Summary:

- Excessive capex spending in memory chips has led to inventory problems and a sharp downturn is expected.

- The much-anticipated recovery in consumer PCs and smartphones will not happen until 2024 as demand is pushed out.

- I expect Micron to report a decrease in NAND revenues of 47.2% YoY and DRAM.

BING-JHEN HONG/iStock Editorial via Getty Images

There are two significant reasons for the downturn in the memory market – the capex/WFE overspend in 2020 and 2021, and the ensuing macroeconomic issues impacting consumer discretionary spending.

Currently, the smartphone market continues to underperform, dropping 5% YoY in 2023. Even worse, I expect global PC sales to drop 17% in 2023.

The much-anticipated recovery in these consumer products will not happen in 2023. These issues will hold off recovery in the memory market despite the rise in AI.

There’s a significant amount of commonality among the three principal memory companies – Micron (NASDAQ:MU), Samsung (OTCPK:SSNLF), and SK Hynix (OTC:HXSCL).

Micron announces its fiscal Q4 2023 earnings on Sept. 27. Because of this commonality, in this article, I used some of the results coming from Korean competitors Samsung and SK Hynix as a basis to attempt to project Micron’s financials in the upcoming earnings call.

Cause of the Memory Crash

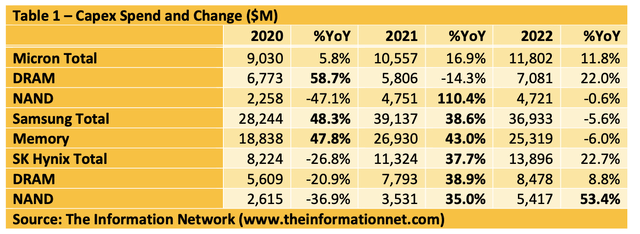

An example of commonality is the large level of capex spend by the three companies between 2020 and 2022, as shown in Table 1. In bold, I highlight the excessive capex spend for these companies. This was the basis of my warning to readers that there would be a substantial drop in equipment revenues in 2023 due to excess capex spend in 2020 and 2021 in my June 25, 2021, Seeking Alpha article entitled “Applied Materials: Tracking A Likely Semiconductor Equipment Meltdown In 2023.” I argued that the excess capex spend on equipment would result in an excess supply of chips.

Micron has reacted by scaling back capex spend in 2023. In the company’s prepared remarks for its Q3 2023 earnings call, Micron’s CEO noted:

“Our fiscal 2023 capex plan of $7 billion is down more than 40% from last year, with wafer fab equipment (WFE) down more than 50%. We continue to expect fiscal 2024 WFE to be down year on year.”

The large capex in 2020 and 2021 led to the downturn in memory chips that started in 2022, several months sooner than my initial prediction because of COVID lockdowns in China and because of the dour economy in which consumers spend money on food and gasoline during 15% inflation instead of purchasing consumer electronics products like PCs and smartphones utilizing memory chips.

Now a year after the memory market went into its downturn, the macroeconomics have changed, but the outlook is still poor. Inflation has dropped from 15% to 3.7%, but food items are rising on top of huge increases in the past year. To make matters worse, fuel prices are rising again, U.S. college loans are starting to be paid back, and credit card and auto loan defaults are at a 10-year high.

Estimating Micron’s Q4 Results by Memory Exports from Korea

Having established the commonality of metrics, I endeavor to estimate Micron’s financials based on memory exports from South Korea. Samsung and SK Hynix are the two dominant memory companies in Korea, and semiconductor is Korea’s largest export item. Memory chips were 57.1% of total semiconductor exports in 2022.

By country, Korea shipped 55% of all its semiconductor exports to China in 2022, followed by 12% to Vietnam, 9% to Taiwan, and 7% to the US, according to the Bank of Korea. More than 60% of Korean chips were applied to smartphones and data center servers. The chief reason for Korea’s chip export slump is the declining chip demand from China.

In the first 20 days of September, chip exports fell 14.1% over the same period, continuing the downward streak after falling for 13 consecutive months through last month. The drop in exports follows data for August, in which semiconductor exports diminished by 20.6% over the year to $8.56 billion.

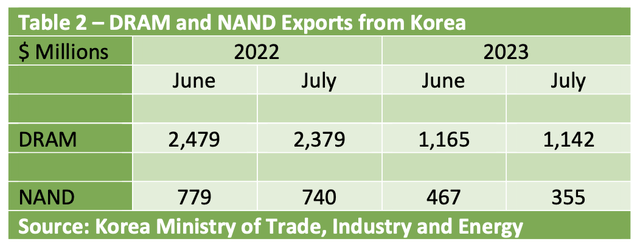

In the month of July, exports of DRAM amounted to $1.14 billion, marking a YoY decline of 52% and a MoM decrease of 2%. This compares to the previous months of May and June, which saw declines of 52% and 53% year-on-year, respectively. Interestingly, the pricing per unit for DRAM increased by 7% MoM in July, a notable uptick compared to the 1% increase observed in June.

For NAND Flash, exports for the month of July amounted to $355 million, reflecting a YoY decrease of 52% and a MoM decline of 24%. In comparison, May and June witnessed YoY drops of 54% and 40%, respectively. Also in July, there was a 7% MoM increase in pricing per unit for NAND Flash, a notable improvement compared to the 12% decrease observed in the previous month.

Table 2 illustrates the continuous drop in DRAM and NAND exports between June 2022 and July 2023.

Investor Takeaway

Micron’s DRAM and NAND Revenues and ASPs Analysis

From Table 2 above, DRAM and NAND exports from Korea are down by 50% for June and July, which are two months into Micron’s current quarter.

For NAND, I estimate an increase of just 0.1% QoQ for Q4, to $1.020 billion from $1.013 billion in Q3. But on a YoY basis, I expect NAND revenues to decrease 47.2% from $4.801 billion in Q4 2022.

The main reason for this growth is the announcement by Samsung that it has stepped up NAND flash production cuts and has reduced NAND production by about 40%. This is on top of Samsung’s 20% cut in the first half of 2023.

In Q3, Micron reported ASPs (average selling prices) for NAND decreased 16% QoQ. With cuts from Samsung, I anticipate NAND ASP growth will moderate to -5% in Q4.

Conversely, I estimate Micron’s DRAM ASPs, which exhibited a -10% QoQ change in Q3, will grow 2% QoQ in Q4 on strong DDR5 demand. Micron has achieved notable advancements in cell size and bit density in its DDR5 technology compared to Samsung and SK Hynix. As a result, Micron’s DDR5 die size measures a compact 66.26 mm2, which is smaller than Samsung’s 73.58 mm2 and SK Hynix’s 75.21 MM2 counterparts. Micron had introduced its DDR5 based on its 1z process with a 40% greater memory density compared to 1y for competitors.

For DRAM, I estimate an increase in revenues of 2.3% QoQ, meaning an increase from $2.672 billion in Q3 2023 to $2.733 billion in Q4. But on a YoY basis, I expect DRAM revenues to decrease 39.7% from $1.692 billion in Q4 2022.

These DRAM and NAND revenues are consistent with the decrease in revenues shown in Table 2 above.

Impact on Late Start and Lack of Appreciable Market Share in HBM

But as I mentioned above, Micron has two factors that limit its performance compared to its Korean competitors and the data in Table 2 – Lack of an appreciable share of the HBM (High Bandwidth Memory) market and Chinese imposed sanctions.

There’s growing anticipation of a substantial uptick in demand for AI semiconductors, primarily fueled by Nvidia (NVDA). This heightened demand stems from the expansion of the generative AI sector, which is projected to result in a notable increase in the need for high-performance memory, specifically HBM for generative AI like ChatGPT.

Moving beyond Q4 2023 in DRAM, I expect continued headwinds in the HBM as it competes against SK Hynix and its strong competitiveness in high-value-added products such as DDR5 and HBM chips, which positions it favorably for achieving accelerated improvements in both ASP and bit growth when compared to its competitors Micron and Samsung for the current year.

Remarkably, SK Hynix holds the unique distinction of being the sole company globally engaged in mass-producing HBM3, with exclusive supply arrangements to NVIDIA for the H100 Tensor Core GPU. Anticipated sales of HBM chips are set to experience a substantial 45% year-on-year surge in 2023, followed by a notable 40% year-on-year increase in 2024. These developments are poised to be a strong headwind for Micron.

Micron has boasted it will gain better performance with its 1α-based HBM3 Gen2 products. Specifically, Micron has emphasized that their HBM3 Gen2 is anticipated to outpace SK Hynix’s HBM3E by approximately 15%, noting a robust data rate of 9.2 GT/s in contrast to SK Hynix’s 8 GT/s offering.

Possible Tailwind as DDR5 DRAM Ramps

I also note that the market penetration rate of DDR5 is anticipated to surge from 1% in 4Q 2022 to a noteworthy 40% in 1H 2024. Additionally, SK Hynix is actively preparing for the adoption of next-generation 1b nanometer process technology, building upon its successful production of 1a nanometer-class chips. Consequently, SK Hynix’s leadership in the DDR5 market is expected to remain unchallenged through the year 2024.

Headwind from China’s Sanctions Against Micron

On May 21, 2023, The Cyberspace Administration of China (“CAC”) said Micron had failed to pass a cybersecurity review. The Chinese regulator’s decision came seven weeks after it kicked off a cybersecurity review of Micron’s products.

Micron said in a June 16, 2023 8-K filing, referencing the ongoing review by China’s Cybersecurity Administration over its products in the country.

“We now believe that approximately half of that China HQ customer revenue, which equates to a low-double-digit percentage of Micron’s worldwide revenue, is now at risk of being impacted.”

Micron’s initial estimate range of low-single-digit to high-single-digit impact. It updated that estimate to the high-single digit percent range. This new estimate represents about 50% of Micron’s revenue from customers headquartered in mainland China and Hong Kong, which it has disclosed are about 25% of total sales.

Last year Micron generated 11% of its $30.8 billion in revenue from China selling DRAM, NAND flash memory, and solid-state drives.

I also expect Micron’s revenue and EPS to further decline YoY due to China’s Cybersecurity Administration’s continuing investigation into its devices. Amid what is often referred to as the “Huawei Shock,” where the company introduced its Mate 60 Pro smartphone featuring a 7-nanometer semiconductor, the United States may be adopting a stricter stance towards China.

Reiterating my Sell Rating on Micron

With recovery in consumer discretionary products pushed out until 2024 and Micron’s late entry and hence small market share in the HBM market, I maintain a Sell on Micron.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk-free 2-week trial now.