Summary:

- History suggests Microsoft stock is likely to rebound in 2023.

- Dividend coverage is so strong that Microsoft can afford doubling it and still not be at the risk of a dividend cut.

- Microsoft is the strongest stock among mega-caps from technical perspective.

- Satya Nadella is playing chess while the field is playing checkers, building an empire in the process.

Jean-Luc Ichard

Microsoft Corporation (NASDAQ:MSFT) investors like myself are perhaps having a mixed feeling as we reflect on 2022. It was undoubtedly a bad year for the stock as it finished down nearly 30%. But investors can also take heart from the fact that the company’s underlying strength showed in many ways, including beating earnings estimates three out of the four quarters and the measured, limited layoffs. The company’s underlying strength through its diversified and sticky businesses showed in the fact that the stock was the best performer in the mega-cap tech group that includes Apple Inc. (AAPL), Alphabet Inc. (GOOG) (GOOGL), Amazon.Com, Inc. (AMZN) and Meta Platforms, Inc. (META).

This article presents a few reasons why I believe Microsoft is a safe bet as we enter 2023.

History

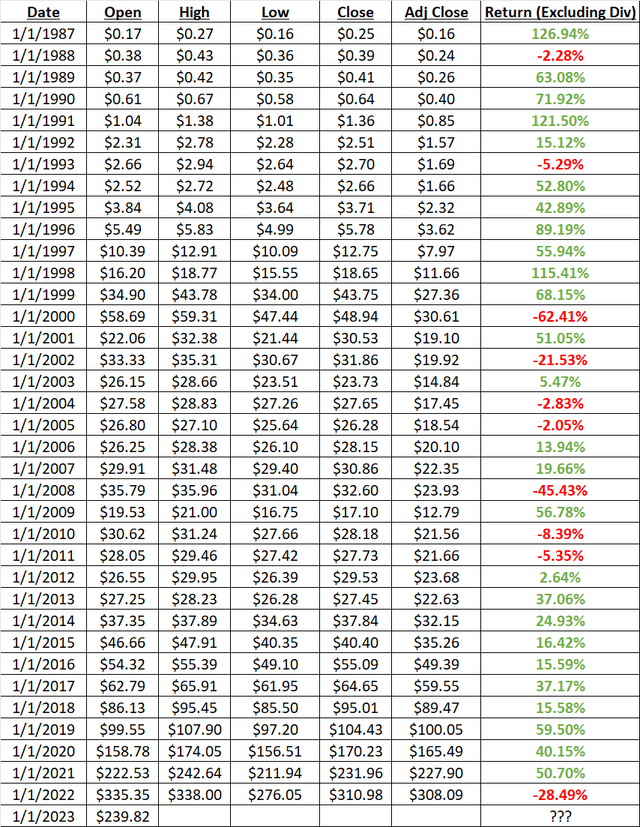

Let us begin the article with a fun fact that is also the main premise of the article. Since going public in 1986, Microsoft has never had two consecutive years of meaningful declines. What is meaningful? I say 10% and above while the textbook bear market definition is 20% and above.

- Microsoft’s 2022 decline ranks third from the bottom going all the way to 1987, only behind the dot com crash of 2000 and the great recession of 2008/09.

- Only twice in its 35 year old history has Microsoft had two consecutive years of negative returns: 2004/2005 and 2010/2011.

- Please note the “Return” column below does not include dividends and is adjusted for splits. For simplicity, I’ve used the opening price on 1/1 of each year for this calculation.

- Past does not necessarily prologue to the future in the world of investing but offers guiding light. Based on the data shown below, it is hard to see Microsoft have a significantly bad year in 2023.

MSFT Annual Returns (Compiled by Author with data from Yahoo Finance)

Upcoming Dividend Increase

As written in this article, I fully expect Microsoft to announce its annual dividend increase in September 2023. Given the enormous room in the payout ratio based on both free cash flow and earnings per share, investors can expect another 10% dividend increase, which will push the new quarterly dividend to 75 cents per share.

Just because that is what I expect Microsoft to give us, it doesn’t mean that is all the company can afford though. Microsoft’s cash flow and earnings are so strong that even a generous 20% increase will not be much of a strain on the company as shown below. A hypothetical 20% dividend increase will push the new quarterly dividend to about 82 cents per share.

- Using forward earnings per share estimate of $9.54, a quarterly dividend of 82 cents per share will represent a payout ratio of 34%.

- Using current shares outstanding of 7.45 Billion, Microsoft will need about $6 Billion in free cash flow to cover dividends. Dating back to 2017, only once has Microsoft recorded quarterly free cash flow below the $6 Billion mark and the quarterly average over the last five years stands at a healthy $12.18 B. In other words, using the five year average, even a 20% dividend increase will only push the payout ratio to 50% based on free cash flow.

- In short, these numbers look so strong that even doubling the dividend from its current level will not push the payout ratios (based on EPS or FCF) beyond 85%.

Technical Uptrend – Early Signs

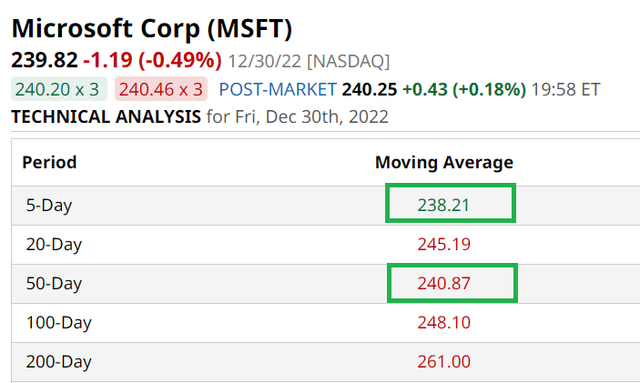

Microsoft’s stock is showing early signs of forming a new base and moving upward from the base. As shown below, the stock has just moved past its 5-Day moving average (not that important) and is a hair below the slightly more important 50-Day moving average. Most importantly, the stocks are now just about 8% from its 200-Day moving average. If you think that is ways off, then please note that other mega-cap tech names like Apple Inc. and Amazon.com, Inc. are 16% and 42% away from their respective 200-Day moving averages.

In addition, a relative strength index of 44 suggests the stock is clearly closer to being oversold than overbought.

MSFT Moving Avgs (Barchart.Com)

Fundamental Strength

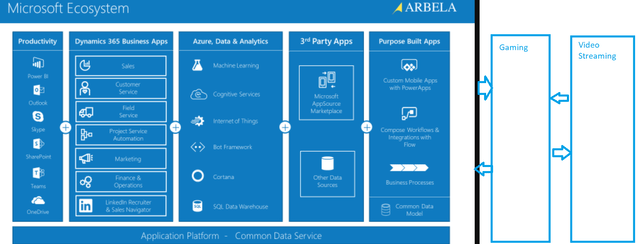

Last but not least, business fundamentals matter more than historical data and technical indicators. While the latter two factors are akin to paddles, fundamental strength is the boat that keeps investors afloat. Fundamentally, Microsoft is firing on all cylinders with its diversified eco system.

Make no mistake about it, Microsoft will fight tooth and nail to close the Activision Blizzard, Inc. (ATVI) deal and is well prepared to counter regulatory hurdles, which frankly were anticipated. Once the dust settles on this deal, Microsoft is likely to continue expanding its ecosystem. What comes next? No one knows for sure but this idea floated by Seeking Alpha contributor Manuel Paul Dipold is intriguing. With just cash on hand and short term investments exceeding $100 Billion, Microsoft has the firepower to buy Netflix almost outright, currently valued at $131 Billion.

What makes me think Microsoft can execute this if they do decide to go after it? Recent history. Satya Nadella was the primary force behind Microsoft’s acquisition of LinkedIn back in 2016 as can be seen in this email sent to Microsoft employees as well as this presentation. Most striking for me, with about 7 years of hindsight, is Mr. Nadella’s clarity in this statement:

“The opportunity for Office 365 and Dynamics is just as profound. Over the past decade we have moved Office from a set of productivity tools to a cloud service across any platform and device. This deal is the next step forward for Office 365 and Dynamics as they connect to the world’s largest and most valuable professional network.”

Anyone who has used Microsoft’s Office can relate to the above, seeing how seamlessly LinkedIn’s features are integrated with Office 365 and Teams to name a few. And bear in mind, that statement was made almost 7 years ago. It shows that not only does Mr. Nadella have the vision but also has a team that can follow through on the execution.

Taking the liberty of adding to Arbelatech’s depiction of Microsoft’s ecosystem, I present the sketch below with the two new potential silos: Gaming and Video Streaming. Notice how in the existing ecosystem as well as in the projected one below, Microsoft’s ability to cross-leverage (and sell) its platforms stands out. In other words, Microsoft is carefully expanding its presence across diversified business units but only those it can make more powerful using its existing platforms. For example,

- LinkedIn deal provided the world’s leading cloud provider with the world’s leading professional network. And who was and still is the industry leader in professional productivity and business applications? Microsoft. That’s the existing ecosystem, a juggernaut in the enterprise, professional world.

- Now, to that already powerful ecosystem, add in one of the most popular names in the gaming world (which needs powerful cloud servers) and video streaming (which once again needs powerful cloud servers, currently hosted on Amazon’s AWS). Can gaming experiences be combined with video streaming? Absolutely. Can professional customers (on existing eco system) cross over into retail, individual consumers (in the new ecosystem)? Absolutely. So, what do you get as a result? An enterprise juggernaut with all the necessary foundations to start dominating the consumer world.

New MSFT Ecosystem (Arbelatech.com)

Conclusion

Microsoft’s balance sheet remains as strong as ever. Their commitment to investors is not in question either. In Satya Nadella, they have a CEO who is playing Chess while the competitors seem to be playing Checkers in their own silos. As a bonus, the stock is showing relative technical strength as well heading into the new year. Add in other factors like the potential to continue its position and perhaps even expand in the Cloud segment, it is safe to say Microsoft is looking strong as we head into 2023. Buy this stock on any weakness and settle in for the long haul.

Disclosure: I/we have a beneficial long position in the shares of MSFT, AAPL, AMZN, GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.