Summary:

- Micron expects negative DRAM and flat NAND growth in 2023 in contrast to Samsung and SK hynix, which see positive growth for both.

- Although Micron is the DRAM and NAND technology leader, bit shipments of its memory chips were negative in the past quarter, which underperformed peers.

- Inventory oversupply at PC/smartphone customers is now intensifying in datacenters and industrial sectors of memory chips with only automotive chips secure so far.

mikkelwilliam

With both Samsung Electronics (OTCPK:SSNLF) and SK hynix reporting Q4 earnings in the past week following Micron’s (NASDAQ:MU) F1Q2023 earnings a month earlier, this article analyzes DRAM and NAND results for each company, and presents their capex strategies as they address the oversupply of memory chips amidst continued macro headwinds coupled with a risk of recession in 2023.

In my Semiconductor Deep Dive Marketplace newsletter I report on both DRAM and NAND. In this abridged version, I discuss just DRAMs.

DRAM Metrics

Micron CEO Sanjay Mehrotra reported in its earnings call:

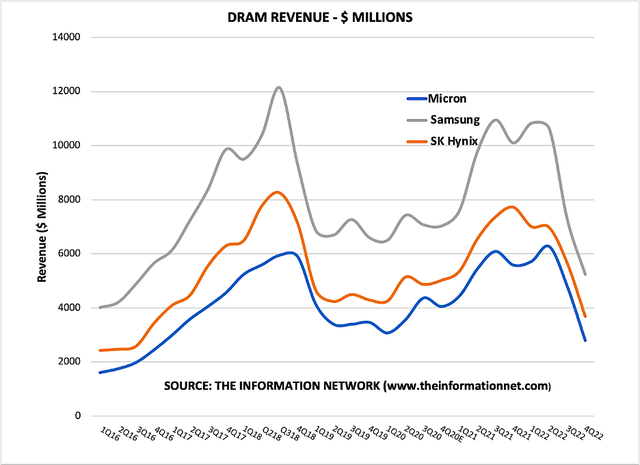

Fiscal Q1 DRAM revenue was $2.8 billion, representing 69% of total revenue. This represents approximately a 40% reduction year-on-year and Micron expects fiscal 2023 WFE to be down more than 50% year-on-year.

Samsung reported in its Q4 2022 earnings call:

For DRAM, in the fourth quarter, its bit growth increased by a percentage in the high single digits and ASP declined by a percentage in the early 30% range. For the first quarter of 2023, the company expects market bit growth to decrease by a low single-digit percentage and bit growth should be similar.

SK hynix cautioned in its Q4 2022 earnings call that the chip industry downturn, the worst in over a decade, that it expects it will deepen further in the next few months. SK hynix managed to increase high-capacity DRAM shipments for the server and PC markets during 2022, while boosting sales of DDR5 and HBM products, as datacenter SSD chips, shipments more than quadrupled YoY.

The Information Network

Chart 1

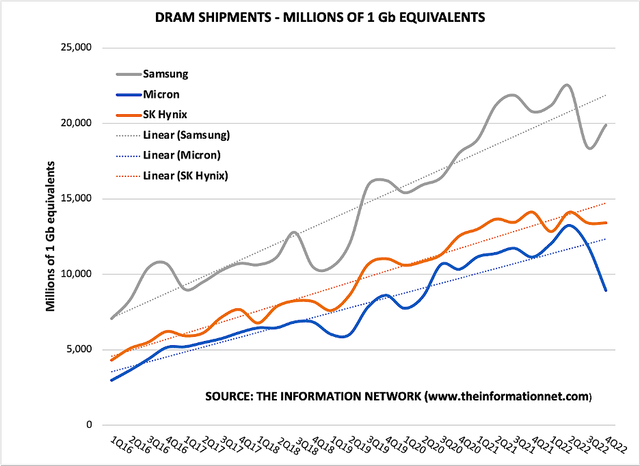

Chart 2 shows DRAM bit shipments, which I want to address because Micron exhibited a drop in bit shipments in the past quarter while competitors did not. Not only that, but Micron stated in its recent Fiscal Q1 2023 Earnings Call prepared remarks that:

“We believe that negative year-on-year calendar 2023 industry DRAM bit supply growth and flattish year-on-year calendar 2023 industry NAND bit supply growth will accelerate this recovery.”

But Micron is making an effort to reduce bit supply by noting:

“Second, we have reduced near-term bit supply through a sharp reduction in wafer starts. As we have previously announced, we reduced wafer starts for DRAM and NAND by approximately 20%. Through a combination of these actions, we expect our calendar 2023 production bit growth to be negative in DRAM and up only slightly in NAND.”

In contrast, Samsung’s increased by a percentage in the high single digits.

Micron’s strategy is the direct opposite of Samsung, which feels near-term growth will restart in 2H 2023 provided inventory is depleted in 1H2023. As a result, Samsung expects a recovery in 2H2023 and is keeping capex high for near-and-long-term growth.

SK hynix reported a DRAM bit shipments were flat QoQ in 4Q22. In Q1’23 sees a double digit % decrease. Nevertheless, for 2023, hynix expects DRAM shipments to be +Low Teen% YoY.

The Information Network

Chart 2

Company Capex Metrics

Micron

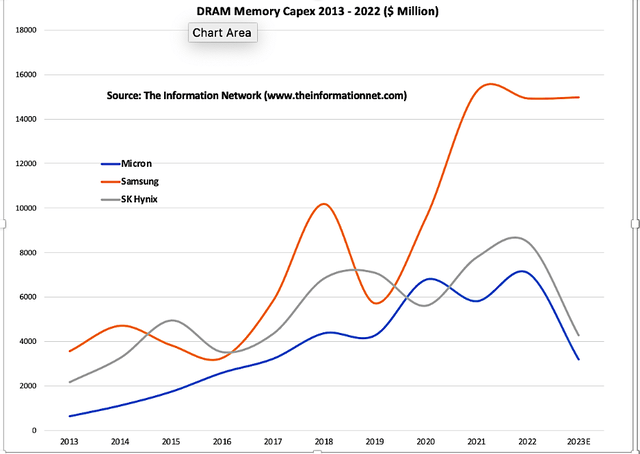

Micron is reducing its capex investments to reduce bit supply growth in 2023 and 2024. Fiscal 2023 capex is being lowered to a range between $7 billion to $7.5 billion from the earlier $8 billion target and the $12 billion level in fiscal year 2022. This represents approximately a 40% reduction year-on-year and we expect fiscal 2023 WFE to be down more than 50% year-on-year.

Samsung

Samsung in its Q4 2022 earnings call noted its strategy that instead of cutting investment in response to slowing demand and falling prices, Samsung would curb short-term production organically through line maintenance, equipment adjustment and moving to advanced chipmaking processes.

Memory capex has concentrated on preparations for advanced technologies, which included investing in P3 and P4 infrastructure to provide readiness for mid- to long-term bit supply as well as in EUV to further bolster future competitiveness.

This year’s capex plan is expected to be similar to previous years. Samsung has said it has no plans to cut investment despite reporting a 97% plunge in its chip operating profit for the October-December period.

SK hynix

The company said it will reduce its shipment volume by a double-digit figure for DRAM in the first quarter of 2023 compared to that of 2022.

In order to do so, SK hynix announced in October that it will more than halve its capex compared with 19 trillion won in 2022. However, investments for mass production of mainstream products such as DDR5, LPDDR5, and HMB3 and markets with growth potential will be continued.

The Information Network

Chart 3

Investor Takeaway

Driven by a mix of skyrocketing consumer demand followed by pandemic supply constraints, the traditionally cyclical memory industry moved along a new cycle that started in Q1 2021 and ended in Q2 2022. The downturn was amplified by a 40-year high inflation rate and recessionary fears that dampened demand primarily for consumer electronic products.

Memory prices are dropping due to a slowdown in shipments of consumer electronics products such as PCs and smartphones. As demand decreases memory chips aren’t sold, inventory builds up, and spot prices decrease.

To counter oversupply and high inventory, memory companies have talked about plans to reduce capex spend (combination of construction and equipment). Significant capex cuts on memory expansion by Micron and SK hynix will negatively impact Applied Materials (AMAT) and Lam Research (LRCX), according to our report entitled “Global Semiconductor Equipment: Markets, Market Shares, Market Forecasts.”

One of the factors that may hurt the memory market is Samsung’s resistance to cut back on DRAM spend. This may appear unusual because Samsung in its earnings call outlook for 2023, the company noted that in 2022, the industry’s overall inventory level increased due to the lowest ever demand bit growth.

But Samsung’s approach in 2023 is to continue to make the infrastructure investments that are necessary to respond to mid- to long-term demand. And so, Samsung feels near-term growth will restart in 2H 2023 provided inventory is depleted in 1H2023. In summary, Samsung expects a recovery in 2H2023 and is keeping capex high for near-and-long-term growth.

Bit shipment outlook is vastly different by company:

- In addition, Samsung reported positive bit shipment growth in DRAM in 2022, as shown above in Chart 2 as DRAM capex actually dropped from $15.2 billion in 2021 to $14.9 billion in 2022.

- SK hynix for 2023 expects DRAM shipments to be +Low Teen% YoY.

- Micron expects a negative YoY industry DRAM bit supply growth.

An important consideration for Samsung and SK hynix are their fabs in China, which are under U.S. sanctions. U.S. sanctions are imposed on Korean memory companies Samsung Electronics and SK hynix, with a one-year waiver to keep upgrading their fabs in China before they will not be permitted to purchase advanced equipment. These two memory companies must weigh spending capex money on upgrading their China fabs in light of uncertain sanctions.

Samsung’s and SK hynix’s fabs in China produce a substantial portion of the global 3D NAND and DRAM supply. Samsung makes some 40% of its 3D NAND chips in China, whereas SK hynix produces around 40% of its DRAMs.

Although Samsung and SK hynix expect a recovery in 2H 2023, I’m in agreement with Micron that a recovery won’t happen until 2024. I discussed my thesis in a Sept. 8, 2022, Seeking Alpha article entitled “Micron: Memory Chips Won’t Recover Until 2024,” which provides more data metrics for the reader.

At this point, I have a Hold on Micron, and concur with Seeking Alpha’s Quant rating of a Hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This free article presents my analysis of this semiconductor sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk free 2 week trial now.