Summary:

- Micron Technology, Inc. is attractively valued at an estimated 12x forward non-GAAP EPS, with strong momentum in data centers and AI markets.

- Despite some concerns with debt and competitive pressures, Micron’s robust guidance for fiscal 2025 supports a compelling value proposition.

- Micron’s investment in advanced technologies, including AI memory solutions, is expected to drive continued growth in fiscal 2025.

- Paying 12x this year’s non-GAAP EPS for Micron makes sense, given its earnings potential and growth prospects.

tadamichi

Investment Thesis

Micron Technology, Inc. (NASDAQ:MU) is a highly contentious stock, with both bulls and bears watching its earnings results very attentively. This quarter was no different. And the bulls won, with investors cheering Micron’s guidance for fiscal 2025.

Arguably, the most important driver of the stock is that its valuation is still very attractive at an estimated 12x forward non-GAAP EPS.

Yes, there are some notable blemishes in this report, just its balance sheet still being somewhat leveraged and the tough comparables coming in fast after the next quarter. But altogether, I like this name and believe it will move higher in the coming months.

Rapid Recap

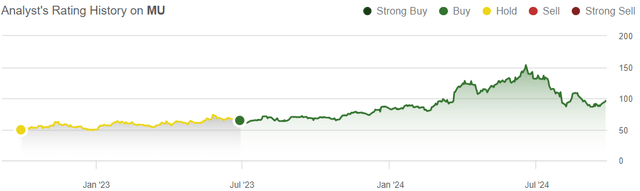

Back in June 2023, I said,

Altogether, investors’ expectations for Micron are muted and there’s room for long-term investors to be positively surprised.

In hindsight, it looks like I made two very good calls. I went from neutral to bullish at the absolutely right time. It’s not that every stock works out this well, but when it does, it feels very rewarding.

What’s more, after Micron’s stock has taken a slight breather, I believe that this stock is going to continue to move higher over the next year.

Micron’s Near-Term Prospects

Micron Technology is a semiconductor company that specializes in manufacturing memory solutions, namely DRAM and NAND, which are critical components for computing and electronic devices.

Its products are widely used across data centers and mobile devices, as well as other industries.

During the just-reported fiscal Q4 2024, Micron achieved record revenues in NAND and its storage business unit, driven by strong demand in the data center and automotive sectors.

However, Micron operates in a highly competitive industry with a limited “moat.” Its top competitors, Samsung and SK Hynix, are key players in the memory sector and have similar technological capabilities.

Furthermore, as close followers of this sector know, these 3 memory giants end up with intense price competition and frequent oversupply cycles, leading to massive changes in profitability, followed by dramatic swings in Micron’s valuation.

Given this balanced background, let’s now discuss its fundamentals.

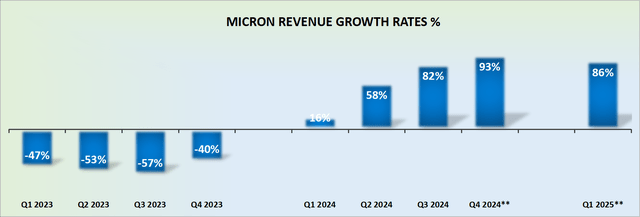

Micron’s Growth Rates Are Going to Moderate

Here’s probably the most quotable line that investors most wanted to hear from the earnings call,

AI servers is expected to be strong this year, strong next year. We don’t see any kind of change in that expectation that we have provided over the last couple of quarters. For 2025, definitely that momentum in AI continues.

Micron is investing heavily in advanced technologies, including AI memory solutions, and expects continued growth in fiscal 2025.

This is key because, as everyone following Micron knows, fiscal Q1 2025 will be the last easy comparable quarter. The remain quarters of fiscal 2025 are going to become progressively more challenging. So, investors wanted to know that the demand side of the story is still intact, as that quote above reassures investors that this is the case.

MU Stock Valuation — 12x This Year’s Non-GAAP EPS

Let me get to the main deterrent that stops me from being highly bullish on Micron. I don’t like to back businesses with more debt than cash. I’ll infrequently make exceptions, but for the most part, this is not a setup that I invest in.

Case in point, Micron holds about $4 billion of net debt, if we factor in its long-term marketable securities.

Nevertheless, what I do like here is the fact that Micron is guiding for nearly 40% non-GAAP gross margins. This is a strong gross margin profile that forgives many blemish bears may point towards.

Furthermore, as it stands already, Micron’s fiscal Q1 2025 non-GAAP is points towards approximately $1.80.

Consequently, even though there are always going to be questions hanging over Micron’s ability to maintain these high-profit margins and whether Micron has much, or any real moat, but this valuation is very forgiving.

Without backing in much acceleration in its underlying prospects, Micron could with some ease report $9 of non-GAAP EPS in fiscal 2025. This leaves the stock priced at 12x this year’s non-GAAP EPS. A figure that makes a lot of sense.

The Bottom Line

Paying 12x this year’s non-GAAP EPS for Micron makes sense because the company is showing strong momentum in critical markets like data centers and AI, with robust guidance for fiscal 2025.

While there are some concerns with its debt levels and competitive sector, Micron’s earnings potential and growth prospects support a compelling value proposition at this valuation.

In sum, I like MU at $110.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.