Summary:

- The bottom for Micron is in, but the hole is very deep. They will not climb out entirely until 2025.

- Their ballooning D&A is also making profitability difficult. They will likely report their third negative gross margin in a row next quarter.

- AI is a tailwind for them, but too small to make up for all the rest of what is going on.

vzphotos

The Bottom Is In, But The Hole Is Deep

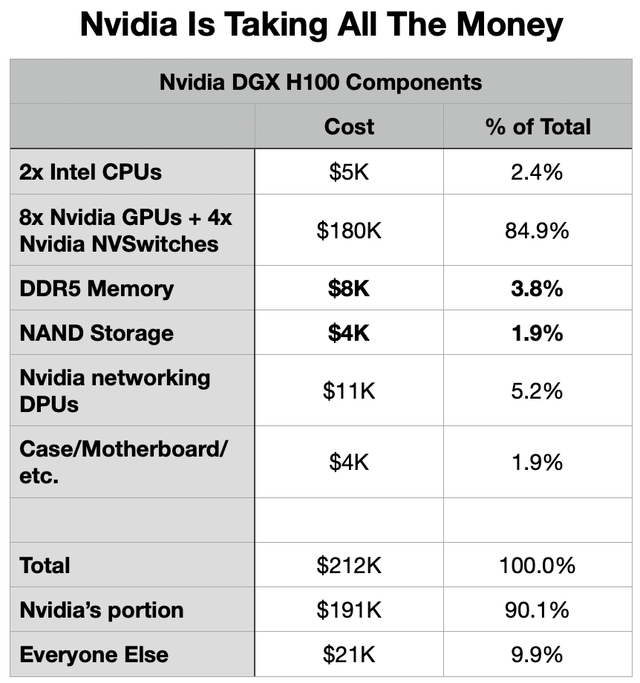

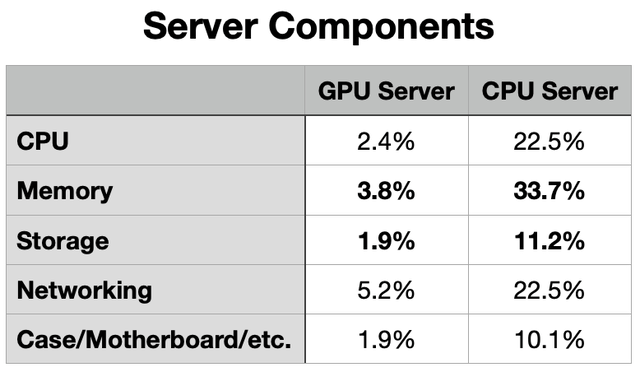

There is a lot of attention on the memory companies like Micron (NASDAQ:MU), the only US name in the group. The reason, as you may have already guessed, is AI. Let’s look at some estimated costs for the Nvidia DGX H100 AI server, the new gold standard for AI GPU servers:

Analyst estimates

I bolded memory and storage. Nvidia (NVDA) sources their DRAM from Micron and the NAND from Korean SK Hynix, but as you see, combined they are the second highest portion at 5.7%. There is also a total of 640 GB of very expensive SBM memory in the Nvidia GPUs, probably in the range of $6k-$8k, also from SK Hynix. Others will build AI servers with Micron memory and storage, that 5.7%.

A recent paper from the University of Washington estimated that Nvidia GPUs account for 98% of capital and operational costs for language model inference.

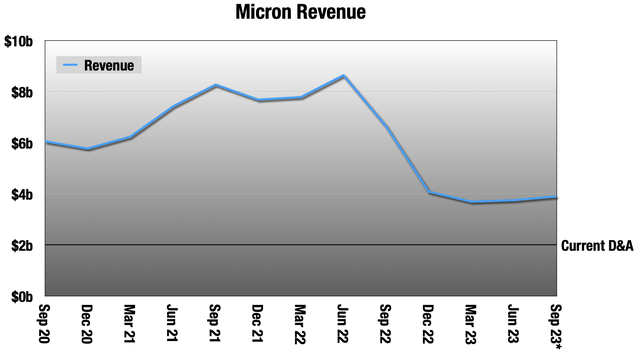

But this is one of the few places Micron is seeing decent demand off of a terrible previous quarter:

In data center, we saw strong sequential revenue growth in both cloud and enterprise in fiscal Q3, driven by some recovery from depressed sales levels in fiscal Q2. The recent acceleration in the adoption of generative AI is driving higher-than-expected industry demand for memory and storage for AI servers, while traditional server demand for mainstream data center applications continues to be lackluster.

– Micron Earnings Call, 6/28/23

But the PC and smartphone markets are just awful.

In PCs, we now forecast calendar 2023 PC unit volume to decline by a low double-digit percentage year over year, with PC units expected to be below the pre-COVID levels last seen in 2019…

In mobile, we now expect calendar 2023 smartphone unit volume to be down by a mid-single digit percentage year over year.

– Micron Earnings Call, 6/28/23

Investors are looking for AI-something-besides-Nvidia, because that valuation has already accounted for the gains from AI. But as you see, Nvidia is taking all the money and leaving scraps for everyone else. The memory companies are at least looking at the largest scrap.

Micron always gets a lot of attention. They are the only US-traded memory company. They also report a month ahead of most of the rest, so they have the stage to themselves. This is particularly important now, because the giant chip inventories we saw in H2 2022 were especially bad in memory.

These bullets from Micron’s presentation sort of sum up the state of the memory business right now:

- While the supply/demand balance is improving, due to the excess inventory, profitability and cash flow will remain extremely challenged for some time.

- We expect Micron’s year-on-year bit supply growth to be meaningfully negative for DRAM, and to produce fewer NAND bits in calendar 2023 than in calendar 2022.

Bit density in memory and storage is always increasing, so negative growth implies larger negative unit growth. Bit supply has to keep growing just to keep unit growth steady.

But, it looks like the very deep bottom is now in:

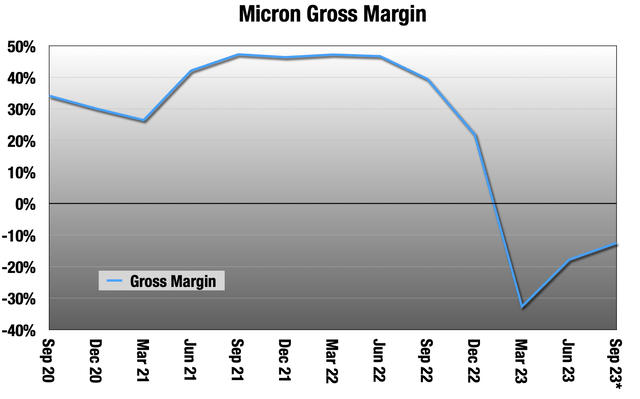

*Guidance midpoint (Micron guidance)

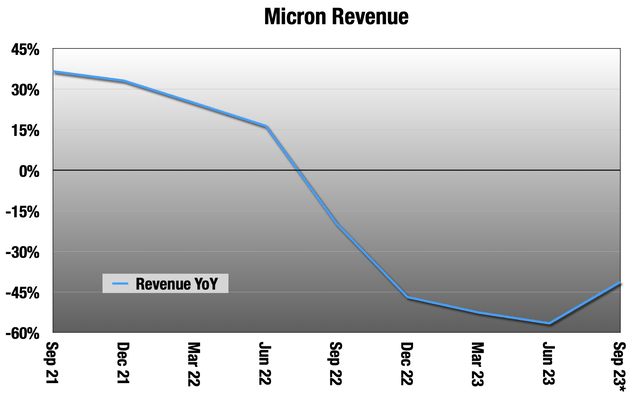

It looks like the March quarter was the bottom, but we hardly see them taking off. This is the worst memory downcycle in a couple of decades, and we are still looking at -41% YoY next quarter in the guidance midpoint:

*Guidance midpoint (Micron guidance)

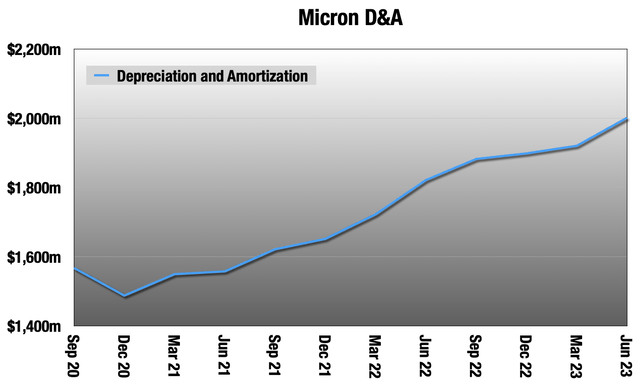

In the first chart, I put in a line at their current D&A, around $2 billion a quarter, how companies account for past Capex and acquisitions. As a result of that high D&A and poor demand, they will likely be looking at their third straight quarter of negative gross margin three months from now:

*Guidance midpoint (Micron guidance)

All these charts look like the same thing to me: the bottom is in, but the hole is very deep. This will not clear up until calendar 2024, and a full recovery not until 2025. Analysts on the call hammered them on this gross margin question.

Fixed Costs and Margin Leverage

That D&A line is concerning, because it is a big chunk of their revenue, 53% in the reported quarter, that never makes it farther down the operating statement. They cut back significantly on Capex this reported quarter and will continue into 2024 with that, but they have large plans, including a new $100 billion complex in upstate New York. This will keep pushing D&A up, and raising that floor for positive gross profit.

Micron earnings reports

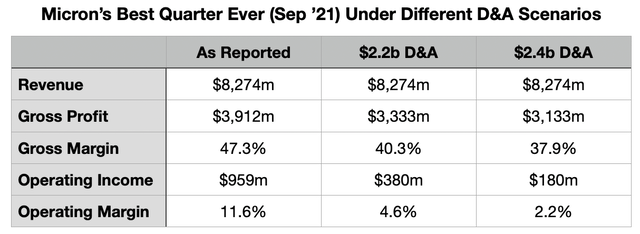

Because of those large fixed D&A costs, Micron is a very big leverage play, and their margins are very sensitive to changes in revenue. D&A will likely hit $2.2 billion in a year and $2.4 billion in two years. Let’s look at Micron’s best quarter ever, September 2021, with those quarterly D&A costs:

Micron reporting, analyst calculation

A year from now, if Micron can get revenue up 121% in the June 2024 quarter, they will still only have a 4.6% operating margin. But that’s not going to happen. Micron is now saying that memory will not fully recover until calendar 2025, when they will have more like $2.4 billion of D&A per quarter, dropping their operating margin in a record revenue quarter to 2.2%.

More headwinds:

- Still a few more months of high customer inventories. Outside of data center customers, it will not be normalized until the end of the year. But no more inventory write down for Micron themselves.

- Some smartphone vendors are taking advantage of the low prices right now and stocking up. That bodes ill for the recovery in 2024.

- They also have a large China headwind, with a national security warning on their products there. China represents about a quarter of their revenue, and they are now saying half of that is at risk.

The Cannibalization Scenario

There is also a possible cannibalization scenario that would be terrible for the data center hardware companies not named Nvidia. This is especially dangerous for the memory companies. For the price of one of those DGX H100 servers we were talking about, you can get 10 or more really great CPU servers. At some point, GPU compute growth may come to displace CPU compute growth. If capital budgets become more constrained, cloud and enterprise customers will have a choice to make.

If they choose GPU compute, this is very bad for the memory companies.

Analyst estimates

Memory and solid-state storage take over 40% of the component costs of a really powerful CPU data center server, but under 6% of a GPU server. If customers are choosing between column A and column B and opt for the GPUs, that math is especially bad for the memory companies.

The Upshot

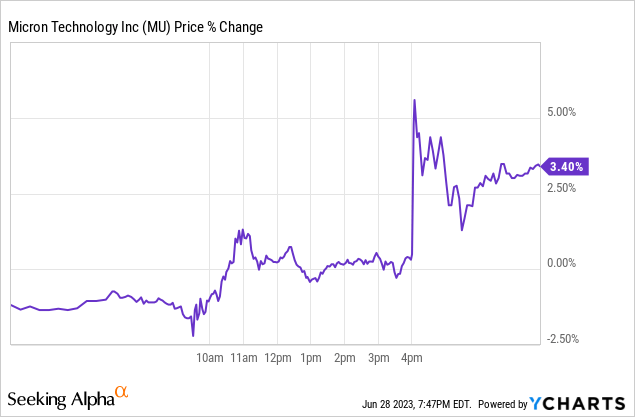

This looks to be the deepest and longest memory downcycle in at least a couple of decades. Micron jumped on the earnings release, because the quarter was not quite as bad as people expected.

Micron chart 6/28/23 (YCharts)

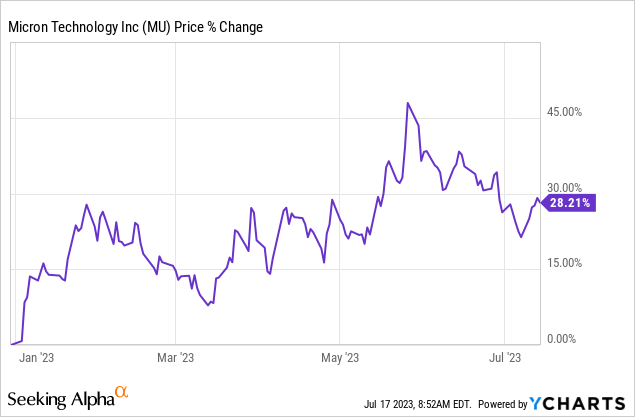

I’m going to sit this out at least until next earnings. I think people really jumped the gun in 2023 in Micron, not realizing how deep the hole is. Some of that froth is coming off now.

But cycles are exactly that, and this too will end. It’s just going to take longer than usual.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

At Long View Capital we follow the trends that are forging the future of business and society, and how investors can take advantage of those trends. Long View Capital provides deep dives written in plain English, looking into the most important issues in tech, regulation, and macroeconomics, with targeted portfolios to inform investor decision-making.

Risk is a fact of life, but not here. You can try Long View Capital free for two weeks. It’s like Costco free samples, except with deep dives and targeted portfolios instead of frozen pizza.