Summary:

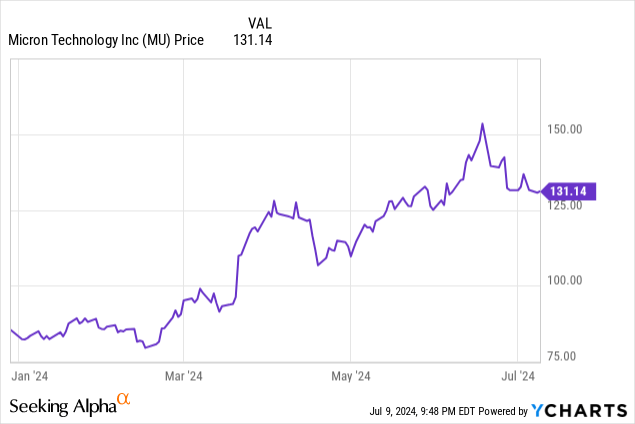

- Micron stock is up nearly 60% YTD, but a recent dip is presenting a buying opportunity.

- The company benefits not only from multi-year catalysts in AI investments, but also from an upcoming PC refresh cycle (stemming from the end of life of Windows 10).

- Memory prices are surging after a period of oversupply, and customers are securing bulk purchases in advance to hedge against future price increases.

- Micron still looks attractive at a forward P/E ratio below 14x.

JHVEPhoto

It’s no secret that chip stocks, including and especially NVIDIA (NVDA), have been among the best performers in the stock market all year. Memory hardware vendors like Micron (NASDAQ:MU) have benefited tremendously as well from the surge in investment into AI applications and datacenters, turning around a highly cyclical industry that has recently dealt with a glut of oversupply.

Year to date, Micron is up nearly 60%, though a recent dip has taken the stock into a technical correction from YTD highs above $150. For those who missed out on the earlier Micron upsurge, I believe this is an opportunity to buy in.

I’m putting a buy rating on Micron, despite its strong YTD rally. The main crux of my bull case for this stock is the fact that, though the major memory suppliers (Micron, Western Digital (WDC), and Korean rival SK Hynix) have typically gone through short boom-and-bust cycles in the memory industry governed by periods of tight supply and oversupply, the AI investment cycle is expected to be a multi-year investment cycle that will benefit memory prices for a sustained period of time.

But it’s not just enterprise investment into AI-ready datacenters that is fueling demand, either. As we’ll discuss in the next section, other end-markets are also benefiting from secular demand tailwinds that will benefit Micron’s trajectory.

All in all, while many AI-type plays may be speculative buys after this year’s rapid run-up, Micron still has plenty of steam left in its rally to go.

End markets are looking favorable for a number of reasons

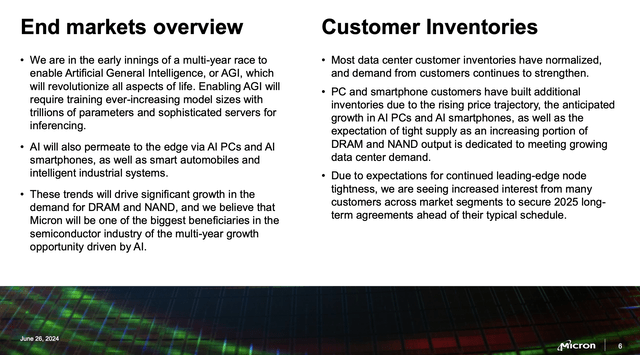

We don’t need to reiterate the number-one reason that customers are snapping up memory and other chips to invest in AI datacenters:

Micron market overview (Micron FQ3 earnings presentation)

But there are several smaller key points to emphasize here:

- AI will drive a multi-year investment cycle, especially as applications and use cases are still being figured out and customers continue to invest to meet adapting needs

- The impact of AI will be across devices, not just enterprise datacenters. Expected upgrades to PCs and mobile devices will also spur consumer upgrade cycles

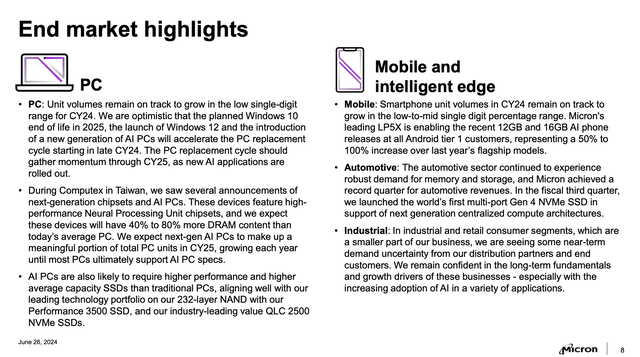

However, it’s also key to realize that AI is not the only factor driving strong memory demand at the moment. In particular, note that Windows 10 is reaching its end of life at the end of calendar 2025, which will render a lot of PCs useless and necessitate upgrades. Coinciding with the Windows 12 launch later this year, Micron is expecting significant PC upgraders between this year and next:

Micron PC and Mobile market overview (Micron FQ3 earnings presentation)

There are also secular tailwinds in the mobile and automotive spaces as well. In mobile, one of the biggest drivers to point out is that as cameras on phones continue to improve, and applications become more and more sophisticated and complex, file sizes will continue to swell: necessitating more NAND storage. And in automotive, as more cars roll out connected features and in-car displays and control centers, memory will also continue to be a core input.

Industry dynamics are pushing up prices and bolstering margins

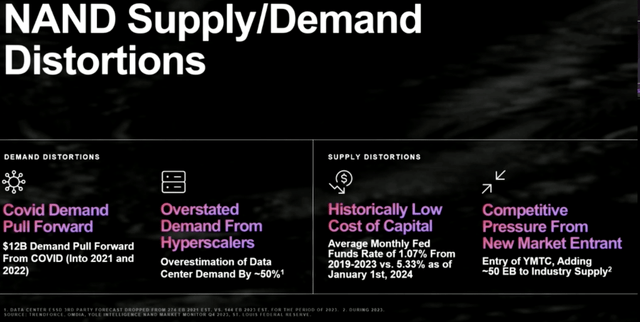

The view that the memory markets are in a multi-year upsurge isn’t just Micron’s house view, but rather an industry consensus.

We note that Western Digital just hosted a special investor conference titled the “New Era of NAND,” in which it cited that COVID pulled a lot of datacenter and device investment forward (leaving 2023 a barren year for memory suppliers), coupled with oversupply from the various memory suppliers as interest rates were very low (stimulating investment into capex).

NAND market dynamics (Western Digital “New Era of NAND” shareholder presentation)

Now, however, the supply/demand equation has changed. On the supply side, Micron notes that data center inventories have normalized, and we’ve already discussed all the tremendous demand drivers, including and especially AI.

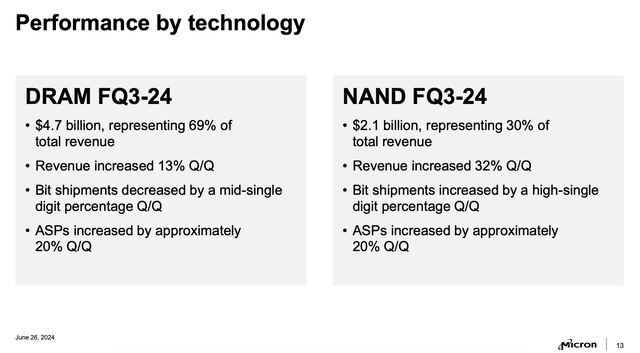

The net result of this is a sharp increase in memory pricing. As shown in Micron’s earnings summary by memory segment below from its most recent quarter (FQ3, which is the May-end quarter for Micron), ASPs for both DRAM and NAND jumped by “approximately 20%” sequentially versus FQ2:

Micron DRAM and NAND metrics (Micron FQ3 earnings presentation)

What’s more, the increase in pricing is making many customers nervous and prompting advance purchases of memory to try to get ahead of spot rate increases.

Per CEO Sanjay Mehrotra’s remarks on the recent Q3 earnings call (key points highlighted):

Most data center customer inventories have normalized, and demand from customers continues to strengthen. PC and smartphone customers have built additional inventories due to the rising price trajectory, the anticipated growth in AI PCs and AI smartphones, as well as the expectation of tight supply as an increasing portion of DRAM and NAND output is dedicated to meeting growing data center demand. Due to expectations for continued leading-edge node tightness, we are seeing increased interest from many customers across market segments to secure 2025 long-term agreements ahead of their typical schedule.

In data center, industry server unit shipments are expected to grow in the mid-to-high single digits in calendar 2024, driven by strong growth for AI servers and a return to modest growth for traditional servers. Micron is well positioned with our portfolio of HBM, D5, LP5, high-capacity DIMM, CXL, and data center SSD products.

Recently, our customers have announced their long-term AI server product roadmaps, with an annual cadence of new products with significantly improved capabilities for the next several years. Micron’s technology and product leadership puts us in an excellent position to support this growth.”

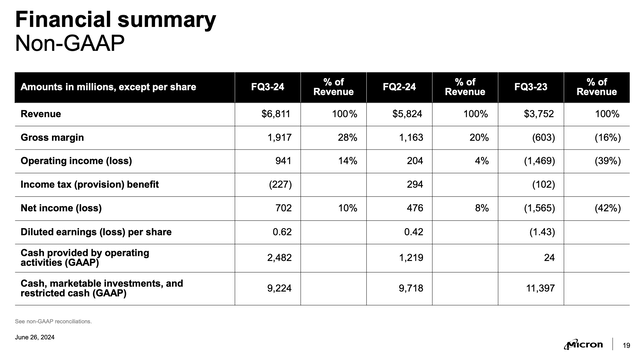

We don’t need to wait quarters into the future to see the impact on Micron’s results. In Q3, Micron’s gross margin jumped from -16% in the year-ago Q3 (a particularly sharp down cycle for memory vendors) to positive 28% (also improving eight point q/q, alongside the 20% sequential jump in DRAM and NAND ASPs per bit).

Micron FQ3 results (Micron FQ3 earnings presentation)

This, in turn, helped net income jump to $702 million, despite a loss twice that large in the year-ago quarter.

Valuation and key takeaways

Wall Street analysts are expecting Micron to generate pro forma EPS of $9.53 in FY25 (the year for Micron ending in August 2025), which is predicated on 54% y/y revenue growth to $38.6 billion (compared to 82% y/y growth in Micron’s most recent quarter, and consensus expectations for 91% growth in FQ4). This puts Micron’s valuation multiple at 13.7x FY25 P/E.

Micron and its peers have historically traded at valuation multiples that are at a discount to the broader market (in the low teens range) due to the short boom-and-bust nature of memory pricing: but as outlined above, there are a number of reasons to believe the benefits of AI and other end-market drivers may provoke a multi-year upcycle.

It is worth noting that Micron is trading at a premium to rival Western Digital at a ~10x forward P/E, but that premium is justified as Western Digital investors are waiting for clarity on an upcoming flash division spin-off to be finalized later this year.

All in all, I believe Micron to be an attractive buy under a ~15x P/E ratio. Take advantage of this dip as a buying opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.