Summary:

- Micron Technology, Inc. reported its fiscal Q4 earnings after the market closed on Wednesday.

- Consumer demand remains weak in NAND and DRAM markets, but enterprise and HBM show growth.

- While improvements in bit shipments are not uniform, the current upcycle remains intact. HBM will offset weakness until consumer demand recovers.

Wiyada Arunwaikit/iStock via Getty Images

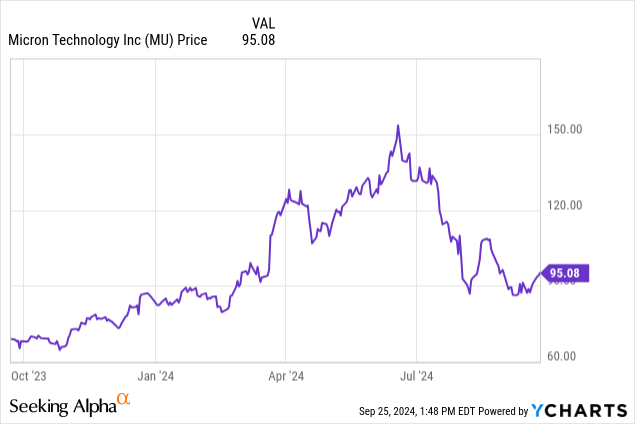

Micron Technology, Inc. (NASDAQ:MU) reported fiscal Q4 earnings after the close Wednesday to a positive reception, as the stock is up around 12% after hours. The company beat estimates on both revenue and EPS in what was envisioned as a major inflection point following a 40%+ sell off from 52-week highs and fears of a shortened memory upcycle loomed. Those results, paired with upbeat guidance that significantly beat estimates, seem to have allayed those fears.

Let’s begin with a quick recap of the results:

- Q4 revenue of $7.75 billion, which beat by $100 million and grew a whopping 93% YoY growth, and EPS of $1.18, which beat by $0.07 and is well above the -$1.07 Micron saw in Q4 2023.

- Guided for Q1 2025 revenue of $8.7 billion at the midpoint and EPS of $1.74, which also smashed estimates and represent major improvements over Q1 2024.

- Micron attributes the strong results to strength in high-bandwidth memory (HBM) and data center NAND sales.

This report comes at a pivotal time as analysts have been slashing price targets and downgrading the stock on fears that consumer memory demand might be waning at a time when the memory upcycle should be in full swing.

In an article I wrote last week, I argued that MU is a Strong Buy. This was based on expectations of a multi-year upward trend in DRAM and NAND demand, the ramp of a high-margin HBM for data center applications, and a depressed valuation offering a favorable risk-reward profile. That piece can be read here.

Regarding the earnings report, I mentioned last week that these were my main topics for investors to keep an eye on:

- Does Micron expect consumer DRAM and NAND demand to remain soft in FY2025 or for bit shipments to improve?

- Is HBM3E beginning to make a material impact on revenue, and how will it affect the bottom line and margins in FY2025?

- Are average selling prices (ASPs) continuing to improve despite volume uncertainty?

Analysts were expecting the answers to these questions to be bearish, and I was expecting them to be bullish. It appears the bulls have won this round. As expected, HBM and data center NAND shipments led the way in Q4, but Q1 2025 guidance was surprisingly upbeat in defiance of the myriad analyst downgrades. Micron’s Q1 guidance blew past estimates, indicating that the growth in HBM and NAND in the data center is more than offsetting any weakness in consumer NAND and DRAM demand, which further demonstrates that demand for AI infrastructure remains strong.

In fact, Micron said that Q4 saw record NAND revenue, with enterprise SSD sales crossing $1 billion in a quarter for the first time. As inventory for consumer memory clears, 2H2025 could see the return of increased bit shipments and higher ASPs across all of Micron’s offerings, which would lead to record earnings and continued margin expansion. ASPs appear to be holding firm as for the quarter, gross margin ballooned to 36.5%, a more than 800 bps sequential improvement, and with HBM becoming a larger part of the revenue mix in FY2025, we will only see this number increase. The company’s 39.5% midpoint gross margin guidance is evidence of that.

The company also generated $323 million in free cash flow despite major capital expenditures to build out production for the company’s sold out HBM3E capacity. As capex normalizes and the memory cycles really enters full swing, which I expect in 2H2025, I think we will see FCF ramp up significantly. Micron should be able to repurchase massive numbers of shares, like it did in the last upcycle. Typically, I’m not a huge fan of share repurchasing, but with a cyclical company like Micron, it makes at least a bit more sense to spend on that while the times are good, anticipating when the times get bad.

Overall, this report seems to show that many of the concerns over a shortened memory up cycle appear to be unfounded. DRAM and NAND demand in the data center remains robust, even while consumer demand remains somewhat muted. I expect this to reverse too as inventory clears. Margin expansion, a projected major increase in revenue and earnings for Q1, and strong enterprise demand demonstrate this cycle, and MU shares, still have plenty of room to run.

Investor Takeaway

Despite some softness in consumer memory demand, I expect this weakness to be transitory as the broader upcycle continues. Micron shares remain at a favorable valuation, and margin expansion and top and bottom-line growth are continuing their upward trajectory. NAND enterprise demand and HBM demand are solid, which will buoy the company as consumer inventory clears.

I continue to rate MU a Strong Buy.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.