Summary:

- Micron faces China-related challenges with potential revenue impact, a hit of around 13% of total revenues.

- Generative AI demand brings positive dynamics for Micron’s memory business.

- Expectations for Micron’s revenues remain muted, but the company anticipates easing comparables in the future.

- Altogether, I’m bullish on Micron.

William_Potter

Investment Thesis

Micron (NASDAQ:MU) delivered guidance that was very much in line with expectations. On the surface, there wasn’t enough for traders to get excited about here and I wouldn’t be surprised if in the coming hours and few days Micron’s share price falls back below the $67 per share it went into the earnings print.

However, the ultimate takeaway from Micron’s results is that no news is good news.

As expected, Micron signals that this is the trough of the memory cycle and that comparables should get easier.

I believe that the stock could surprise if next fiscal year, Micron finds some way to reignite its revenues, without seeing a proportional increase in operating expenses.

In fact, presently, expectations from Micron themselves are that fiscal 2024 will continue to see Micron reporting negative free cash flows.

Altogether, investors’ expectations for Micron are muted and there’s room for long-term investors to be positively surprised.

Micron’s Near-Term Prospects

Micron’s earnings call highlights 2 main news items. One bad news and one good news.

The bad news facing Micron is that its China exposure, which is at risk of restriction, accounts for approximately 13% of its revenues. Here’s a quote that puts into context the China-risk,

“the CAC [China-risk] decision is a headwind to our outlook. We expect the revenue impact to vary by quarter, with the impact in fiscal Q4 being less than the quarterly impact in the first half of fiscal 2024.”

For a business that is not profitable today and not expecting to be profitable or free cash flow positive next year, for it to also signal to investors that it could see up to 13% of its global revenues being hit, is quite a lot for investors to chew on.

The good news is Micron’s exposure to generative AI memory demand is delivering positive dynamics, here’s the quote from the earnings call:

The recent acceleration in the adoption of generative AI is driving higher-than-expected industry demand for memory and storage for AI servers

But is generative AI demand going to be enough to get investors excited about this memory company? Honestly, I don’t think so. I think the market is more discerning than that.

However, the other side of the argument is that Micron’s share price has been stuck below $70 per share for years already. So, I believe it’s safe to say that expectations are already muted.

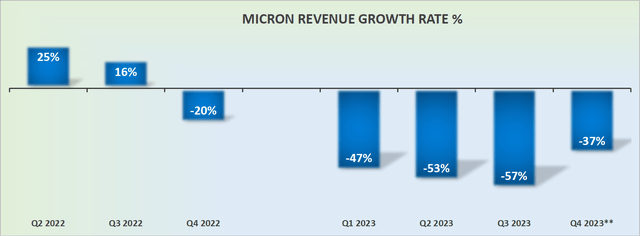

Micron’s Trough Revenues

Micron’s guidance comes in as expected. Essentially, there’s expected to be one more quarter of challenging performance before the following quarter starts to see comparables easing up.

And then, beginning Q1 2024, the comparables will become so easy that even on the back of negligible sequential growth, Micron will look as if its revenue growth rates are accelerating.

That has been the thesis for a while and continues to be so. Despite the China-risk aspect.

Cost Structure Remains Elevated

When it comes to Micron’s cost structure there’s bad news and good news. The bad news is that Micron’s operating expenses point to around 21% at the midpoint for the quarter ahead.

This is a significant increase in operating expenses compared with the same period a year ago.

In last year’s fiscal Q4 2022, Micron’s operating expenses were 15%. This shows that even as Micron’s revenues compress, there are minimal cutbacks that Micron can make.

Here’s a quote from the Q&A section of the call, where Micron’s CFO said:

“[…] the market conditions, they remain weak, and we have high fixed costs. So we are trying to remain operating cash flow positive through this period of weakness, and we were able to do that in the third quarter.

At these low levels of operating cash flow, though we’ve reduced CapEx considerably, we expect to be negative free cash flow into and through a good part, if not all, of FY ’24”

The good news is that if in actuality, we are navigating the trough of the cycle, this means that after the next quarter, about 90 days from now, as Micron’s revenues start to improve, and Micron enters fiscal Q1 2024, we should see its underlying profitability rapidly ramp back up again.

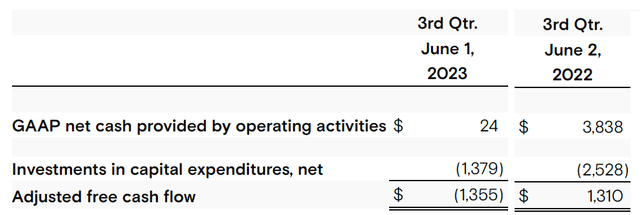

Similarly, given Micron’s limited ability to substantially cut back on its capex, this saw Micron’s free cash flow go from positive $1.3 billion in the prior year to negative $1.4 billion in this recently reported quarter, fiscal Q3 2023.

One main difference between this memory trough and previous trough cycles is that Micron’s balance sheet is in a much better position. Rather than navigating through the cycle with a perilous and restrictive balance sheet, Micron still holds just over $9 billion in cash, providing it with plenty of breathing room.

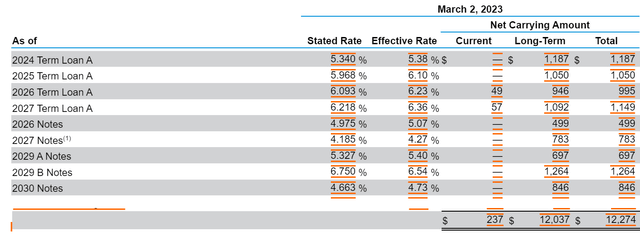

This figure is offset by $12 billion in debt. However, observe in the table that follows how well-laddered the debt stack is.

There’s approximately $1 billion due of debt maturities each year. In sum, Micron’s balance sheet poses no impediment to its prospects.

The Bottom Line

Micron delivered guidance that was in line with expectations, but there wasn’t much to excite traders, potentially causing the share price to decline in the coming few hours.

However, the overall message is that no news is good news. Micron signals that this is the bottom of the memory cycle and expects comparables to improve.

Despite the risk of restriction in China, which accounts for around 13% of its revenues, Micron’s exposure to generative AI memory demand is showing positive dynamics.

While this may not be enough to generate significant investor excitement, the market’s expectations for Micron are already muted.

Micron’s revenue growth rates are expected to accelerate starting in Q1 2024 as comparables become easier.

On the cost side, operating expenses have increased compared to the same period last year, but if the cycle trough is truly being navigated, Micron’s profitability should rebound as revenues improve.

Despite negative free cash flow and debt of $12 billion, Micron’s balance sheet remains relatively strong with over $9 billion in cash, providing room for growth.

Altogether, I’m bullish on Micron.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.