Summary:

- Micron is a top memory company with a market cap of over $150 billion, benefiting from AI demand but lacking earnings to justify its current valuation.

- The company expects strong demand from the AI market, but faces challenges with high capex requirements and potential overvaluation.

- Micron’s financial performance shows growth in AI segments, but struggles to justify high valuation and future shareholder returns.

hapabapa

Micron (NASDAQ:MU) is one of the largest memory companies in the world, with a market capitalization of more than $150 billion. The company has been lifted heavily by the artificial intelligence wave, growing from more than $60 billion. As we’ll see throughout this article, with continued competition and capital requirements, the company’s earnings highlight how it doesn’t have the earnings to justify its valuation.

Micron Overview

Micron has continued to deliver above guidance ranges as demand for DRAM remains strong.

The company has continued to see price increases from temporary GPU demand, and it is performing well as part of the $10s of billions of AI GPU demand. The company expects demand to remain strong going to next year, but AI also requires hefty artificial intelligence investments, and we expect demand to peak in the next few years.

Micron End Market Views

The company sees itself as being in the early innings of a multi-year race to enable AGI.

We see this as optimistic, chat models like ChatGPT are impressive, but there’s minimal indication of the breakthroughs required to turn LLMs into AGIs. Meta’s AI chief himself has discussed how LLMs with the current models will never hit AGI. Micron is pricing itself and arguing about an industry and the revolutionary aspects when it’s yet to exist.

More so, the company isn’t even building that industry, it just knows should it exist with current models, its DRAM will be essential. The company does, at the end of the day though, continue to operate in a commodity industry. One that continues to fight the powerhouse Samsung, which continues to build the fastest DRAM for AI.

Micron Outlook

The company’s outlook is for continued strength in the market driven by artificial intelligence.

The company is expecting a bit demand growth to be in the mid-teens percentage rate, although that’ll be impacted by price declines. The company does expect supply growth to be below demand growth, the impact of reduced capex during a tough time for the market. With HBM3E memory, that’s expected to have an impact, with 3 times wafer supply consumption.

The company is maintaining capex discipline, but capex is expected to expand next year to continue to support investments.

Micron Capex

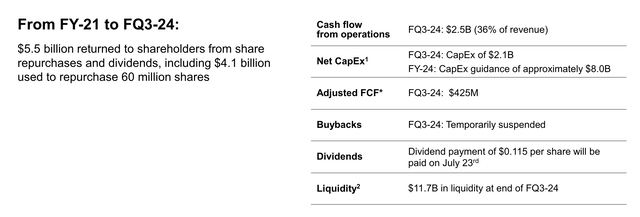

Micron expects FY24 capex plan to be $8 billion, with WFE spending down YoY in FY24.

The company expects to increase capex substantially next year, from ~30% of revenue today, to the mid-30s% range of growing revenue for FY25. This will support HBM assembly and test equipment, and expects average quarterly capex to be meaningfully above $3 billion. That’s concerning because it locks the company into more spending and if things change it’s in a tough position.

The company has had issues in the past where it’s ramped up capex, and a sudden downturn has put it in a tough position given the forward-looking nature of capex. This is both a potential benefit and a potential concern. Especially because the capex isn’t all AI, part of it is making up for prior lower capex.

Micron Financial Performance

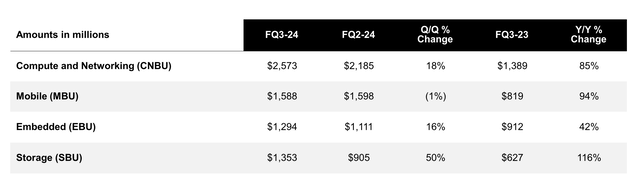

The company’s financial performance shows both the benefits of AI, along with the company’s lack of ability to justify its valuation.

The company saw revenue increase in all segments, especially in the artificial intelligence Storage and Compute and Networking. Those are segments that have benefited from overall strong artificial intelligence demand. However, it’s worth noting that revenue was atrocious a year ago, and that it simply doesn’t have the revenue today to justify its valuation.

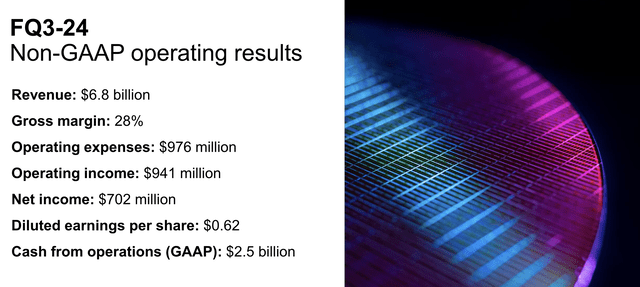

The company earned $6.8 billion in revenue at a 28% gross margin, with operating expenses at just under $1 billion. Diluted EPS came in at $0.62, annualized at almost $2.5 / share, putting the company at a P/E ratio of more than 50. That shows how the company needs substantial growth and profit to justify future shareholder returns.

To hit a P/E of 10, the company needs almost $4 billion in quarterly profits, well above the company’s gross margin not counting all of its other expenses.

A better picture of the company’s business is from FY-21 to FQ3-24, which included a time of massive strength for tech, and a substantial portion of the artificial intelligence business. The company returned $5.5 billion to shareholders during that time, along with repurchases that in retrospect were intelligence.

However, the company only managed to return less than 4% of its current market cap to shareholders over almost 4 years. Those are annualized returns of roughly 1% and shows how lofty the company’s valuation is.

Micron Shareholder Returns

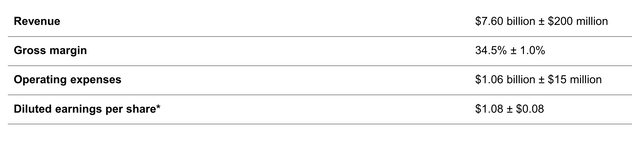

The company’s future returns are based on its guidance for FQ4-2024, along with 2025.

The company expects $7.6 billion in revenue and a higher gross margin, but with a growth in expenses. EPS is expected to increase dramatically QoQ, but still nowhere near a long-term sustainable quarterly EPS of ~$3-4 / share to justify the company’s valuation long-term. The company is providing low single-digit returns in the meantime.

It’s also concerning that the company spends most of its cash on share repurchases. That can help in a downturn, but at its current inflated prices, we see it as a poor decision.

Thesis Risk

The largest risk to our thesis is a market flush with cash searching for opportunity, and artificial intelligence is fulfilling that gap. Investors are bidding up Micron’s share price. Those investors can outbid your selling or betting against Micron’s share price, and the market can remain irrational longer than you can remain solvent.

Conclusion

Micron is a great company with a unique portfolio of DRAM products. The company has shown the ability to weather the downturn and increased consolidation in the industry, and is now a top 3 DRAM company, sharing the throne with Hynix and Samsung. However, despite that strength, the company is heavily overvalued in a volatile industry.

The company has a market capitalization of $150 billion, and it needs billions annually to justify its valuation. It’s ramping up capital spending, which could put it in a tough position if prices take a turn for the worse. Overall, Micron is a solid company, but overvalued, which makes it a poor long-term investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.