Summary:

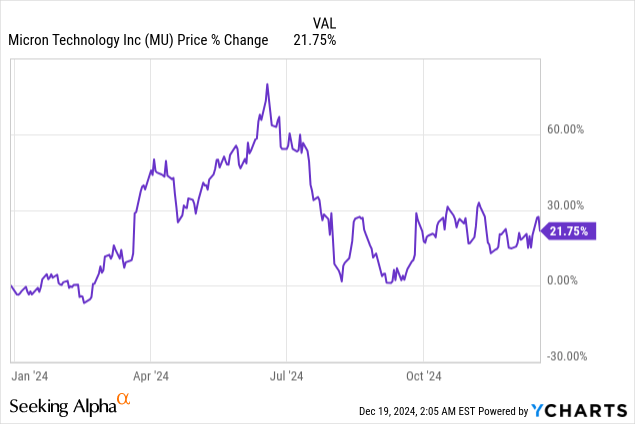

- Micron Technology reported better than expected fiscal Q1 ’25 earnings, but issued weak Q2 ’25 guidance, causing a 16% share drop in extended trading.

- Despite the guidance, Micron’s HBM3E memory solutions are driving results, with DRAM revenue growing 87% Y/Y.

- Micron’s valuation draw-down presents an attractive investment opportunity, especially given the expected HBM shipment ramp into FY 2026.

- Micron expanded its short-term HBM total addressable market prediction to $30B, indicating overall strong demand for new high-bandwidth memory solutions.

- The main risk is a potential decline in AI-related spending, which could impact HBM3E shipments and margins.

shih-wei

Micron Technology, Inc. (NASDAQ:MU) reported better than expected fiscal Q1 earnings for its first fiscal quarter of FY 2025 on Wednesday. However, the memory manufacturer issued a weak guidance for the second fiscal quarter as well… which caused shares to crash 16% in extended trading. Further, Micron saw a sequential 9 PP revenue deceleration, which stirred up investors.

Nonetheless, Micron is seeing strong demand for HBM3E memory solutions, which resulted in the memory maker updating its TAM forecast. I believe Micron’s HBM3E shipment ramp continues to make shares highly attractive, and the valuation is now even lower than it was before the Wednesday’s slump!

Previous rating

I rated shares of Micron a strong buy — Why Micron Could Double Its Valuation — at the beginning of December. Then, I expected a strong earnings scorecard and stronger guidance for the second fiscal quarter. However, Micron expanded its expectation for total addressable market, or TAM, expansion, and the memory maker continues to expect a full HBM3E ramp into FY 2026, creating a long-term catalyst for growth. Margins are expected to remain in the high-30s percent range, which is a positive. With Micron’s shares dropping below $100 on heavy volume in extended trading on Wednesday, I believe investors are dealing with a unique buying opportunity.

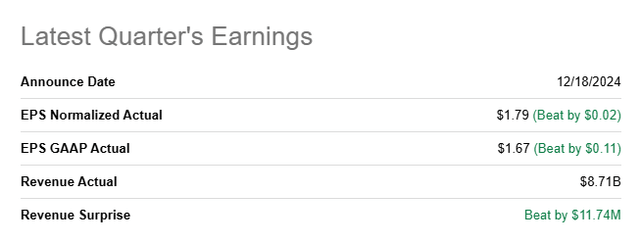

Micron crushes Q1 ’25 earnings

Micron beat top and bottom-line estimates on Wednesday, which I expected, given the company’s very bullish guidance for its Q1’25 quarter in terms of both revenue and gross margins. Micron earned $1.79 per-share in adjusted earnings per-share, which beat the average prediction by $0.02 per-share. Further, Micron’s revenues came in at $8.71B, beating the consensus prediction by $12M.

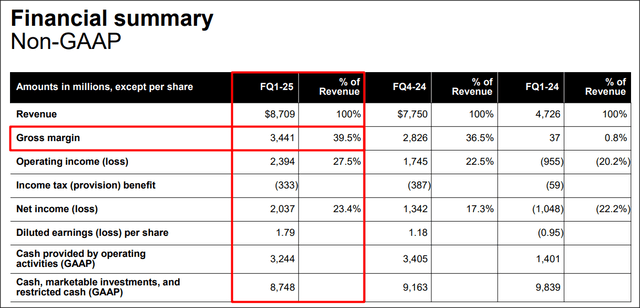

Micron had a very successful quarter in Q1 ’25 which saw a massive increase in the company’s top line, chiefly due to growing demand for high-bandwidth memory products. Micron generated $8.7B in revenue in Q1 ’25, showing 84% year-over-year growth. However, Micron’s top-line results were not as strong as in the previous quarter, which is when the memory maker almost doubled its revenue base compared to the year-earlier period (+93% Y/Y). Nonetheless, Micron made considerable revenue gains, which were mainly driven by an acceleration in the DRAM category. Micron’s gross margin in Q1 ’25 came in at 39.5% which bet the company’s mid-point guidance exactly.

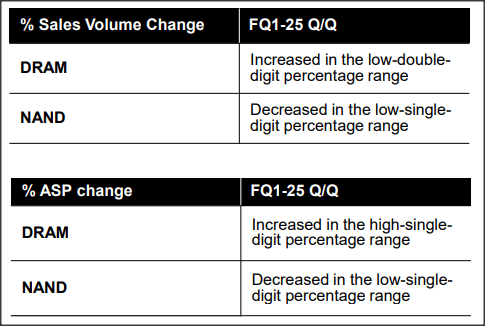

DRAM represented 73% of consolidated revenue for the company in the first fiscal quarter. DRAM-related revenue increased 20% Q/Q and 87% Y/Y due to strong demand for the company’s HBM products, especially HBM3E. DRAM therefore benefited from both volume and rising average selling prices (high-single digits range) in the last quarter and the outlook here, for both volume and price growth, is favorable. This is because Micron sees continual demand strength for high-bandwidth memory solutions and raised its outlook for the total addressable HBM market (FY 2025) to $30B (+5B Y/Y compared to previous projection). On the other hand, Micron’s NAND-related revenues, which made up 27% of consolidated revenues in Q1 ’25, fell 5% Q/Q, to $2.2B, but revenue rose 82% Y/Y.

Micron

Micron’s guidance for Q2 ’25

The main reason why shares of the memory and storage company slumped in extended trading on Wednesday, which pulled the entire semiconductor sector down as well, was the guidance for Q2 ’25. Micron is looking for total revenues of $7.9B +/- $200M, which implies a year-over-year growth rate of 36%. The figure missed consensus estimates of $9.0B by a considerable margin, raising concerns about the resilience of AI-related investment spending. However, Micron’s simultaneous TAM expansion and volume/price improvements in the DRAM segment strongly indicate that investors should stay positive on Micron’s longer-term prospects for growth, especially in the HBM segment.

Micron’s valuation

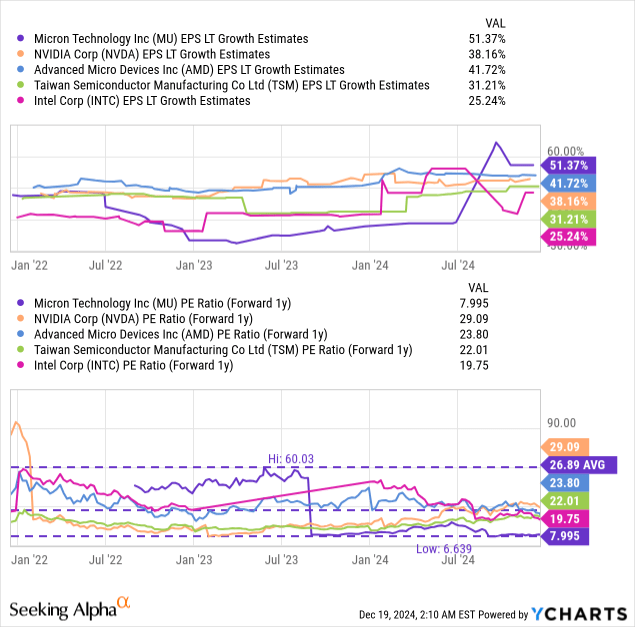

Micron’s valuation reflects the cyclicality of the company’s underlying earnings profile. As a semiconductor company operating in the volatile memory and storage market, Micron’s earnings have been all over the place in the last several years. Micron lost money in what can only be described as a terrible FY 2023, but staged a significant comeback in the last fiscal year, riding a wave of accelerating spending on AI products that need high-bandwidth memory solutions to function.

Micron’s shares are valued at a forward price-to-earnings ratio of 8.0X which is significantly (70%) below the longer term (3-year) average P/E ratio of 26.8X. Nvidia (NVDA), Advanced Micro Devices (AMD) and Taiwan Semiconductor Manufacturing (TSM) all trade at significantly higher earnings multipliers. The industry group average P/E ratio in the semiconductor industry group is currently 20X, and Micron’s valuation is one of the reasons why I continue to see shares as one of the most attractively priced. Even Intel (INTC) with its numerous problems and struggling core business is trading at a much higher valuation than Micron.

In my last work on Micron, I made the claim that I saw potential for the memory maker to double its valuation… which I continue to believe, although it may take the company longer to achieve this. My last calculation revealed a fair value of Micron’s shares of $191 per-share and a fair value P/E ratio of ~15X, which I view as a reasonable multiplier. While investors reacted very negatively to the company’s Q2 ’25 guidance, Micron is still expected to offer investors one of the fastest EPS growth rates going forward (50%+) in the years ahead. For those reasons, strong expected EPS growth and a low valuation, I confirm my long-term price target for Micron at $191 per-share.

Risks with Micron

The biggest risk for Micron is a potential decline in AI-related spending in the Data Center sector. As Micron’s memory products, especially its HBM3E solutions, are needed alongside GPUs, a pullback in AI/Data Center spending may pose a considerable challenge for Micron. In large part, this is because HMB3E margins have been accretive to the company’s DRAM segment margins. In other words, a contraction in spending on AI chips is likely going to lead to lower HBM3E shipments as well as growing margin pressure for the semiconductor company.

Closing thoughts

The positives in Micron’s Q1 ’25 earnings scorecard still exceeded the negatives, in my opinion. Specifically, I liked Micron’s DRAM-related revenue growth, which was driven by both higher average selling prices and higher volume shipments (due to HBM) and high gross margins. The guidance for Q2 ’25 was not as great as expected, but it still signified considerable growth in the company’s revenue. What appeals to me the most about Micron is the company’s attractive valuation and undeserved pullback after earnings, as I believe HBM continues to represent a solid long-term investment opportunity. With Micron also increasing its short-term TAM guidance for high-bandwidth memory products and average DRAM prices still increasing, I believe the risk profile is a lot better than investors think.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, NVDA, AMD, TSM, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.