stock-price boost Micron expects may prove short lived.

Fourth, while I’m not an expert in the technical analysis area, I’ve noticed that the MU stock price has fallen below its 200-day moving average. There’s a popular trading adage saying “nothing good happens below 200 MA.” So the recent attempt by the stock to rise above this line, followed by significant selling pressure (look at the volumes), could indicate a potential further decline in the stock’s price in the medium term:

TrendSpider Software, MU daily, notes added

The Bottom Line

I understand the market’s perception of cyclicality and the reasons for MU’s sell off, but I don’t think they are justified. The assumption about the company’s cyclical selling may overlook the strong demand coming from artificial intelligence, and it may also ignore the firm’s wide moat in its niche. Additionally, the company’s valuation is already below 10-year norms when looking at the forwarding EV/EBITDA multiples for the next 12-24 months. For this reason, I see a growth potential of at least 15-20% from current levels. If the company continues to surprise positively and exceeds analysts’ consensus forecasts, the potential upside could be even greater. I therefore believe that the market is wrong in this case and that Micron Technology deserves a “Buy” rating.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!