Summary:

- Micron’s revenue has dropped by 26% over the last year.

- Despite a big write-off of $1.4 billion, Micron’s inventory is still 50% higher than last year.

- The quant rating has gone from a Strong Buy to a Hold in the last 9 months while analysts have done the exact opposite.

hapabapa

Micron Technology, Inc. (NASDAQ:MU) released its second quarter earnings for FY 2023 on March 28, 2023. Those results were not pretty as Micron reported a loss of $1.91. But the bad news didn’t stop there, it also projected losses for the next quarter of between $1.51 and $1.65 per share.

That puts MU’s total return (including dividends) for the last 12 months at a negative 14% compared to the S&P 500 (SPY) loss of 6%.

Seeking Alpha

The question for investors at this point in time is if this is a reasonable investment return or whether investors should be on the lookout for better performance going forward.

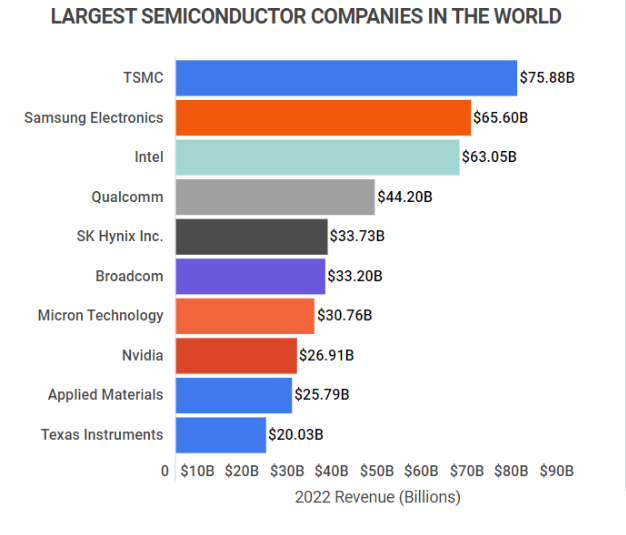

Micron is the seventh largest semiconductor company in the world by revenue.

zippia.com

In this article, we will look at Micron’s prospects for the next year to try and determine the price direction out to 2024 as compared to the last year.

MU Stock Key Metrics

Let’s look at Micron’s financial metrics comparing the latest TTM (Trailing Twelve Months) with the previous year. As might be guessed there are some pretty bad comparisons.

I use the financial metrics to discover what I consider to be positive investment numbers (Yellow boxes) and compare them with any negative investment numbers (Orange).

Seeking Alpha and author

One quick look at the financial metrics table above comparing 2022 to 2023 shows what I consider to be serious problems in results for Micron over that time period.

Micron’s price (Line 1) has decreased by only 14% over the last 12 months despite a decrease in Revenue (Line 2) of 26%. Gross Margin (Line 4) is also significantly lower, down 57% since last year. This would imply serious pricing concerns and/or operational inefficiencies over that one-year time period.

Enterprise Value (Line 7) decreased by only 9% although revenue was down 26%. That may imply a higher market price than deserved.

Also, FCF (Line 15) is $7 billion less this year than last.

Perhaps the most worrisome indicator of all is outstanding Inventory (Line 19) which sits 50% higher than last year even after a $1.43 billion write-down this quarter. If the business doesn’t pick up significantly in the coming quarter will there be another big billion-dollar inventory write-down?

The one glimmer of good news is Micron’s dividend (line 18) more than doubled, but still sits at under 1%.

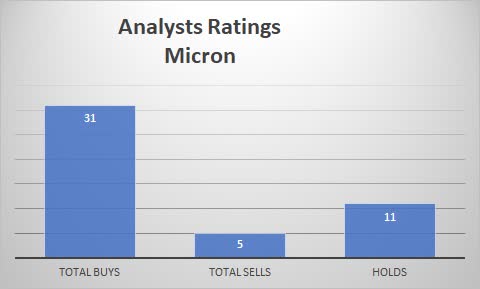

What Do Analysts Think?

Wall Street and Seeking Alpha analysts are very positive on Micron with 31 Buys versus only five Sells. And interestingly 19 of those Buy recommendations are Strong Buys, a very high number.

Seeking Alpha and author

The quant rating was very positive on Micron last summer with a Strong Buy rating over most of that time period. However, since July 2022, the rating has been a consistent Hold on Micron.

So analysts are where the quant rating was a year ago.

Seeking Alpha

The quant rating is considerably less enthused about buying Micron compared to analysts.

How Does Micron Compare To Other Semi-conductor Stocks?

A legitimate question when looking at any stock is to compare its potential with other stocks in the same market sector. If we look at Micron’s performance over the last year and compare it to other large market-value stocks in the semiconductor sector, we can see Micron has performed poorly compared to the others with a total return (including dividends) of minus 13%.

In the following chart, we compare Micron’s performance with Intel (INTC), AMD (AMD), Nvidia (NVDA), and Broadcom (AVGO). Only bruised and battered Intel has performed worse than Micron.

Seeking Alpha

Another good comparison is with the iShares Semiconductor ETF (SOXX) which includes all the major semiconductor stocks in one ETF.

Seeking Alpha

In this case, SOXX has outperformed MU by 13% over the last year.

It is easy to see once again that Micron has not performed as well as the semiconductor sector in general over the last 12 months.

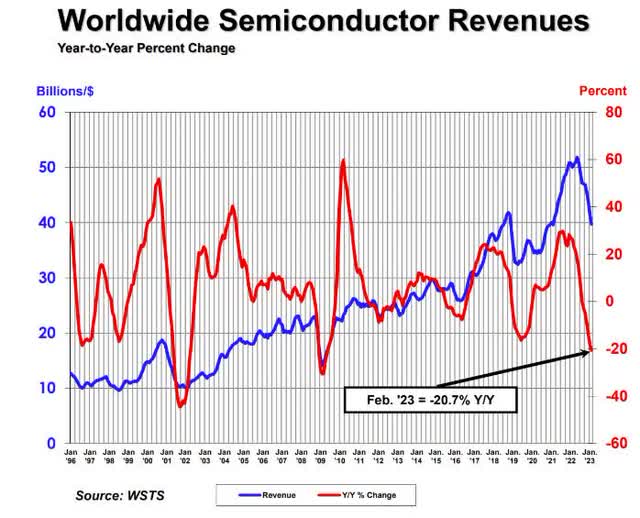

The other looming issue is whether semiconductor revenue, in general, is done falling yet.

The following chart says maybe not.

WSTS

Is MU Stock A Buy, Sell, or Hold?

Obviously, there are risks with a Micron investment. For example, if semiconductor sales continue to be muted through the end of 2023, Micron shares will almost certainly go lower. Add to those risks the risk of a recession within the next year or so and you may have a precarious investment environment.

UBS reports weak IT spending may have impacted chips. Why would April or May be any different?

And the biggest chip manufacturer in the world, Samsung, just announced it was cutting back on chip production.

Also, the big inventory overhang is a concern at least for the next quarter.

In addition, the big drop in enthusiasm in the quant rating which went from Strong Buy last July to Hold ever since makes one wonder what will make the rating for Micron’s performance change those ratings to a Buy.

Considering the poor performance relative to competitors, the possibility of a weak sales environment, and the Hold rating on the quant rating, I rate Micron a Sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.