Summary:

- Micron is a highly cyclical stock that could be headed for a prolonged upcycle on data center demand.

- The stock fell 20% on light guidance; however, management is probably setting up a “beat and raise” scenario.

- Here’s why I bought the recent dip.

JHVEPhoto

The boom in artificial intelligence (AI) has stocks like Microsoft (MSFT) and Nvidia (NVDA) exploding to new highs and nosebleed valuations. The same can be said for many semiconductor stocks, like Arm Holdings (ARM), which trades at 58 times sales (48 times on a forward basis). The demand for data centers and computing power is intense.

Here are some facts about data centers:

- Statista forecasts that Data center global sales will grow from $344 billion this year to $440 billion in 2028.

- Hyperscale data centers house over 5,000 servers and 10,000 sq feet; many have over 1 million sq feet. For instance, Meta’s (META) Prineville, Oregon center checks in at 4.5 million sq. ft.

- Hyperscalers like Amazon (AMZN), Microsoft, Alphabet (GOOG)(GOOGL), and Meta plan to spend billions constructing new massive facilities in the next few years.

Data centers desperately require memory, specifically High Bandwidth Memory (HBM). Enter Micron (NASDAQ:MU) into the equation, a name synonymous with memory.

What does Micron do?

In a nutshell, Micron provides memory solutions, specifically Dynamic Random Access Memory (DRAM) and flash memory or NAND.

- DRAM is the primary working memory for servers, PCs, and other devices. It stores data temporarily while the system is on.

- NAND retains data when a device is powered off. For instance, flash drives and Smartphones use NAND memory to retain data.

Micron’s products are critical to smartphones, PCs, automotive, and other industries. Under the DRAM umbrella is HBM, which is widely used in data centers where DRAM chips are stacked on top of each other to increase processing power and efficiency.

You can see by the end markets why Micron is a cyclical stock. AI is driving an upcycle now.

What happened?

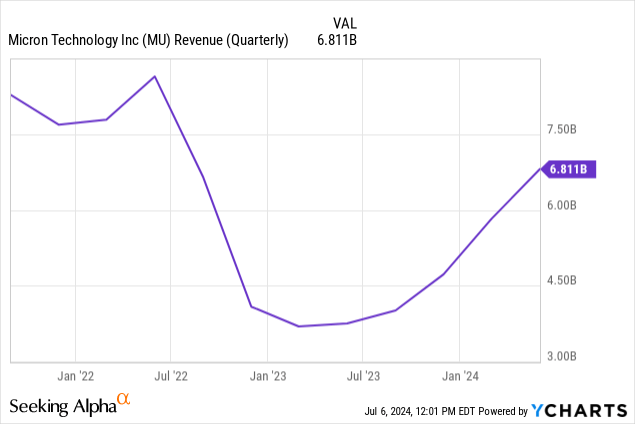

The cyclical nature was on full display in fiscal 2023, as sales were cut nearly in half, dropping from $30.8 billion to $15.5 billion year-over-year (YOY). Demand cratered because its customers had too much inventory, many expected a recession and cut back spending, and tensions with China hurt sales in that market.

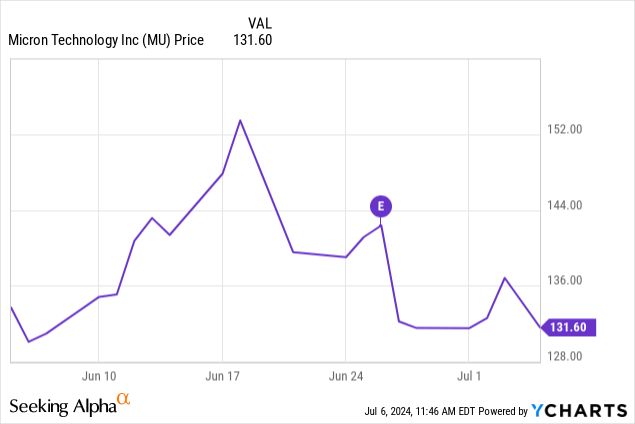

More recently, the stock pulled back 20% from its high after a terrific earnings report, but on “soft guidance,” as shown below.

I always chuckle when quality stocks report excellent results and then fall on light guidance. As if we never learn that nearly all management teams sandbag guidance. Some more than others, but they all want targets that they can beat and raise.

I suspect this is no different.

Is Micron a buy now?

Revenue

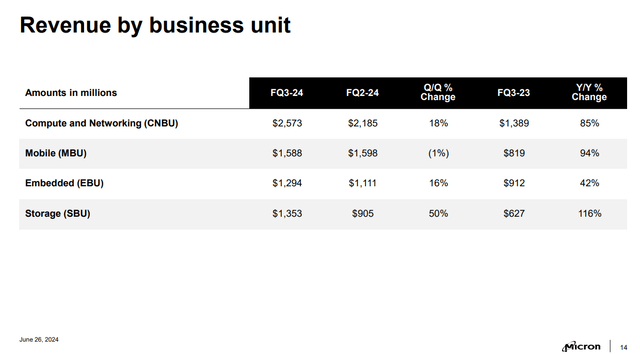

Sales in Q3 FY24 popped 82% YOY and 17% sequentially, reaching $6.8 billion, as depicted below.

Data center sales grew 50% over the prior quarter.

Management Commentary

Even more intriguing, the company didn’t provide solid guidance for HBM next fiscal year.

From the company’s presentation:

We expect to generate several hundred million dollars of revenue from HBM in FY24 and multiple $Bs (Billions) in revenue from HBM in FY25.

Throwing out that “multiple billions” line so casually tells me that they expect extreme demand. Management also stated that HBM is already sold out through the end of 2025.

Smartphones and PCs

AI will also drive the need for upgraded smartphones and PCs since the applications require more processing power. Unfortunately, slowing consumer spending could hamper this segment. Mobile was the only segment where revenue fell sequentially, albeit by just 1%.

Still, the medium-term prospects are positive.

Margins

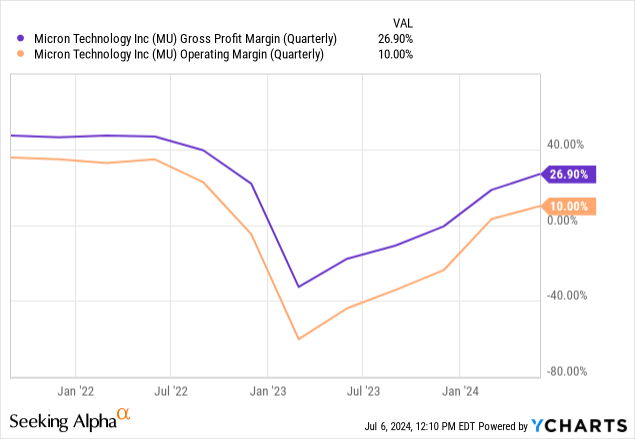

A hallmark of an upcycle is pricing power. Micron’s margins are steadily increasing, as shown below.

Rising margins are excellent leading indicators.

Valuation

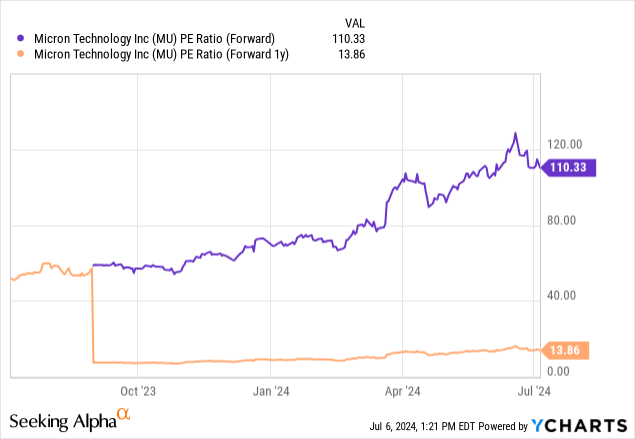

Micron’s current valuation looks ridiculous. Seeking Alpha’s quant ranking gives it an “F”. However, the current valuation is highly misleading.

The company lost money last year, and analysts expect just $1.22 earnings-per-share (EPS) in 2024; however, they predict an average of $9.51 EPS next year (with a low estimate of $6 and a high estimate of $15).

As shown below, this makes the forward valuation for 2025 quite attractive at a P/E under 14.

During the last upcycle, the P/E passed 30 before plunging when it was clear the cycle was reversing. Therein lies the risk. If this cycle is interrupted, then the stock is likely dead money. However, if analysts are correct, then this is a $190 stock next year based on a reasonable P/E of 20. For me, the reward is greater than the risk, so I bought the recent pullback.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The author has a beneficial short position in ARM.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.