Summary:

- Micron’s financial performance is improving, with strong liquidity, positive earnings surprises, and promising new product developments, making it a “Strong Buy” before the fiscal Q4 earnings release.

- Micron’s valuation is attractive after the recent dip, with a 64% upside potential based on DCF analysis.

- Historical seasonality patterns indicate that the most challenging period of the year for Micron’s stock is likely behind us.

hapabapa

Investment thesis

My previous cautious earnings preview about Micron (NASDAQ:MU) aged well, as the stock lost around a third of its value since then.

A new earnings release is coming soon, and today I want to preview it. I am very optimistic about the upcoming earnings release as the company will highly likely deliver positive earnings surprise once again. Recent developments in new products suggest that the management might share positive forward-looking insights as well. Historical seasonality patterns suggest that the worst part of the year is over for MU. Moreover, the stock became dirt cheap after the pullback of the last three months. All in all, I upgrade MU to “Strong Buy” prior to the fiscal Q4 earnings release.

Recent developments and earnings preview

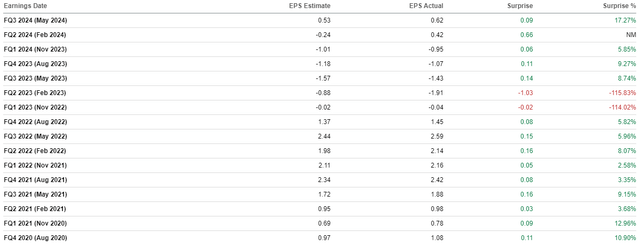

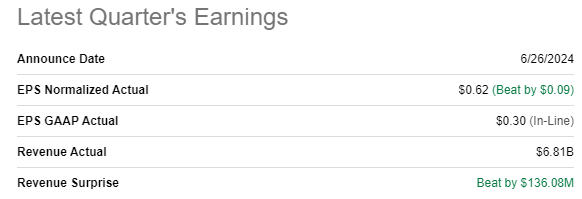

The company reported its latest quarterly earnings on June 26, surpassing consensus estimates both from the revenue and EPS perspectives. Revenue growth accelerated to a massive 8.53% YoY as the company’s top line continues to recover after the dip due to adverse geopolitical developments between the U.S. and China. The adjusted EPS was $0.62 after being deeply negative in the same quarter last year. The metric demonstrated notable improvement on a sequential basis, from $0.42 to $0.62.

Seeking Alpha

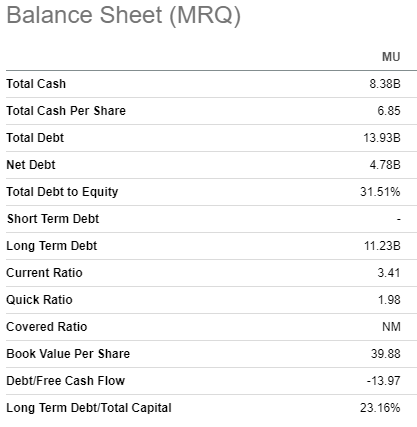

Despite all the challenges of recent years, the company’s financial position is still very strong. The company had a solid $8.4 billion cash balance as of the latest reporting date. A $4.8 billion net debt position is quite healthy compared to the company’s $100 billion market cap. The company also boasts strong liquidity ratios, meaning that MU is very financially flexible.

Seeking Alpha

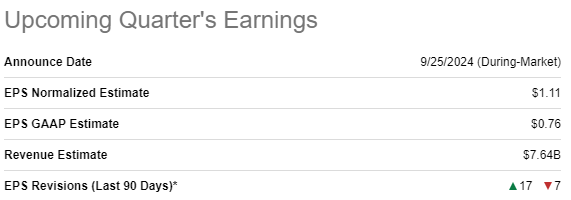

A long time passed since the last earnings release, so I am not going into deeper details. Moreover, the upcoming quarter’s earnings release is very close to us as it is scheduled for release on September 25. Wall Street’s sentiment around the upcoming earnings release is quite positive, with seventeen upward EPS revisions over the last 90 days. On the other hand, some of the analysts are less optimistic as there were seven downward revisions as well.

Seeking Alpha

Fiscal Q4 2024 revenue is expected by consensus to be $6.64 billion, a 91% increase on a YoY basis. The adjusted EPS is expected to expand sequentially from $0.62 to $1.11, which is a bullish sign indicating strong operating leverage.

Micron’s solid earnings surprise history over the last 16 quarters is another reason that adds to my optimism. If just two quarters of the company’s struggles between in FY2023 are excluded, Micron consistently delivered robust EPS beats. Past results do not guarantee future success, but strong success track record is always a crucial factor to me indicating the management’s commitment to deliver results exceeding expectations.

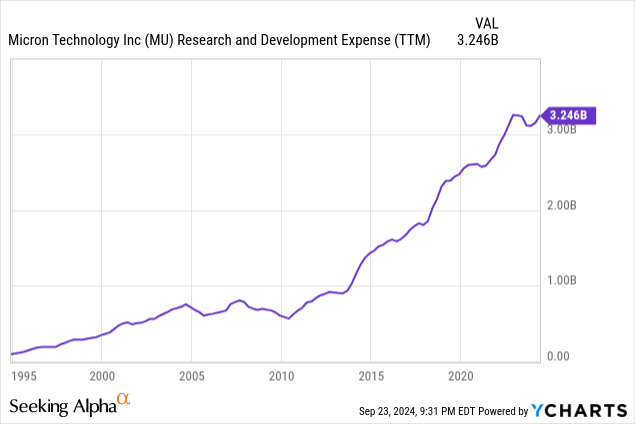

Beyond the financial performance, the management’s insights about new products and plans will also be crucial. I expect positive information here as well, since MU is known for its aggressive R&D spending, which did not dip even when the company experienced severe geopolitical headwinds.

Moreover, the company is very active in rolling out new products and features, and it is highly likely that the management will also share more information about the successes of recent releases. For example, in July the company unveiled its Micron 9550 NVMe SSD, which was called the world’s fastest data center SSD in the official press-release. In late July, the company also announced that it has started volume production of the ninth-generation of its TLC NAND memory chips.

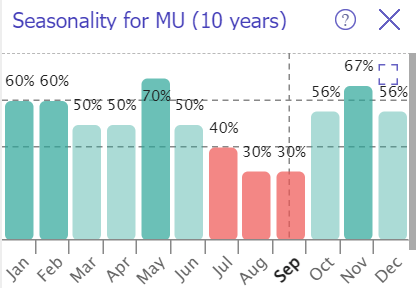

TrendSpider

The last but not least, the stock’s seasonality trends suggest that July-September are historically the weakest months for MU. Since only one week left in September, I can conclude that the year’s worst part is highly likely over for Micron’s stock. The stock usually performs well during the last three months of a year, which also adds to my bullishness.

To summarize, I think that the blend of catalysts is quite robust before the upcoming earnings release. The company’s financial performance is improving every quarter, it has ample liquidity to fuel more innovation, and recent product releases look promising. Moreover, seasonality trends are quite favorable, making me bullish about MU.

Valuation update

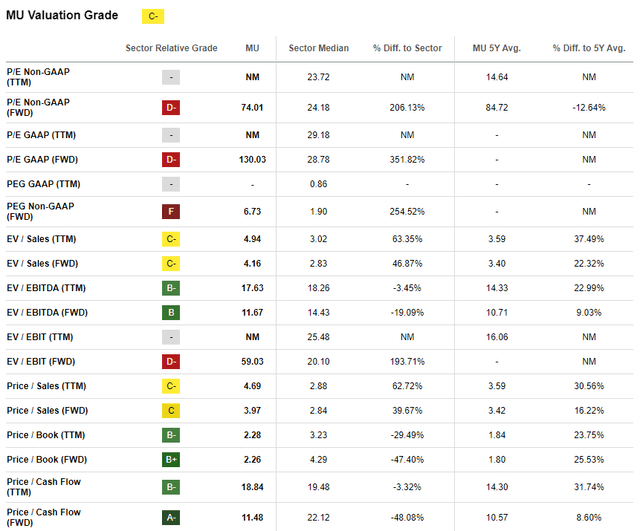

MU’s price grew by 36% over the last twelve months, outpacing the broader U.S. stock market’s growth. Performance in 2024 is solid with a 20% YTD rally. Valuation ratios are mixed, and some of them are high because the company’s profitability is still recovering after disruptions of recent years. As an investor who seeks strong FCF companies, I like a modest 11.5 forward Price/Cash flow ratio.

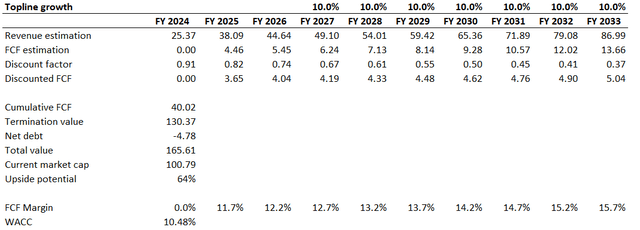

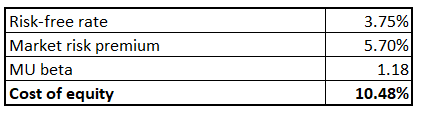

I must simulate the DCF model to better understand Micron’s valuation. Cost of equity calculated using the CAPM approach will be the discount rate for my DCF. All variables to figure out Micron’s cost of equity are easily available on the Internet. Micron’s cost of equity is 10.48%.

Author’s calculations

I rely on revenue consensus estimates for the upcoming three years because it summarizes the opinion of dozens of Wall Street analysts, which is a representative sample. A 10% CAGR is implemented for the years beyond FY2026, which is my professional judgment. This optimistic CAGR is based on Micron’s strengthening revenue mix. While various sources forecast mid-single industry CAGRs for DRAM and NAND over the long term, the SSD industry is expected to thrive with almost 19% CAGR. Since MU expands into SSD, I think that incorporating a 10% annualized revenue growth is sound.

For the FCF margin assumption, we need to look back a bit. The TTM FCF ex-SBC margin is negative, which makes my zero assumption for FY 2024 quite reasonable. Consensus forecasts the adjusted EPS to spike from $1.23 in FY 2024 to $12.38 in FY 2026. The company generated a 12.2% FCF margin in FY 2018, the last time MU’s EPS was at around $12. Therefore, I apply a 12.2% FCF margin for FY 2026 with a 50 basis points yearly expansion. To estimate the FY 2025 FCF margin, I deducted half a percentage point from FY 2026 levels.

According to my DCF simulation, the business’s fair value is around $165 billion, which is substantially higher compared to the current $100 billion market cap. There is a 64% upside potential, which is compelling for a stock like MU.

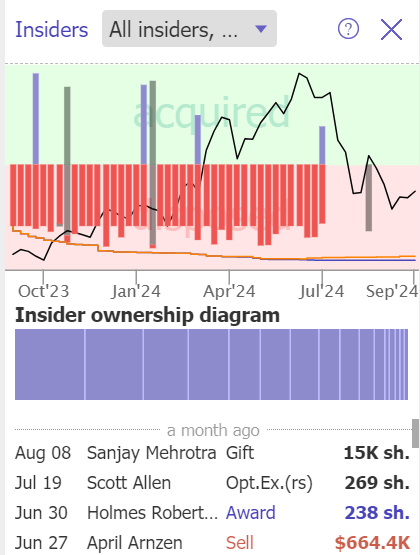

TrendSpider

Another factor suggesting that MU is highly likely undervalued is that insider selling stopped after the previous earnings release, which has led to a share price plunge. If we look at the above chart, we can see that June 27 was the last time when insider selling took place.

Risks update

Writing a thesis about the company that releases its quarterly earnings is inherently risky. A lot depends on non-fundamental factors like the broader market sentiment, or big macro-headlines that might not even be related to the company I am writing about. Investors’ reaction is something that is almost impossible to foresee. Therefore, there is a risk that the stock price might dip after the earnings release, and this will work against my rating upgrade. For example, I highlighted above that the stock delivered a solid fiscal Q3 earnings surprise, but it did not protect investors from a sell-off.

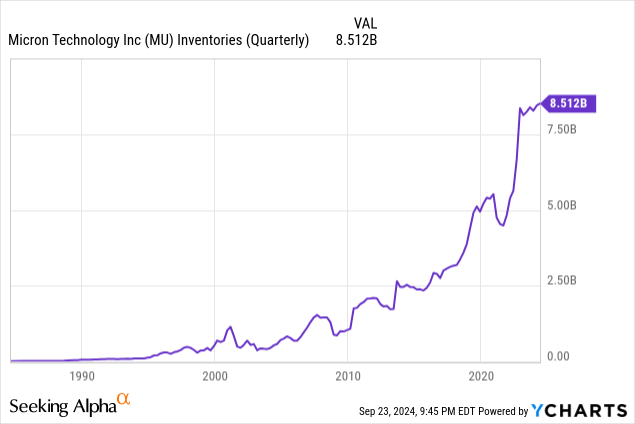

If we speak about the earnings release itself from the fundamental perspective, the only problem I see is Micron’s high inventory. Inventory levels growth moderated in recent quarters, but they are still at historical highs, while the company’s revenue did not recover in full yet. High inventory levels are always a risk that might weigh on profitability metrics, which is always a negative catalyst for investors.

Bottom line

To conclude, I believe that Micron’s stock is a “Strong Buy” at the moment. After the recent dip, MU’s valuation became extremely attractive. The company is fundamentally strong and the business experiences robust momentum, making such a deep discount unfair.

Analyst???s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.