Summary:

- AI-driven demand and recovery in traditional segments position Micron for strong growth into 2025.

- Inventory normalization from traditional markets boosts Micron’s revenue after a challenging 2023.

- HBM chips are sold out, with orders already booked into 2026-2027, supporting future growth.

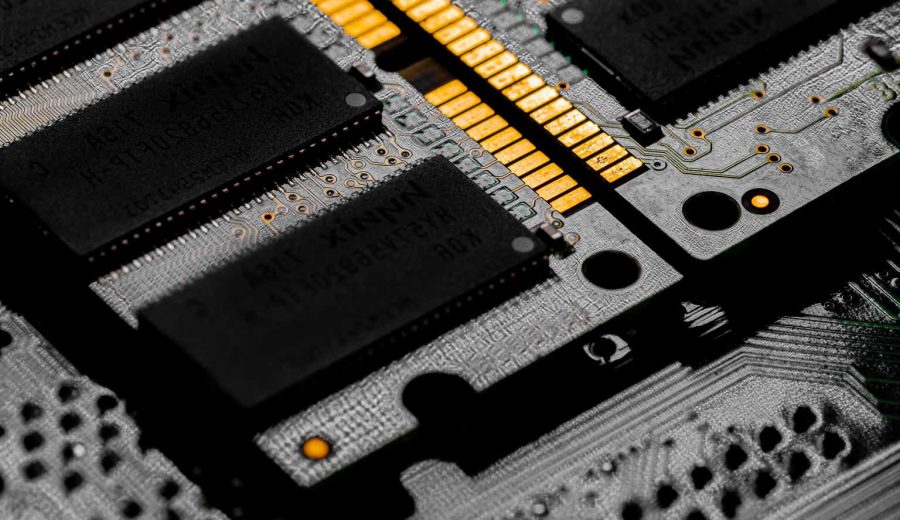

Sunshine Seeds/iStock via Getty Images

Investment Thesis

Things are looking up for Micron Technology (NASDAQ:MU)(NEOE:MU:CA) as favorable market conditions create the strongest sales momentum in years. Customers who stocked Micron’s memory chips during the post-pandemic supply chain disruptions are coming back as their inventories have finally returned to normal levels. We saw early signs of this happening in the twelve months ended August 2024, with Micron’s sales rebounding from 2023 lows.

Second, the ‘new economy’ customers, manifested in autonomous driving and generative AI, are taking the world by storm. High-bandwidth memory chips ‘ HBM’ on this planet are sold out. All new orders are for 2026-2027 deliveries, and even this window is almost closed, as reported by the three HBM manufacturers; Micron, Samsung (OTCPK:SSNLF), and SK hynix (OTCPK:HXSCF).

We’re at the early innings of a multi-year secular tailwind, supporting Micron’s 2025 growth forecasts.

But before making a decision, it is important to understand Micron’s unique characteristics and the challenges it faces in the industry.

Commoditized Memory Market

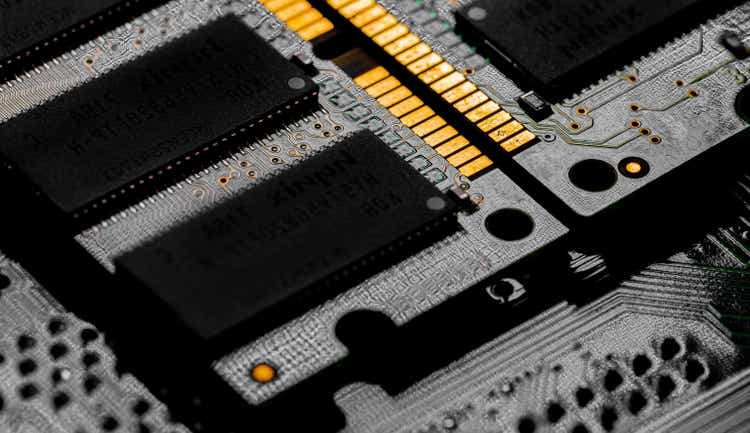

If you shopped for a laptop on Amazon.com, you might have noticed the filter tab on the left side of the screen that helps shoppers filter through the dozens of options. Shoppers are presented with different CPU brands, including various brands of Intel (INTC) Core and AMD (AMD) Ryzen families. NVIDIA’s (NVDA) Tegra and Apple (AAPL) M2 are also available. You can filter your options by motherboard brand too: Dell (DELL), HP (HPE), ASUS (OTCPK:ASUUY), Lenovo (OTCPK:LNVGY), Panasonic (OTCPK:PCRFF), among others, and Operating system; Windows OS, Chrome OS, macOS, Linux.

But what about that Hard Disk Drive “HDD”, Solid State Drive “SSD”, or Random Access Memory “RAM”? What’s the brand or manufacturer? The Amazon website only shows numbers in gigabits.

This lack of brand identification for memory products on Amazon.com manifests one of the most critical flaws of investing in Micron; the commoditization of memory products such as RAM and SSD. An 8GB RAM is the same whether it is manufactured by Micron, Samsung, or SK hynix.

Amazon

Misconceptions: Why Now?

One might ask, Micron’s sales declined after the rollout of generative AI applications in September 2022, unlike its peers, who saw their revenue and share prices soar. Why buy now?

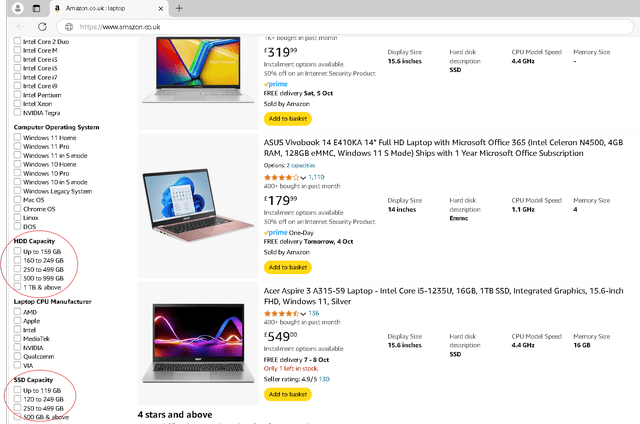

During the pandemic, companies worried about supply chain disruptions stocked on memory chips, boosting Micron’s profits in 2021 and 2022, but causing lower demand in 2023, as Micron’s customers adjusted their inventory levels. Revenue in the FY 2023 (twelve months ended August 2023) was down by 50% YoY, overshadowing higher HBM chip sales on the back of the AI tailwinds.

Author’s estimates based on Micron filings

In FY 2024 (twelve months ended August 2024) we saw a shift and normalization of the inventory dynamics that impacted the company last year. Micron’s PC, Mobile, and enterprise customers are coming back after working through their inventories accumulated during the pandemic era. These ‘traditional economy’ customers are adding to the momentum created by AI.

Micron is Leading the Industry, but here’s the Catch.

Micron has been touting its 1β node technology as a competitive edge in the memory market. But, while this is genuine progress, it is a manifestation of the same-old Moore’s law. Microchip nodes, which refer to the size of the wires connecting microchip components, have been decreasing year over year for decades.

In June, Micron announced sample deliveries of its new GDDR7 Graphics Memory chips. These 16Gb GDDR chips, used to enhance video and gaming resolution, have a data rate speed of 32Gb/second/pin, double that of GDDR6. SK hynix quickly followed, with mass production of SK hynix GDDR7 to be expected this quarter, according to a company press release. Samsung told investors it completed the development of GDDR7 earlier in January, but I’m not sure about time-to-market plans, but typically, they fall close to peers’.

Last February, Micron started shipping HBM3E for generative AI applications. SK hynix followed suit last month with its own HBM3E, and so did Samsung.

The memory market is characterized by a tight race between three dominant players; Micron, Samsung, and SK hynix, and there is no clear winner. Even when one releases a new product first, as Micron did this year, the other two follow quickly, often within a few months or weeks, suggesting that, despite the long R&D horizon, the development cycles of these three companies are in sync.

This isn’t surprising. As mentioned above, the technological platform of the three companies is the same; making nodes smaller, and by extension, the memory chip more dense with transistors. But the problem is that all three companies rely on the same Semiconductor Equipment suppliers; ASML (ASML), for lithography equipment, Applied Materials (AMAT) for wafer deposition, Lam Research (LRCX) for etching equipment, Tokyo Electron (OTCPK:TOELY) for wafer packaging solutions, KLA Corp (KLAC) for process control, and Teradyne (TER) for quality control.

The AI Tailwinds

Do you remember when ChatGPT first came out? With limited queries to ration computing capacity. They gradually increased speed, added new features such as image generation, and then lifted off the cap on the number of questions you can ask.

Recently, they put a new cap on the number of questions users could ask ChatGPT o1, the latest version that comes with reasoning skills.

The thing is, as these generative AI models become more sophisticated, the demand for data centers will continue, potentially providing a revenue tailwind for Micron for at least the next decade. We’re not even close to the level of computing power needed to power even immediate needs for AI chatbots.

Valuation

For many investors in US-listed companies, Micron’s forward PE ratio of 13x appears attractive. This is partly because US companies often trade at a higher valuation compared to companies in other parts of the world. This valuation premium may be due to the strength and dynamism of the US economy.

But this advantage dims for multinationals such as Micron and its competitors, who share the same global customers and supply chains.

Last year, SK hynix generated $35 billion in revenue, a level never achieved by Micron in its entire history. Yet, despite its scale, SK hynix trades at a forward PE ratio of 4.3x. Samsung, on the other hand, trades at a forward PE ratio of 6.9x.

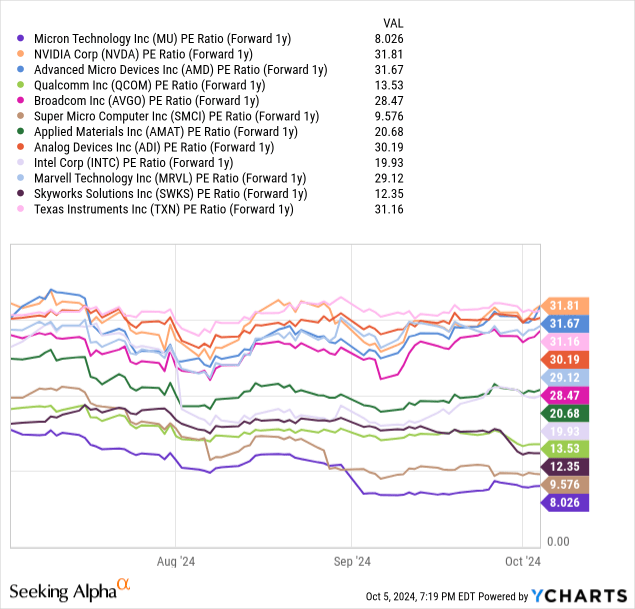

When comparing Micron’s valuation to other US-based companies, its valuation shines a bit brighter. Below is the 2025 forward PE ratio of Micron and a set of major US-based semiconductor companies.

Final Thoughts and Risks to Our ‘Buy’ Rating

Micron, Samsung, and SK hynix are the three market leaders in the memory chips market. To my knowledge, they are the only companies that sell HBM chips used with GPUs for AI and autonomous driving applications.

Still, there are risks to our buy rating.

Micron’s lack of product differentiation has had a significant impact on its performance. Prices are set by supply and demand and not innovation cycles as is common with other semiconductor companies such as NVIDIA and AMD.

Still, Micron has done well given the circumstances. With inventory headwinds dissipating, we see personal computer, mobile, and industrial customers coming back, adding to AI cyclical tailwinds.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.